Here’s How to Fix a Major Error while Filing ITR-4 Online: “[#/ITAR/ITR4/PersonalInfo/Address/Phone: required key [PhoneNo] not found]”

The Portal is still not fully glitch free and professionals are demanding an extension to enable smooth filings.

![Here’s How to Fix a Major Error while Filing ITR-4 Online: “[#/ITAR/ITR4/PersonalInfo/Address/Phone: required key [PhoneNo] not found]” Here’s How to Fix a Major Error while Filing ITR-4 Online: “[#/ITAR/ITR4/PersonalInfo/Address/Phone: required key [PhoneNo] not found]”](https://images.taxscan.in/h-upload/2025/09/15/2087409-itr-4-filing-taxscan.webp)

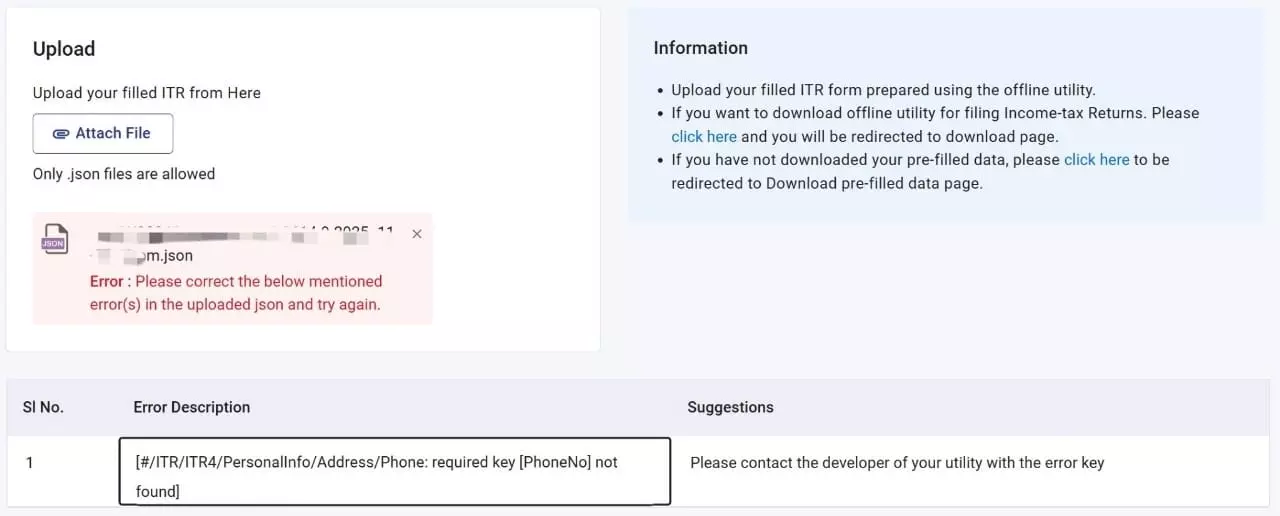

Taxpayers filing their Income Tax Return (ITR-4) online have recently encountered a major error while uploading JSON files prepared using the Income Tax Department’s offline utility.

The error message displayed reads as follows:

“[#/ITR/ITR4/PersonalInfo/Address/Phone: required key [PhoneNo] not found]”

This prevents the JSON file from being successfully uploaded on the e-filing portal.

Cause of the Error

The error arises because the JSON file generated by the offline utility is missing a mandatory field for the taxpayer’s Phone Number under the “Personal Info > Address > Phone” section. Since the e-filing system validates the schema strictly, the absence of this field causes the upload failure.

In simple terms, even though the taxpayer may have entered contact details, the utility is not passing the required “PhoneNo” key in the JSON file, leading to rejection at the upload stage.

System Message

When the JSON is uploaded, the error log displays as follows:

- Error Description: [#/ITR/ITR4/PersonalInfo/Address/Phone: required key [PhoneNo] not found]

- Suggestion Shown: Please contact the developer of your utility with the error key

Solution

Taxpayers need not panic. The issue can be fixed easily by correcting the JSON file using the Income Tax Department’s updated utility or by manually ensuring that the “Phone Number” field is properly saved before exporting the JSON.

The Fix: At times, in the secondary phone number and landline blanks to be filled, “91” will be auto populated, which causes this error. You can just remove that to get the filing done easily and without errors.

A detailed step-by-step fix has been demonstrated in this video guide: Watch Here

Things to Keep in Mind

- Always download the latest version of the ITR offline utility from the Income Tax e-filing portal.

- Ensure the Personal Info section, especially phone number, is correctly filled before generating the JSON.

- If the error persists, re-download the pre-filled data and regenerate the JSON afresh.

This is a technical validation error and not related to the taxpayer’s financial details. Timely correction ensures smooth uploading and avoids delays in filing.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates