ITC Claimed, Reversed and Re-Claimed in FY 2024-25: How Will It Reflect in GSTR-9? [GSTR 9/9C FAQ Explained]

To prevent mismatches, audit objections, and future disputes consistent and proper reporting across these tables is essential.

![ITC Claimed, Reversed and Re-Claimed in FY 2024-25: How Will It Reflect in GSTR-9? [GSTR 9/9C FAQ Explained] ITC Claimed, Reversed and Re-Claimed in FY 2024-25: How Will It Reflect in GSTR-9? [GSTR 9/9C FAQ Explained]](https://images.taxscan.in/h-upload/2025/12/19/2113133-itc-fy-2024-25-gstr-9-itc-gstr-9-reclaimed-itc-itc-reversal-taxscan.webp)

In this article, we’ll explain the claim, reversed and re-claim within the same financial year. It is quite the taxpayers and the professionals who get confused when Input Tax Credit (ITC) is claimed, reversed, and later re-claimed within the same financial year. GSTR-9 reporting becomes tricky because of auto-population rules and separate disclosure requirements for claims, reversals, and re-claims.

How Table 6A of GSTR-9 is Auto-Populated

Table 6A of GSTR-9 is auto-populated based on Table 4A (columns 1 to 5) of GSTR-3B filed for the entire financial year April 2024 to March 2025.

This means that all ITC entries reported in Table 4A of GSTR-3B are automatically picked up in Table 6A of GSTR-9, regardless of whether such credit is subsequently reversed. Accordingly, where ITC is claimed and later re-claimed within the same financial year, both instances are captured separately in Table 6A.

As a result, the same ITC amount appears twice in Table 6A once at the time of the original claim and again at the time of re-claim. This duplication is entirely system-driven, arising from the auto-population mechanism of GSTR-9, and does not indicate any reporting error on the part of the taxpayer.

3000 Illustrations, Case Studies & Examples for Ind-AS & IFRS, Click Here

For accurate reporting in GSTR-9, instances of ITC claim, reversal and subsequent re-claim must be disclosed separately in the relevant tables. The original ITC claim is required to be reported in Table 6B, while any reversal of ITC should be reflected in Table 7 (Tables 7A to 7H, as applicable depending on the nature of reversal).

Where such credit is re-claimed, the same must be reported in Table 6H. This structured reporting ensures that the total ITC availed during the financial year is accurately disclosed, all reversals are transparently accounted for, and the net eligible ITC is correctly reflected in the annual return, avoiding mismatches and future disputes.

The GSTN has provided two examples in its FAQs.

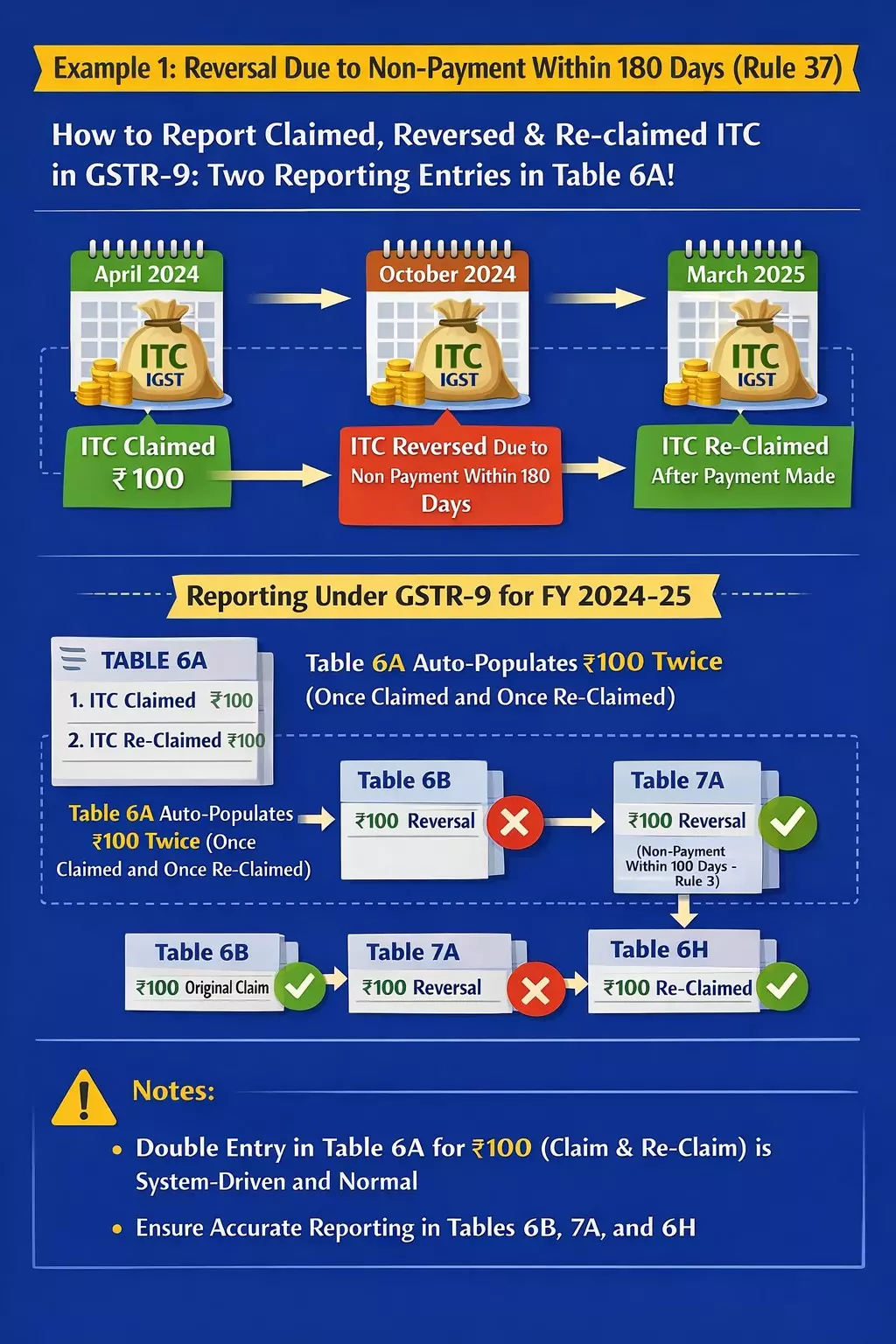

Example 1: Reversal Due to Non-Payment Within 180 Days (Rule 37)

The ITC of ₹100 (IGST) was initially claimed in April 2024. However, since payment to the supplier was not made within 180 days, the credit was reversed in October 2024 in accordance with Rule 37 of the CGST Rules, 2017. Subsequently, upon making payment to the supplier on 4 March 2025, the taxpayer became eligible to re-claim the ITC, which was accordingly availed again in March 2025.

Reporting under GSTR 9 for the Example 1 situation:

For GSTR-9 reporting of FY 2024-25, the original ITC claim of ₹100 is required to be reported in Table 6B, while the reversal of the said ITC on account of non-payment within 180 days is to be disclosed in Table 7A. After the payment to the supplier, the re-claimed ITC is to be reported in Table 6H. Consequently, Table 6A will auto-reflect ₹100 twice, once at the time of the original claim and again at the time of re-claim, this duplication is reconciled through the disclosures in Tables 7A and 6H, ensuring correct net ITC reporting.

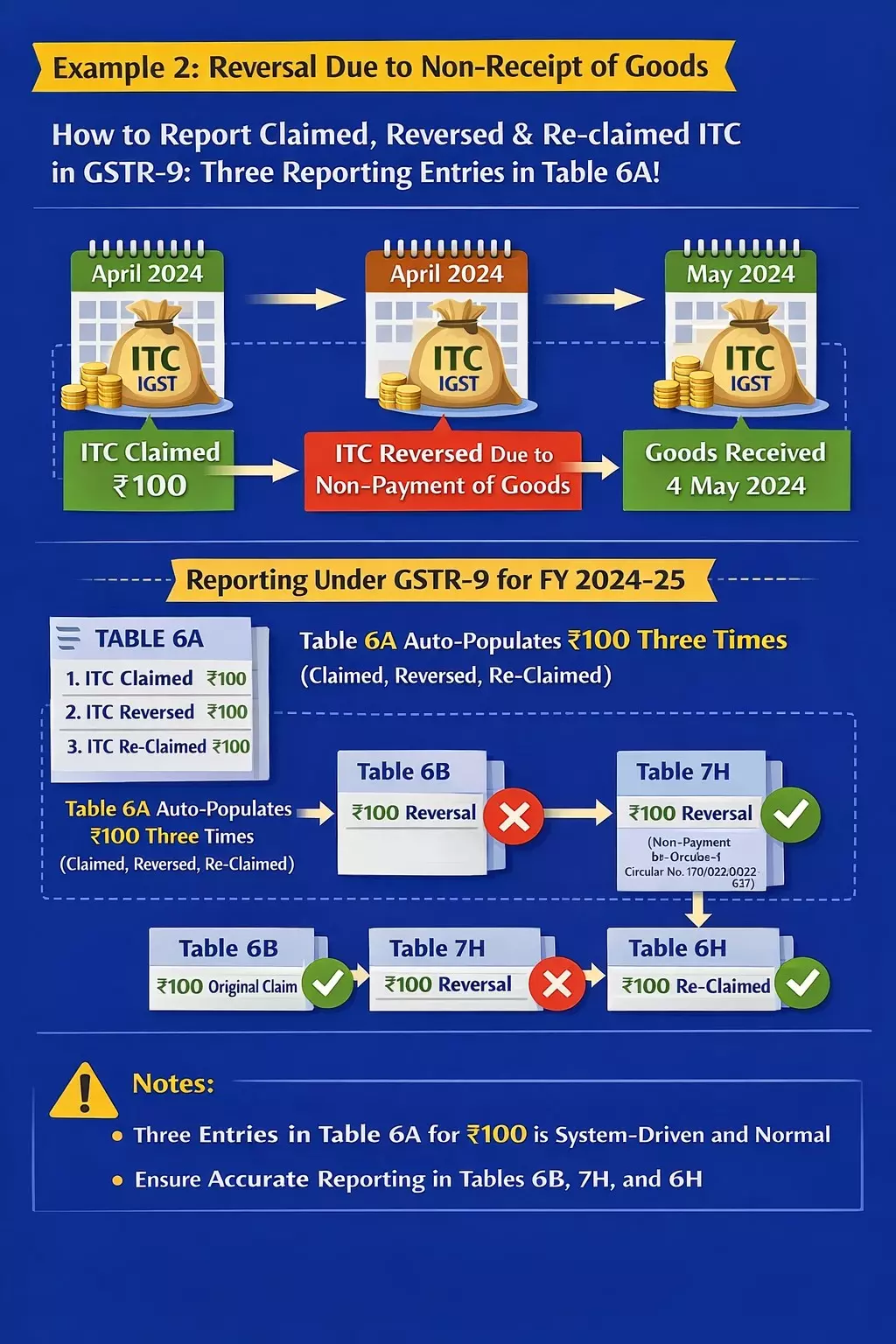

Example 2: Reversal Due to Non-Receipt of Goods Fact

The taxpayer claimed ITC of ₹100 (IGST) in April 2024. However, since the goods were not received during the same tax period, the credit was reversed in April 2024 in accordance with Circular No. 170/02/2022-GST dated 6 July 2022, which mandates reversal of ITC where goods or services are not received. Subsequently, the goods were received on 4 May 2024, making the taxpayer eligible to re-claim the ITC, which was accordingly availed again in May 2024.

Reporting under GSTR 9 for the Example 2 situation:

The initial ₹100 ITC claim must be recorded in Table 6B for GSTR-9 reporting for FY 2024-2025, the reversal resulting from non-receipt of goods must be revealed in Table 7H, and the re-claimed ITC must be reported in Table 6H. Accurate disclosure of ITC movement and correct reconciliation of auto-populated values in the yearly return are guaranteed by this reporting approach.

The primary takeaways are that the double appearance of ITC in Table 6A is a system driven result when credit is first claimed and then again in the same fiscal year. Since Table 6A is automatically populated by the GST system based on GSTR-3B filings, taxpayers should not try any manual adjustments.

Instead, Table 6B (original claim), Table 7 (reversal), and Table 6H (re-claim) must be used for proper reconciliation. To prevent mismatches, audit objections, and future disputes consistent and proper reporting across these tables is essential.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates