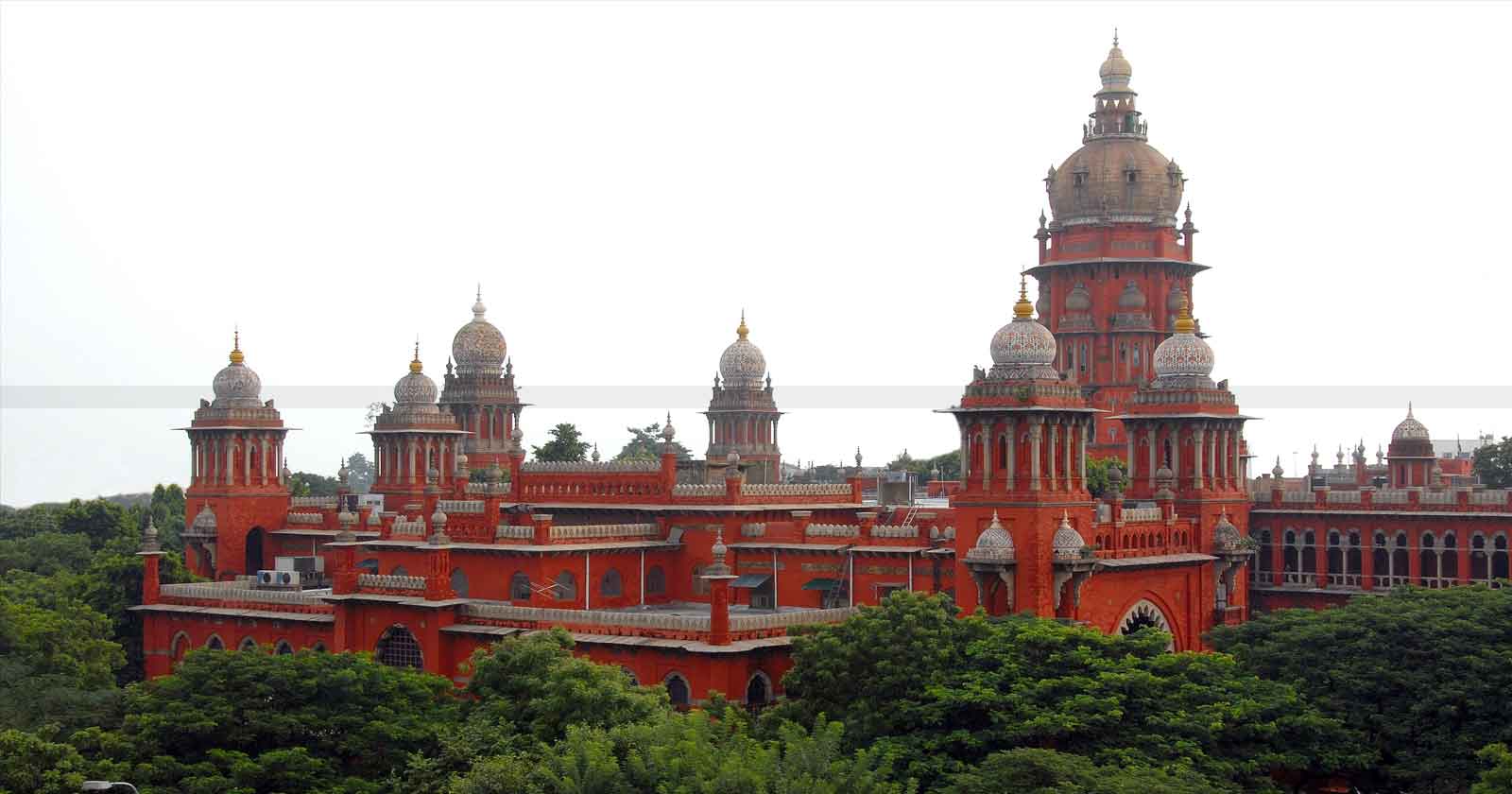

Provident Fund Dues Not Part of Liquidating Company’s Estate: Madras HC Allows 255-Day Late Claim by EPFO [Read Order]

The Madras High Court noted that provident fund dues must be considered even if claims are delayed.

![Provident Fund Dues Not Part of Liquidating Company’s Estate: Madras HC Allows 255-Day Late Claim by EPFO [Read Order] Provident Fund Dues Not Part of Liquidating Company’s Estate: Madras HC Allows 255-Day Late Claim by EPFO [Read Order]](https://images.taxscan.in/h-upload/2025/09/30/2092704-provident-fund-taxscan.webp)

The Madras High Court recently ruled that provident fund dues are excluded from the liquidation estate of a company under Section 36(4)(a)(iii) of the Insolvency and Bankruptcy Code, 2016, and thus cannot be denied to claimants on grounds of delay.

The instant case arose from the liquidation proceedings of K.N. Interior Designs and Engineering Pvt. Ltd., as ordered by the NCLT on 19 September 2022. Pursuant to this, the liquidator published a notice calling upon all creditors to submit their claims on or before 19 October 2022.

Also Read:Madras HC Orders Fresh Adjudication on Former Director’s Liability for Company’s GST Dues, Treats Bank Attachment as SCN [Read Order]

Also Read:Madras HC Orders Fresh Adjudication on Former Director’s Liability for Company’s GST Dues, Treats Bank Attachment as SCN [Read Order]

The EPFO filed its claim on 21 October 2022, seeking recovery of provident fund dues amounting to ₹21,94,745. The liquidator rejected the claim, citing the delay of two days and alleged non-compliance by the EPFO with procedural requirements as per the Insolvency and Bankruptcy Board of India (IBBI) Regulations. The EPFO was informed that their claims could not be considered via e-mails dated 29 October and 23 December 2022.

Aggrieved, the EPFO filed applications before the National Company Law Tribunal (NCLT) seeking condonation of delay of 255 days and directions under Section 42 of the Insolvency and Bankruptcy Code, 2016.

However,the NCLT dismissed the petitions holding that liquidation is a time-bound process and that the claim could not be entertained since the liquidation process had almost come to an end.

Also Read:Dealer Fails to Appear Due to Illness: Madras HC Quashes Sales Tax Ex Parte Order, Remands Matter on Sales of Children’s Educational Books [Read Order]

Also Read:Dealer Fails to Appear Due to Illness: Madras HC Quashes Sales Tax Ex Parte Order, Remands Matter on Sales of Children’s Educational Books [Read Order]

In the present case before the High Court, R. Thirunavukarasu appeared for the petitioner and argued that provident fund dues enjoy statutory priority as per Section 11 of the Employees' Provident Funds and Miscellaneous Provisions Act, 1952. It was further submitted that PF claims are expressly excluded from the liquidation estate, making the rejection unsustainable.

S. Sathiyanarayanan representing the liquidator defended the rejection on grounds of procedural delay and stated that such situation did not warrant interference

The Bench of Justice S.M. Subramaniam and Justice C. Saravanan observed that provident fund contributions are protected by statute and cannot be treated as part of the liquidation estate available for distribution among creditors. The Court noted that the delay in filing the claim was marginal and that rejection on technical grounds would defeat the object of protecting employees’ social security and held that the decision of the NCLT in refusing to entertain the petitioner’s claim was legally unsustainable.

Also Read:Assistant Commissioner (ST) Found Explanations in 39 Slips “Very Satisfactory” Yet Ordered Remand Instead of Allowing: Madras HC Quashes Order [Read Order]

Also Read:Assistant Commissioner (ST) Found Explanations in 39 Slips “Very Satisfactory” Yet Ordered Remand Instead of Allowing: Madras HC Quashes Order [Read Order]

Accordingly, the Court set aside the impugned order and remitted the matter to the liquidator to consider the claim raised by the EPFO on its merits. The High Court directed that if dues are found payable, steps must be taken to recover the funds from the stakeholders who had received distribution, and the process be completed within a period of six months, until when the dissolution of the company was also kept in abeyance.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates