Supreme Court Upholds Gujarat HC Order Quashing Income Tax Reassessment Against Adani Wilmar, Dismisses Revenue’s SLP

The Supreme Court dismissed the Revenue’s appeal and confirmed that the reassessment against Adani Wilmar was invalid

The Supreme Court of India has dismissed the appeal filed by the Income Tax Department against Adani Wilmar Limited, upholding the judgment of the Gujarat High Court which had quashed reassessment proceedings initiated under Section148 of the Income Tax Act, 1961.

The case arose from a Gujarat High Court judgment dated 11 March 2025, where the Court ruled in favour of Adani Wilmar Limited and set aside the notice issued under Section 148 of the Income Tax Act for Assessment Year 2013-14.

Adani Wilmar had filed its return declaring Nil income under normal provisions and paid tax under Section 115JB on book profits. The return was scrutinised and assessment was completed under Section 143(3). After this, the Revenue issued a notice to reopen the assessment based on information received from the Investigation Wing regarding alleged accommodation entry transactions.

Before the High Court, the assessee’s counsel argued that the reopening was based on borrowed satisfaction and that all material facts were already disclosed during the original assessment. The assessee also argued that even after the proposed addition, tax was payable only under MAT and no income had escaped assessment.

The revenue counsel argued that fresh information was received from the Investigation Wing and reopening was valid.

The Gujarat High Court observed that the Assessing Officer had examined the issue during original scrutiny and accepted the explanations. The court explained that the assessee continued to be taxed under MAT even after the proposed addition, so there was no escaped income. The court also pointed out that reopening beyond four years was not valid without failure to disclose material facts. The reassessment notice was quashed.

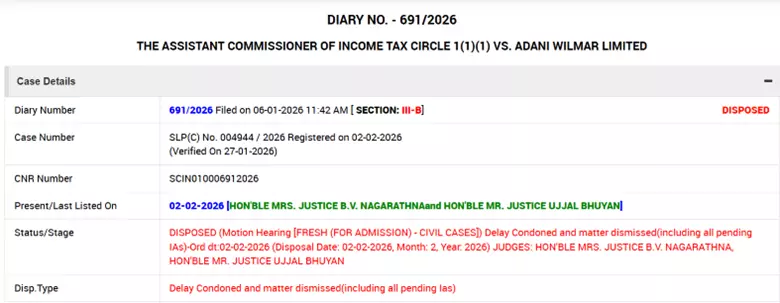

The Revenue filed an SLP before the Supreme Court. The Division Bench of Justice Bhargav D. Karia and Justice D.N. Ray condoned the delay and dismissed the SLP at the admission stage. The Gujarat High Court order has become final and the reassessment proceedings against Adani Wilmar Limited stands closed.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates