Tax Implications on Physical Gold and Digital Gold in India

Budget 2024-25 has changed gold taxation. Find out which type of gold investment now saves you the most tax

Gold remains a favored investment in India for its security and potential for value appreciation. However, the tax treatment of physical gold (jewellery, coins, bars), digital gold (online platforms), gold ETFs, gold mutual funds, and Sovereign Gold Bonds (SGBs) varies significantly.

The Union Budget 2024-25, effective from July 23, 2024, introduced key changes to capital gains taxation and holding periods. This article provides a clear, updated guide to the taxation of gold investments in India.

Capital Gains Tax: The New Rules Explained

Capital gains tax on gold investments depends on the holding period, classified as short-term capital gains (STCG) or long-term capital gains (LTCG) under Section 2(42A) of the Income Tax Act. The Union Budget 2024-25 simplified these rules, effective from July 23, 2024:

Holding Periods for LTCG:

- Physical Gold (jewellery, coins, bars): 24 months (previously 36 months).

- Digital Gold: 24 months (previously 36 months).

- Gold Mutual Funds: 24 months (previously 36 months).

- Gold ETFs: 12 months (previously 36 months, effective for units purchased on or after April 1, 2025).

- Sovereign Gold Bonds (SGBs): Capital gains on redemption are exempt after 8 years (maturity) or during premature redemption after 5 years on specified interest payment dates.

Your ultimate guide for mastering TDS provisions - Click here

Tax Rates:

- LTCG: Taxed at a flat 12.5% without indexation (previously 20% with indexation).

- STCG: Taxed at the investor’s applicable income tax slab rate for assets held less than the specified period.

The removal of indexation benefits increases the tax burden for long-term investors, especially for physical and digital gold, as inflation adjustments are no longer allowed. For SGBs, the capital gains exemption applies only on redemption, not on secondary market sales, which are taxed as per the holding period (12.5% LTCG after 24 months, or slab rate STCG).

GST and Other Indirect Taxes

Investors must consider Goods and Services Tax (GST) and other indirect taxes when purchasing gold:

- Physical Gold (Jewellery): 3% GST on the metal value; making charges typically attract 5% GST, though some jewellers may charge up to 12% for specialized services.

- Bullion (Coins, Bars): 3% GST on the purchase value.

- Digital Gold: 3% GST on the gold component, with no making charges or customs duties.

- Gold ETFs and Mutual Funds: No GST applies. Listed ETFs incur a Securities Transaction Tax (STT) of 0.001% on sales in stock exchanges.

- Sovereign Gold Bonds: Exempt from GST and customs duties, as they are government-issued securities.

The GST rate on making charges is typically 5%, but higher rates may apply for additional craftsmanship. Digital gold’s lack of making charges makes it slightly more cost-effective than physical gold jewellery.

Cost of Acquisition and Exemptions

For calculating capital gains:

- Gold Acquired Before April 1, 2001: Use the higher of the actual cost or the Fair Market Value (FMV) as of April 1, 2001.

- Gold Acquired On or After April 1, 2001: Use the actual purchase cost.

Investors can reduce LTCG tax liability through exemptions:

- Section 54F: Full exemption if gains are reinvested in a residential property within 2 years (purchase) or 3 years (construction), provided the investor does not own more than one residential property (excluding the new one) at the time of reinvestment. Selling the new property within 3 years revokes the exemption.

- Section 54EC: Exemption up to Rs. 50 lakh if gains are invested in specified bonds (e.g., NHAI, REC) within 6 months of the sale. These bonds have a 5-year lock-in period.

Proper documentation of purchase costs is essential, especially for physical gold, to substantiate claims during tax assessments.

Your ultimate guide for mastering TDS provisions - Click here

TDS and Reporting Obligations

TDS (Tax Deducted at Source):

- Physical Gold: No TDS on sales, but cash purchases exceeding Rs. 2 lakh attract 1% TDS under Section 194S.

- Digital Gold: No TDS on sales; TDS may apply on cash purchases above Rs. 2 lakh if processed through certain platforms.

- Gold ETFs and Mutual Funds: TDS of 10% for residents (20% for NRIs) applies on dividends exceeding Rs. 5,000. For NRIs, TDS may apply to ETF redemptions if processed directly with the fund house.

- Sovereign Gold Bonds: Interest (2.5% annually) is taxed under “Income from Other Sources” at slab rates, with no TDS deducted by RBI.

Reporting: All capital gains (STCG and LTCG) must be reported in Income Tax Returns (e.g., ITR-2 or ITR-3; ITR-1/ITR-4 for LTCG up to Rs. 1.25 lakh under Section 112A). Failure to report may lead to penalties. Investors should retain purchase invoices for physical and digital gold to avoid scrutiny during tax assessments.

Recent Regulatory Updates

The Union Budget 2024-25 and related guidelines from SEBI and CBDT introduced the following changes:

- Holding Periods: Reduced to 24 months for physical gold, digital gold, and gold mutual funds, and 12 months for gold ETFs (effective April 1, 2025, for new purchases).

- Hybrid Gold Schemes: Taxed as debt mutual funds. For units purchased after April 1, 2023, gains are taxed at slab rates (STCG) if held less than 24 months; post-April 1, 2025, LTCG applies at 12.5% after 24 months.

- Gold Seizure Guidelines: CBDT guidelines specify no limit on holding gold jewellery if acquired from explained sources. However, during tax raids, practical thresholds for unexplained gold are 500 grams (married women), 250 grams (unmarried women), 100 grams (men).

- SGB Discontinuation: Budget 2025 announced the discontinuation of fresh SGB issuances due to high borrowing costs, impacting new investors.

The seizure thresholds are not legal limits but guidelines for tax authorities. Investors should maintain proof of legitimate gold sources to avoid seizure risks.

Your ultimate guide for mastering TDS provisions - Click here

Comparative Tax Efficiency Across Gold Instruments

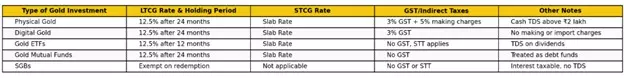

The table below summarizes the tax treatment of gold investments based on the latest rules:

Which Gold Investment Is Most Tax Efficient?

Sovereign Gold Bonds (SGBs) are the most tax-efficient for long-term investors due to capital gains exemption on redemption (after 5 years for premature redemption or 8 years at maturity) but the discontinuation of fresh SGB issuances (Budget 2025) limits their availability, requiring investors to rely on secondary markets, where gains are taxable (12.5% LTCG after 24 months).

Gold ETFs offer high liquidity and a shorter 12-month LTCG holding period, making them ideal for investors seeking flexibility without GST burdens.

Physical and Digital Gold are less tax-efficient due to 3% GST and STCG taxed at slab rates for short-term holdings. Digital gold avoids making charges, offering a slight edge over physical gold jewellery.

For better outcomes, use Section 54F or Section 54EC of the Income Tax, these exemptions reduce LTCG tax and maintain purchase records for physical and digital gold to substantiate costs. C

onsult a tax advisor for personalized planning, especially given the SGB discontinuation and new ETF rules effective April 1, 2025.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates