GSTAT Second Appeal Filing: Step-by-Step Appeal Filing Guide on GSTAT Portal

The process involves entering order details, furnishing party and demand particulars, uploading supporting documents, and completing payments either online or through Bharatkosh. .

The Goods and Services Tax Appellate Tribunal (GSTAT) has enabled a structured online mechanism for filing second appeals through its dedicated e-filing portal. Taxpayers, tax officers, and authorized representatives are required to complete a one-time registration before accessing the system for filing, managing, and tracking appeals.

Make sure to bookmark this article for future reference.

The Goods and Services Tax Appellate Tribunal (GSTAT) has also issued a detailed User Advisory for taxpayers, tax officers, and authorized representatives on the newly launched GSTAT e-filing portal, outlining timelines, prerequisites, and procedural safeguards for filing second appeals under Section 112 of the CGST Act.

The advisory stated that the filing process will follow a staggered schedule until December 31, 2025, based on the ARN/CRN of the first appeal (APL-01/03) or notice (RVN-01). Appeals linked to orders or notices dated before 31 January 2022 can be filed between 24 September 2025 and 31 October 2025, while subsequent filing windows have been notified up to 31 March 2026.

Filing a Second Appeal

- ●Open the official GSTAT e-filing portal.

Link Here: GSTAT

Step 1: Navigate

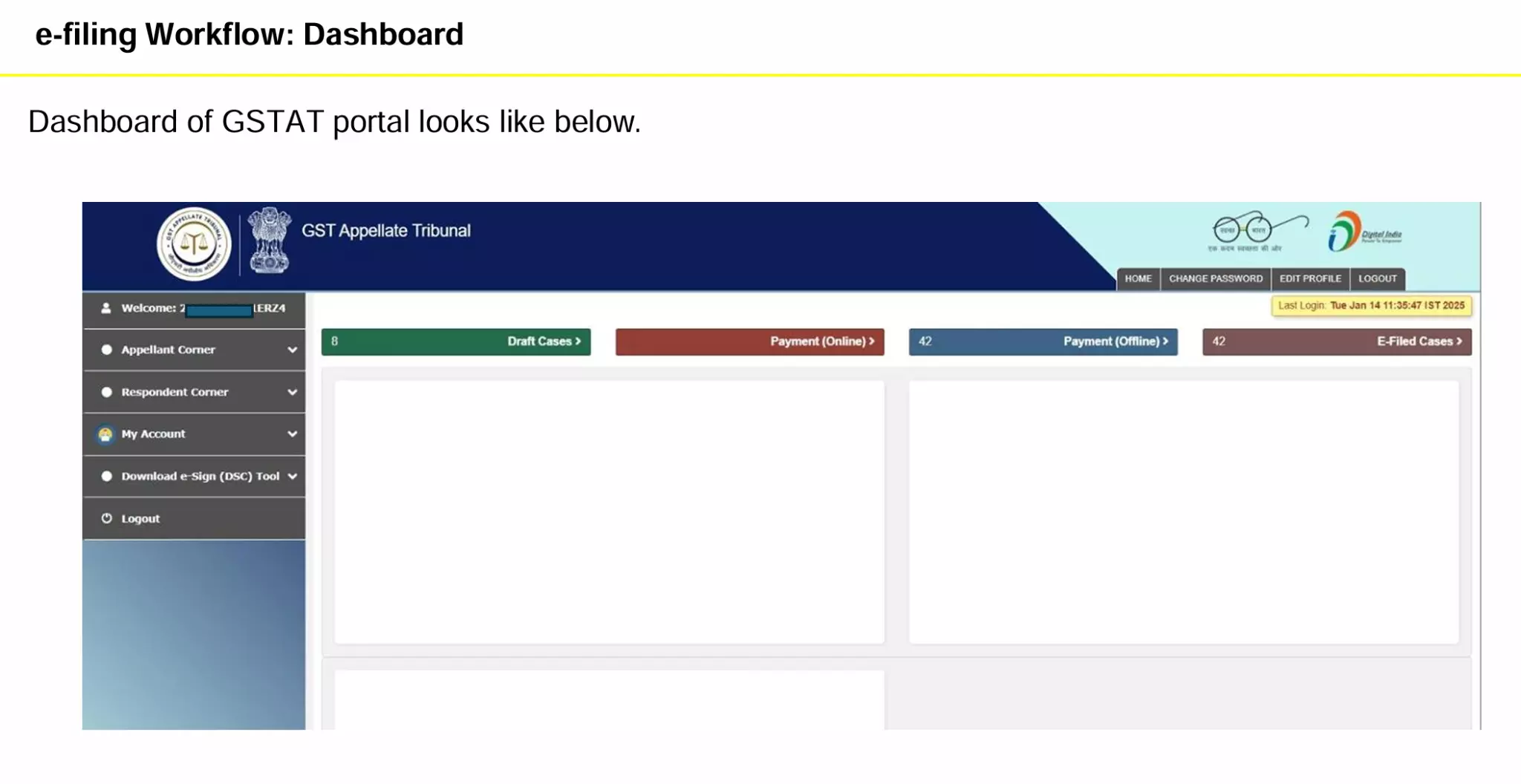

From Dashboard → Click Appellant Corner → Filing → Appeal Filing.

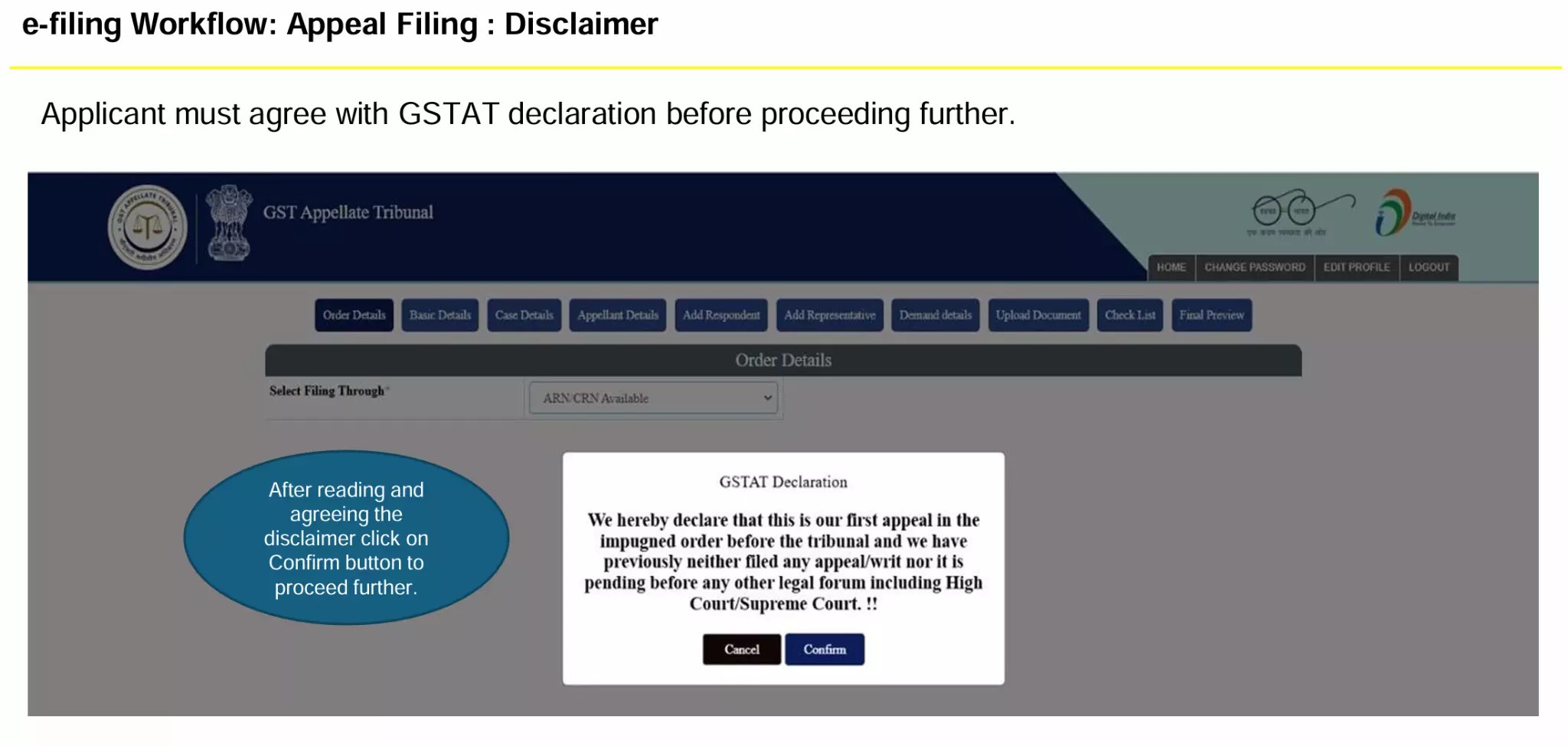

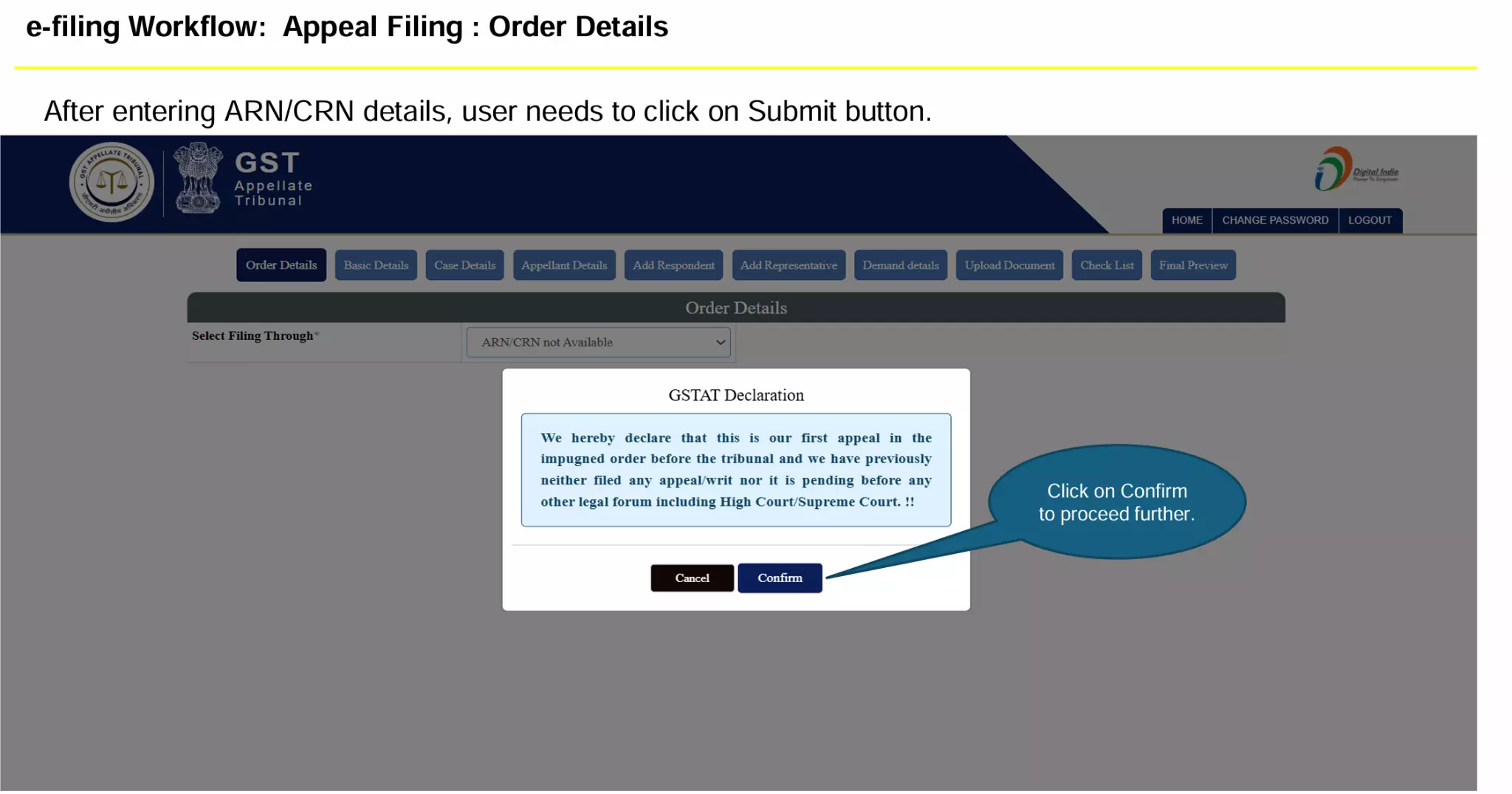

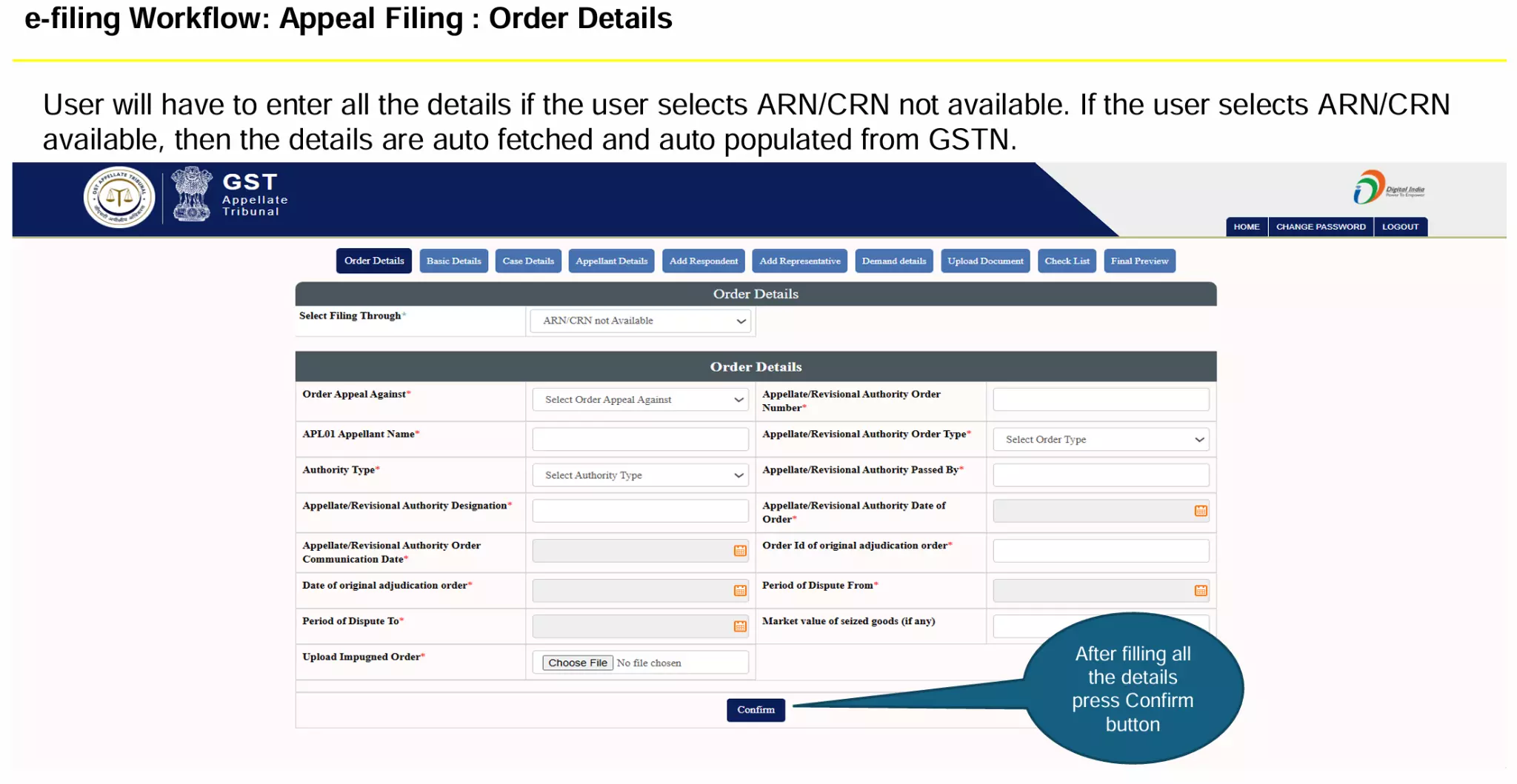

Step 2: Enter Order Details

Enter ARN/CRN → Submit.

If available, details auto-fetched from GSTN.

If not, enter manually.

Confirm to proceed.

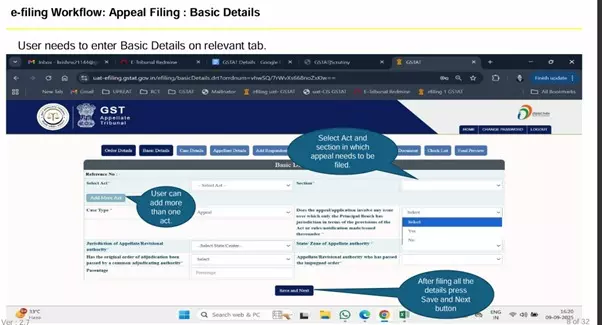

Step 3: Enter Basic Details

Select Act and Section for appeal.

Click Save & Next.

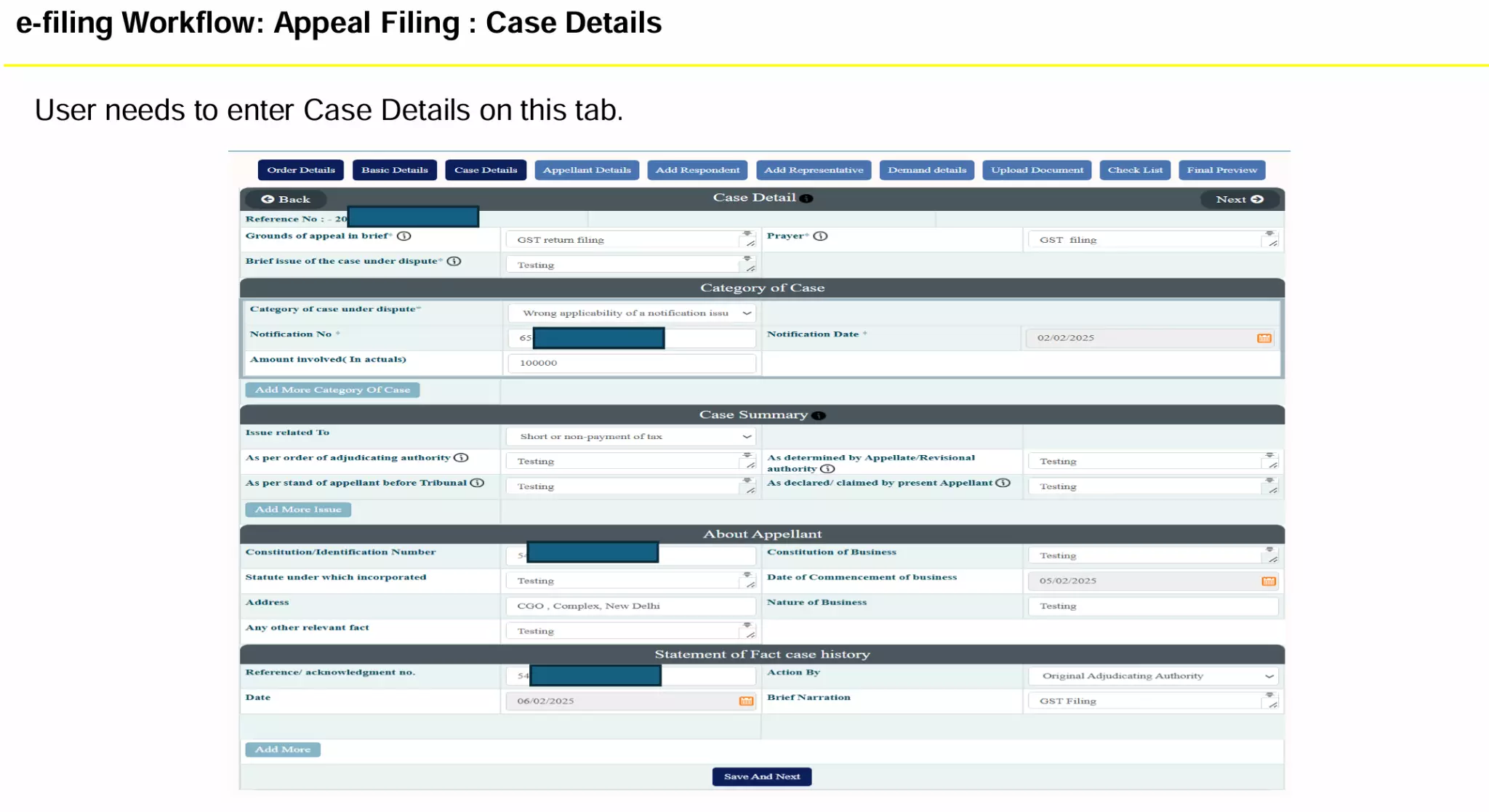

Step 4: Case Details

Enter all case-specific details.

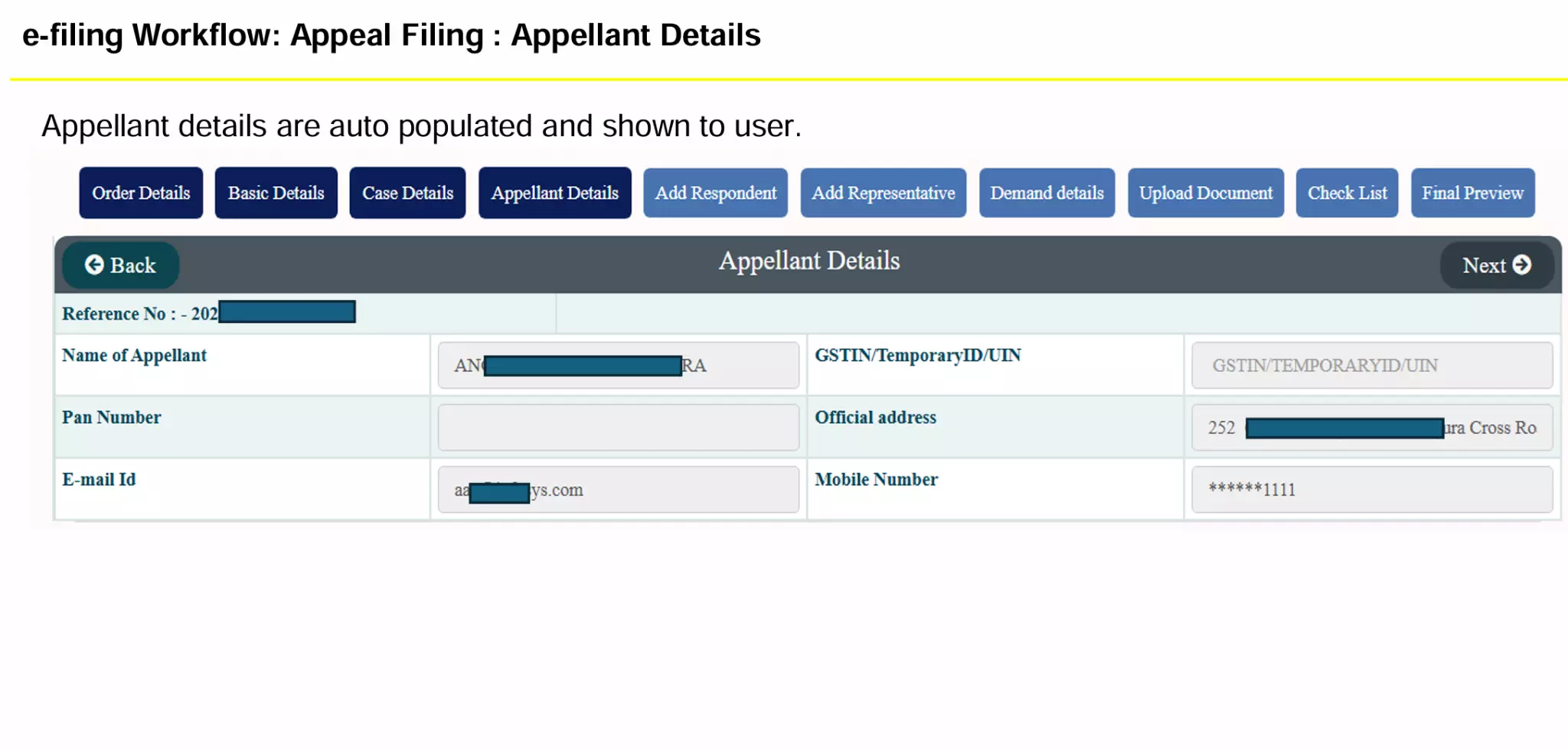

Step 5: Appellant Details

Auto-fetched, displayed for verification.

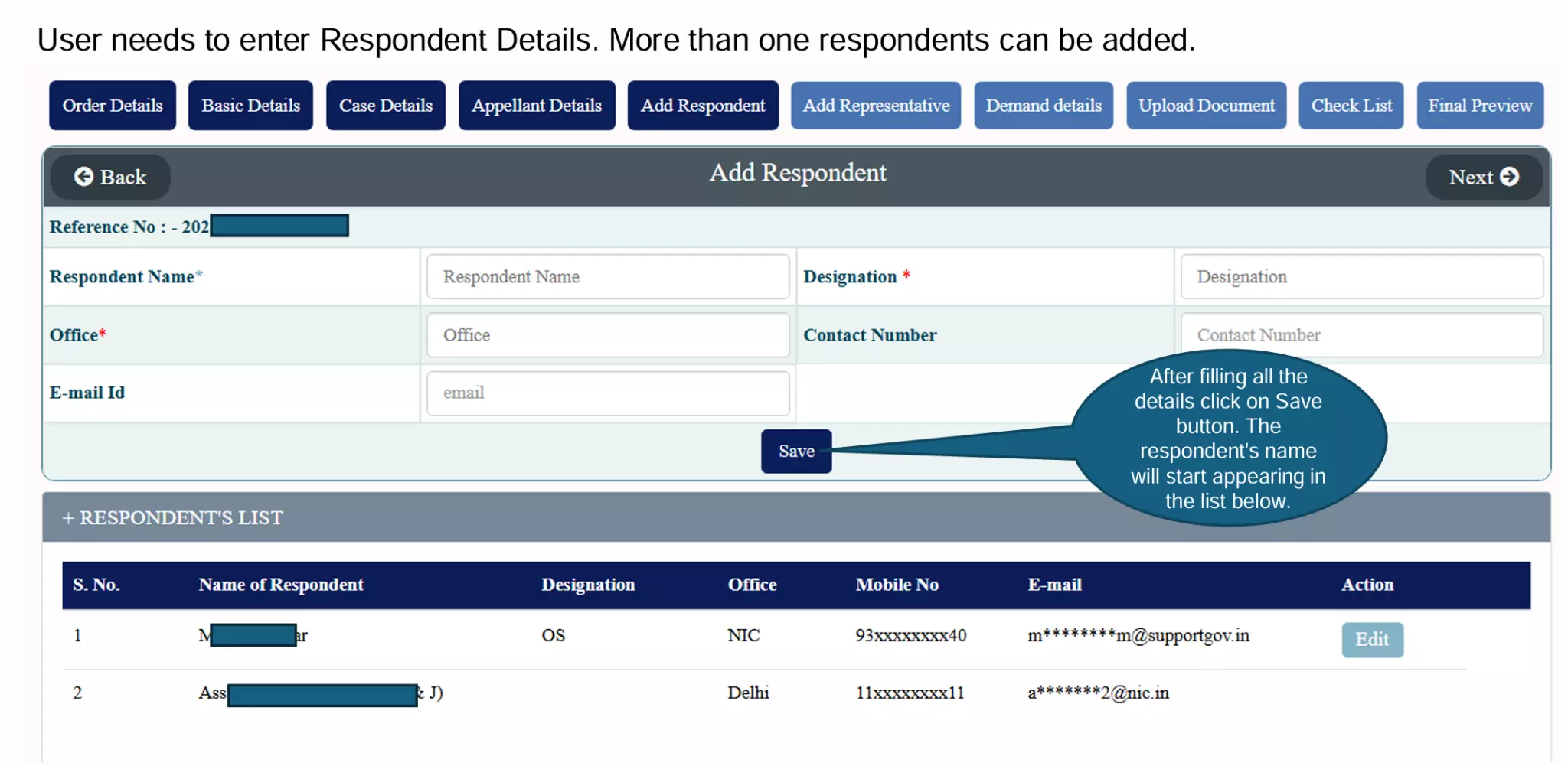

Step 6: Respondent Details

Add Respondent(s). Multiple entries allowed.

Click Save to confirm.

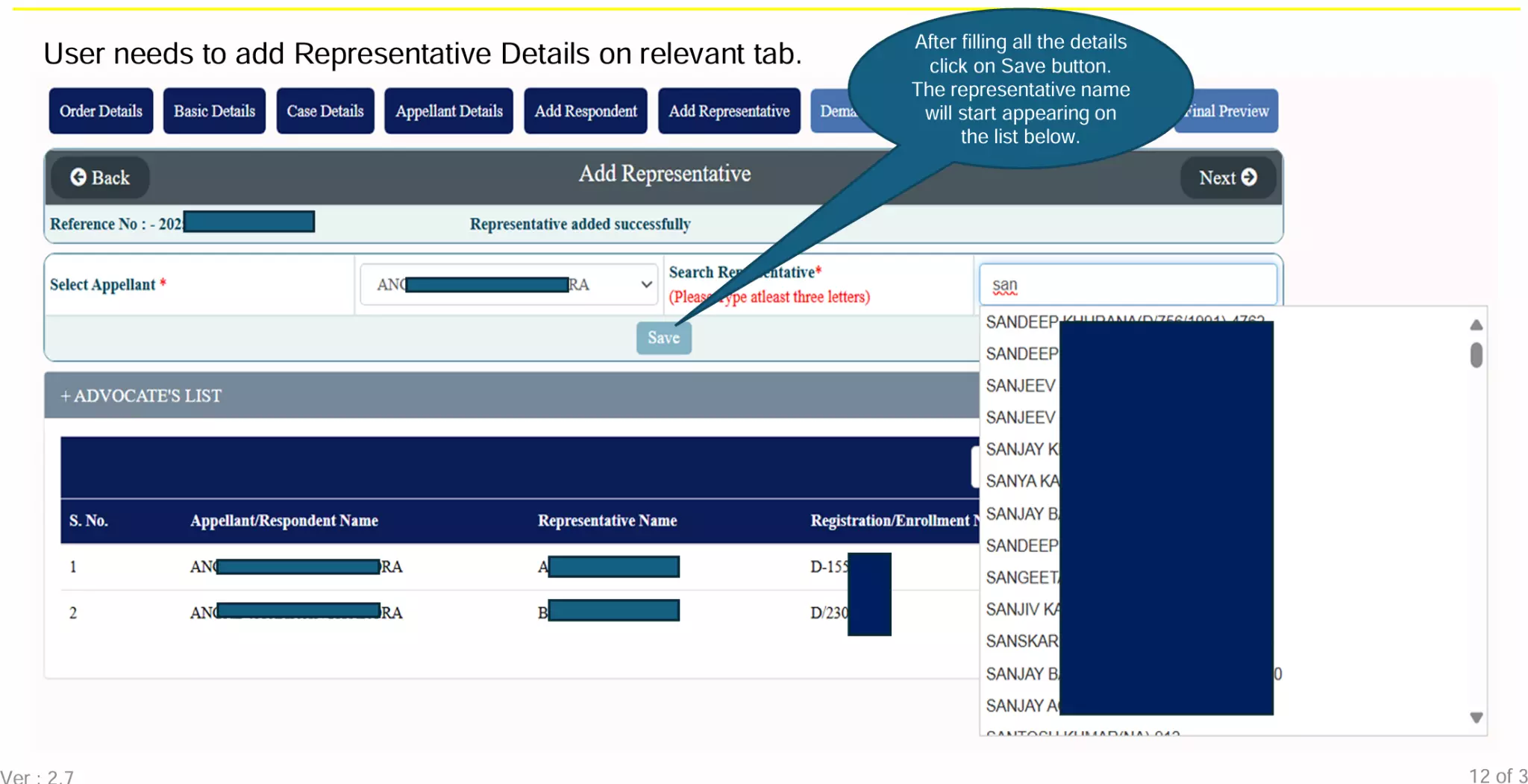

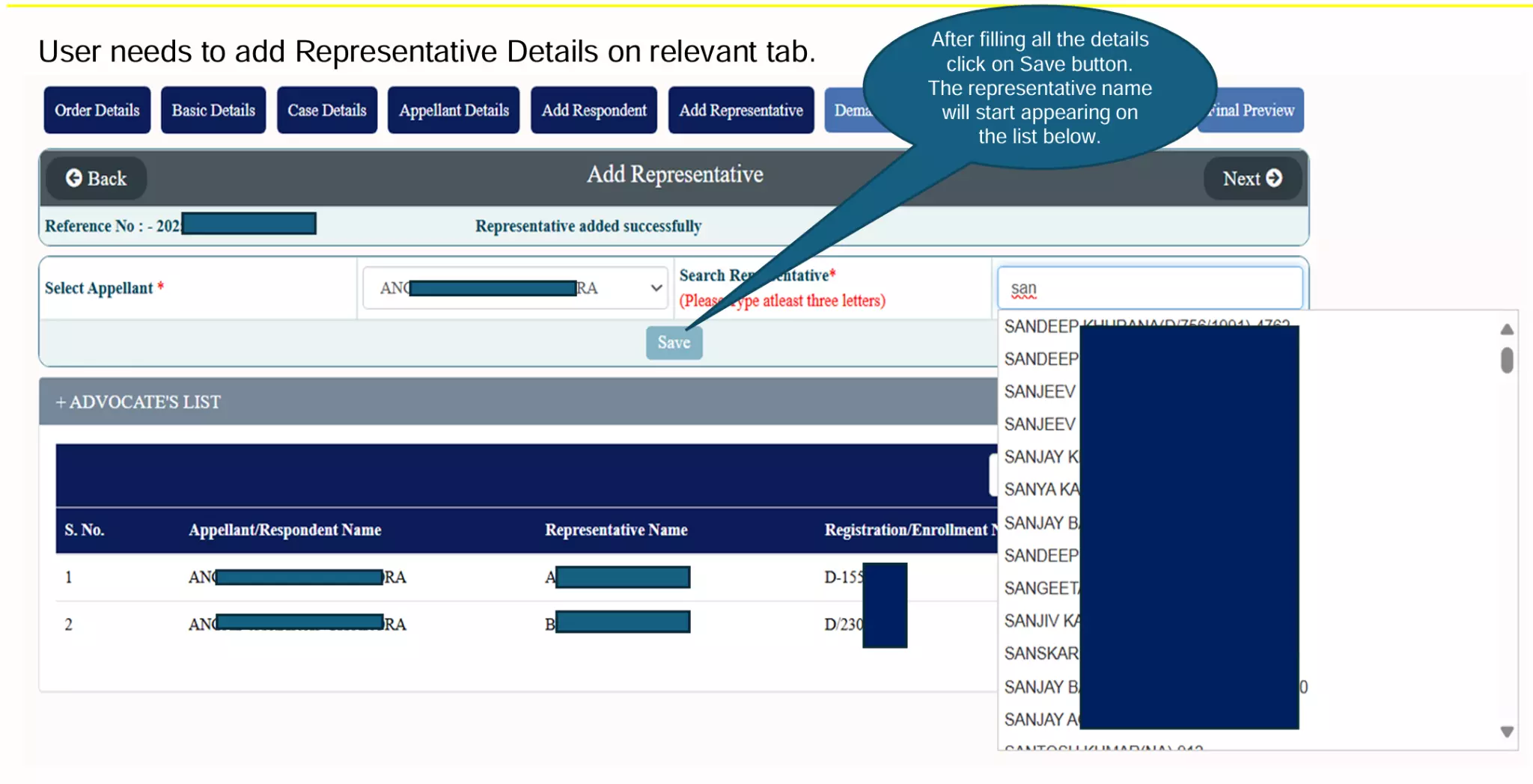

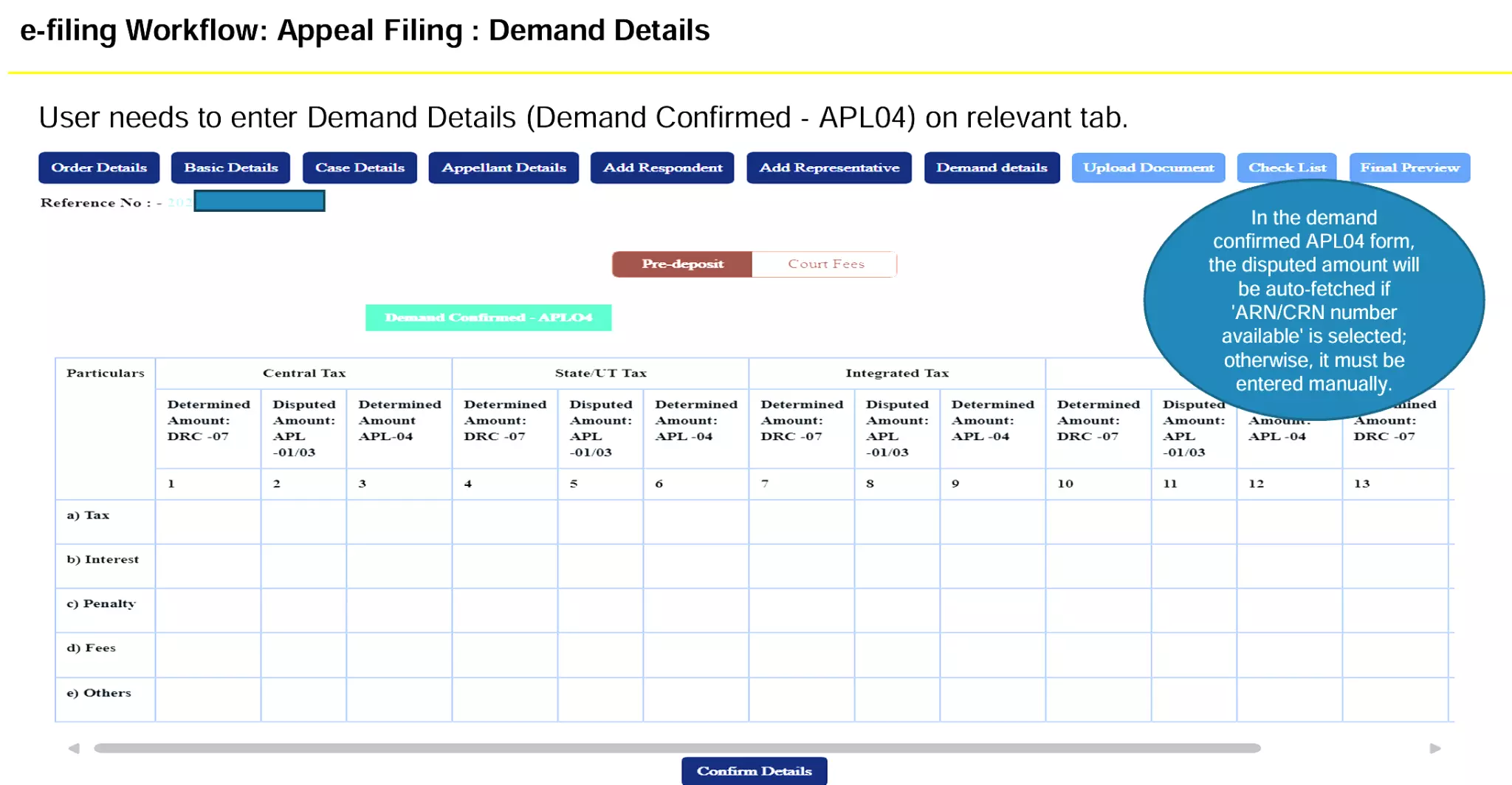

Step 7: Authorized Representative

Add Representative details or mark as “In Person”.

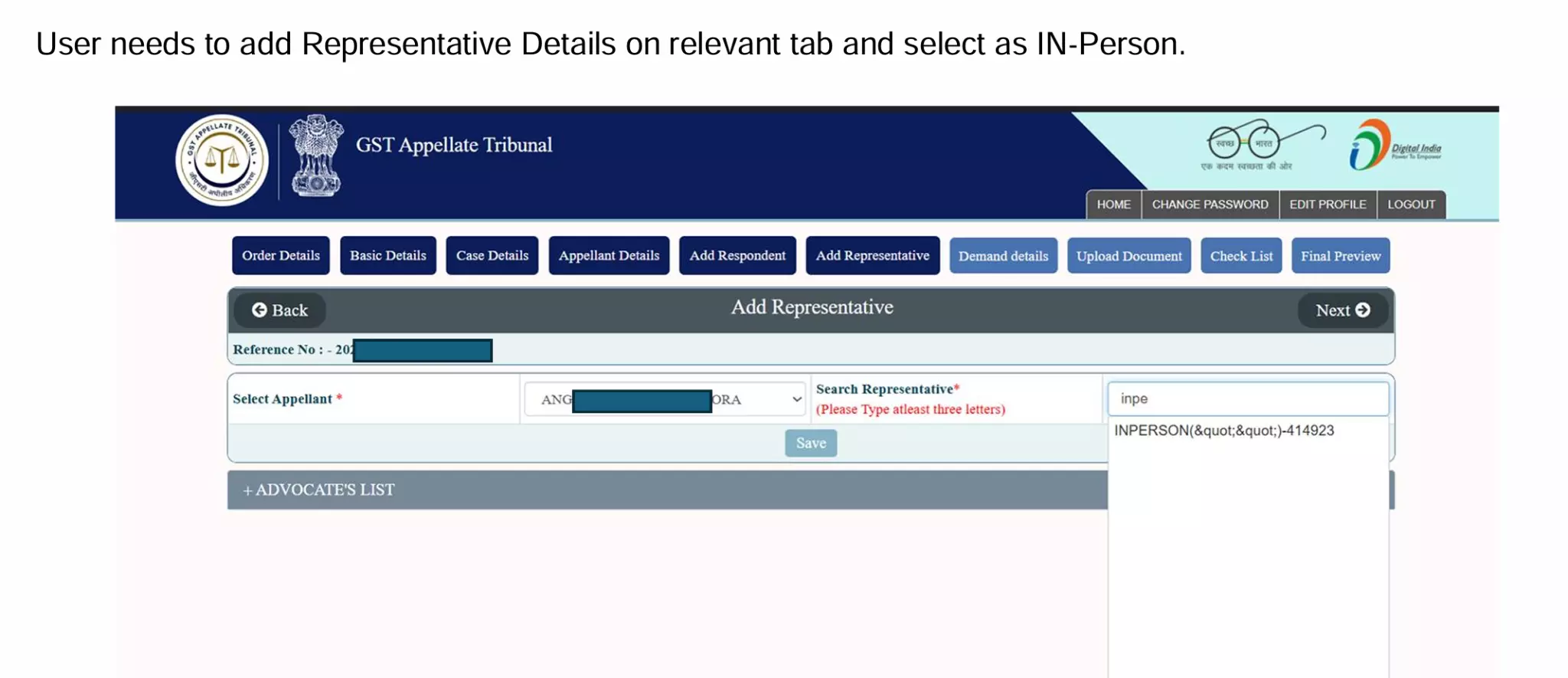

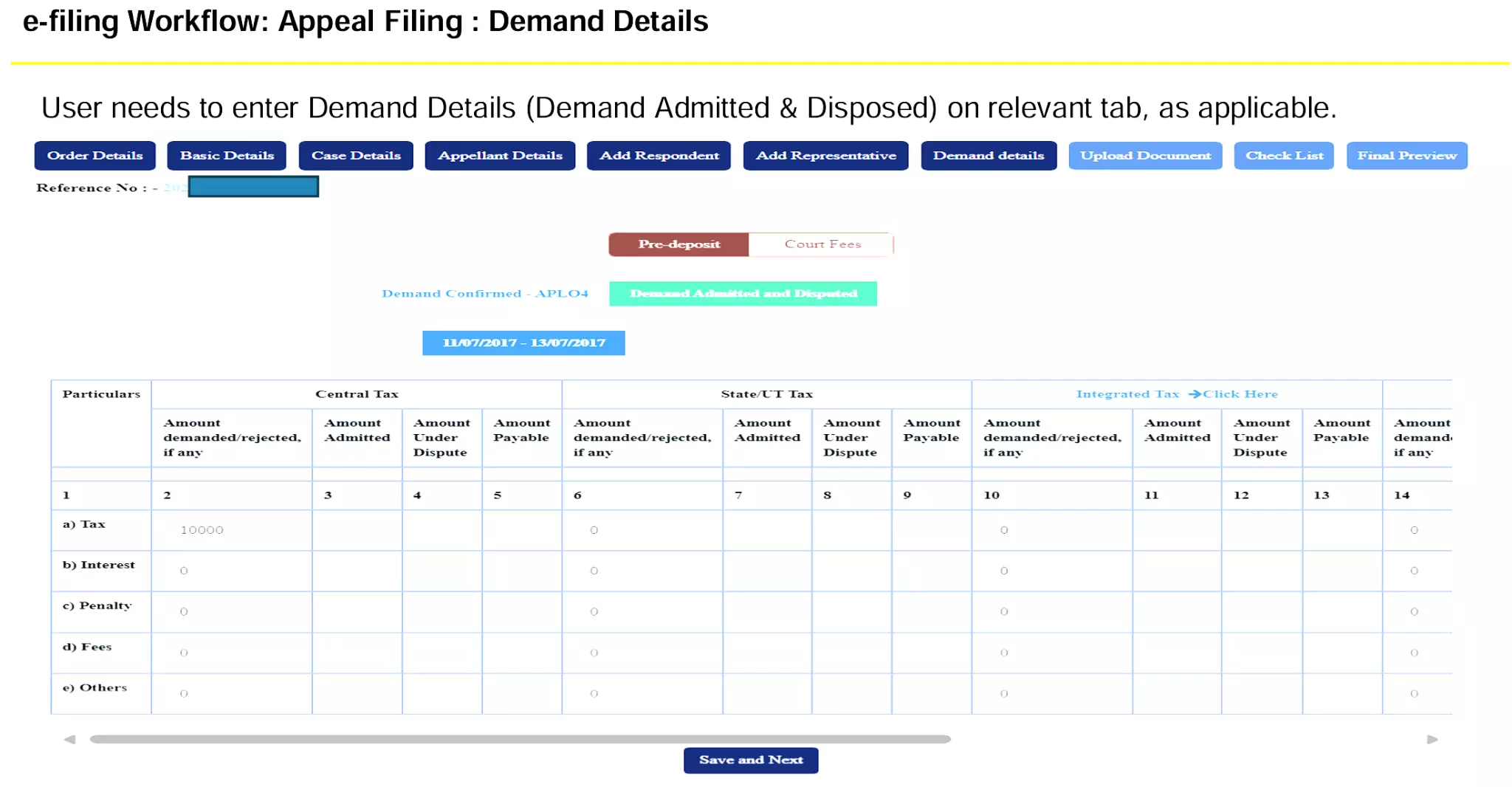

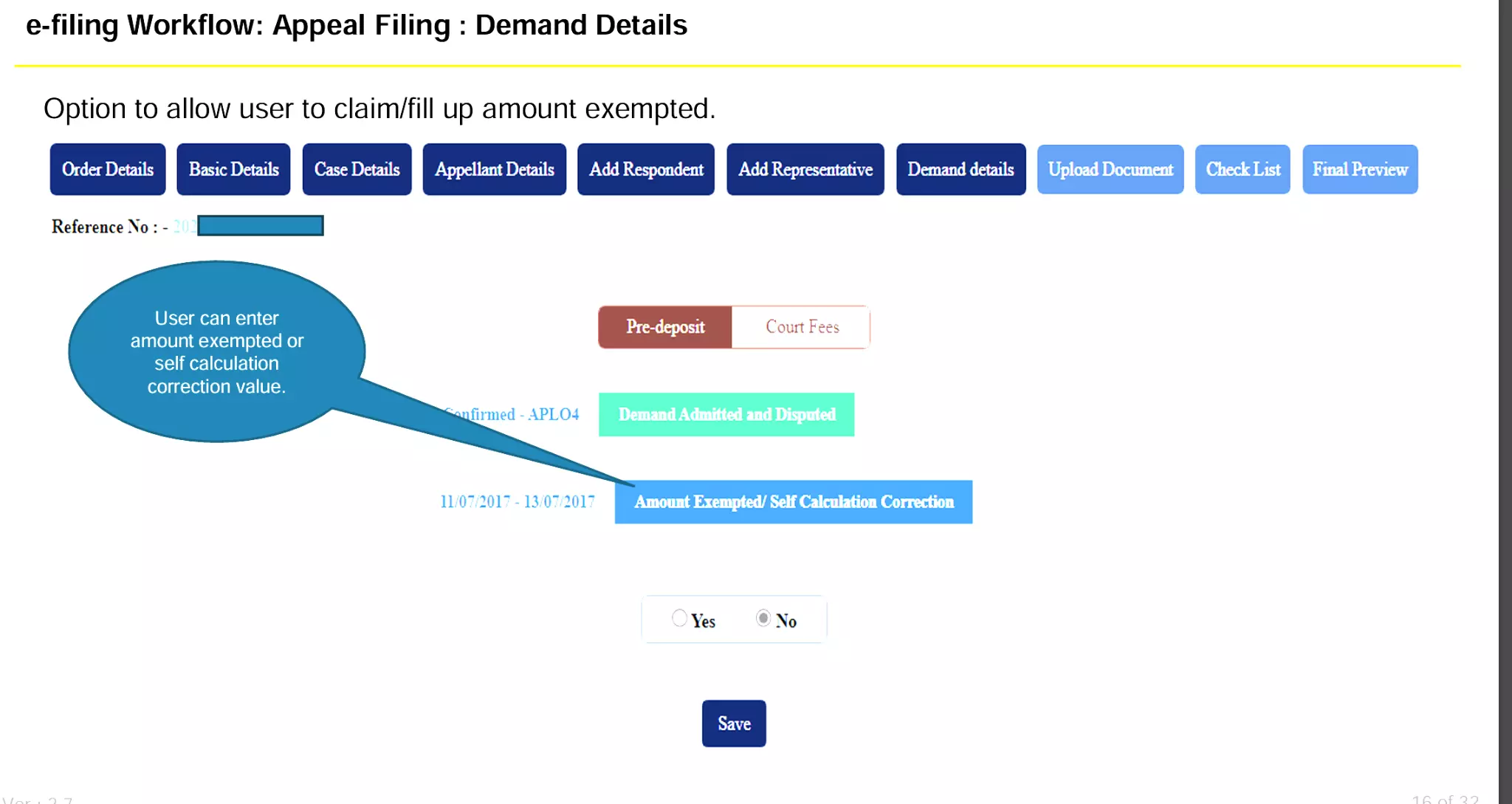

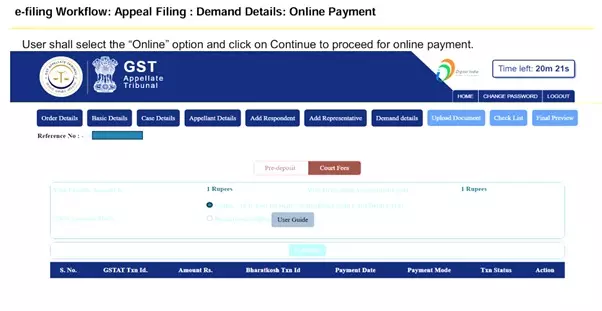

Step 8: Demand Details

Enter Demand Confirmed (APL-04) and Demand Admitted & Disposed.

If ARN/CRN linked, data auto-fetched; else manual.

Enter pre-deposit exemption details (up to 100%).

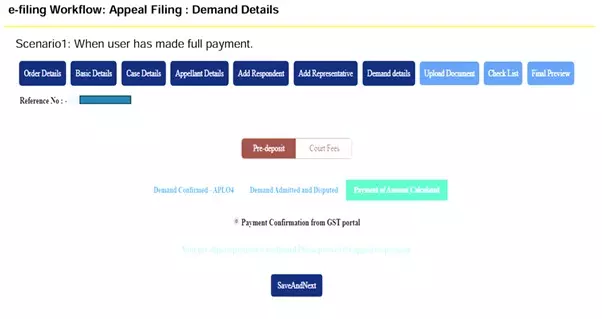

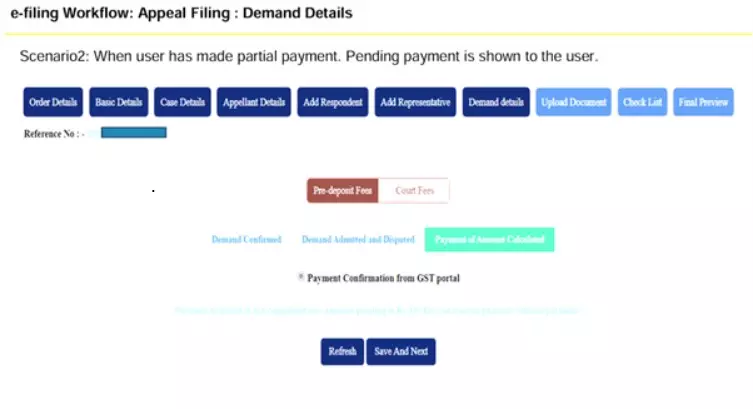

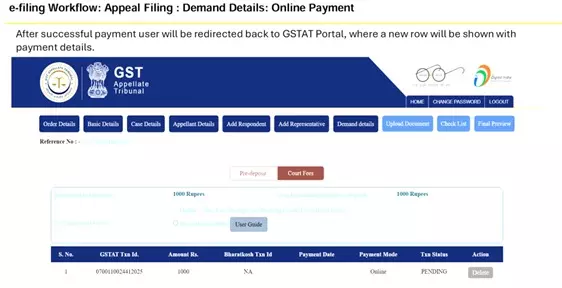

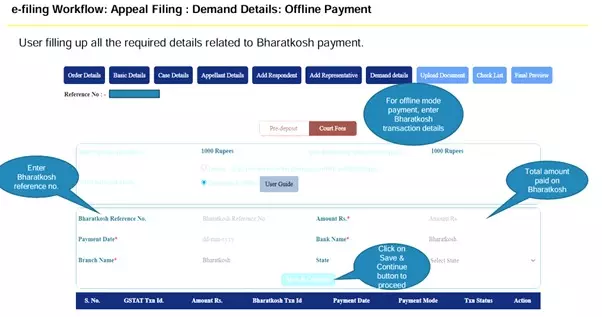

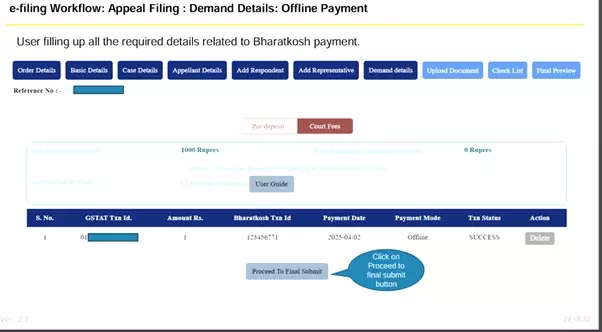

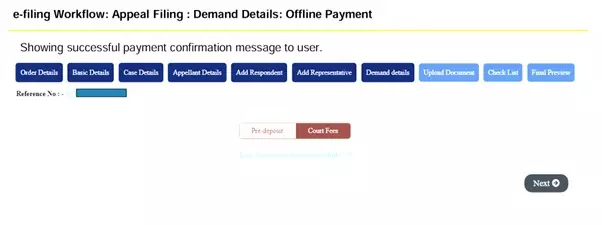

Record payment details:

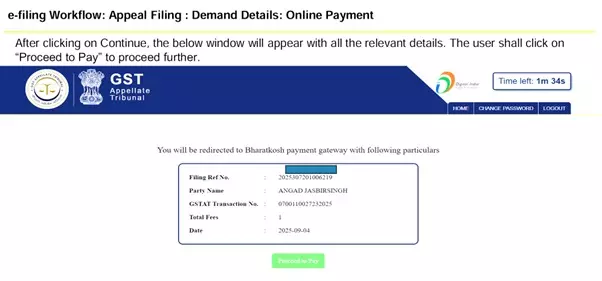

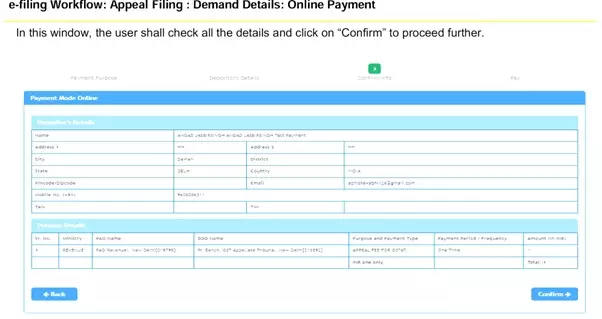

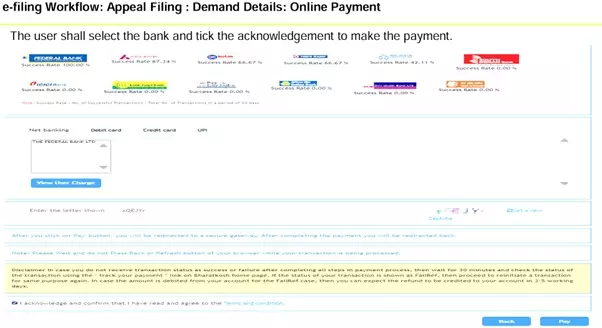

Online → Proceed to Pay → Confirm → Bank selection → Payment success.

Offline → Enter Bharatkosh transaction details → Save & Continue.

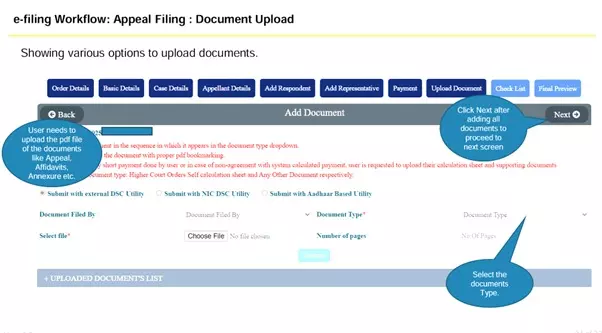

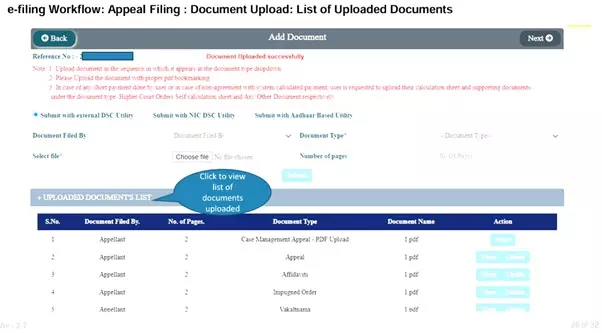

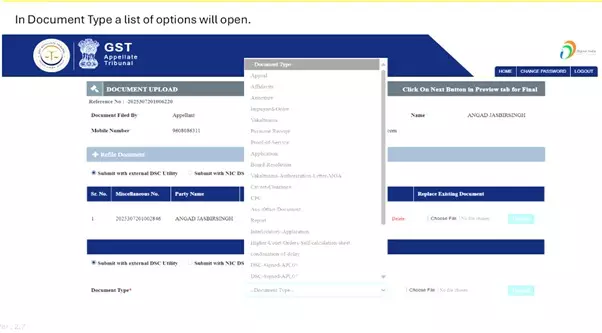

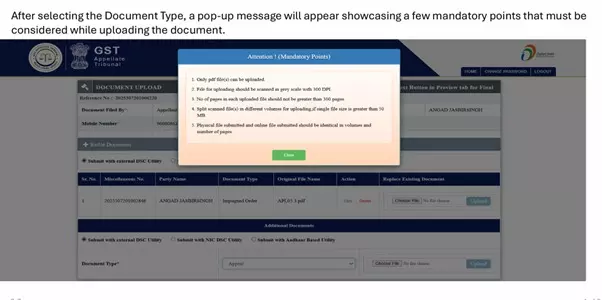

Step 9: Upload Documents

Upload PDF documents: Appeal, Affidavits, Annexures, etc.

Verify uploaded content before submission.

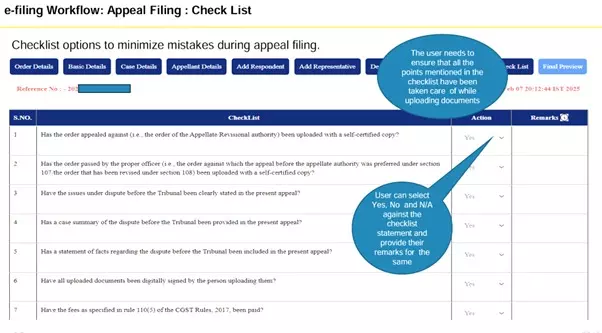

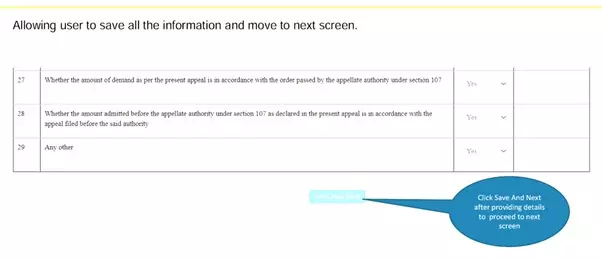

Step 10: Checklist

Tick compliance points (Yes/No/NA).

Save & Next.

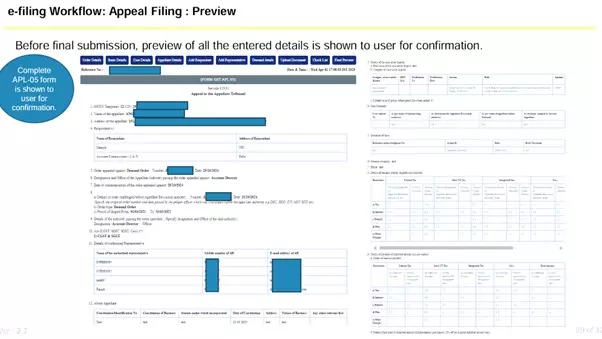

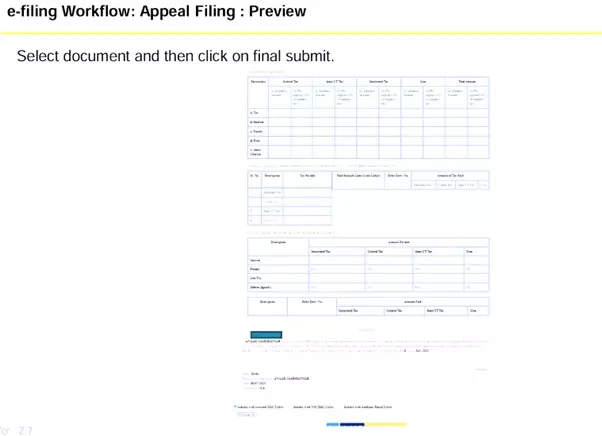

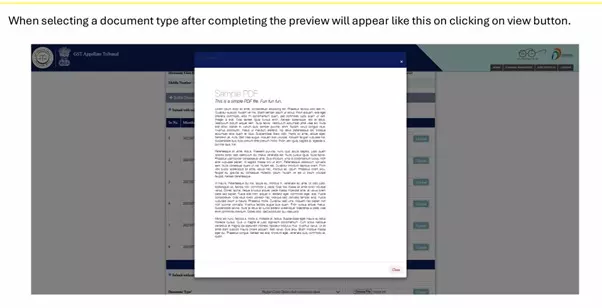

Step 11: Preview

Full preview of APL-05 Form.

Verify details before final submission.

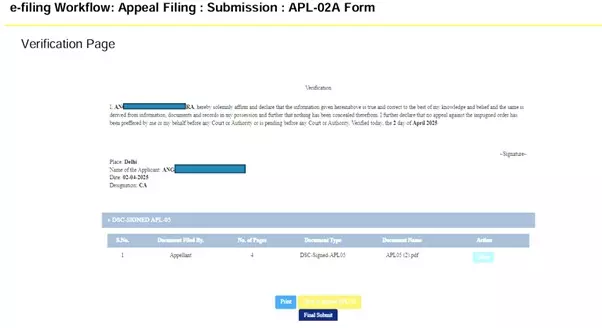

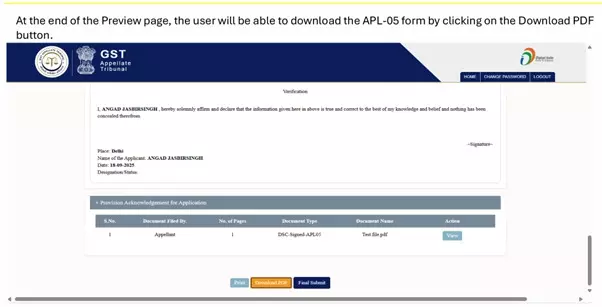

Step 12: Final Submission

Submit with verification on APL-02A Form.

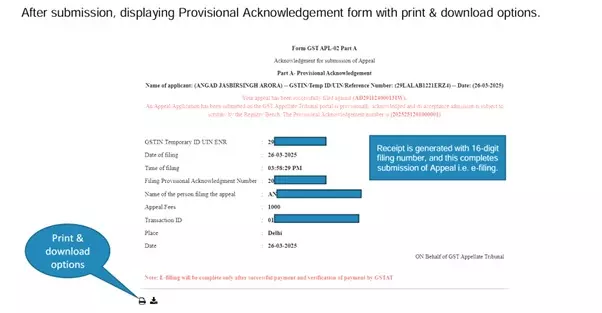

System generates 16-digit filing number with Provisional Acknowledgement (downloadable).

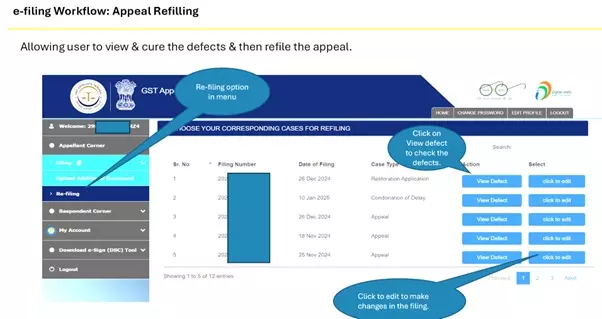

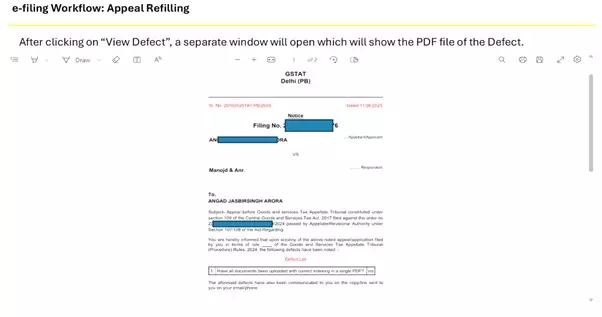

5. Re-Filing (if Defects Found)

Click Re-Filing in Appellant Corner.

View Defect PDF.

Edit details or upload corrected documents.

Preview and Final Submit.

Download updated Acknowledgement.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates