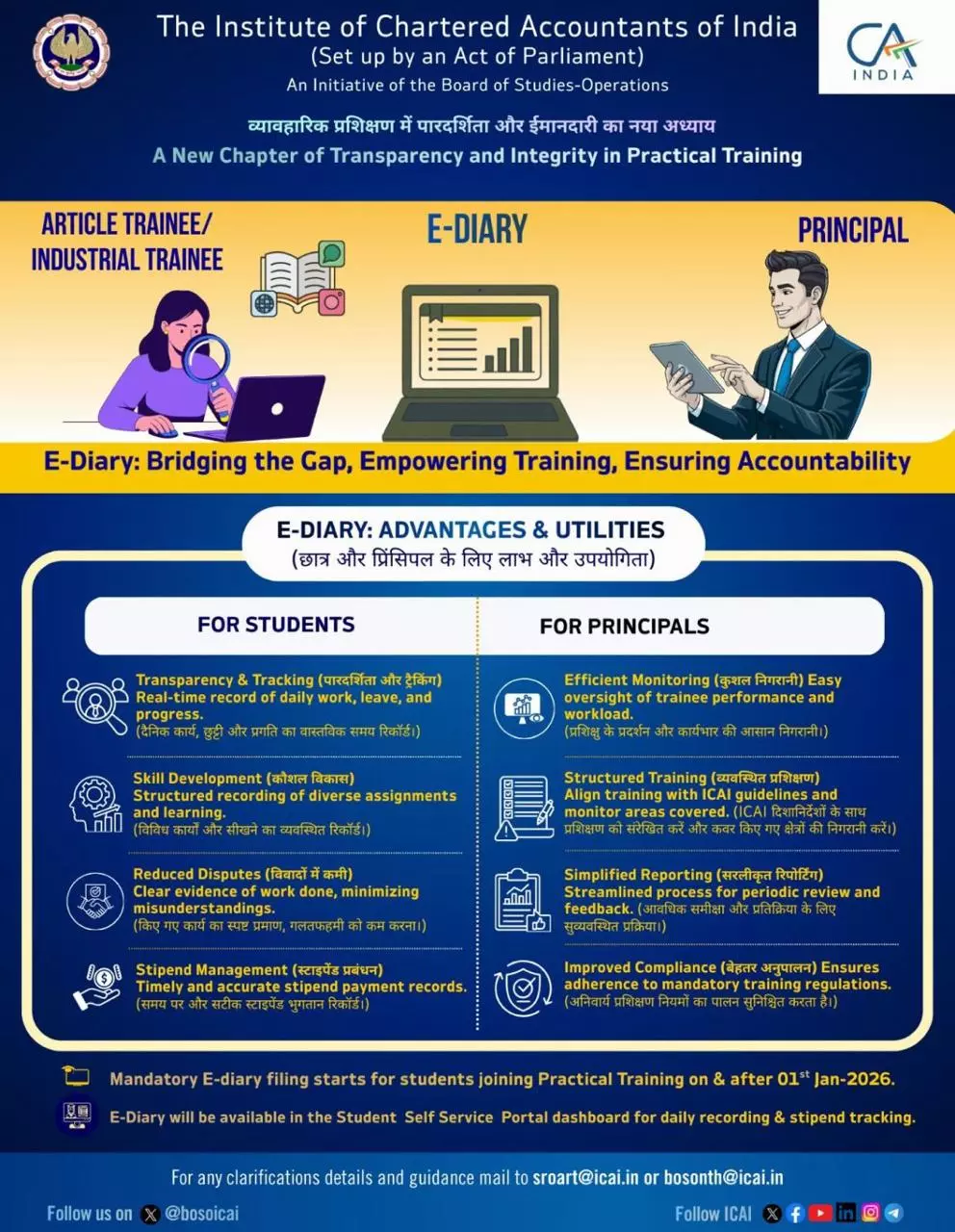

Important update for CA Students: ICAI Introduces Mandatory E-Diary for Articleship Starting Jan 1, 2026 [Read Manual Here]

The E-Diary is positioned as a dual-benefit tool, empowering students with autonomy and principals with accountability.

![Important update for CA Students: ICAI Introduces Mandatory E-Diary for Articleship Starting Jan 1, 2026 [Read Manual Here] Important update for CA Students: ICAI Introduces Mandatory E-Diary for Articleship Starting Jan 1, 2026 [Read Manual Here]](https://images.taxscan.in/h-upload/2025/12/31/2116265-icai-introduces-mandatory-e-diary-articleship-taxscan.webp)

The Institute of Chartered Accountants of India (ICAI) has introduced mandatory E-Diary filing for students joining practical training from Jan 1 of 2026. This is to improve the transparency and integrity of practical training and ensuring accountability.

The E-Diary, accessible via the Student Self Service Portal, will serve as a digital logbook for daily work records, leave tracking, assignment summaries, and stipend management. ICAI describes the move as a “new chapter of transparency and integrity in practical training,” designed to bridge gaps between trainees and principals while aligning with institutional guidelines.

Through the E-diary, the students can avail several Benefits like, students can record daily tasks, leave, and progress, ensuring a transparent training journey. Also Structured documentation of diverse assignments promotes learning and self-assessment. Clear digital records can help minimise misunderstandings between trainees and principals, and accurate logs support timely and fair stipend payment records

As far as the principals are concerned, there are benefits for them as well. Principals gain easy oversight of trainee workload and performance. The system helps align training activities with ICAI’s guidelines. Periodic reviews and feedback can become streamlined, and also it ensures adherence to mandatory training regulations

The E-Diary is positioned as a dual-benefit tool, empowering students with autonomy and principals with accountability. ICAI emphasises that the system will reduce administrative friction and foster a more professional training environment.

For queries and onboarding support, ICAI has provided contact emails: sroart@icai.in and bosonth@icai.in.

Support our journalism by subscribing to Taxscanpremium. Follow us on Telegram for quick updates