UAE Corporate Tax: Federal Tax Authority issues new Decision on specified deadlines for Registration

UAE Federal Tax Authority specified Deadlines for Corporate Tax Registration

UAE Corporate Tax – Federal Tax Authority – new Decision – specified deadlines for Registration – taxscan

UAE Corporate Tax – Federal Tax Authority – new Decision – specified deadlines for Registration – taxscan

In a recent development, the Federal Tax Authority ( FTA ) of the United Arab Emirates has unveiled a new decision outlining specific timeframes for Taxable Persons subject to Corporate Tax to apply for registration. Effective from March 1, 2024, this decision aims to ensure compliance with Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses and its amendments.

The FTA's decision applies to both juridical and natural persons, whether they are Resident or Non-Resident, as per the following :

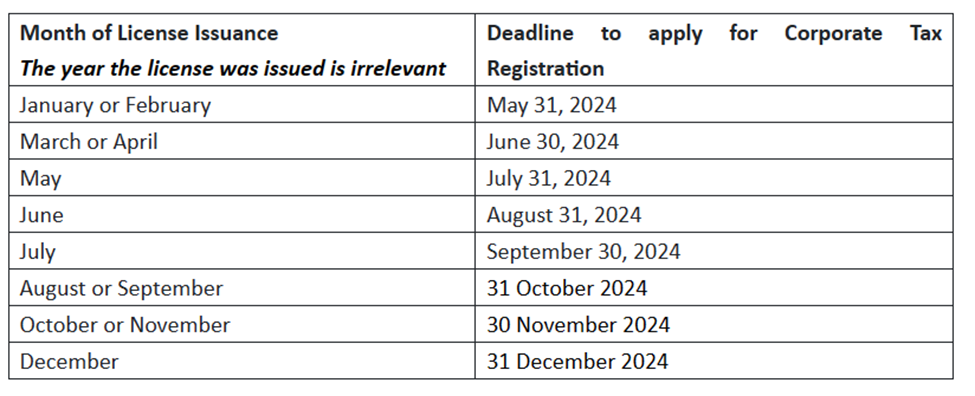

For Juridical Persons (Resident) incorporated, established, or otherwise recognised Before March 1, 2024:

For Juridical Persons (Resident) Incorporated On or After March 1, 2024:

- Must apply within three months from the date of incorporation, establishment, or recognition.

For Juridical Persons (Non-Resident) with a Permanent Establishment Before March 1, 2024:

- Must apply within nine months from the date of the Permanent Establishment's existence.

For Juridical Persons (Non-Resident) with a Nexus in the UAE:

- Must apply by May 31, 2024.

For Juridical Persons (Non-Resident) On or After March 1, 2024:

- Must apply within six months of establishing a Permanent Establishment or within three months from establishing a nexus in the UAE.

For Natural Persons (Resident and Non-Resident):

- Must apply by March 31 of the following year if the Turnover threshold is exceeded.

Failure to adhere to these timelines may result in administrative penalties, as specified in Cabinet Decision No. 75 of 2023.

The FTA is also set to conduct webinars to educate taxable persons on the Corporate Tax registration requirements for each category.

The FTA reiterates that Corporate Tax registration is available 24/7 through the EmaraTax digital tax services platform, with a streamlined process taking approximately 30 minutes to complete.

Existing VAT or Excise Tax registrants can use their accounts on EmaraTax, while new users must create profiles on the FTA's e-Services portal: Federal Tax Authority.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates