‘Income Tax Data Exists for Publicity, Not for Accountability’: RTI Response on ITR Filings Data Sparks Transparency Uproar

An RTI reply stating that daily ITR filing data is "not available" has sparked a debate over the Income Tax Department’s transparency and data accountability

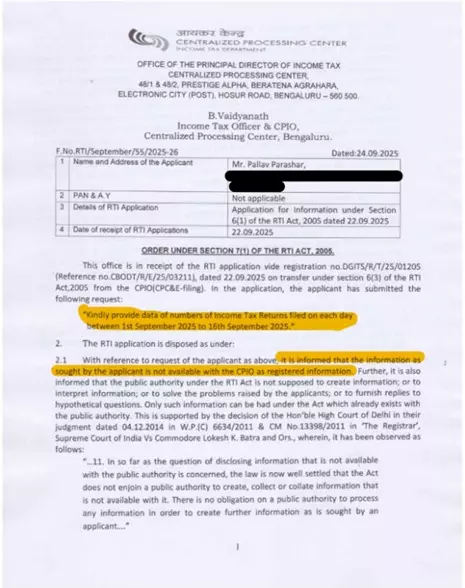

A recent Right to Information (RTI) response from the Income Tax Department’s Centralized Processing Centre (CPC) in Bengaluru has triggered widespread debate over data transparency and public accountability. The controversy arose after the CPC claimed that daily Income Tax Return (ITR) filing data for the first half of September 2025 was “not available”, even though cumulative totals are displayed publicly on the department’s e-filing portal.

The RTI Request and Response

The RTI application, filed by Chartered Accountant Pallav Parashar, sought to obtain the number of ITRs filed each day between September 1 and September 16, 2025, a crucial period coinciding with the extended deadline for filing returns for Assessment Year (AY) 2025–26.

In its official reply dated September 24, 2025, the CPC’s Public Information Officer (PIO), B. Vaidyanath, stated:

“The information as sought by the applicant is not available with the CPIO as registered information.”

The response clarified that under the RTI Act, 2005, a public authority is not obligated to create, collect, or interpret data not maintained in the form requested. It also cited legal precedents, including:

- Delhi High Court judgment (W.P. (C) 6634/2011)

- Supreme Court’s observation in The Registrar case, affirming that public authorities are only required to provide existing records, not generate new ones.

Your Ultimate Guide to India’s Latest Income Tax Laws, Click Here

Publicly Available Data Raises Questions

Despite the claim, the Income Tax Department’s e-filing portal prominently displays that over 7.5 crore ITRs have been filed for the year, thanking taxpayers for timely submissions and urging verification.

During the filing season, the department regularly shared daily statistics on social media to encourage compliance. However, its homepage now only shows cumulative figures, with no daily breakdown, fueling skepticism about internal data practices.

Deadline Extension and Technical Glitches

The request covered the period from September 1 to September 16, during which the government extended the filing deadline from July 31 to September 15 due to portal glitches and taxpayer complaints. Filings were accepted till September 16, owing to continuing technical issues on the portal.

Given the importance of this period, the absence of daily data disclosure has raised concerns about record-keeping and transparency.

Social Media Reaction

Your Ultimate Guide to India’s Latest Income Tax Laws, Click Here

CA Pallav Parashar shared the RTI response on X (formerly Twitter), commenting:

“When it’s for publicity, data exists. When it’s for accountability, it vanishes! This isn’t transparency... it’s a cover-up.”

His post garnered over 21,000 views, 379 likes, and 183 reposts, sparking a larger debate among tax professionals.

Other users joined in:

- @SandeepDevidan questioned: “If data is not available, then how does the portal publish total ITRs? Are those figures fake?”

- @CARaman1 quipped, “NDA means No Data Available,” taking a jab at the ruling coalition.

CA Vibhor Gupta (@heyvibhor) argued the RTI might have been misdirected:

“They are right as they don’t have the data; the RTI should have been filed to DG Systems, which compiles the data and publishes it on the website.”

This suggests that the issue may have arisen from internal data silos, with CPC handling processing, while the Directorate General of Systems manages data compilation and analytics.

RTI and Public Trust

The RTI Act, enacted in 2005, has processed over 17.5 million applications in its first decade, reflecting citizens’ growing demand for transparency. However, rejections and delays remain frequent.

A 2021 NIPFP study warned that inconsistencies in data sharing could erode public trust and affect voluntary tax compliance, especially in a system already challenged by technical glitches and digital transition issues.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates