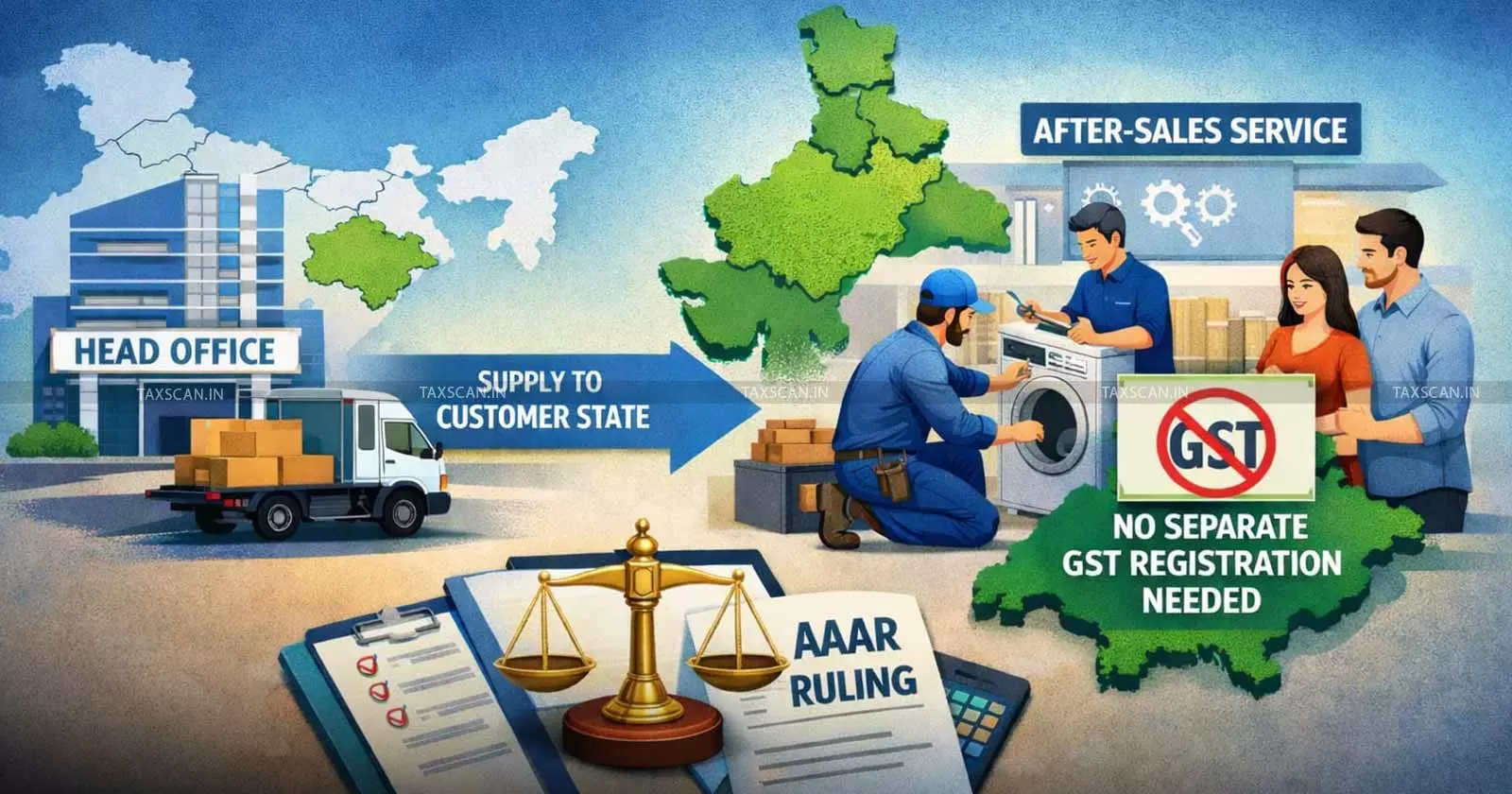

No Separate GST Registration Needed for After-Sales Service in Customer State When supply is from HO: AAAR

AAAR held that a company is not required to take separate GST registration in the customer State for after-sales service when the supply is made from the Head Office.

In a recent ruling, the Odisha State Appellate Authority for Advance Ruling (AAAR) held that no separate GST registration is required in the customer State merely because after-sales repair and maintenance services are carried out there, when the supply is made from the Head Office (HO) and the contracts, invoicing and receipt of consideration are handled from that HO.

The case arose after M/s Thermo Fisher Scientific India Private Limited filed an appeal against an order passed by the Odisha Authority for Advance Ruling (AAR). The AAR had held that the appellant’s activities in Odisha including service through Field Service Engineers and temporary storage of spare parts, created a place of business and fixed establishment in the State.

On that basis it held that the appellant was required to obtain separate registration in Odisha.

Before the AAAR, the appellant's counsel argued that its AMC/CMC contracts with customers in Odisha were entered into by its HO in Maharashtra. They also argued that all invoices for the AMC/CMC services were issued by the HO and that payments were received by the HO.

The appellant's counsel further explained that the Field Service Engineers in Odisha were employees providing service support and were not entering into contracts or making supplies from Odisha.

After examining the relevant provisions, including the definitions of “place of business” and “fixed establishment”, the two-member bench comprising Yamini Sarangi (State Tax Member) and Shri P.R. Lakra (Central Tax Member) observed that the appellant did not have a permanent set-up in Odisha from where the supply of services was made. The AAAR observed that the supply was being made from the HO in Maharashtra since the contractual and billing activities were carried out from there.

Also Read:Goods Supplied Under Fraudulent Order Without Payment: AAR Rules GST Still Applicable on Issued Invoices [Read Order]

Also Read:Goods Supplied Under Fraudulent Order Without Payment: AAR Rules GST Still Applicable on Issued Invoices [Read Order]

The AAAR also observed that merely deploying employees for service delivery and temporarily holding spare parts for operational convenience did not create a fixed establishment or a place of business in Odisha. It pointed out that, in the absence of such a place of business or fixed establishment, the requirement of taking separate GST registration in Odisha did not arise for these supplies.

The AAAR set aside the AAR’s finding on registration and held that the appellant was not required to obtain separate GST registration in Odisha for the after-sales repair and maintenance services carried out through its Field Service Engineers.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates