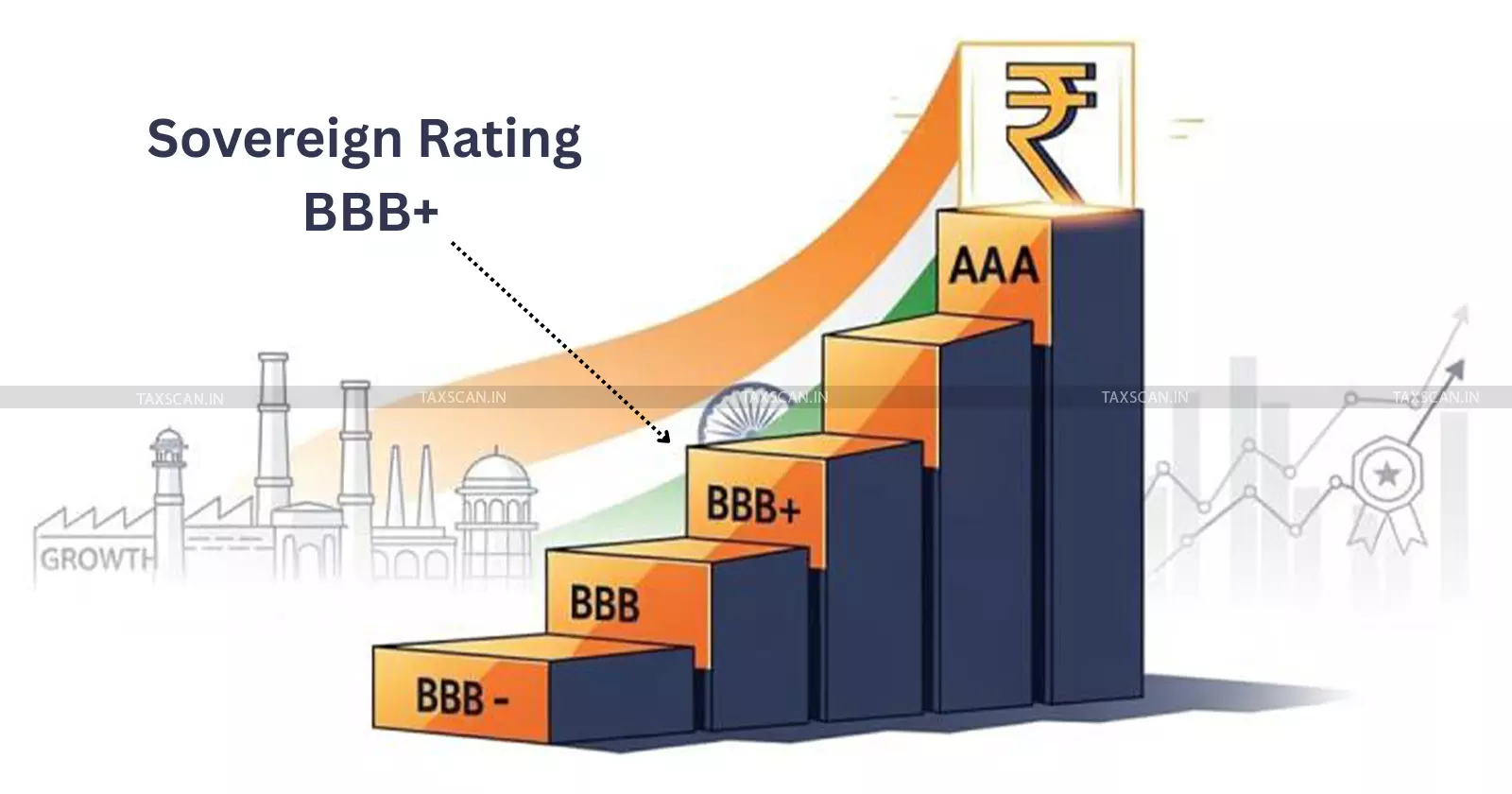

R&I Japan raises India’s Sovereign Rating to BBB+: Signals Strong Macroeconomic Conditions & GST Reforms

R&I expects part of the loss incurred by the recent GST rate rationalization processes to be offset by stronger private consumption

The Rating and Investment Information, Inc., Japan (R&I) recently raised India’s long-term foreign-currency sovereign issuer rating from BBB to BBB+, noting that the outlook is ‘Stable’ and affirming the short-term rating at ‘a-2’.

In essence, the higher rating labels India as a lower-medium investment grade sovereign and reflects an assessment of stronger macroeconomic fundamentals and improved fiscal markers in recent times.

India recorded a real or Gross Domestic Product (GDP) growth of 6.5% in FY2024 as well as a 7.8% year-on-year expansion in April-June 2025. R&I projects the growth to settle at the mid-range of 6% from FY2026, a pace that is deemed sufficient to support tax revenue gains and reduce debt ratios over time.

Also Read:RBI Issues Master Direction on Regulation of Payment Aggregators: Strengthens Rules on KYC, Cross-Border Transactions [Read Notification]

Also Read:RBI Issues Master Direction on Regulation of Payment Aggregators: Strengthens Rules on KYC, Cross-Border Transactions [Read Notification]

Essentially this means a larger domestic market and higher demands being raised within the market.

The latest rating also relies extensively on changes on public finance indicators. The central government deficit narrowed to 4.8% of GDP in FY2024 and the budget plans have targeted a lower deficit for FY2025, which is driven by higher tax collections and subsidy rationalisation even when capital expenditure rose.

Combined central and state debt has been calculated to be around 80% of the GDP, but R&I judged the debt profile to be manageable, given domestic investor holdings and nominal GDP growth prospects.

The current account deficit was slightly under 1% of GDP in FY2024. Services surpluses, remittance inflows, low external-debt ratios and adequate foreign-exchange reserves together limit vulnerability to extraneous factors. R&I noted that risks existed, alluding to higher U.S. tariffs but judged India’s export mix and domestic-demand orientation would mitigate immediate impact. At the same time, investors may view this as lower tail-risk for currency and external funding.

Also Read:GST Act Intended for Ease of Business, Not Harassment: Allahabad HC Slams Revenue for Misusing Section 74 [Read Order]

Also Read:GST Act Intended for Ease of Business, Not Harassment: Allahabad HC Slams Revenue for Misusing Section 74 [Read Order]

The assessment has also extensively contemplated the changes brought about by the recent GST rationalisation - condensing the regime into a simpler two-tier structure. Even though the changes are slated to reduce some revenue once its effects come into force on September 22, 2025, R&I expects part of the loss to be offset by stronger private consumption.

The net effect, in R&I’s view, is manageable within the current fiscal consolidation path, highlighting a trade-off between lower rates and increased consumption that will shape revenue projections.

Credit conditions and borrowing costs for sovereign-linked entities may also be eased going forward. The wider takeaway is that India’s policy mix of demand-supporting investments, revenue mobilisation and targeted reform has improved sovereign creditworthiness while keeping policy space for growth.

India’s successive upgrades in 2025 have also bolstered market confidence. This could slightly reduce borrowing costs for sovereign-linked borrowers. Overall, the government’s mixed strategy of public investment, higher tax revenues and targeted reforms have strengthened India’s credit profile.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates