Mandatory CA Verification for Companies and High-Value Foreign Tax Credit Claims: Income Tax Rules 2026 Draft

The Draft Income Tax Rules 2026 proposes mandatory CA verification for foreign tax credit claims by companies and taxpayers with foreign tax paid of Rs. 1 lakh or more.

The government has proposed a new compliance requirement for taxpayers claiming Foreign Tax Credit (FTC) under the Income Tax Act, 2025. As per the Draft Income Tax Rules, 2026, certain foreign tax credit claims will now require verification by a Chartered Accountant (CA).

The proposal is part of Rule 76, which explains how a resident taxpayer can claim credit for foreign taxes paid outside India, if the same income is also taxed in India.

What is Foreign Tax Credit

Foreign Tax Credit is a relief given to Indian residents who have paid tax in another country on income like salary, interest, dividends, capital gains, royalty or fees for technical services. This credit helps to avoid double taxation.

Under the draft rules, the credit will be allowed only when the taxpayer submit required documents such as:

- Form 44 (statement of foreign income and foreign tax paid)

- foreign tax payment proof or deduction proof

- certificate from foreign tax authority, payer, or self-signed statement

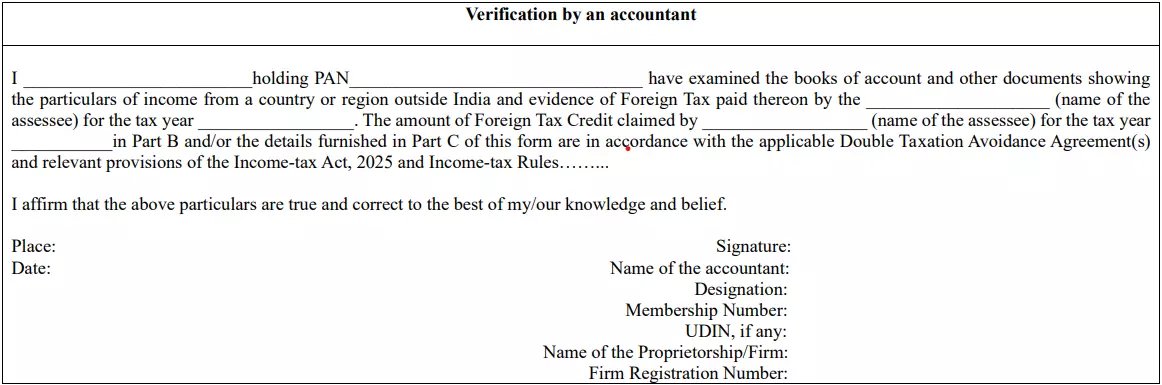

CA verification made compulsory in some cases

A key change proposed in the draft is that Form 44 must be verified by an accountant in the following cases:

- Where the assessee is a company or

- Where the foreign tax paid outside India is Rs. 1 lakh or more in a tax year, even for non-company taxpayers.

This means many salaried individuals, professionals and investors with foreign income may now need if their foreign tax payment is large.

Form 44 alsCA certification o includes refund reporting

The draft rules also state that Form 44 must be furnished even in cases where foreign tax credit earlier claimed results in refund due to revision of return, carry backward of losses, or any other reason.

Form 44 contains detailed reporting tables asking for:

- country name and taxpayer identification number (TIN)

- source of income

- income-tax paid outside India

- tax payable in India on the same income

- DTAA article and rate

- foreign tax credit claimed and disputed amounts

Timeline for filing

As per the draft, Form 44 and supporting documents must be filed within 12 months from the end of the relevant tax year, provided the income tax return is filed within the due date.

The new CA verification requirement may bring more accuracy and reduce incorrect FTC claims. But it may also increase compliance burden especially for individuals who have foreign investments or overseas salary income.

Since the rules are still in draft stage, the final requirements may change after public feedback.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates