SEBI amends Listing and Disclosure Requirements, New Schedule Inserted for Material Related Party Transactions [Read Notification]

SEBI has expanded the scope of who qualifies as a related party under Regulation 2.

![SEBI amends Listing and Disclosure Requirements, New Schedule Inserted for Material Related Party Transactions [Read Notification] SEBI amends Listing and Disclosure Requirements, New Schedule Inserted for Material Related Party Transactions [Read Notification]](https://images.taxscan.in/h-upload/2025/11/20/2106837-sebi-taxscan.webp)

The Securities and Exchange Board of India ( SEBI ) has notified the Listing Obligations and Disclosure Requirements (Fifth Amendment) Regulations, 2025, inserting a new schedule for Related Party Transactions (RPTs).

These amendments come into effect from the date of publication in the Official Gazette, while certain provisions including changes to the definition of related party, RPT approval requirements, and Schedule XII shall apply 30 days after publication.

Key Changes in the Related Party Transaction (RPT) Framework

1. Expanded Definition of Related Parties

SEBI has expanded the scope of who qualifies as a related party under Regulation 2. The key inclusions now are Directors and Key Managerial Personnel (KMPs) of the listed entity or its subsidiaries and Relatives of such directors or KMPs.

The two provisos under Regulation 12 (regarding redemption/repayment amounts) have been removed.

Major Changes in RPT Approval Requirements under Regulation 23

New Materiality Thresholds via Schedule XII

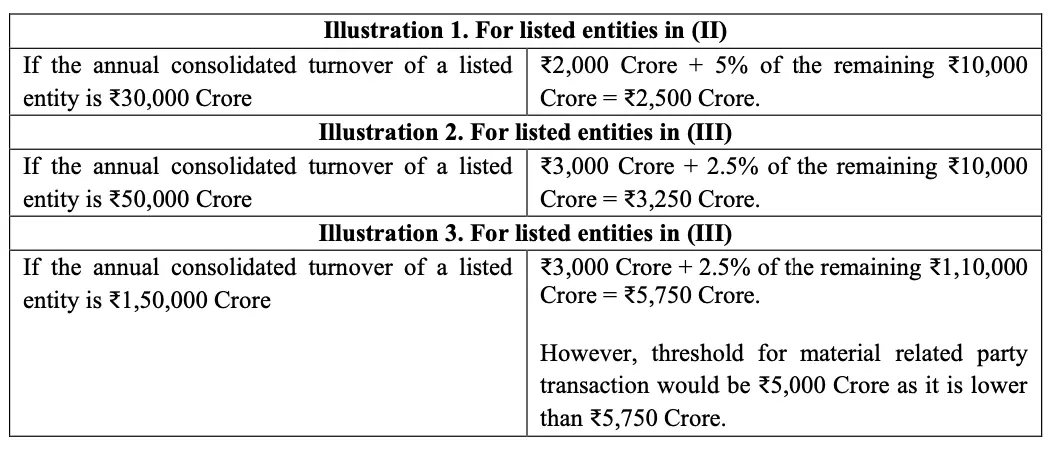

Earlier materiality for RPTs was defined as: ₹1,000 crore OR 10% of annual consolidated turnover, whichever is lower. This has now been replaced entirely with new monetary slabs under Schedule XII, aligned to the size of the listed entity.

Audit Committee Approval for Subsidiary-Level RPTs

Even when the listed entity is not a party to the transaction, audit committee approval is mandatory if the RPT value exceeds ₹1 crore; and the value crosses the materiality thresholds specified in Schedule XII or 10% of standalone turnover/10% of paid-up capital + securities premium (depending on availability of audited statements).

Validity of Omnibus Shareholder Approvals

SEBI has added two new provisos: Omnibus approval in AGM is valid only till the next AGM. and Omnibus approval in any general meeting other than AGM is valid for one year from approval.

The amendment reads that “in sub-regulation (4), after the second proviso, the following new provisos shall be inserted, namely,-

“Provided further that the omnibus approval granted by the shareholders for material related party transactions in an annual general meeting shall be valid till the date of the next annual general meeting held within the timelines prescribed under Section 96 of the Companies Act, 2013 or rules, notifications, or circulars issued thereunder from time to time: Provided further that in case of omnibus approvals for material related party transactions, granted by shareholders in general meetings other than annual general meeting, the validity of such omnibus approvals shall not exceed one year from the date of such approval.”

Clarification on Holding Company

In sub-regulation (5), after clause (e), the following Explanation is added: “For the removal of doubts, it is clarified that the term ‘holding company’ used in clause (b) of this sub-regulation refers to and shall be deemed to have always referred to a listed holding company.”.

Complete Supreme Court Judgment on GST from 2017 to 2024 with Free E-Book Access, Click here

New Disclosure Requirements under Regulation 53

in sub-regulation (1), after the words, “The annual report of the listed entity shall contain disclosures as specified in Companies Act, 2013” and before the words, “along with the following”, the words “or the statute under which such listed entity is constituted,” shall be inserted;

According to the new changes in the sub-regulation (2), listed entity shall submit to the stock exchange and the debenture trustee and publish on its website:

- (a) a copy of the annual report, on or before the date of dispatch of the same to its shareholders or the date of submission to the Central Government or the State Government, as the case may be; and

- (b) in the event of any changes to the annual report, the revised copy along with the details and explanation for the changes, within 48 hours after the annual general meeting or on or before the date of dispatch of the same to its shareholders or the date of submission to the Central Government or the State Government, as the case may be.”

Also Read:NCLAT Upholds CCI’s Jurisdiction Under Section 4 of the Competition Act to Probe WhatsApp–Meta Data-Sharing Practices [Read Order]

Also Read:NCLAT Upholds CCI’s Jurisdiction Under Section 4 of the Competition Act to Probe WhatsApp–Meta Data-Sharing Practices [Read Order]

The new amendments also state that A letter providing the web-link including the exact path where complete details of the Annual Report is available, which may at the option of the listed entity, also include a static Quick Response Code, to those holder(s) of non-convertible securities that have not registered their respective email addresses. Also, all such documents must be dispatched within statutory timelines under Section 136 of the Companies Act, 2013.

New Schedule XII Introduced for Material Related Party Transactions

A transaction becomes material if the cumulative transaction value in a financial year exceeds the threshold applicable to the listed entity’s previous year’s audited consolidated turnover.

Thresholds Under Schedule XII

Explanation: For the purpose of computing the thresholds stated above, the annual consolidated turnover of the listed entity shall be determined based on the last audited financial statements of the listed entity.

Illustration:

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates