GSTN rolls out 3 Day GST Registration

The new feature is legally implemented through Goods and Services Tax Rule 14A.

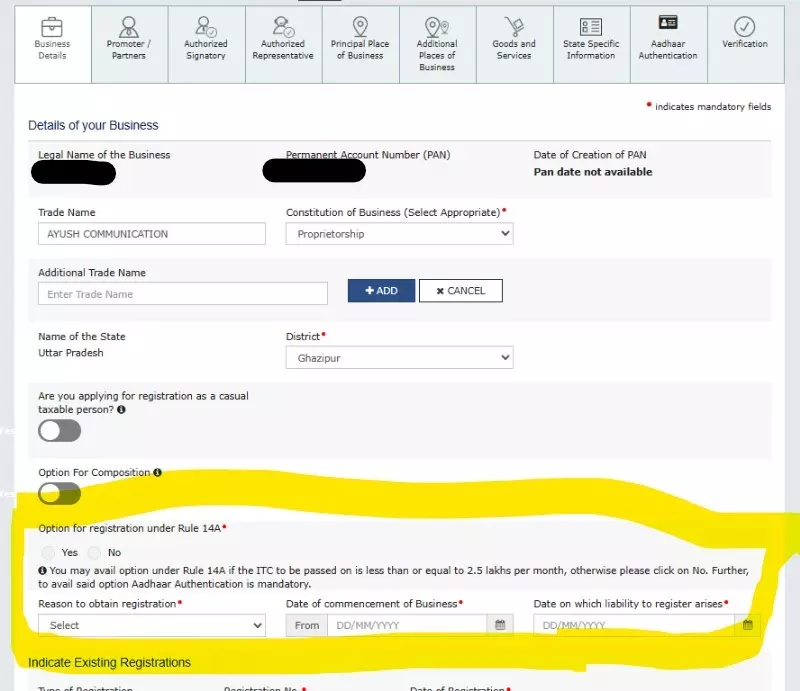

The Goods and Services Tax Network (GSTN) has introduced a new option on the GST registration portal that enables businesses to obtain registration within three working days. The new feature, implemented through Rule 14A, is now live on the GST portal and is expected to significantly reduce the time required for processing low-risk registrations.

The GST registration form now displays a new section titled “Option for registration under Rule 14A”, allowing eligible applicants to opt for expedited approval. The provision applies to businesses whose input tax credit (ITC) to be passed on is less than or equal to ₹2.5 lakh per month. Applicants choosing this option must mandatorily complete Aadhaar authentication.

Earlier, under the existing framework, the standard time for GST registration approval was seven working days, extendable if physical verification was required. With the introduction of Rule 14A, low-risk applications that meet prescribed criteria will now be processed within three working days, provided all documentation and Aadhaar verification are in order.

According to information displayed on the GST portal, the system automatically classifies applicants based on risk parameters. Only those considered low-risk and falling within the prescribed ITC limit are eligible to opt for Rule 14A. Businesses exceeding this limit are required to select “No” for this option and will continue under the normal registration timeline.

Comprehensive Guide of Law and Procedure for Filing of Income Tax Appeals, Click Here

Tax professionals have welcomed the change as a positive step towards reducing procedural bottlenecks. They note that small and medium enterprises (SMEs) often face delays in obtaining registration, impacting business commencement and tax compliance. The new fast-track system is expected to encourage voluntary compliance and faster market entry for new enterprises.

However, experts have also cautioned that applicants must ensure data accuracy in PAN, Aadhaar, and address details. Any mismatch could trigger manual verification, thereby disqualifying the application from the three-day window. Further, while the simplified process promises speed, all standard verification powers of tax officers remain intact in cases of suspicion or inconsistency.

With the implementation of Rule 14A, the government continues its push toward automation and time-bound registrations under GST. The measure aligns with the policy objective of making India’s indirect tax regime more efficient and business-friendly, focused on ‘ease of doing business’.

Support our journalism by subscribing to Taxscanpremium. Follow us on Telegram for quick updates