Unspent CSR Amounts Can Trigger Penalties: Legal Consequences Every Director Should Know

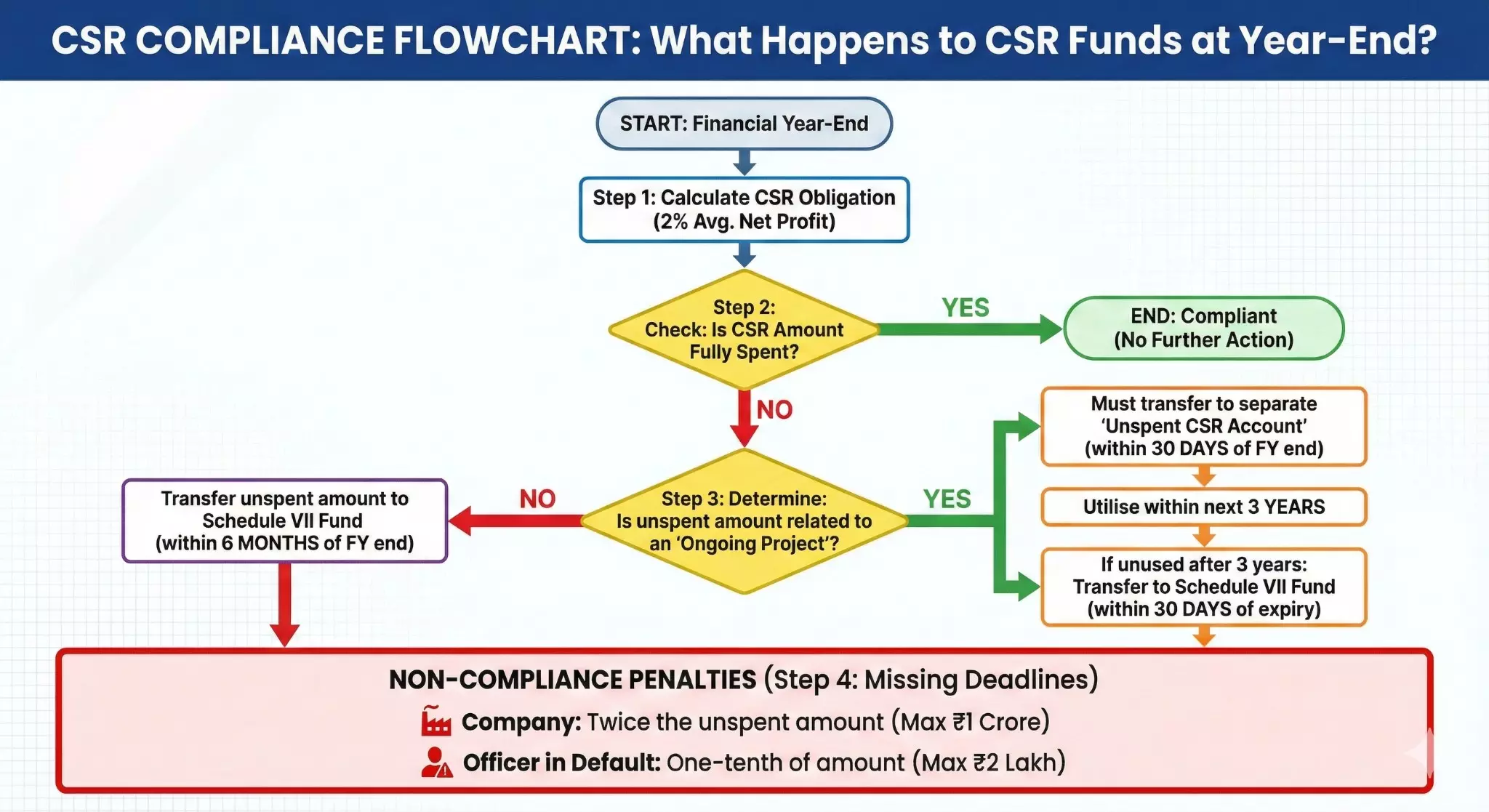

If CSR money is not used or transferred on time, companies and directors can be penalised.

In India today, Corporate Social Responsibility (CSR) is no longer a “nice to have” activity. For companies that fall under Section 135 of the Companies Act 2013, CSR is a legal duty with clear spending rules, strict timelines, and real penalties for non-compliance. One of the biggest pain points is unspent CSR amounts. If these funds are not handled correctly and on time, the company and its directors can face significant penalties.

Sections 135(5), 135(6) and 135(7)

Section 135(5) mandates that companies must spend at least 2% of their average net profits on CSR activities. Any shortfall relating to non-ongoing projects must be transferred to a Schedule VII fund within six months from the financial year-end.

Section 135(6) applies when CSR spending relates to ongoing projects. In such cases, the unspent amount must be transferred to a dedicated Unspent CSR Account within thirty days from the end of the financial year. The company then has three financial years to utilise that amount. If any balance remains, it must be moved to a Schedule VII fund within thirty days.

Penalties under Section 135(7) apply when these deadlines are missed. Companies may face penalties up to twice the unspent amount, subject to a one-crore cap, and officers in default may face penalties up to two lakh rupees each. Importantly, penalties do not eliminate the requirement to transfer the unspent amount and they are imposed in addition to the lapse.

Why Deadlines Matter: Lessons From Recent Penalty Orders

The law focuses on timely action, not eventual compliance. Once a deadline passes, the violation is complete.

FMC Texhnologies, a private limited company that failed to transfer more than twenty-six lakh rupees of unspent CSR funds within the six months ended up facing penalties exceeding sixty-one lakh rupees. Although the company corrected the lapse later, the authorities pinpointed that CSR transfers must occur within prescribed timelines.

Complete Blueprint for Preparing Project Reports, click here

In another case, Comviva Technologies Ltd attempted to transfer its unspent CSR contribution, but the payment bounced due to a technical error and went unnoticed. The corrected transfer was made much later, well beyond the deadline. Penalties followed because the system measures compliance by the actual date the funds reach the designated government account.

Quest Global Engineering Services Pvt Ltd faced huge penalties for failing to spend or transfer a CSR shortfall exceeding one crore rupees. Even though the company cooperated in the proceedings, penalties were imposed on both the company and multiple directors.

These cases show that CSR obligations are not flexible. Compliance must be time-bound, documented and verified.

Penalties for CSR Non-Compliance Are Increasing

Over the past few years, there has been a noticeable rise in CSR penalty orders. Regulators now monitor CSR obligations more closely, and the frequency of adjudication has grown steadily. Several trends stand out:

- Penalties today range from a few lakh rupees to several crores, depending on the scale of violation.

- Even multinational companies with large compliance teams have faced penalties for failing to transfer unspent CSR funds on time.

- In many cases, delays of only a few days or small unspent amounts have still resulted in penalties for both companies and officers.

- Authorities are penalising not just non-spending but also transfer failures, incomplete utilisation, misclassification of ongoing projects and documentation lapses.

This rising enforcement reflects a broader shift that CSR spending is now viewed as a compliance obligation rather than a philanthropic initiative.

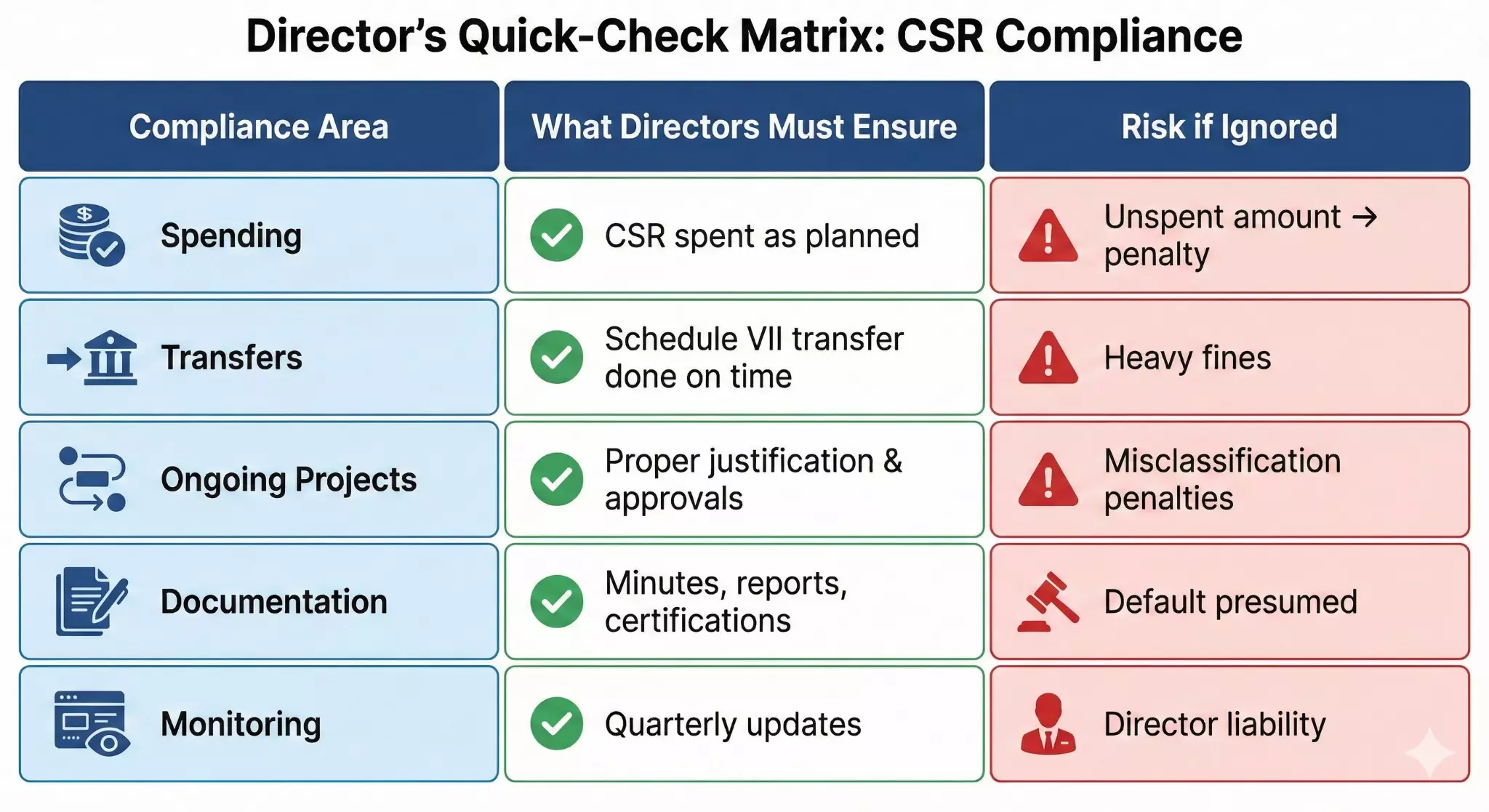

Director Liability Is Much Broader Than Expected

Directors are personally exposed to penalties under Section 135(7). A single director can face up to two lakh rupees per violation each year, and aggregate liability across multiple years can cross several lakh rupees. CFOs, Company Secretaries and Key Managerial Personnel are also treated as officers in default. Non-executive directors may also be liable if they were aware of the violation or failed to exercise due diligence.

Beyond monetary penalties, directors may face:

- Reputational harm due to publication of adjudication orders

- Adverse remarks under CARO 2020

- Questions on compliance with fiduciary duties under Section 166

- Heightened scrutiny from regulators and auditors

CSR defaults often trigger cascading governance scrutiny because they indicate broader issues with internal controls. This pattern is visible in cases such as RHI Magnesita India Ltd, where senior officers including the Managing Director and CFO were penalised individually.

Building Strong Internal Mechanisms to Prevent Penalties

Stronger governance is the most effective way to avoid CSR penalties. Several mechanisms that companies should embed:

- Conduct CSR Committee Meetings at Key Stages: The CSR Committee should meet at least twice a year. A first-quarter meeting should review the previous year’s compliance, approve any required transfers and plan ongoing and new projects. Mid-year meetings should track utilisation against timelines.

- Implement a CSR Compliance Calendar: Internal deadlines should be set five days before statutory deadlines. Automated reminders at 30, 15, 7 and 1 day before every key date help ensure transfers are not missed.

- Strengthen CFO Certification and Evidence: The CFO must certify that disbursements have been used for approved CSR purposes. This requires strong documentation, including agreements, utilisation reports and bank proofs.

- Improve Board Oversight: Boards should receive quarterly CSR dashboards showing spending progress, projected unspent amounts and any MCA compliance flags.

- Manage Project and Agency Risks: Best practices include due diligence of implementing agencies, performance milestones, monthly reporting and partial retention of funds until project completion.

- Maintain Comprehensive Documentation: This includes Board resolutions, CSR Committee minutes, MOUs with implementing partners, project reports, and bank statements. These documents help defend the company if compliance is questioned.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates