ITR Refund Pending even a Month After Filing Return? Here’s Why and How to Check Processing Status

Your ITR Refunds may be delayed due to a number of reasons including verification issues, defects or discrepancies in the entire process.

Why track your ITR status?

Your ITR status shows you exactly where your income-tax return stands in the processing workflow. After filing, you can follow its progress anytime on the Income Tax Department’s e-filing portal.

If the department detects any inconsistencies, it will send you an intimation notice that needs your prompt attention. Regularly checking your status helps you respond quickly and avoid delays.

Practical Case Studies in Forensic Accounting & Corporate Fraud Investigation - Click Here

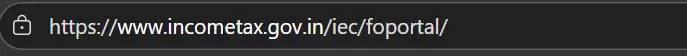

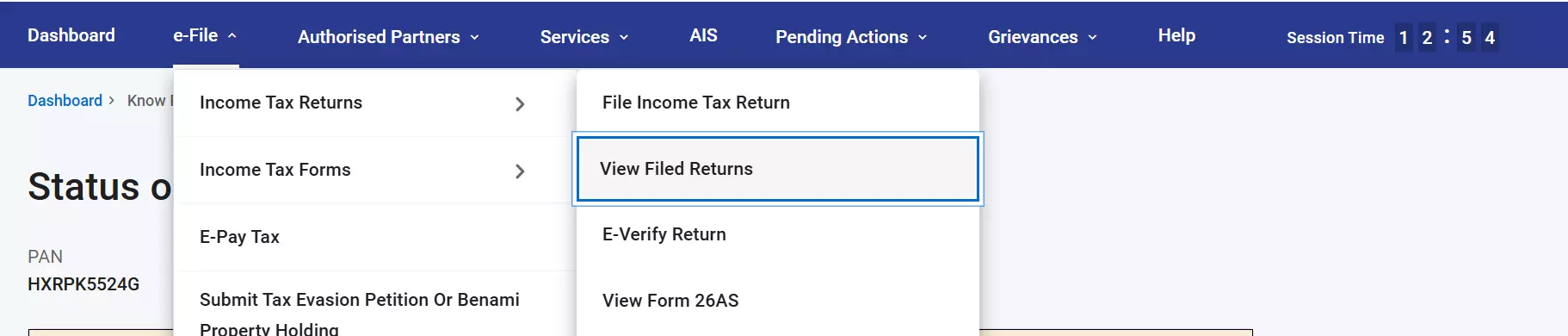

Step 1: Log onto the Income Tax Portal Official Website

Step 2: Login by entering you PAN and Income Tax Portal Password

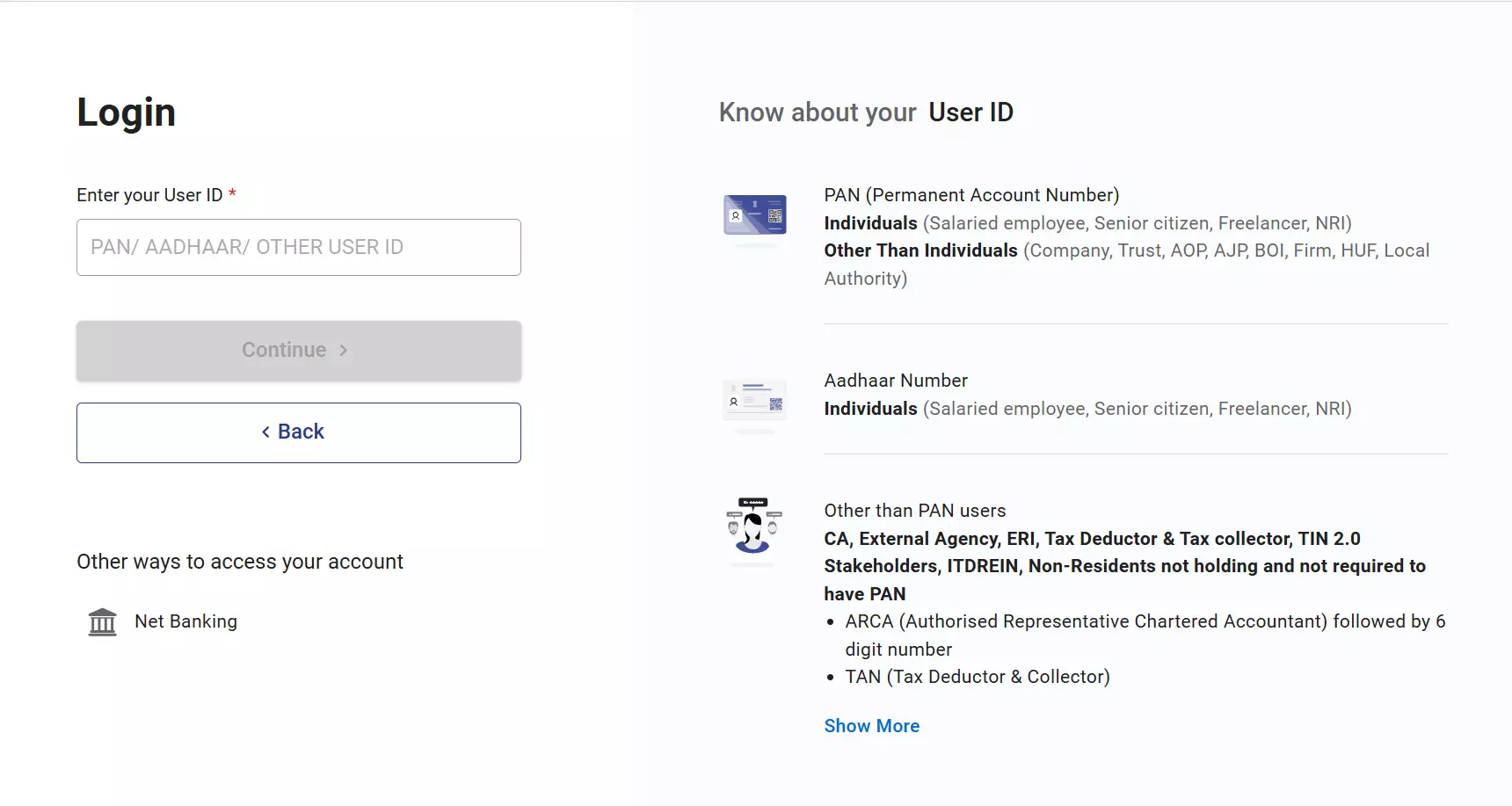

Step 3: Check Refund Status

Step 4: Select Assessment Year (Ongoing Year is the Assessment Year, usually) and Click Submit.

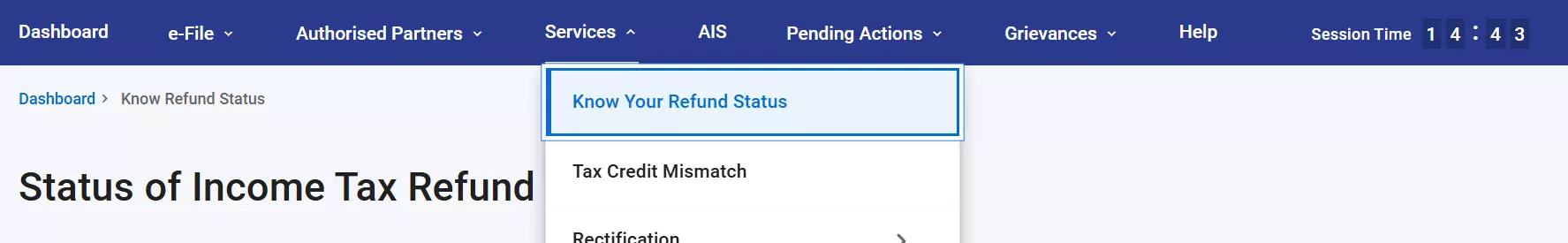

Step 5: See and understand the Refund Status.

Step 6: If the status is “No Records Found…”, go to e-Filing Processing Status.

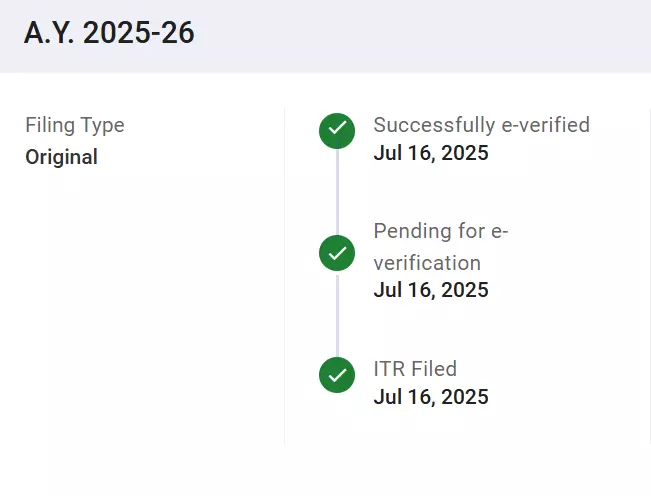

Step 7: Check Verification Status

What are the possible ITR statuses?

Filed, pending verification/e-verification

You have submitted your return but either haven’t e-verified it yet or the signed ITR-V hasn’t reached the Central Processing Centre (CPC), which you need to get done in 30 days from filing.

E-verified/verified, awaiting processing

Your return is fully verified, but CPC hasn’t processed it. You can wait for the CPC to process the return.

Processed

CPC has completed processing your return successfully.

Defective

The department has found an error or omission in your return under Section 139(9). You’ll receive a notice asking you to correct the defect within a specified deadline. Failing to respond will render your return invalid and it won’t be processed.

Transferred to Assessing Officer

The CPC has passed your case to your local Assessing Officer (AO). Your AO will contact you if they need additional information.

You’ll also be able to download your filed return and any intimation notices using the option.

Complete practical guide to Drafting Commercial Contracts, Click Here

If an authorised representative or Electronic Return Intermediary (ERI) files your return, both you and your representative/ERI can see the status. If you file your own return using your registered taxpayer credentials, only you will have access.

Taxpayers are also advised that the refund will be credited only to the PAN linked Bank Account. Please ensure the same.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates