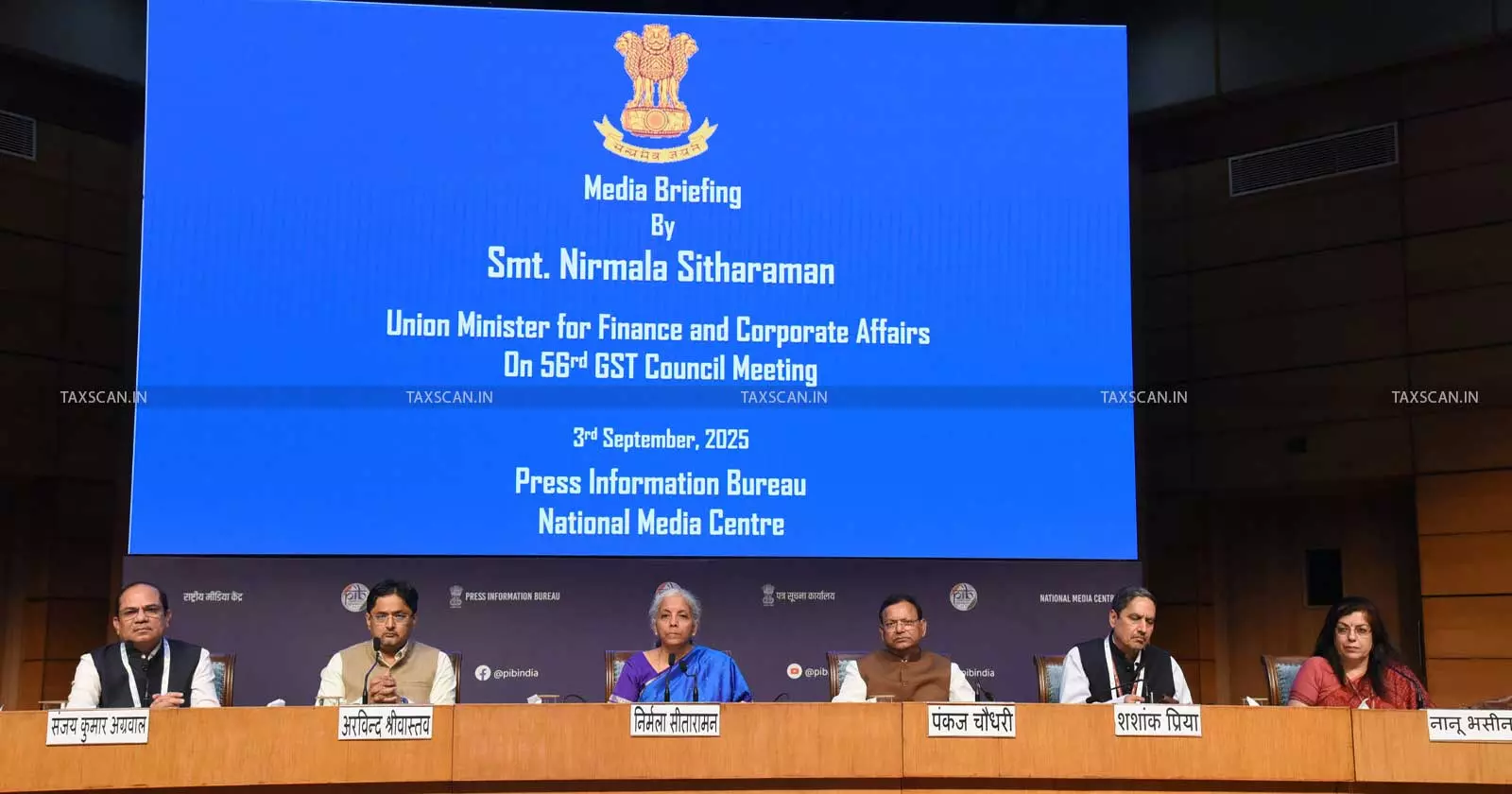

56th GST Council Meet: Rates of Common Man Benefits Reduced to 5%

By lowering taxes on commonly consumed items, the Council has not only reduced costs for families but also supported small traders and manufacturers catering to mass demand

The 56th GST Council, has reduced the GST rate of items of common man from 12% and 18% to 5%. Apart from removing the GST rate on Insurance, this is another diwali gift from the government. The reduction in GST rates consequently affects the consumer rates positively.

GST on Real Estate & Works Contracts – Your Ultimate Guide to GST in the Real Estate Sector! Click here

Items Reduced from 12% to 5%:

- Tooth powder

- Candles, tapers and the like

- All goods-safety matches

- Feeding bottles

- Nipples of feeding bottles

- Hand bags and shopping bags, of cotton

- Hand bags and shopping bags, of jute

- Tableware and Kitchenware of wood

- Umbrellas and sun umbrellas (including walking-stick umbrellas, garden umbrellas and similar umbrellas)

- Parts, trimmings and accessories of articles of heading 6601 or 6602

- Tableware, kitchenware, other household articles and toilet articles, of porcelain or china

- Tableware, kitchenware, other household articles and toilet articles, other than of porcelain or china

- Sewing needles

- Kerosene burners, kerosene stoves and wood burning stoves of iron or steel

- Table, kitchen or other household articles of iron & steel; Utensils

- Table, kitchen or other household articles of copper; Utensils Brass Kerosene Pressure Stove

- Table, kitchen or other household articles of aluminium; Utensils

- Sewing machines, other than book-sewing machine of heading 8440; furniture, bases and covers specially designed for sewing machines; sewing machines needles and parts of sewing machines

- Bicycles and other cycles (including delivery tricycles), not motorised

- Parts and accessories of bicycles and other cycles (including delivery tricycles), not motorised, of 8712 (i.e., Bicycles and other cycles (including delivery tricycles), not motorised)

- Furniture wholly made of bamboo, cane or rattan

- Hurricane lanterns, Kerosene lamp / pressure lantern, petromax, glass chimney, and parts thereof

- Combs, hair-slides and the like; hairpins, curling pins, curling grips, hair-curlers and the like, other than those of heading 8516, and parts thereof

- All goods- napkins and napkin liners for babies, clinical diapers

Items Reduced from 18% to 5%:

- Talcum powder, Face powder

- Hair oil, shampoo

- Dental floss, toothpaste

- Shaving cream, shaving lotion, aftershave lotion

- Toilet Soap (other than industrial soap) in the form of bars, cakes, moulded pieces or shapes

- Tooth brushes including dental-plate brushes

By lowering taxes on commonly consumed items, the Council has not only reduced costs for families but also supported small traders and manufacturers catering to mass demand. The items that are part of day-to-day living, from household necessities to lifestyle products, have been rationalised to fall under lower tax brackets, making them more pocket-friendly.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates