Maintaining Statutory Registers: Practical Challenges & Solutions

Maintaining statutory registers is a legal necessity and strategic safeguard for corporate compliance, governance, and risk mitigation in India

Statutory registers are official records that every company in India is legally required to maintain under the Companies Act, 2013 and its related rules. These include important documents such as the Register of Members (Form MGT-1), Register of Debenture Holders (Form MGT-2), Register of Directors, and Register of Charges.

These registers must be maintained either in physical form or electronically at the company’s registered office. According to Section 88 and Rule 27 of the Companies (Management and Administration) Rules, 2014, the electronic version must be readable, secure, and easily convertible to paper if required.

How to deal with GST special audit and departmental audit? Register Now

If you fail to maintain these registers properly can result in huge penalties: fines of up to Rs. 10 lakh for the company and up to Rs. 1 lakh for officers in default, along with potential imprisonment for the responsible officers.

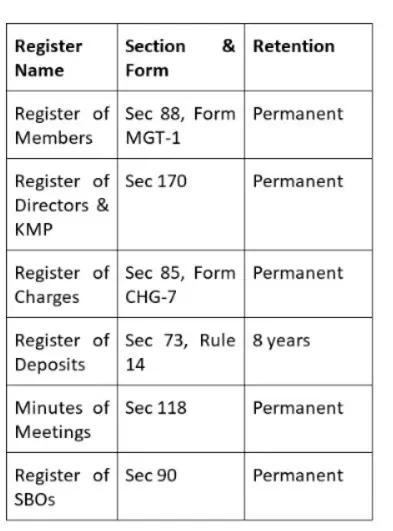

Key Registers Required Under Indian Law

The Companies Act, 2013 mandates several registers, including:

Other laws like the Factories Act, EPF Act, and Income Tax Act mandate additional registers covering labor and tax compliance.

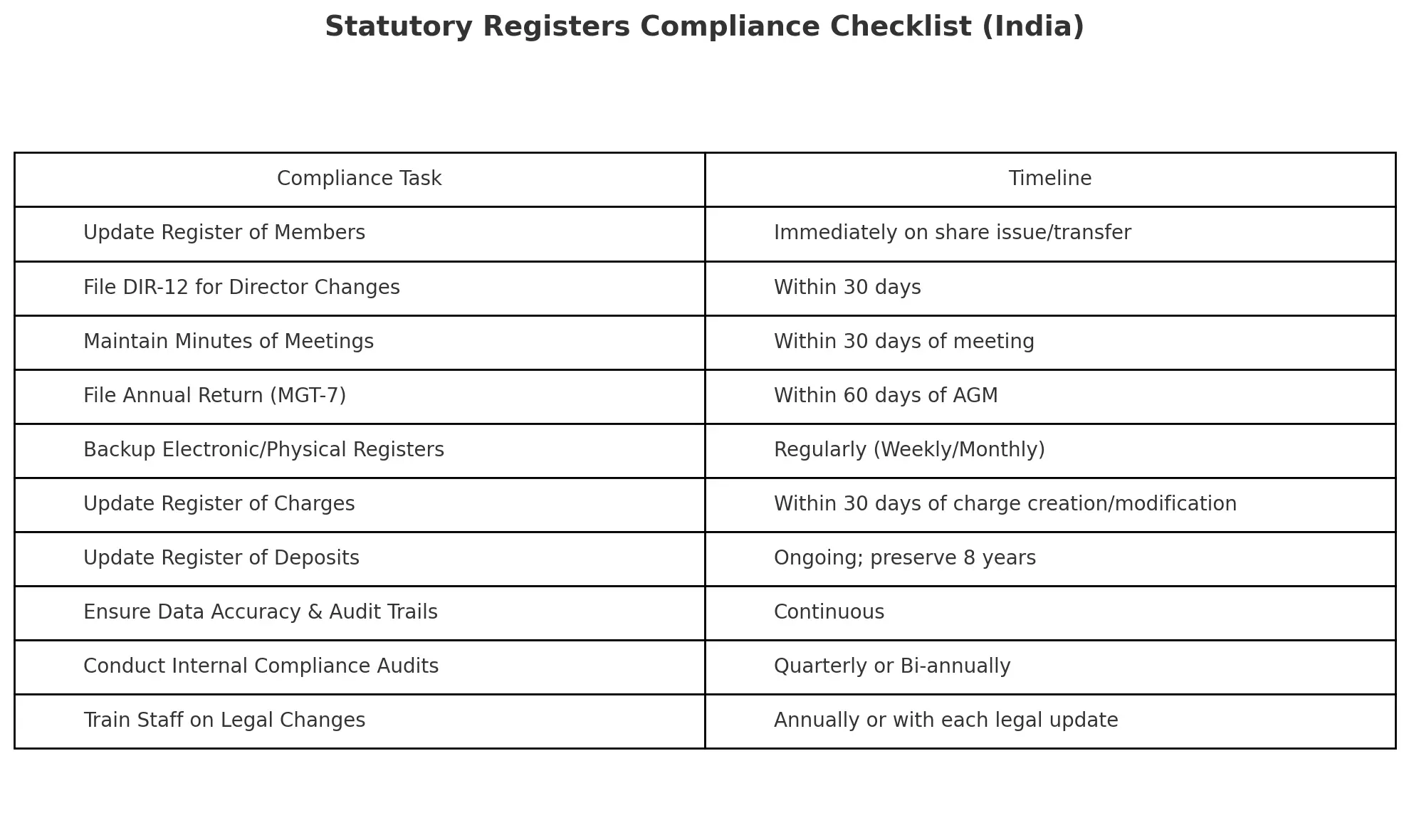

Statutory Registers Compliance Checklist

Common Challenges Faced by Companies

Maintaining statutory registers may seem straightforward but in practice, it presents several challenges especially for small and mid-sized companies. These issues range from physical storage problems to compliance and legal risks.

1. Physical Maintenance Difficulties

- Storage Space: Physical registers take up valuable space, which can be expensive in urban offices. For companies with many shareholders or frequent changes, storage becomes even more difficult.

- Damage or Loss: Physical documents are prone to damage from fire, water, or pests. They can also be stolen or misplaced. One reported case involved registers lost in a fire, leading to legal complications during audits.

- Limited Accessibility: Retrieving information from physical books takes time, especially during inspections by regulators, auditors, or shareholders.

- Error-Prone Updates: Manually updating physical registers is tedious and often results in human errors such as wrong entries, missing data, or unclear handwriting.

- Inspection Delays: Physical inspections require the stakeholder’s presence at the registered office, leading to delays and inefficiencies.

2. Compliance Complexity

The law mandates multiple registers, each with different update timelines and formats. For example:

- The Register of Members must be updated within seven days of any share transfer or allotment.

- If a company keeps a register outside India, Form MGT-3 must be filed within 30 days.

Keeping up with these rules becomes a challenge, especially for companies operating across different states or with complex structures.

3. Risk of Penalties

The Companies Act, 2013 imposes stiff penalties for failure to maintain or update registers correctly. In one reported instance, a company was penalized heavily for not updating its Register of Members, which impacted its legal and financial position.

- The penalty for non-maintenance can range from Rs. 1 lakh to Rs. 10 lakh for the company.

- Officers may face a fine of Rs. 1 lakh or even imprisonment.

These consequences make compliance a high-pressure task, particularly for companies with limited staff.

4. High Resource Requirements

Keeping registers accurate and updated demands time, skilled personnel, and constant oversight. Companies without a dedicated compliance officer often struggle to meet these demands.

Smaller firms may find it hard to allocate enough resources for statutory compliance while also managing everyday business activities.

Practical and Strategic Solutions

Despite the challenges, there are practical ways companies can manage statutory register requirements efficiently. These involve technology adoption, outsourcing, staff training, and regular audits.

1. Electronic Maintenance of Registers

- Electronic registers solve many problems. They reduce storage needs, allow fast retrieval, and can be accessed remotely. They are also safer from fire, theft, or loss.

- Section 120 of the Companies Act and Rule 27 permit electronic records if they are accessible, readable, and can be printed when required.

- Registers must be protected with passwords, encryption, user access controls, and regular cloud or offsite backups.

- Use software that supports MCA compliance, audit trails, and automatic updates. Before shifting to digital, verify all past entries and retain physical records where required.

2. Outsourcing Register Maintenance

- Professional service providers, such as law firms or corporate compliance consultants, offer end-to-end register management. This approach ensures legal accuracy, reduces the risk of non-compliance, and frees up internal teams to focus on core operations.

- Firms like Global Jurix offer comprehensive support for statutory register preparation, updates, and inspections across multiple locations.

3. Staff Training and Legal Awareness

- Personnel responsible for registers must understand legal formats and timelines, such as Form MGT-1 for members or CHG-7 for charges.

- Conduct periodic training sessions. Create checklists, timelines, and guides for employees to follow.

- This is especially useful for small companies where administrative staff often double up as compliance officers.

4. Internal Reviews and Audits

- Regular internal audits help detect mistakes early and avoid penalties. They also improve confidence during regulatory inspections.

- Schedule quarterly or annual reviews. Compare register entries with company resolutions, share transfer forms, and board minutes to ensure accuracy. For example, the Register of Members must reflect every share transfer within seven days, so these timelines should be part of audit checks.

5. Use of Compliance Software

- Advantages: Specialized software simplifies maintenance. It can alert users of due dates, automate filings, and ensure correct formatting.

- What to Look For:

- Role-based access controls

- Password and encryption security

- Compatibility with MCA filings

- Audit trail records

- Cloud backup and recovery options

This reduces manual work and helps in faster decision-making and smoother inspections.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates