Income Tax Dept Sends ‘Nudge’ Intimations on ITR-AIS Mismatches and High-Value Transactions: What Taxpayers Must Do

The Income Tax Department has stepped up its data-driven “NUDGE” campaign, sending alerts to taxpayers over ITR–AIS mismatches, high-value transactions and suspected bogus deduction claims.

The Income Tax Department has stepped up its use of data-driven compliance tools by issuing “nudge” intimations to taxpayers where there is a mismatch between income reported in the income tax return and information available in the Annual Information Statement (AIS).

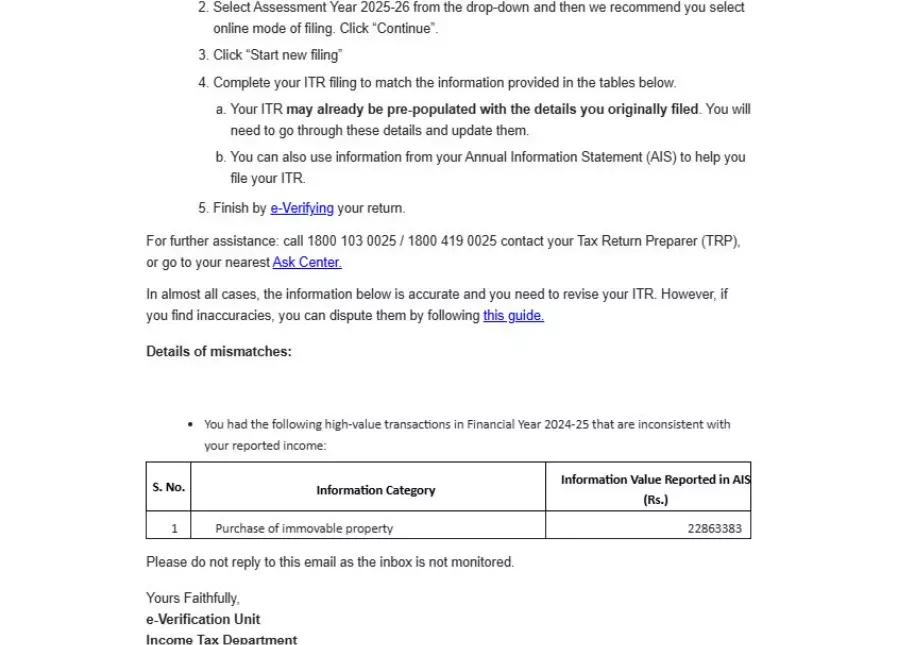

Recently, CA Ajay Konale posted a nudge intimation showing a taxpayer being alerted about the purchase of immovable property worth about Rs. 2.28 crore during the financial year 2024-25. According to the communication, the transaction reflected in the AIS does not appear to be consistent with the income declared in the return. The taxpayer has been advised to review the details, reconcile the mismatch and revise the return for assessment year 2025–26, if required.

Understand the complete process and tax nuances of GST refunds, Click here

These intimations are also being sent in cases involving high-value transactions such as purchase of immovable property, where the transaction value appears inconsistent with the income disclosed in the return.

CA Ajay Konale explained that these nudges are not scrutiny notices or assessment orders. They are meant to be a non-intrusive and preventive compliance tool, giving taxpayers a chance to correct genuine mistakes or explain discrepancies at an early stage. He pointed out that responding promptly is usually treated as error correction, while ignoring such intimations may later be viewed as a conscious decision.

Also Read:Non-Resident Individual Tax Guide for AY 2025-26: Understanding Residential Status, Tax Regimes, and Available Deductions

The CBDT also launched a targeted “NUDGE” campaign against bogus claims of deductions and exemptions for fake donation claims made under sections 80G and 80GGC of the Income Tax Act. Following enforcement actions and data analysis, the CBDT identified suspicious patterns and began sending SMS and email advisories from 12 December 2025 to taxpayers flagged under this risk category.

What taxpayers should do

Taxpayers who receive a nudge intimation should first log in to the income tax e-filing portal and carefully review their AIS. Each item should be reconciled with the income and transactions reported in the ITR to identify the reason for the mismatch.

If the AIS information is correct and was missed or wrongly reported, file a revised return by 31 December for the relevant assessment year. If the AIS data is incorrect or only partly correct, taxpayers can submit feedback in the AIS section by accepting, partially accepting or disputing the information with reasons.

For high-value transactions or deduction claims, taxpayers should keep supporting documents ready, such as loan details, ownership records or proof of genuine donations. Ensure that correct mobile numbers and email IDs are updated on the portal so that you will not miss important communications from the tax department.

The CBDT described the campaign as a taxpayer-friendly measure aimed at voluntary correction before stricter action is taken.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates