ITR-2 Online e-Filing Enabled: Late Yet Riddled with Glitches, says CAs and Tax Filers

Some tax filers complained that even basic features like HRA and LTA exemptions under the salary breakup are difficult to declare properly as the exempted amount field becomes visible only when editing, causing confusion and frustration.

The ITR-2 online utility for filing was already issued late, yet is causing considerable worries among taxpayers and professionals. The Chartered Accountants and Tax filers have raised multiple issues on errors related to filing Income tax returns - 2.

One person pointed out that selecting the previous tax regime removes the ability to add another entry in ITR-2 and disables the Section for deductions under 80C. Even though the salary schedule was correctly unselected, the portal still generates a validation mistake in the Schedule CG for reporting short-term capital losses, incorrectly identifying the balance as negative, according to another taxpayer who did not receive any salary income.

https://x.com/PadmaGanesh12/status/1946878522078941575

Step by Step Guidance for Tax Audit & E-filing, Click Here

Another user flagged that the system does not provide the standard exemptions for long-term capital gains under section 112A and short-term capital gains under section 111A when computing rebates under section 87A, raising questions over possible technical glitches.

Some tax filers raised frustration and ambiguity about the difficulty of correctly declaring even basic features, such as HRA and LTA exemptions under the income breakdown, because the exempted amount section is only available during editing.

“I am facing validation error for Schedule CG in ITR-2 when filing online. I have Short Term capital loss and accordingly I reported in the schedule CG. But It is showing this error saying that balance cannot be negative” said one individual.

https://x.com/infinity_4321_/status/1946866167865372817

Get a Complete Kit of Essential Books for Daily Practice, Click Here

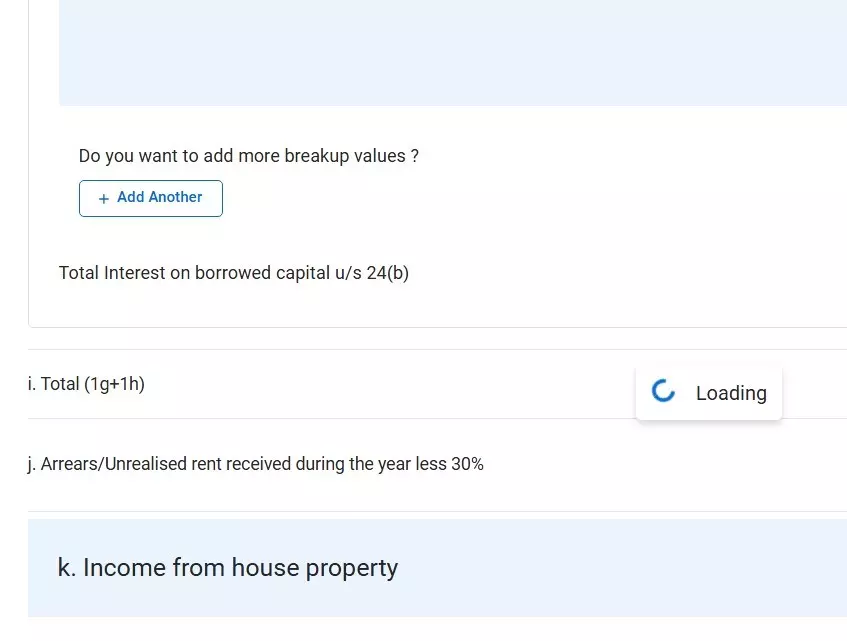

Chartered Accountant Archit Goel tagged the Income Tax Department on social media platform ‘X’, pointing out that the ITR-2 form repeatedly gets stuck at the House Property and Capital Gain schedules despite clearing cache, changing browsers, and even restarting the system.

He added that a grievance has already been lodged but the problem persists. Another filer reported that while filing ITR-2 under the old regime, crucial deduction entries under Section VI-A, such as 80C and 80D, remain greyed out and non-editable, defaulting to zero values.

https://x.com/goelarchit95/status/1946817931632926979

The experts have requested the department to address these problems as soon as possible to prevent genuine taxpayers from being penalized for compliance difficulties that are out of their control.

Support our journalism by subscribing to Taxscanpremium. Follow us on Telegram for quick updates