GST Second Appeal Filing: Step-by-Step Login and Password Reset Guide for GSTAT Portal

To help appellants avoid procedural errors, the portal provides a step-by-step guided workflow that ensures compliance with all statutory requirements before final submission

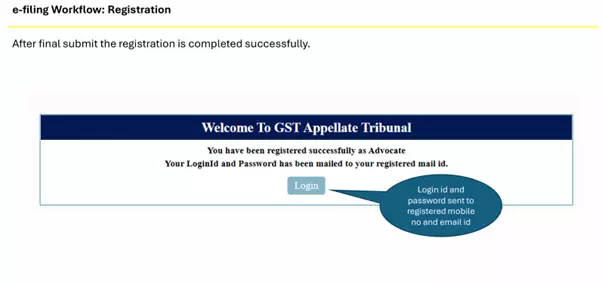

The Goods and Services Tax Appellate Tribunal (GSTAT) has enabled a structured online mechanism for filing second appeals through its dedicated e-filing portal. Taxpayers, tax officers, and authorized representatives are required to complete a one-time registration before accessing the system for filing, managing, and tracking appeals.

The process involves entering order details, furnishing party and demand particulars, uploading supporting documents, and completing payments either online or through Bharatkosh.

Make sure to bookmark this article for future reference

To help appellants avoid procedural errors, the portal provides a step-by-step guided workflow that ensures compliance with all statutory requirements before final submission.

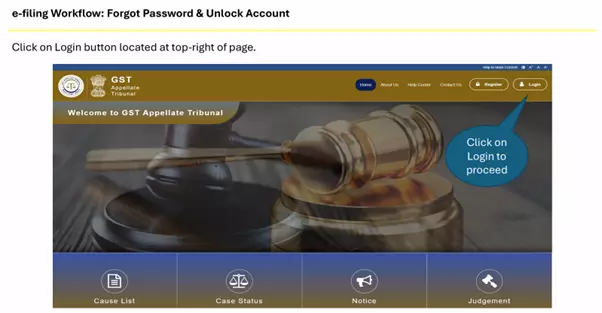

Begin by opening the official GSTAT e-filing portal.

Link Here: GSTAT

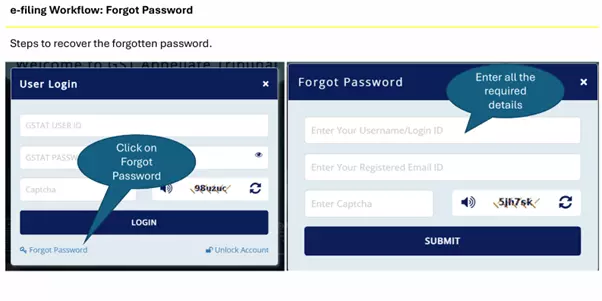

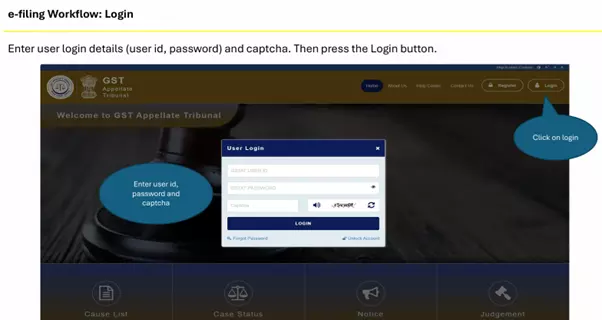

Click Login.

Enter User ID (GSTIN or registered ID), Password, and Captcha.

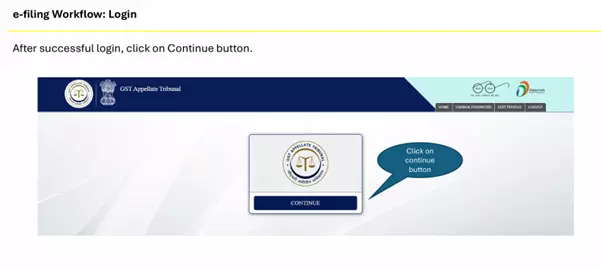

Click Continue after successful login.

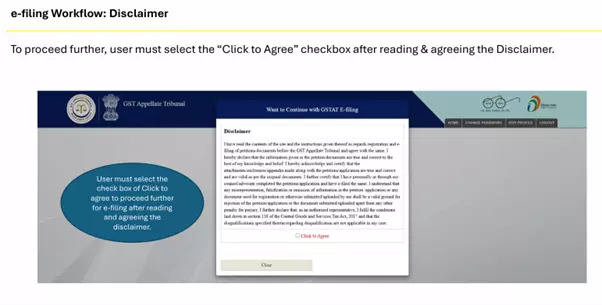

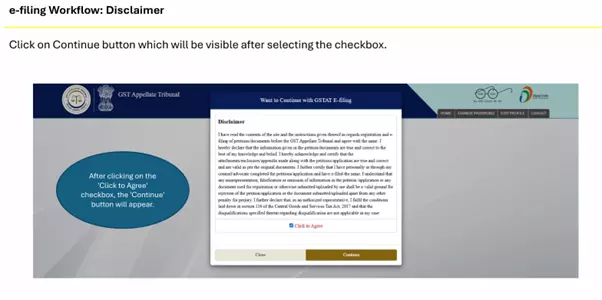

Accept Disclaimer → tick “Click to Agree” → Continue.

For assistance or queries, please utilize the 'Help', 'FAQ', or 'Contact Us' sections available on the GSTAT e-Filing portal.

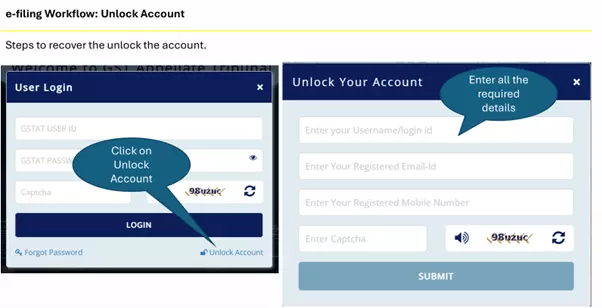

Utilize the "Forgot User ID / Password" and "Unlock Account" features on the login page, if needed.

The Goods and Services Tax Appellate Tribunal (GSTAT) has issued a detailed User Advisory for taxpayers, tax officers, and authorized representatives on the newly launched GSTAT e-filing portal, outlining timelines, prerequisites, and procedural safeguards for filing second appeals under Section 112 of the CGST Act.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates