Silence of ICAI among IT Deadline Pressure and Portal Glitches raises Eyebrows of CA Members, #ICAI Trending on X

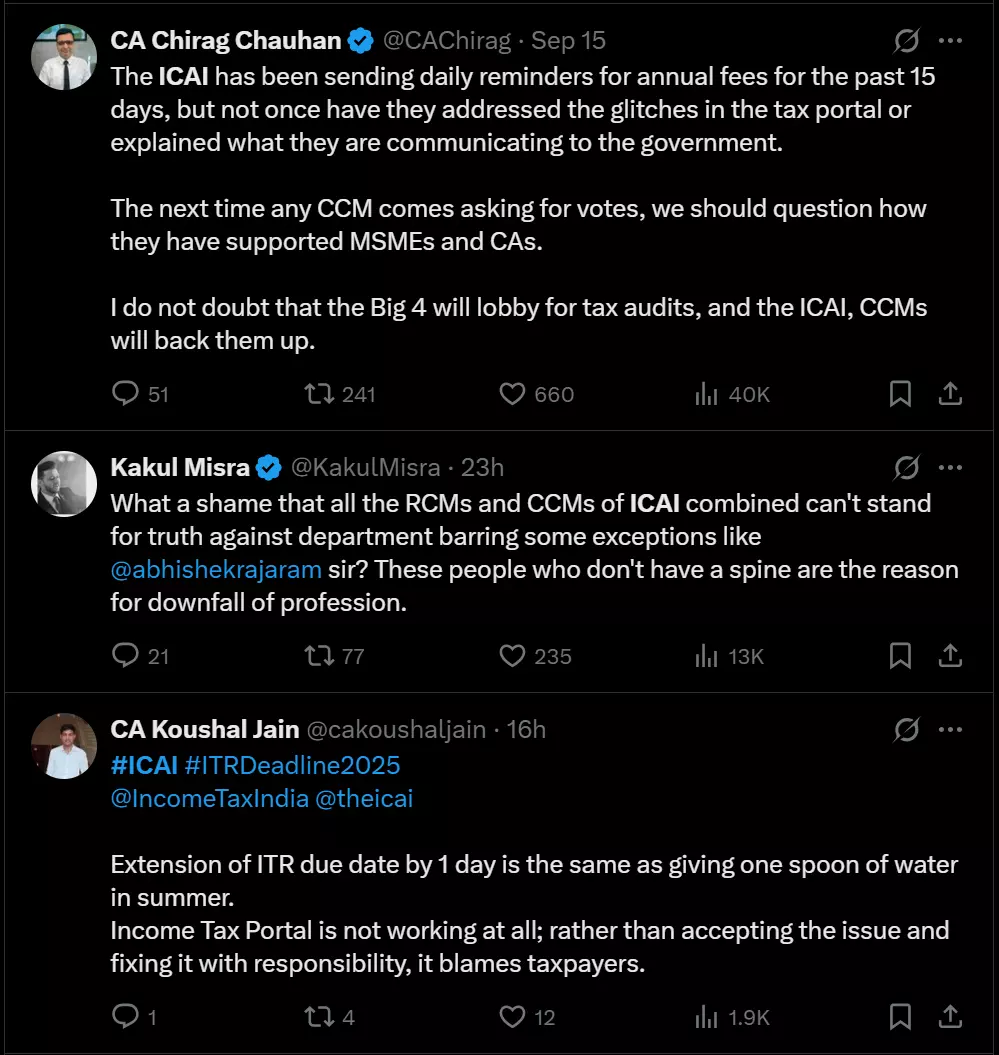

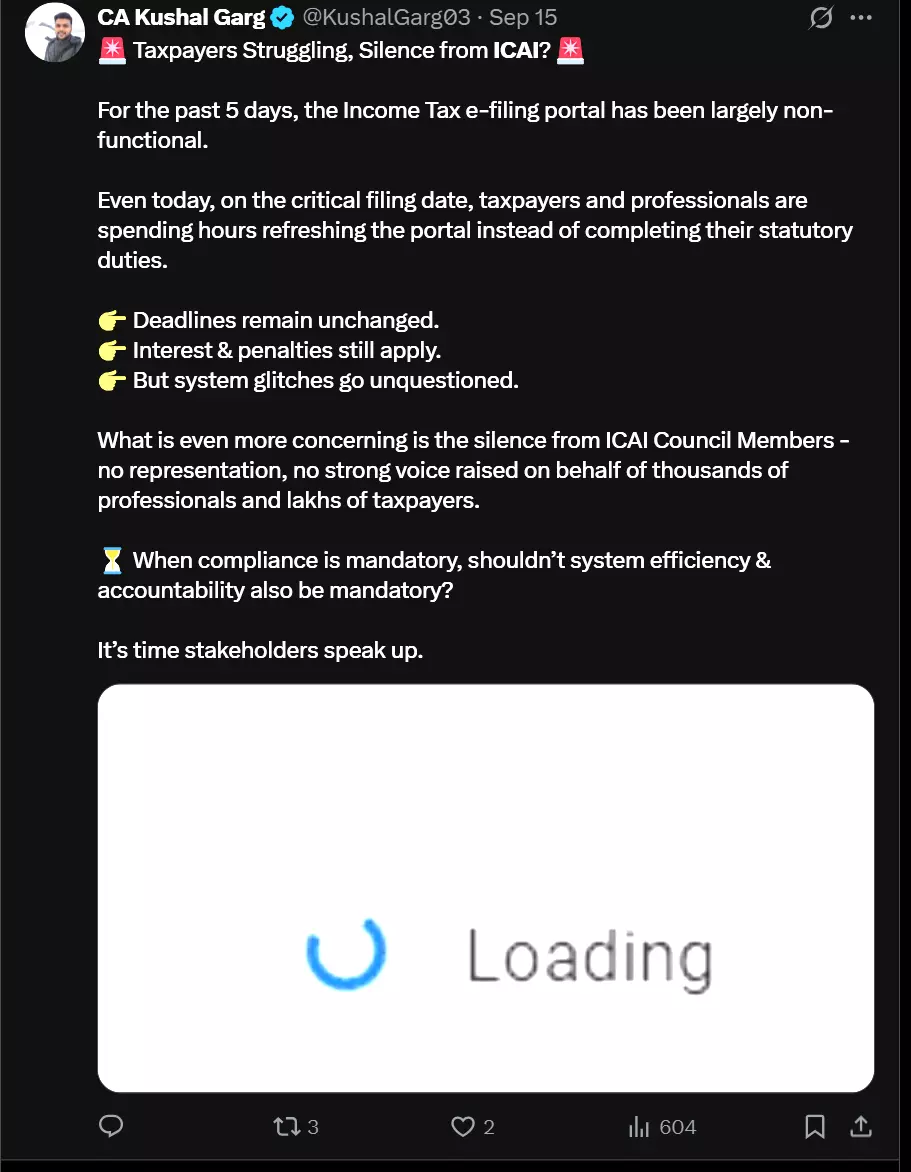

CAs and tax consultants voiced that despite weeks of technical lapses, ICAI made no official representation or statement, leaving members to deal with the crisis alone.

The silence of the Institute of Chartered Accountants of India (ICAI) has raised eyebrows of member Chartered Accountants (CA) who took it to X (Formerly Twitter) to raise their concerns unaddressed by the Institute.

The extended due date for filing Income Tax Returns (ITRs) for AY 2025–26 finally exhausted on 16th September 2025, yet glitches on the e-filing portal continued to trouble professionals until the very end.

Posts under the hashtag #ICAI questioned why the statutory body remained silent while professionals faced mounting stress, repeated late-night working hours, and reputational risks due to failed submissions. Many argued that ICAI’s role is not limited to regulation and discipline but also extends to safeguarding the professional community during systemic breakdowns.

Members further pointed out that while the Central Board of Direct Taxes (CBDT) responded with deadline extensions, the Institute neither acknowledged the hardships nor sought relief on behalf of its members. Comparisons were drawn to previous years when similar silence was noted from ICAI in the face of portal issues and deadline chaos.

With the deadline now over and no further extensions in sight, frustration among members has peaked. The trending of #ICAI reflects growing discontent and calls for the Institute to show accountability and engage more proactively with the difficulties faced by CAs and tax practitioners in high-pressure compliance environments.

While Chartered Accountants took to X with the hashtag #ICAI demanding intervention, insiders point to a different perspective: ICAI may have deliberately adopted a stance of neutrality.

According to senior professionals, ICAI often avoids making public statements on administrative matters directly handled by the Central Board of Direct Taxes (CBDT). Since deadline extensions and portal management fall under the Finance Ministry’s jurisdiction, the Institute may be exercising restraint to avoid appearing confrontational or politically critical of government systems.

Some members argue this silence is a strategic decision to maintain its working relationship with the CBDT and Ministry of Finance, focusing instead on long-term representation through internal channels rather than public outcry.

However, this approach has sparked debate. Critics say that while restraint may preserve institutional relations, it alienates rank-and-file members who expect visible advocacy during high-pressure compliance seasons. The absence of any acknowledgment has been interpreted as indifference by many professionals already struggling with stress, overtime, and reputational risks.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates