GSTAT Second Appeal Filing: Step-by-Step Registration Guide for GSTAT e-Filing Portal

To help appellants avoid procedural errors, the portal provides a step-by-step guided workflow that ensures compliance with all statutory requirements before final submission

The Goods and Services Tax Appellate Tribunal (GSTAT) has enabled a structured online mechanism for filing second appeals through its dedicated e-filing portal. Taxpayers, tax officers, and authorized representatives are required to complete a one-time registration before accessing the system for filing, managing, and tracking appeals.

The process involves entering order details, furnishing party and demand particulars, uploading supporting documents, and completing payments either online or through Bharatkosh.

To help appellants avoid procedural errors, the portal provides a step-by-step guided workflow that ensures compliance with all statutory requirements before final submission.

Make sure to bookmark this article for future reference.

Given below is a detailed step-by-step guide on how to register on the GSTAT e-Filing Portal as Taxpayer, Tax Officer, Authorized Representative, or Legal Representative.

GST on Real Estate & Works Contracts – Your Ultimate Guide to GST in the Real Estate Sector!, Click Here

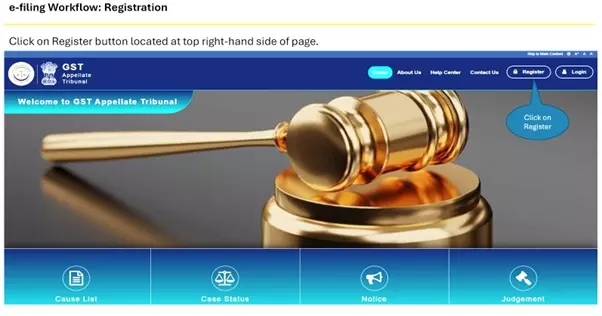

1. Access GSTAT e-Filing Portal

- Open the official GSTAT e-filing portal.

Link Here: GSTAT

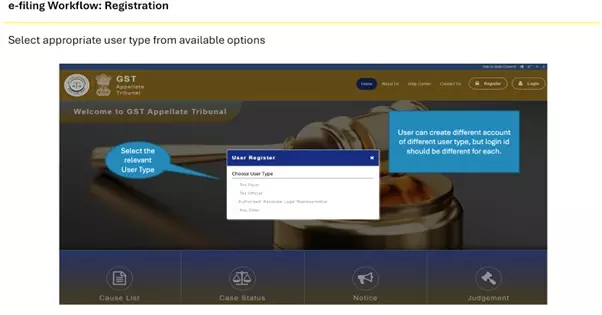

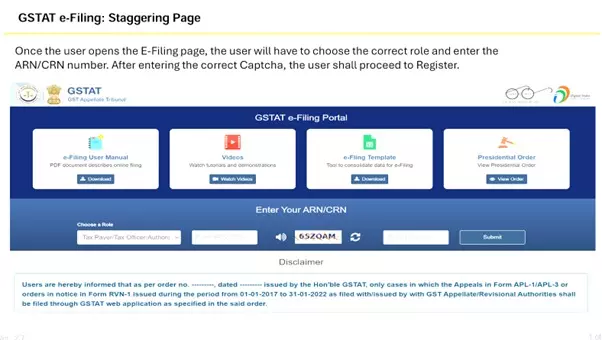

- Select the correct role (Taxpayer, Tax Officer, Authorized Representative, or Legal Representative).

- Enter ARN/CRN number and Captcha.

- Click Register.

2. Registration

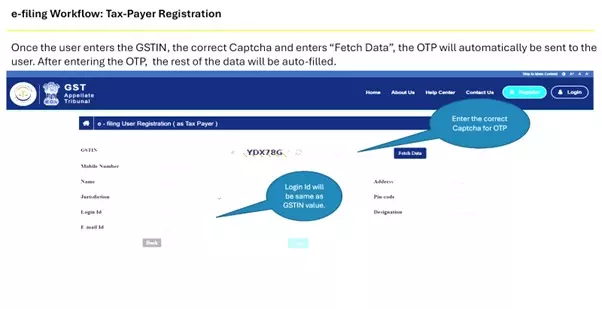

a) Taxpayer Registration

- Enter GSTIN and Captcha.

- Click Fetch Data.

- OTP is sent to registered mobile/email.

- Enter OTP → Basic details auto-filled.

- Login ID = GSTIN.

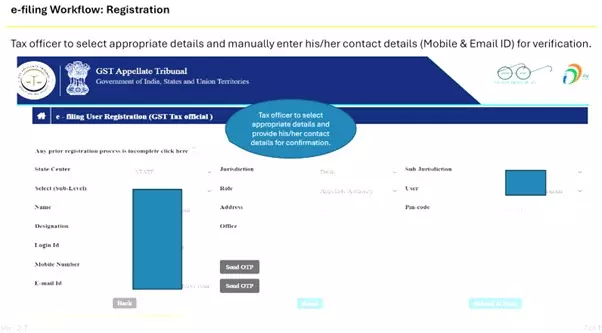

b) Tax Officer Registration

- Select details manually.

- Enter mobile number and email ID for OTP verification.

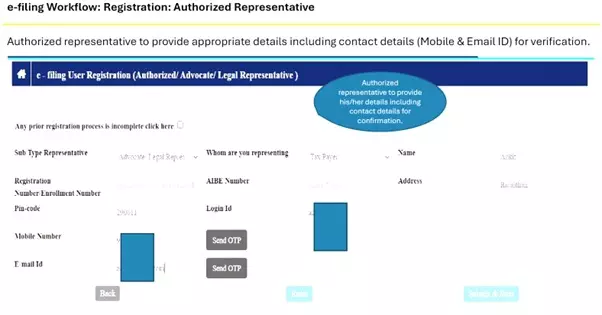

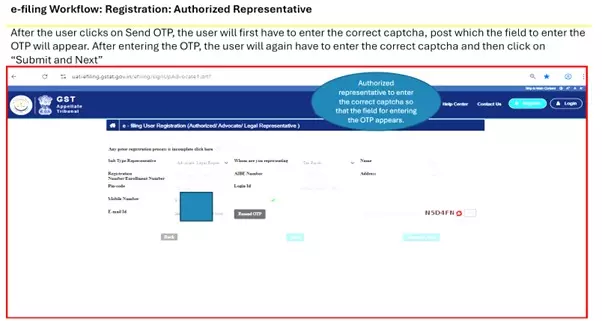

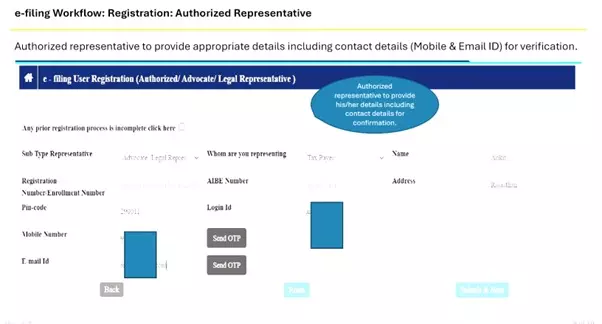

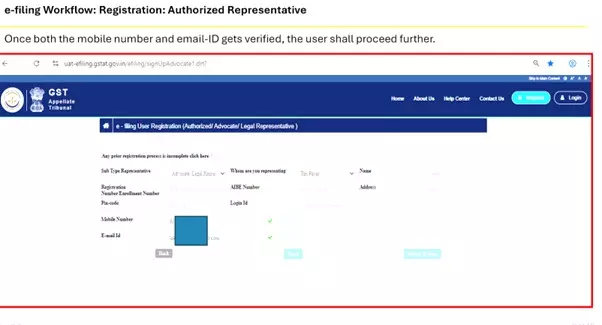

c) Authorized Representative Registration

- Provide personal details.

- Enter Captcha → Send OTP.

- Enter OTP for both mobile and email.

- Verified details are locked.

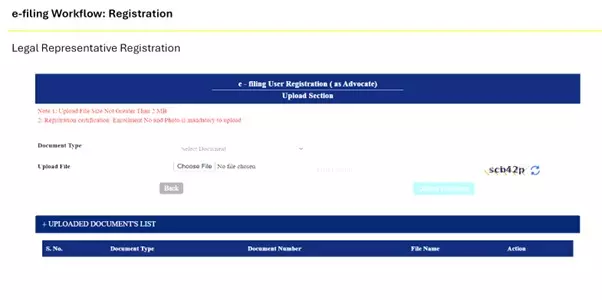

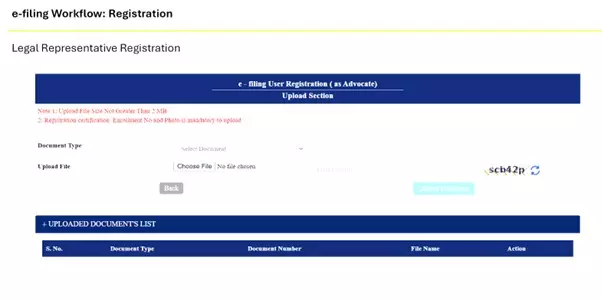

d) Legal Representative Registration

- Enter personal/contact details.

- Verify via OTP.

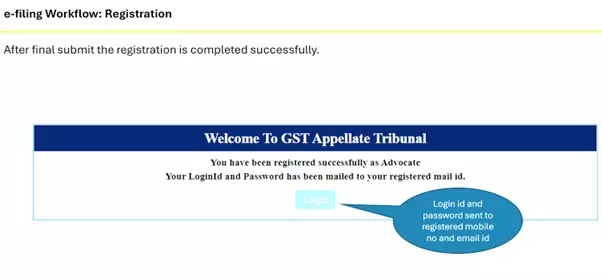

Final Step! After OTP verification and document upload, the system generates Login ID and Password sent to registered mobile and email.

The Goods and Services Tax Appellate Tribunal (GSTAT) has issued a detailed User Advisory for taxpayers, tax officers, and authorized representatives on the newly launched GSTAT e-filing portal, outlining timelines, prerequisites, and procedural safeguards for filing second appeals under Section 112 of the CGST Act.

The advisory stated that the filing process will follow a staggered schedule until December 31, 2025, based on the ARN/CRN of the first appeal (APL-01/03) or notice (RVN-01). Appeals linked to orders or notices dated before 31 January 2022 can be filed between 24 September 2025 and 31 October 2025, while subsequent filing windows have been notified up to 31 March 2026.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates