Important Income Tax Update: CBDT releases Offline ITR utilities for AY 2025-26

As the utility has updated for the ITR form 1 to 4, it can be applicable to the taxpayers who file the returns of these respective forms.

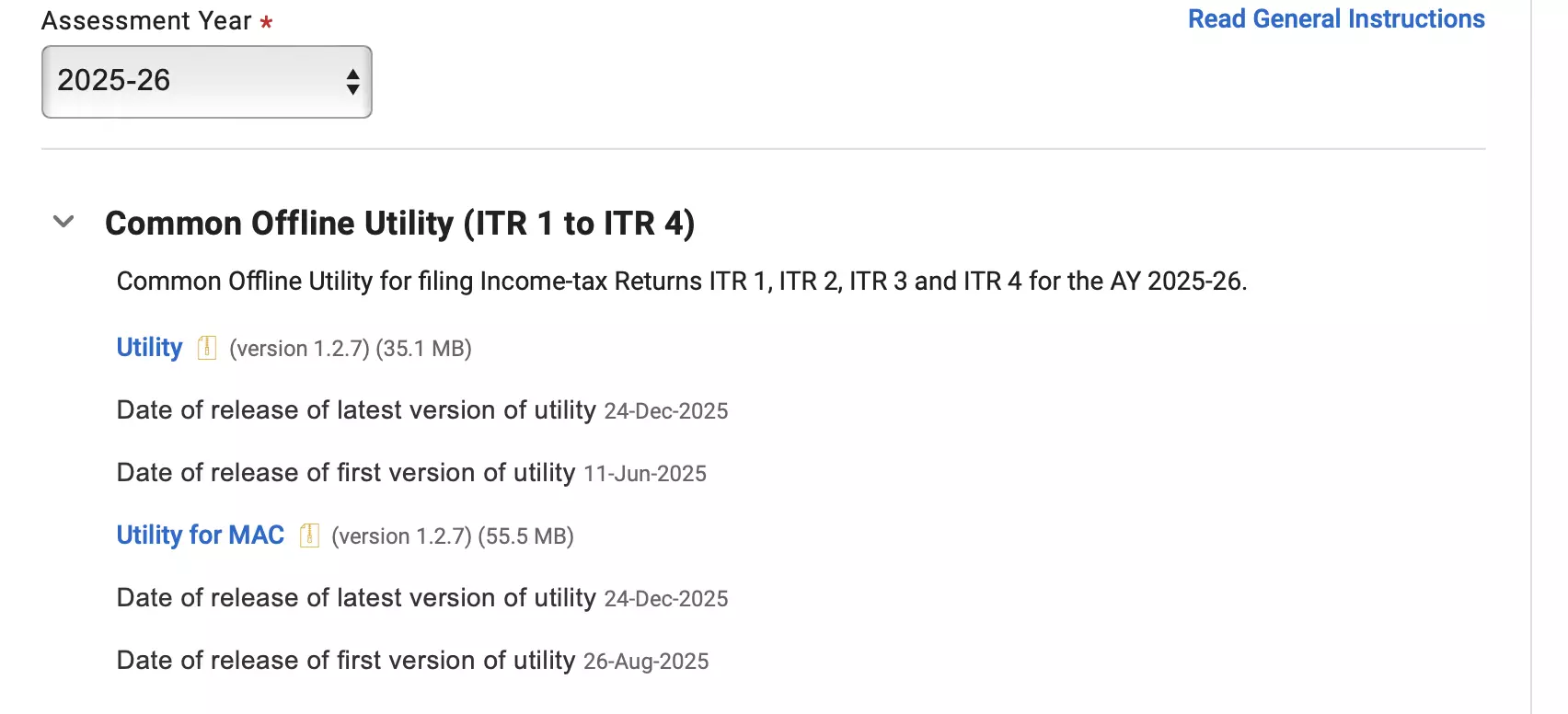

The Central Board of Direct Taxes ( CBDT ) has released the offline Income Tax Return ( ITR ) utilities for the Assessment Year ( AY ) 2025-26. The same was released on 24th December 2025.

The income tax department has updated the offline utility for ITR 1, 2 3 and 4. The offline utility allows the tax professionals to enter the data without the internet access. Once you download the file, you can make your entries and later upload them to the e-filing portal.

How to download Common offline Utility

The tax professionals or the taxpayers can access the common utilities from the ‘Downloads’ section of the income tax department.

First go to the Income Tax Department's downloads section at incometax.gov.in under "Downloads > Income Tax Return" or "Offline Utilities." Next, extract the ZIP file, open the executable, complete the return offline, generate the JSON, and upload via the e-filing portal with e-verification.

Also Read:Publicising Donor Names for Religious Events Not Convert Donations into Business Income: ITAT [Read Order]

Also Read:Publicising Donor Names for Religious Events Not Convert Donations into Business Income: ITAT [Read Order]

Who all can use the Common Offline Utility tool

As the utility has updated for the ITR form 1 to 4, it can be applicable to the taxpayers who file the returns of these respective forms.

ITR-1 or Sahaj : This is the first form and shall be filed by individuals with total income up to ₹50 lakh from salary/pension, one house property (no brought-forward losses), other sources like interest, agricultural income up to ₹5,000, and LTCG under Section 112A up to ₹1.25 lakh.

ITR-2: This form, which includes salaries, multiple home properties, capital gains, foreign income and assets, and Chapter VI-A deductions, is applicable to individuals and HUFs who are not involved in business or a profession. Key schedules include information on capital gains and foreign assets (FA); individuals with presumed business income are excluded.

ITR - 3: This particular form, ITR-3, includes all heads such as salary, home property, capital gains, and company profits (beyond presumptive taxes) and is meant for individuals or HUFs having income from proprietary businesses or professions. It needs partner income from firms, audit data if necessary, and detailed turnover, expense, and balance sheet schedules.

ITR - 4: This form is filed by the presumptive taxation taxpayers (Sections 44AD, 44ADA, and 44AE) with income up to ₹50 lakh (enterprise), ₹75 lakh (profession), with salaries, one home, other sources, and LTCG up to ₹1.25 lakh.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates