Income Tax Portal Horror: Honest Taxpayer Slapped with ₹29 Lakh Fine due to Payment Glitch

A taxpayer was unfairly fined Rs. 29 lakh in interest after the Income Tax portal crashed on the advance tax deadline, sparking outrage and calls from ICAI to waive penalties for glitches

A businessman who tried to pay his advance tax on time has been hit with a penalty of Rs. 29.10 lakh because of failures in the Income Tax portal. Chartered Accountant Avinash Rao shared the case on X, which has sparked outrage among professionals and taxpayers.

Your Ultimate Guide to India’s Latest Income Tax Laws - Click here

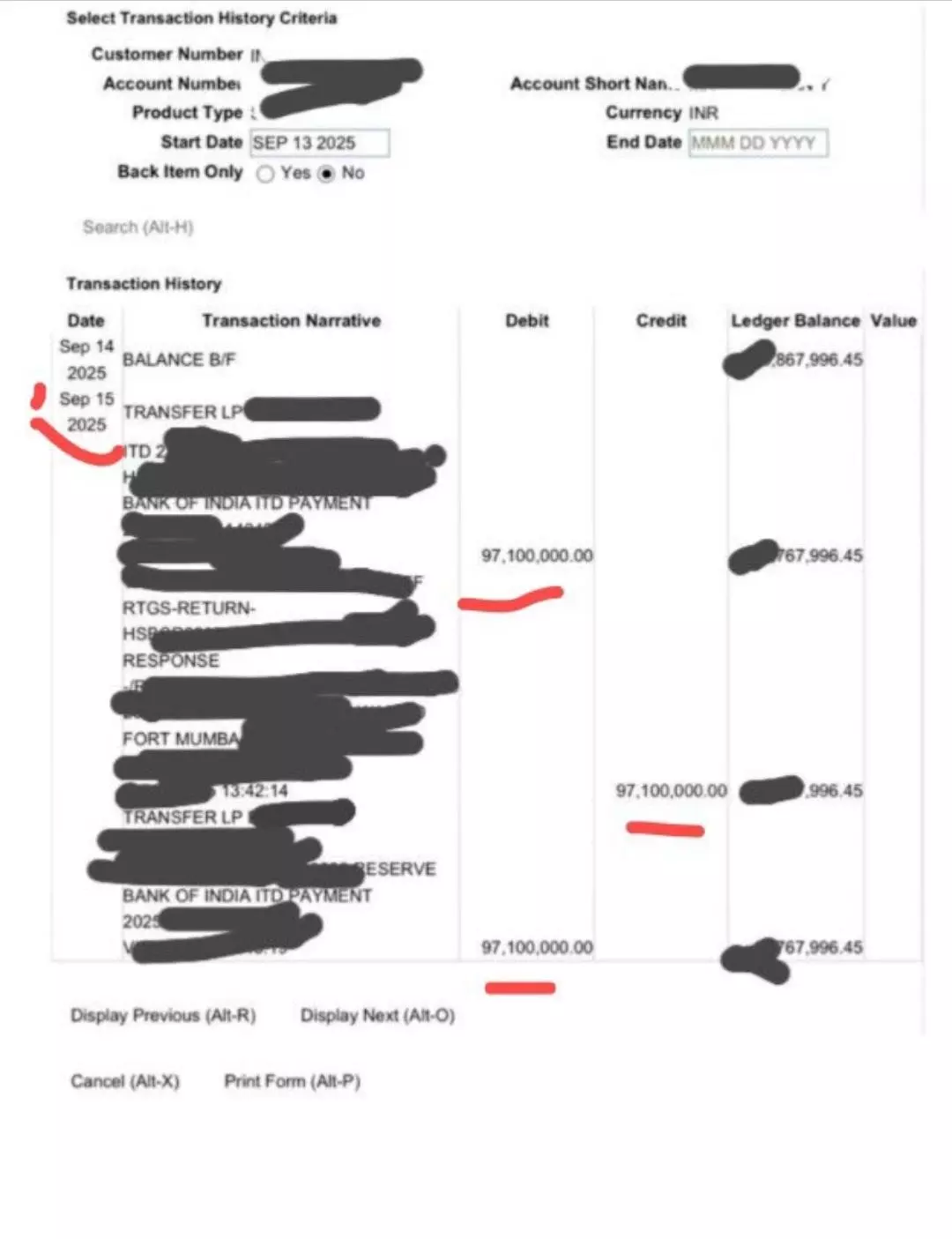

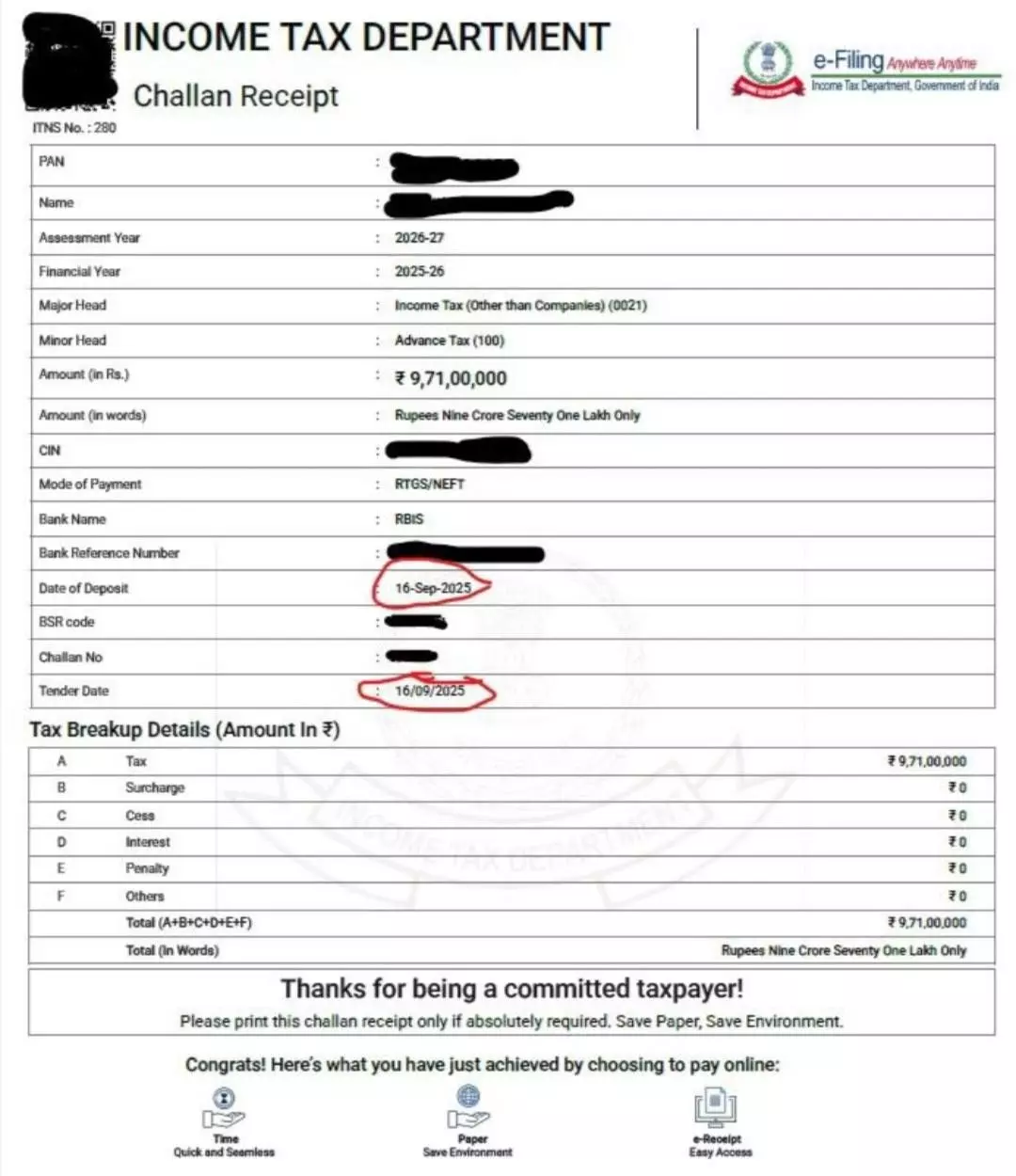

According to Rao, his client had to pay Rs. 9.71 crore in advance tax by September 15. The businessman attempted to make the payment several times on the deadline day. Each time, the amount was debited from the bank but later reversed because the portal failed to process it. Bank statements show the repeated debit and refund of funds.

On September 16, the payment finally went through. However, the system automatically charged 3 percent interest under Section 234C of the Income Tax Act since the official deadline had passed. This added up to Rs. 29.10 lakh, even though the taxpayer was not at fault.

Rao’s post questioned why Infosys, the company that manages the tax portal, is never held responsible for such failures. He also pointed out that the government announced a one day extension for filing Income Tax Returns on the night of September 15. This benefit did not apply to advance tax payments, leaving taxpayers who faced technical glitches without relief.

Many others on social media reported similar problems. Chartered Accountant Chirag Chauhan wrote that he would consider filing a public interest case if enough users shared their experiences. Another taxpayer said he could not pay his advance tax because the portal was down and urged the department to consider this when calculating interest.

News outlets also reported widespread glitches on September 15. The Economic Times reported payment failures and slow loading of the portal, while India Today described it as a recurring problem during deadlines.

Amid the growing outrage, the Institute of Chartered Accountants of India (ICAI) also submitted a representation to the Central Board of Direct Taxes, urging the government to waive penalties arising from such portal glitches and ensure parity in due date relief.

Tax professionals are calling on the Finance Ministry and the Income Tax Department to waive penalties caused by portal failures and to ensure smoother operations during peak filing dates.Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates