No Trace! Income Tax Traces Portal Down amidst Peak ITR Filing Season

Professionals are finding that they cannot validate TDS statements, download acknowledgement reports, or respond to outstanding demand notices, leading to workflow bottlenecks

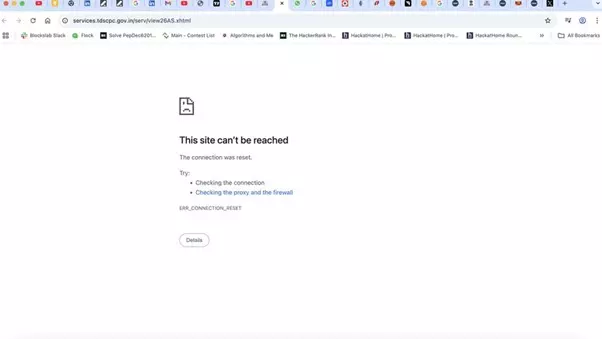

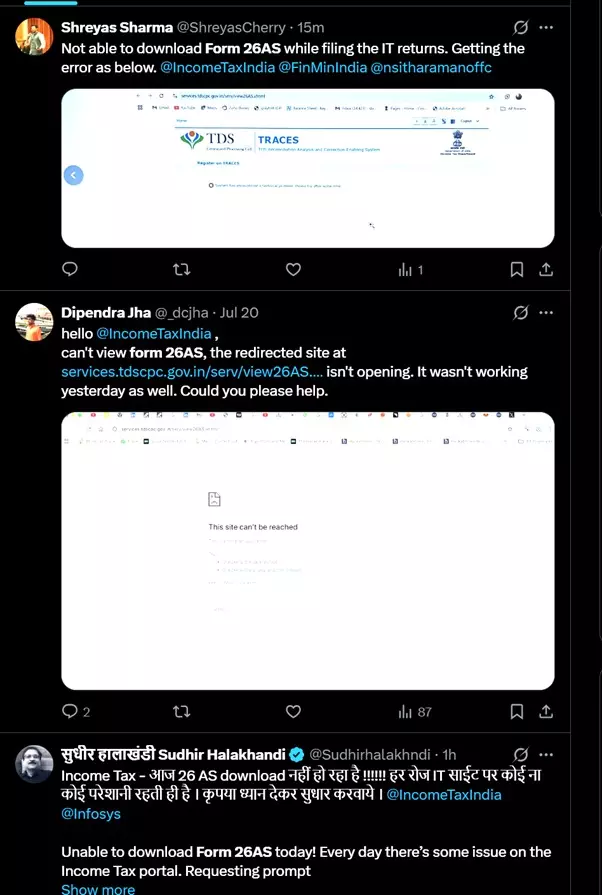

There are widespread reports and growing frustration among tax professionals and consultants on X ‘formerly Twitter’ that the Income Tax Department’s TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal is experiencing significant downtime during the peak filing season in August 2025. TRACES is critical for accessing and downloading TDS certificates, tracking TDS return status, and making corrections that are essential for timely compliance, especially as statutory due dates approach for TDS and income tax filings.

https://x.com/manojgajra/status/1951546233786425677

https://x.com/Ni_Ramchandani/status/1951590813093257579

https://x.com/CAVivek_N/status/1951586063396524304

https://x.com/gmodi1992/status/1948322794040619179

This outage comes at an especially sensitive time, as the filing deadlines for Q1 TDS returns and the extended ITR deadline (now September 15, 2025, for most individual taxpayers) are creating a surge in portal traffic and filing activities.

Professionals are finding that they cannot validate TDS statements, download acknowledgement reports, or respond to outstanding demand notices, leading to workflow bottlenecks.

Get a Handbook on TDS Including TCS as Amended up to Finance Act 2024, Click Here

While portal outages around deadlines are not unprecedented, the persistence of the problem into early August 2025 despite prior deadline extensions has escalated calls for urgent intervention from the Central Board of Direct Taxes (CBDT) and technical teams. Several advisories recommend that users:

Frequently check for any official updates on the main Income Tax e-filing portal, Document their attempts (screenshots, error messages) in case of future compliance queries and Contact TRACES support through official helplines if urgent processing is blocked.

Given the current technical instability, many professionals are advocating for additional extensions of TDS and audit report deadlines and for the quick restoration of TRACES’s key functionalities. The situation continues to be monitored closely, and taxpayers are advised to wait for new notifications from the tax department.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates