Why Can’t You See GSTR-9/9C on the GST Portal? Here’re the Reasons [GSTR 9/9C FAQs Explained]

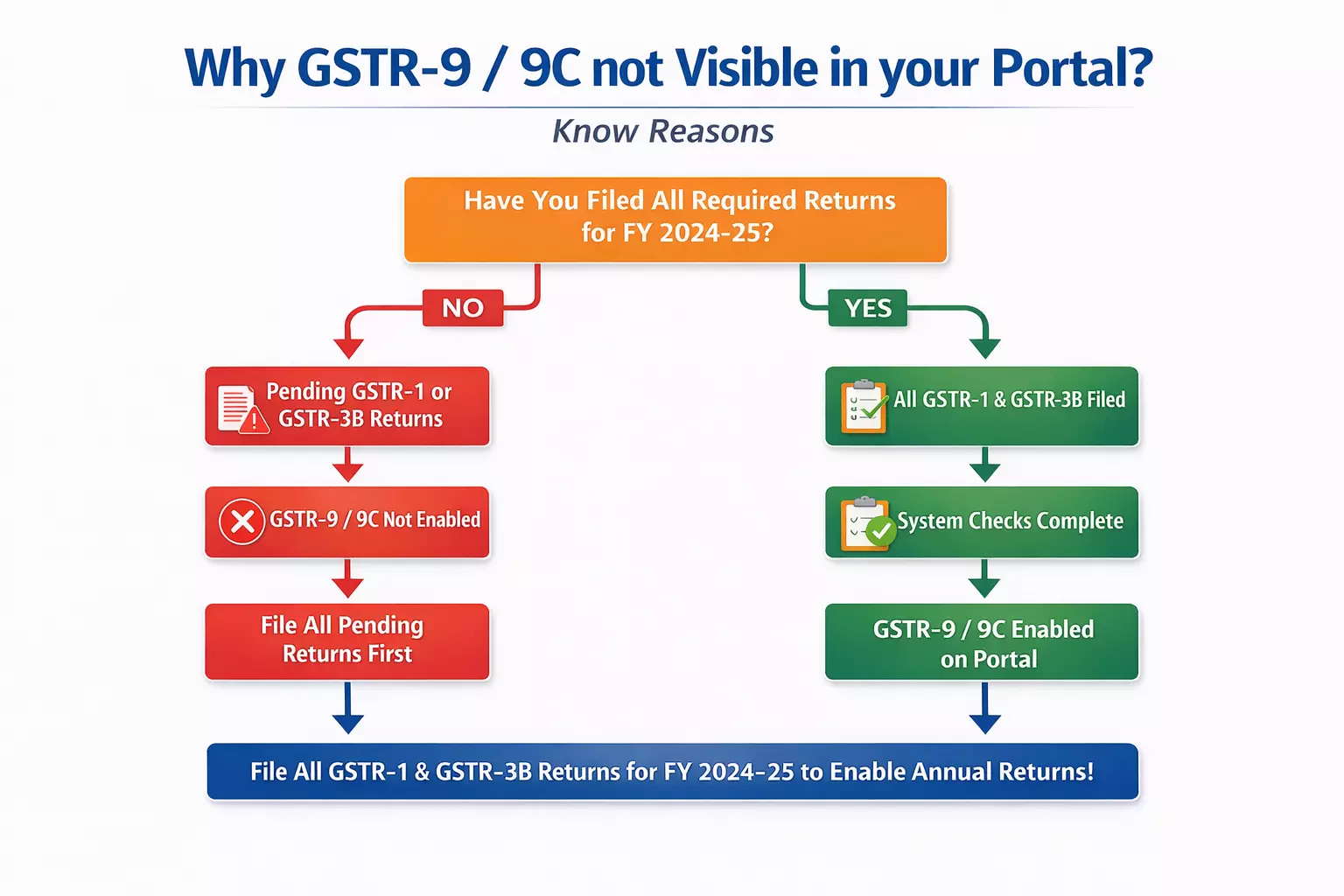

If any GSTR-1 or GSTR-3B for FY 2024-25 remains unfiled, the portal will not activate the option to file GSTR-9 or GSTR-9C. In such cases, the annual return forms will remain disabled until the pending returns are filed.

![Why Can’t You See GSTR-9/9C on the GST Portal? Here’re the Reasons [GSTR 9/9C FAQs Explained] Why Can’t You See GSTR-9/9C on the GST Portal? Here’re the Reasons [GSTR 9/9C FAQs Explained]](https://images.taxscan.in/h-upload/2025/12/18/2113078-gstr-99c-gst-portal-gstr-9-9c-faqs-explained-taxscan.webp)

The GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) for FY 2024-25 will be automatically enabled on the GST portal only after all the required periodic returns for the financial year are filed. Therefore if you’re not seeing the GSTR 9 or GSTR 9C is because you’ve not filed the returns properly or may be partially filed.

Specifically, the GST system checks whether the taxpayer has successfully filed all GSTR-1 and GSTR-3B returns for the entire financial year 2024-25. This includes returns for all tax periods from April 2024 to March 2025.

If any GSTR-1 or GSTR-3B for FY 2024-25 remains unfiled, the portal will not activate the option to file GSTR-9 or GSTR-9C. In such cases, the annual return forms will remain disabled until the pending returns are filed.

Once the taxpayer completes the filing of all due GSTR-1 and GSTR-3B returns, the GST portal automatically enables GSTR-9 and GSTR-9C, without the need for any separate application or request. There is no manual intervention required from the GST department for this activation.

Once the prerequisite returns are filed, the GST system will automatically populate key tables of GSTR-9, namely Tables 4, 5, 6, 8 and 9, based on the data already furnished by the taxpayer. These tables are populated using information reported in GSTR-1 / GSTR-1A / IFF, GSTR-2B, and GSTR-3B.

Accordingly, the accuracy of GSTR-9 is directly dependent on the correctness and completeness of the data reported in the monthly or quarterly returns. Any errors, omissions or mismatches in GSTR-1 or GSTR-3B will reflect in the auto-populated figures of GSTR-9, making prior reconciliation essential before proceeding with the annual return.

Whether No partial filing of returns enables GSTR 9/9C access? The answer is a big ‘NO’. Even a single pending return for FY 2024-25 will block access to GSTR-9/9C. If delayed GSTR-1 or GSTR-3B returns are filed with late fees and interest, the portal will still enable GSTR-9/9C once filing is completed.

This condition applies uniformly to taxpayers required to file GSTR-9 and those mandated to file GSTR-9C (where applicable).

Before expecting GSTR-9/9C to appear on the portal, taxpayers should reconcile their filing status and ensure that:

- All monthly/quarterly GSTR-1 returns are filed, and

- All GSTR-3B returns for FY 2024-25 are filed successfully.

Only after meeting these prerequisites will the annual return and reconciliation statement become available for filing.

Also read: GSTR-9 & GSTR-9CDue Date Extension: Know why it’s Being Demanded and when it May ComeSupport our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates