New GST Slabs Likely To Roll Out Around September 22

India may roll out new two-slab GST rates around September 22 to boost festive demand, say sources.

The Goods and Services Tax ( GST ) Council is preparing for one of the biggest reforms in the indirect tax system since GST was first introduced in 2017.

According to NDTV Profit, new GST slabs are expected to be rolled out around September 22, 2025. The decision is being timed with the start of the Navratri festival season in order to encourage consumer demand and give a boost to the economy.

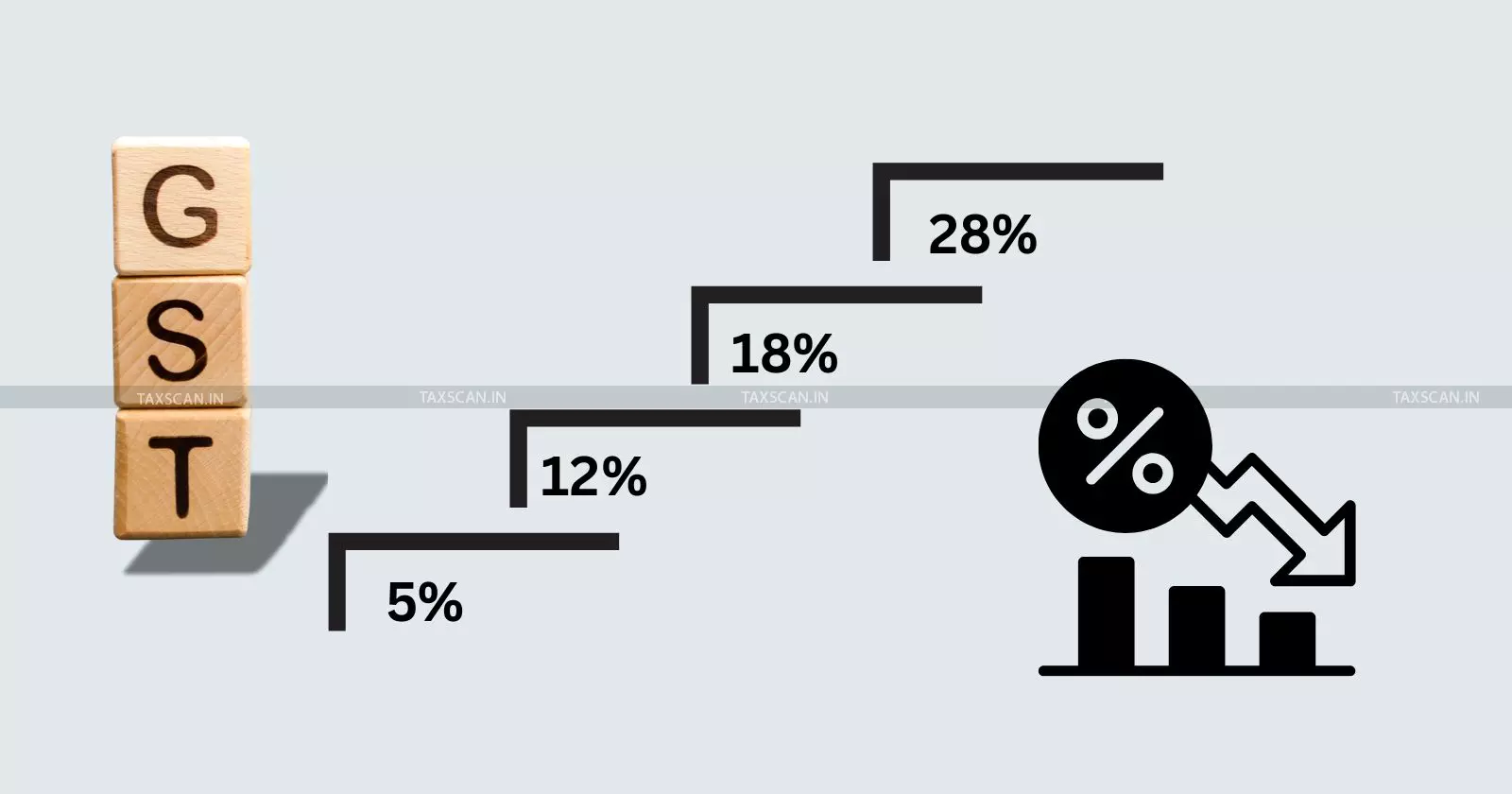

The GST Council will meet in New Delhi on September 3 and 4 to discuss the Centre’s proposal for a simpler two-rate structure. At present, GST has four main slabs of 5 percent, 12 percent, 18 percent, and 28 percent. The new structure is expected to replace this with two slabs of 5 percent and 18 percent.

Under the plan, essential and merit goods will be placed in the 5 percent category, while most other standard goods and services will come under 18 percent. A special higher rate of 40 percent will apply to luxury and sin goods such as ultra premium cars.

At the same time, concessional rates as low as 0.1 percent, 0.3 percent, or 0.5 percent will remain in place for certain labour-intensive products like handlooms and footwear to protect jobs in employment-heavy sectors.

The government believes that this reform will simplify tax compliance, reduce disputes and make GST easier for both businesses and consumers. Prime Minister Narendra Modi had already referred to these changes as GST 2.0 in his Independence Day speech this year. He described the move as an important step towards making India more self-reliant and friendly for small businesses, farmers and the middle class.

Once the GST Council approves the new structure, formal notifications are expected to be issued within a week. For companies, the new GST regime could mean changes in pricing strategies, supply chain planning and accounting systems. Businesses, especially in manufacturing, retail and MSMEs, will need to quickly adjust to the revised rates to remain competitive and to pass on benefits to customers.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates