Should You Form HUF for Tax Planning? Pros, Cons & Eligibility [Q&A]

An HUF makes sense only when your family has ancestral property, rental income, business income, or meaningful investments.

![Should You Form HUF for Tax Planning? Pros, Cons & Eligibility [Q&A] Should You Form HUF for Tax Planning? Pros, Cons & Eligibility [Q&A]](https://images.taxscan.in/h-upload/2025/12/01/2109143-huf-hindu-undivided-family-taxscan.webp)

In recent years, tax planning has become tougher. The government has tightened many traditional tax-saving routes, reduced exemptions, and pushed taxpayers toward the new regime. Yet one option still survives and that is the Hindu Undivided Family (HUF).

An HUF is not a loophole. It is a legally recognised structure under the Income Tax Act but what exactly is an HUF, who is eligible to form one, and how much tax can it realistically save you?

If you want to understand the deep legal, structural and compliance aspects of HUFs.

Read: HUF: Structure, Taxation andCompliance – Detailed Analysis

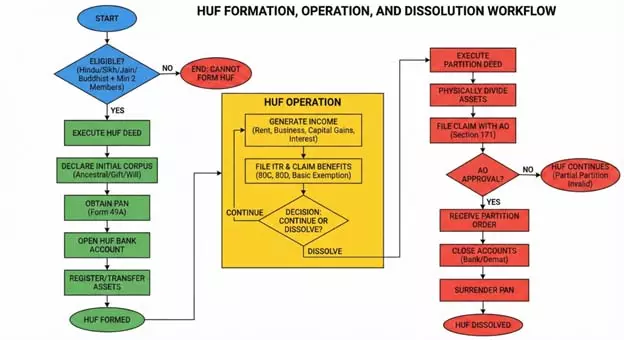

HUF Formation, Operation & Dissolution (Flowchart Overview)

Tax Benefits of Forming an HUF

Benefit 1: Separate Tax Entity Status

The most compelling advantage is that an HUF receives its own basic exemption limit of Rs. 2.5 lakh (Rs. 3 lakh for senior citizens, Rs. 5 lakh for super senior citizens), entirely independent of individual members' exemptions.

This enables an income-splitting strategy where you can assess income partially as an individual and partially as an HUF, utilizing dual exemption limits.

Benefit 2: Deductions Under Section 80C

HUFs can claim up to Rs. 1.5 lakh deduction for investments in:

- Public Provident Fund (PPF)

- Equity Linked Savings Scheme (ELSS)

- Life insurance premiums

- National Savings Certificate (NSC)

- Principal repayment on home loans

This allows couples to double their 80C deductions, Rs. 1.5 lakh individually + Rs. 1.5 lakh through HUF = Rs. 3 lakh total.

Benefit 3: Section 80D Health Insurance Deduction

HUF can claim deductions for health insurance premiums paid for family members, up to the standard limits under Section 80D.

Benefit 4: Capital Gains Exemption

By splitting capital accounts between individual and HUF demat accounts, you can claim LTCG exemption of Rs. 1.25 lakh separately for each (total Rs. 2.5 lakh if both accounts are utilized), effectively doubling capital gains tax benefits.

Benefit 5: Housing Loan Interest Deduction

If property is jointly owned by individuals and HUF as co-borrowers/co-owners, each can claim up to Rs. 2 lakh (self-occupied) or Rs. 5 lakh (let-out) deduction, allowing potential combined deductions of Rs. 4-10 lakh depending on property nature.

Benefit 6: Gifts and Donations

- Gifts from relatives to HUF: Entirely tax-free

- Gifts from non-relatives: Up to Rs. 50,000 tax-free annually

- Donations to charitable trusts: Claim deduction up to 50-100% under Section 80G

Benefit 7: Distribution to Coparceners

Amounts received by coparceners from HUF income are completely tax-exempt in their hands under Section 10(2), providing a powerful income distribution mechanism.

Can an HUF Have a PAN Card?

Yes. A PAN is mandatory for:

- Filing the HUF’s tax return

- Opening a bank account

- Opening a demat account

- Running a business in the HUF name

The Karta signs the PAN application and all HUF documents.

How Do I Create an HUF Deed?

An HUF deed helps prove the existence of the HUF. Here’s how to create one:

- Draft a declaration on stamp paper.

- Mention the HUF name (for example, “Dhoni Family HUF”).

- List the Karta, coparceners, and members.

- Declare the initial contribution (like ancestral property or gift).

- Get the document signed by the Karta and adult members.

- Notarise it.

- Apply for a PAN and open a bank account.

The entire process is simple and affordable.

Can I Transfer My Personal Income to the HUF?

Not directly. If you gift your personal income or property to the HUF, the income from it gets taxed back to you under clubbing rules.

Safe and common ways to fund the HUF are:

- Ancestral property

- Genuine family gifts

- Will-based transfers

- Gifts from non-relatives within limits

Avoid routing salary or freelancing income through the HUF, it doesn’t work and may invite scrutiny.

What Assets Can Belong to an HUF?

An HUF may own:

- Ancestral property

- Jointly inherited land or flats

- Family business assets

- Gold and jewellery received as family gifts

- Investments made from HUF funds

Once an asset is part of the HUF, it belongs to the family unit, not any one person.

How is Property Transfer to HUF Taxed?

- Properties inherited or received via will into the HUF are tax-free.

- Gifts from relatives are exempt.

- Gifts from others above Rs. 50,000 are taxable.

- During full HUF partition, no capital gains tax applies.

Can an HUF Pay Salary to Its Members?

Yes. If a member works for the HUF’s business, the HUF can pay them a salary. The amount should be reasonable and is:

- Deductible for the HUF

- Taxable for the member

This is helpful for families running small businesses.

How is Income Split Between an Individual and the HUF?

Simple rule:

Whoever owns the asset gets the income.

- If HUF owns the flat → rent goes to HUF

- If you own the flat → rent is your income

Salary or professional income cannot be shifted to the HUF.

What Deductions Can an HUF Claim?

Under the old regime, an HUF can claim:

- Rs. 1.5 lakh under Section 80C

- Health insurance under 80D

- Donations under 80G

- Home loan interest up to Rs. 2 lakh under 24(b)

These are over and above what individual members claim.

Can an HUF Apply for IPOs or Open a Demat?

Yes. The HUF can open a demat account and:

- Invest in stocks and mutual funds

- Apply for IPOs as a separate applicant

- Earn capital gains under the HUF’s PAN

This is a major tax planning advantage.

How is an HUF Dissolved?

An HUF ends only through complete partition, where:

- Each coparcener gets a share of property

- The assessing officer recognises the partition

Partial partitions are not allowed for tax purposes.

Does Divorce Affect the HUF?

For Divorced or Separated Wives

The situation for divorced wives differs dramatically from married status, creating significant legal complications:

Before Divorce:

- Wife is a member of HUF but not a coparcener (cannot independently demand partition)

- Wife has no legal right over HUF ancestral property during husband's lifetime

- Wife is entitled to maintenance from HUF income, not property ownership

- In divorce proceedings, wife can claim marital property share but not HUF ancestral property

After Divorce:

- Wife is completely removed from HUF status

- Wife has no claim on HUF property acquired before divorce

- HUF continues to exist among husband and lineal descendants (sons, daughters)

- Wife loses all future income distribution rights from HUF

- Wife cannot demand partition of HUF property post-divorce

Issues for Women in HUF

Recent discussion highlights serious concerns for women entering HUF:

- Loss of Ownership: Money/property in HUF legally becomes family wealth, not individual property

- Limited Control: Karta (usually husband) has sole authority over all financial decisions

- Divorce Vulnerability: Disentangling assets during divorce becomes complex and women often remain financially exposed

- Actual Tax Savings: For salaried couples, real savings are only Rs. 10,000-Rs. 40,000 annually not justified by loss of financial independence

Recommendation for Women: Consider joint investments in both names with clear documentation rather than pooling into HUF, maintaining individual ownership and control.

Can a Female Be a Karta?

Yes, per the Delhi High Court in Sujata Sharma vs Manu Gupta (2016). Women (eldest daughters) can lead as Karta, thanks to equal coparcenary rights. It is a progressive shift for modern families.

Conclusion

An HUF makes sense only when your family has ancestral property, rental income, business income, or meaningful investments. It can legally reduce taxes, create a second tax entity, and preserve family wealth but it also reduces individual control. Start an HUF for tax planning only when the financial and family logic supports it.