GST Portal Update: FY 2024-25 GST Annual Return GSTR-9 and Reconciliation Statement GSTR-9C Now Live

Under the new schedule, all eligible filers must complete the process by December 31, 2025.

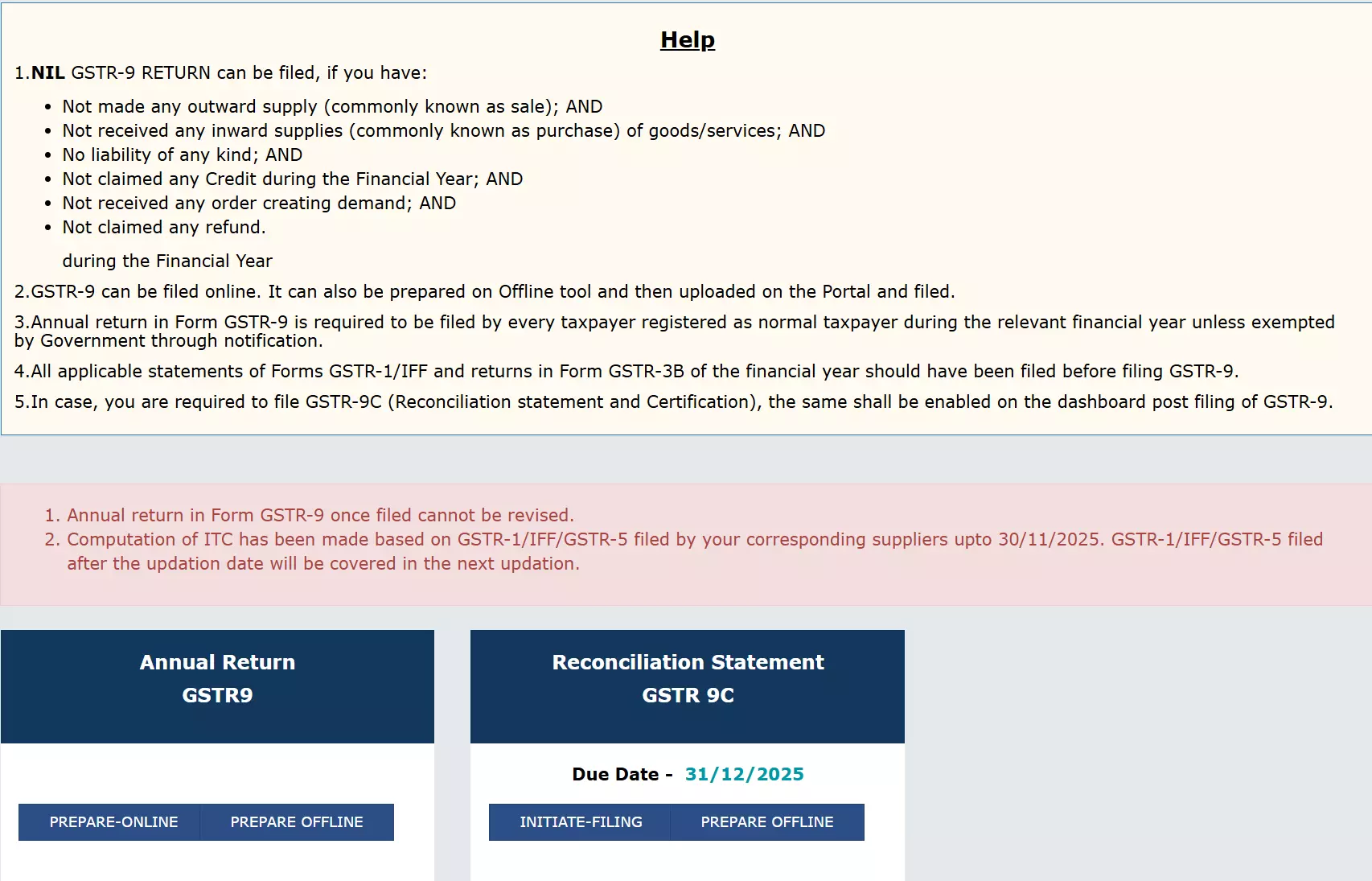

The GST portal has officially opened the filing window for the annual return (GSTR-9) and the reconciliation statement (GSTR-9C) for the financial year 2024-25, marking a key step in India’s ongoing effort to tighten tax compliance. Taxpayers who were registered as normal (regular) under the GST regime can now submit their annual summary and reconcile figures between their tax returns and audited accounts.

Notably, a Downloadable Table 12 - Outward Supplies containing HSN details from GSTR-1 is now available on the portal for easier GST Annual Return GSTR-9 filing.

Under the new schedule, all eligible filers must complete the process by December 31, 2025, a date that leaves little margin for delay given year-end accounting work. For those with larger turnovers, the reconciliation statement (GSTR-9C) becomes mandatory. That means the taxpayers must not only file the summary return but also validate the numbers against audited financial statements and disclose discrepancies or additional liabilities if any.

Filing on the portal follows a structured process. Taxpayers must log in to the GST website, navigate to the “Returns → Annual Return” section, select the relevant financial year, download the auto-populated data (including tables like “8A” drawn from earlier returns), validate and adjust entries, preview the draft, compute any outstanding liability or late fee, and finally submit using digital signature or electronic verification. The portal also supports offline utilities for preparing returns in bulk before uploading.

However, procedural vigilance is critical. The automated pre-population of tables doesn’t guarantee accuracy; discrepancies between GSTR-1, GSTR-3B and one’s internal books may still exist. Those with high volumes of invoices, inter-state supplies, or complex credit flows are especially vulnerable to mismatches. Late submission beyond the December cutoff invites penalties and interest, which can accumulate quickly, eroding margins or cash flows.

This round of filings comes amidst an evolving compliance environment. Starting July 2025, GST return rules will tighten further: auto-populated liabilities in monthly returns (GSTR-3B) will be less editable and returns older than three years will become time-barred. That makes the discipline of getting 2024-25 filings right all the more urgent.

In short: the window is open, the deadline is firm, and the burden of reconciliation lies squarely on taxpayers-big and small. Accuracy matters now more than ever, because mistakes or delays carry financial consequences. If you like, I can walk you through a sample checklist or highlight common pitfalls to avoid while preparing GSTR-9 and 9C.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates