Madras HC Reserves Orders on Actor Vijay’s Plea Against ₹1.5 Crore Income Tax Penalty

The Madras High Court reserved orders on actor Vijay’s plea challenging a ₹1.5 crore income tax penalty imposed for alleged undisclosed income.

The Madras High Court reserved orders on writ petition filed by actor Vijay challenging Rs. 1.5 crore income tax penalty imposed for alleged undisclosed income.

The case arose from income tax searches conducted at Vijay’s residence in September 2015. Assessment order was passed and penalty proceedings initiated for income of Rs. 15 crore said to have been surrendered during the search.

Aggrieved, the petitioner (Vijay) appealed to the Commissioner of Income Tax (Appeals). The Commissioner partly allowed Vijay’s appeal. Then, the Income Tax Appellate Tribunal partly ruled in favour of the department after observing that some expenses were linked to Vijay’s fan association.

Later, the department issued notice to revise the assessment order. Vijay challenged this before the ITAT, which in May 2022 set aside the revision proceedings, stating that penalty proceedings had already been initiated.

When the matter came before the High Court earlier, Justice Anita Sumanth observed that the main issue was not initiation of penalty but whether the final penalty order was passed within the time limit under Section 275 of the Income Tax Act, 1961. The court had stayed recovery of the penalty at that stage.

Before Justice Senthilkumar Ramamoorthy, Vijay argued that the penalty proceedings were time-barred and that the department wrongly invoked Section 263 of the Income Tax Act. The Income Tax Department opposed the plea and stated that the penalty was valid.

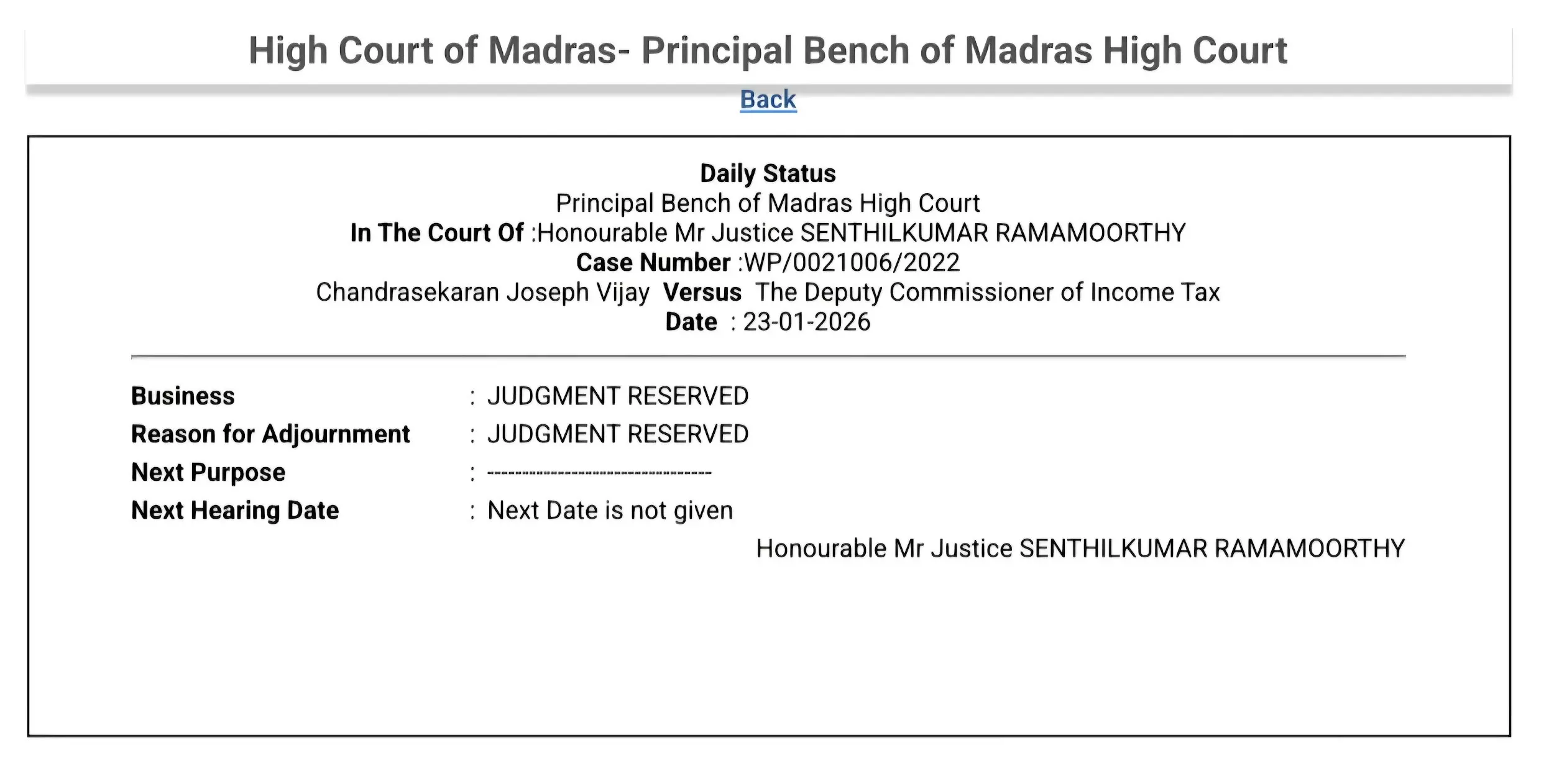

After hearing both sides, the Madras High Court reserved orders. No date has been fixed for pronouncement of judgment.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates