GSTN enables UPI, Credit and Debit Card GST Payment Facility in Chhattisgarh

Taxpayers in Chhattisgarh can now pay GST via UPI, Credit and Debit Cards as GSTN expands digital payment integration across more States and UTs

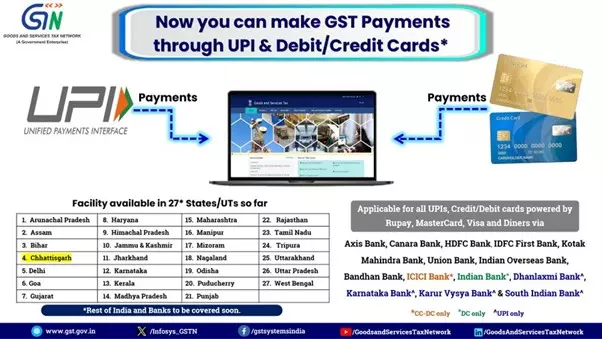

The Goods and Services Tax Network (GSTN) has announced that taxpayers in Chhattisgarh can now make their Goods and Services Tax (GST) payments using Unified Payments Interface (UPI), as well as Credit and Debit Cards, powered by major card networks such as Rupay, Visa, MasterCard, and Diners Club.

This initiative, rolled out under the GST payment modernization drive, marks a significant expansion of the new payment facility to 27 States and Union Territories, as part of the government’s push for simplified, cashless tax compliance.

The feature is currently operational in States including Andhra Pradesh, Gujarat, Maharashtra, Karnataka, Delhi, Tamil Nadu, Kerala, Uttar Pradesh, and now Chhattisgarh, among others. The remaining States and banks are expected to be integrated soon.

Through this facility, GST-registered taxpayers can seamlessly pay taxes directly through the GST portal using their preferred payment method – UPI or Debit/Credit cards without the need for net banking or manual challan generation. The payments can be processed instantly, reducing delays and errors in reconciliation.

The payment system supports major banking partners such as Axis Bank, Canara Bank, HDFC Bank, IDFC First Bank, Kotak Mahindra Bank, Union Bank, Indian Overseas Bank, Bandhan Bank, ICICI Bank, Indian Bank, Dhanlaxmi Bank, Karnataka Bank, Karur Vysya Bank, and South Indian Bank.

According to GSTN, UPI transactions are expected to greatly benefit small taxpayers and businesses by allowing faster and more secure digital payments directly from mobile devices. Similarly, credit and debit card options provide greater flexibility for taxpayers who prefer instant settlement and record tracking through their banking channels.

Currently, the Central Board of Indirect Taxes and Customs (CBIC) and GSTN are working jointly to ensure all States and banks are progressively brought under the network to ensure uniform access across the country.

The initiative follows a series of technology-driven reforms within GSTN, including improved return filing interfaces, AI-enabled data analytics for compliance, and real-time invoice matching (IMS), all designed to streamline tax administration.

Taxpayers can access the payment feature through the official GST portal and choose “Payment through UPI or Credit/Debit Card” while generating their challan, ensuring a secure, efficient, and paperless transaction experience.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates