Transition to Digital Space – Impact on Auditing and Taxation

The impact of technology is so pervasive in all spheres of our lives and we may like it we may hate it, we may even dread it, but we just can’t miss it.

Innovative technologies and ideas have brought in a fee of convenience, for the common be it transportation like Uber, shopping like Flipkart, entertainment like Netflix, and holding meeting like Zoom. The dynamics of each particular space have fundamentally changed, which such frequent changes in technology come to the threat of redundancy of both people as well as jobs. As per OECD PIAAC Data 30% of jobs at potential risk of automation by mid-2030s and $15tn Potential boost to global GDP from AI by 2030. Due to the paradigm shift towards a digital society where the usage of IT is continuously increasing, it is important to realize how the audit and taxation are affected by digitalization. So the transition to digital space would lead to a great change in business model and provide new revenue and value-producing opportunities and have clear advantages in accessibility, security, and scalability; it is the process of moving to a

Impact on Auditing:

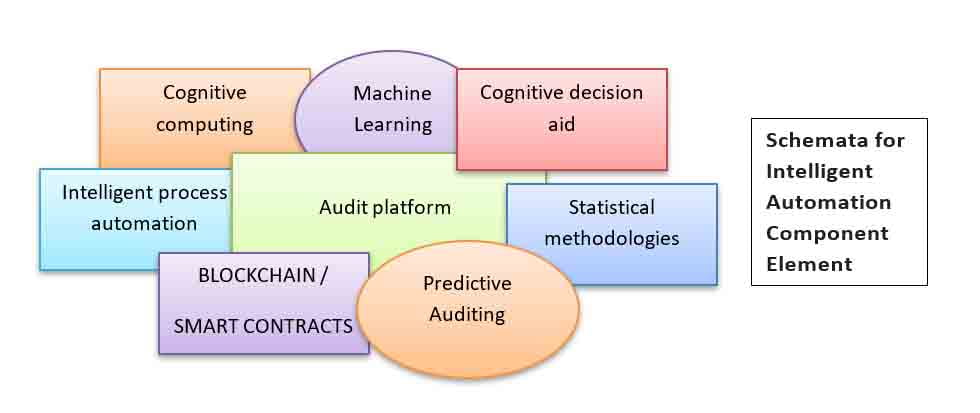

Exponential technology and other innovations have begun to transform the traditional audit delivery model. Impacting who, where, and how the audit is done. Through significant improvements and advancements, information technology is quickly and profoundly transforming the auditing industry and profession. Finance teams need to understand that the world will continue to move even faster. We need to prepare ourselves to meet the demands of a business we haven’t even seen yet. So do the Auditors. Here are some ways of how technology is transforming the auditing industry:

- Data Analytics: For auditors, the main driver of using data analytics is to improve audit quality. It allows auditors to more effectively audit the large amounts of data held and processed in IT systems in larger clients. Auditors can extract and manipulate client data and analyze it. By doing so they can better understand the client’s information and better identify the risks. Data analytics tools have the power to turn all the data into pre-structured forms/presentations that are understandable to both auditors and clients and even to generate audit programs tailored to client-specific risks or to provide data directly into computerized audit procedures thus allowing the auditor to more efficiently arrive at the result. For example, NRV testing – comparing the last time an inventory item was purchased with the last time it was sold and at what price.

- Artificial Intelligence (AI): It is the ability of a computer program or a machine to think and learn. They work on their own without being encoded with commands

Now with regard to audit, if we talk, earlier audit fees were based on hours but now we use a tool that runs through thousands of contracts and by-single click we get the quantum of data and though the work is done more efficiently within minutes. Then the question arises will the fees would drop down dramatically? So the answer is yes. Therefore in order to save auditors from such disruptive Trends Impacting auditing would require integrating with AI.

Artificial intelligence, cognitive services, and robotics are helping to automate complex and repetitive tasks and processes. This type of emerging technology supports the transitional role of today's auditor from a process-centered practitioner to a critical strategic partner. AI will not replace auditors, but auditors using AI will replace those not using it.

- Cloud: Cloud-based computing, such as Amazon Web Services, (AWS), Google Cloud, and Microsoft Azure are a type of Internet-based computing that provides shared processing resources and data to computer devices on demand. This enables auditors to perform auditing and testing tasks from any location as well as the ability to deliver working papers, information, and reports through the cloud. Cloud-based computing opens up a new way for auditors to work with their clients. Consequently, auditors can spend more time engaging with clients on key business issues rather than mundane processes.

- Audit Software: Auditors are able to retrieve the necessary information in a timely, efficient manner, and it allows them to organize and present it, however, and whenever they see fit. Your data quality will improve, and positively affect your overall performance. Audit software applications include audit analytics, continuous monitoring, fraud detection, and workgroup collaboration. BI applications include connecting desktops to mainframes for accessing legacy data, data migration and querying, and data analysis.

In practice the most preferred software is Form.com. KPMG utilizes audits for auditing and PwC utilizes Aura. These are both audit documentation software. Both businesses and auditors are embracing new audit software technology to help avoid costly mistakes and prevent issues with stakeholders.

So it is the high time that auditors need to move in parallel with technology so as to exist in the market because Exponential Organizations have stated that, in the last two years we have seen nine times more data created than in the entire history of humanity.

- SAP Audit Management: SAP stands for System Applications and Products in Data Processing and SAP AuditManagement can enable the auditors in auditing. It is a fully mobile solution, with audit management software improving quality and automating internal auditing procedures. This in-memory audit software makes it quick and easy to document evidence, organize working papers, and create audit reports.

- Blockchain: It can be described as a data structure that holds transactional records and while ensuring security, transparency, and decentralization.

While traditional audit and assurance services will remain essential, blockchain business applications and new accounting technology are likely to have a significant impact on the way auditors execute engagements. With more companies exploring blockchain business opportunities—including the blockchain audit trail—many accounting firms have undertaken blockchain initiatives to further understand the implications of this important and versatile technology.

The rapidly evolving relationship between auditing and information technology means auditors and accountants now need to understand how technology impacts their business, and how it can be used to improve operational efficiency, achieve regulatory compliance, support financial reporting, guide management decisions, and ultimately increase revenues.

Impact on taxation:

Today we are at a turning point in tax. There are enormous issues affecting and disrupting our industry – issues that layer new complexities, pressures, and opportunities onto businesses. Accelerated by technology, digital is a disruptive megatrend that is enabling real-time access, real-time analytics, and heightening the expectation for real-time visibility. Responding to this, the tax function needs to increasingly operate across a number of fronts.

Organizations must ask how technology can be leveraged to help build an operationally more effective tax function and meet the requirements of real-time data. New technologies, such as blockchain, robotics process automation (RPA), and artificial intelligence (AI) can offer a new era of visibility into transactional data and unlock value, help manage risk, improve efficiency and provide critical business insight.

- Blockchain: Blockchain, for example, creates an environment in which every transaction is open, verified, and available in real-time. Its application in tax has the potential to move the function from retroactive analysis and historical financial information gathering to a position where transactions, expenses, assets, and liabilities can be recorded in real-time and publicly scrutinized. Mistakes, risk, and fraud could, in theory, be eliminated.

- Robotic Process Automation: RPA is another step in the evolution of business process bundling and outsourcing, facilitating a virtual workforce of software robots that can work faster, more inexpensively, and more accurately than human beings. TaxBots are already being used to transform tax function operations, helping to accelerate indirect tax compliance, tax provision, and sales and use compliance to name just a few activities.

- Artificial Intelligence: AI is delivering many benefits for the tax function, such as improved decision-making. AI will be loaded with information such as tax codes, case law, and administrative guidelines, and will be able to make certain decisions on this basis.

Now in today’s era, many software has been introduced and even used everywhere so frequently, as for the purpose of income tax return or other work regarding income tax we use Compu-Tax, in GST for Return filling and Billing in2020 we can use Horizon ERP, Busy Accounting, ProfitBooks GST, Easy GST and many more, for transfer pricing we can use prowess for the relevant database.

And if we go towards the latest step by the government which can be an example towards the transition to digital space is that “Finance minister Nirmala Sitharaman on May 28, 2020, officially launched the instant Permanent Account Number (PAN) facility which uses Adhaar number-based e-KYC. The beta facility was earlier launched in February 2020 on the income tax department’s e-filing website.” This would ease our work.

With tax complexity only increasing, the time is now for technology in the corporate tax department— and here are seven key reasons why.

- Accuracy and Compliance: Tax technology increases accuracy and compliance by … • Providing comprehensive data management • Increasing internal knowledge ownership and control • Enabling adherence to increasing regulation

- Process Efficiency: Tax technology enables more efficient tax processes by … • Facilitating the flow of data • Eliminating duplicate work • Decreasing the time and resources spent on tax processes

- Global Collaboration: Tax technology enables global collaboration by … • Providing anytime, anywhere data access • Removing barriers related to language, time zone, and local reporting requirements • Allowing tax operations to run continuously

- Transparency: Tax technology increases transparency by … • Breaking down walls between tax areas • Providing an opportunity to look across all tax calculations • Fortifying audit substantiation • Decreasing the administrative burden associated with global reporting mandates

- Tax Team Satisfaction: Tax technology increases tax team satisfaction by … • Shifting focus from strict compliance to tax strategy and analysis • Elevating the visibility of the tax department within the broader organization • Creating a more rewarding work environment • Increasing staff retention

- Key Insights and Metrics: Tax technology increases insight and analysis by … • Improving analytics • Enabling peer group benchmarking • Providing a basis to determine best practices

- Sustainability: Tax technology increases sustainability by … • Preparing your tax department for the future • Providing an agile foundation that can evolve in the years ahead

The introduction of technologies, globalization, complex tax rules, and the need for transparent systems has made technology in taxa ‘must-have’ rather than ‘good to have’ for the taxpayers as well as tax administration.

- Wrap-Up Remarks:

Since diverse technology solutions are now available, it is time to avail of these and make an enhanced contribution by transforming functions to support decision-making and mitigate risk. And remember that it is practical to go ahead and implement technology with standard functionalities early in an area of high impact, and thereafter use this as a core to build enhancements. Implementing technology in your organization is your opportunity to give it a competitive advantage.

Would like to conclude it by adding five points that are required to be considered by a Chartered Accountant:

- Think like an immigrant in this technology-driven world.

- Think like an artist.

- Always be in beta mode, never be in finished mode.

- PQ+CQ>IQ, as per this an organization doesn’t require IQ today, what it requires is PQ i.e. Passion Quotient but most important is Curiosity Quotient which generates a questioning mind that why, why not, what is the implication of the technology.

Further would like to add HQ i.e. human quotient as in this age of robotics we need humans, who have feelings and EQ i.e. Emotion Quotient as we need a balance and stability in our lives.

- Think like an entrepreneur take a risk in your life if you win, you can lead. If you lose, you can guide.

Remember “Nothing or no one can replace an auditor’s knowledge, judgment, and exercise of professional skepticism.”

Jyoti Jaiswal is a CA Finalist and Article Trainee at Jain Shrimal and Company.

Jyoti Jaiswal is a CA Finalist and Article Trainee at Jain Shrimal and Company.