Income Tax Dept Issues Intimations using Outdated ITR Filing Status: CA Flags use of ‘Harsh Language’

The fact that such e-mails will not cause concern for those who have actually submitted their income tax returns by the deadline. Being notified may not indicate a default or adverse result if the return has previously been properly submitted and acknowledged.

The Income Tax Department is sending intimations based on outdated ITR( Income Tax Return ) filing status. As per a Chartered Accountant, not only the department is sending notices based on old information to the assessee who filed their returns on time, the mails are drafted using harsh language.

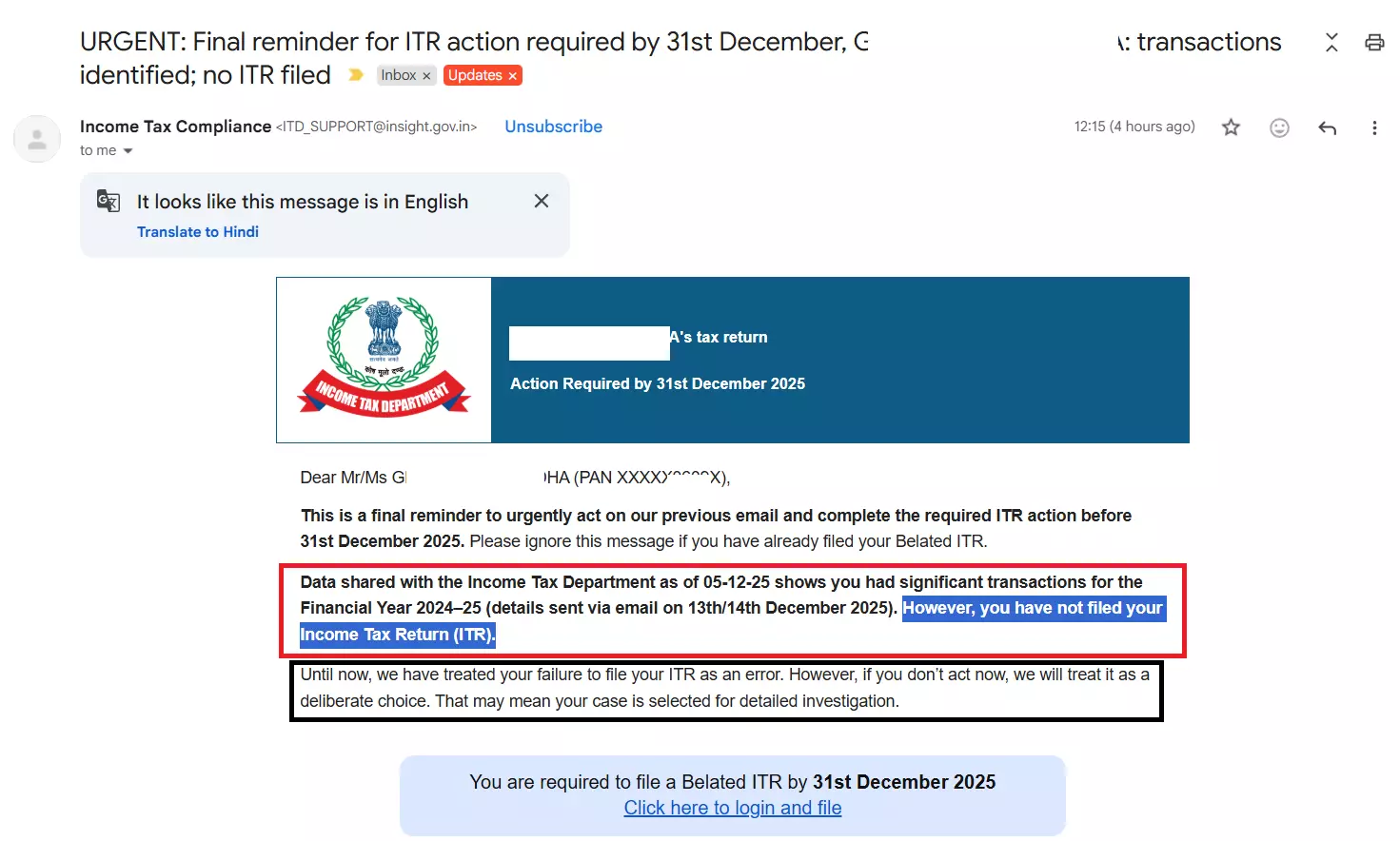

A screenshot was shared by CA Abhas Halakhandi which shows the e-mail intimation of the income tax department. The content of the mail was ‘Data shared with the Income Tax Department as of 05-12-25 shows you had significant transactions for the Financial Year 2024-25 (details sent via email on 13th/14th December 2025). However, you have not filed your Income Tax Return (ITR).’

It is evident from the email itself that the department used data from December 5, 2025. This email was sent out by the department on December 28, 2025. Before sending out mass emails, they neglected to update their details.

The department in the mail said that “Until now, we have treated your failure to file your IT as an error. However, if you don't act now, we will treat it as a deliberate choice. That may mean your case is selected for detailed investigation.”

The CA, viewing this mail said that “Today once again @IncomeTaxIndia has sent non-filing communication (with a harsh language) even to assessees who have already filed ITR within the due date!!” Several chartered accounts raised the same concerns, especially in terms of language use. The Accountant, in his ‘X’ post has said that “system update before bulk mails is essential”.

https://x.com/AbhasHalakhandi/status/2005253457239031854?s=20

Should Taxpayers Need to Worry?

The fact that such e-mails will not cause concern for those who have actually submitted their income tax returns by the deadline. These mails mostly do not represent the assessee's actual compliance position. It could be prepared based on out-of-date filing status. Being notified may not indicate a default or adverse result if the return has previously been properly submitted and acknowledged. Therefore, the genuine taxpayer has no room to worry about.

However, taxpayers should verify with their Chartered Accountant or tax consultant whether the return has in fact been successfully filed, validated, and processed. It is also important to check the factual claims made in the email by the department, such as the assessment year, financial year, and the nature of transactions referred to.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates