Unsettled Waste Collection Fees to turn Property Tax Dues Soon: Kerala LSGDs start issuing notices with No Opportunity of Hearing and 2 Days to Pay User Fee

Unpaid Waste Collection Fee Notices received by Individuals across Kerala, same to be levied as Property Tax Dues Soon

Unsettled Waste Collection Fees – Turn Property Tax – Kerala LSGDs – notices – Hearing – Pay User Fee – taxscan

Unsettled Waste Collection Fees – Turn Property Tax – Kerala LSGDs – notices – Hearing – Pay User Fee – taxscan

Local Self Government Departments ( LSGD ) such as Panchayats and Municipalities in Kerala have started issuing notices of unpaid waste collection fees to citizens, which are in turn, set to be levied as property tax dues if left unsettled.

The Kerala Government recently issued an order stating that unpaid waste collection fees will be considered property tax dues and subject to recovery. The state government of Kerala had made it compulsory for households and establishments to pay a monthly user fee to the local bodies for waste collection, including plastics, starting from April 1, 2023. The fee applied to everyone, with no exception for the Below Poverty Line (BPL) category.

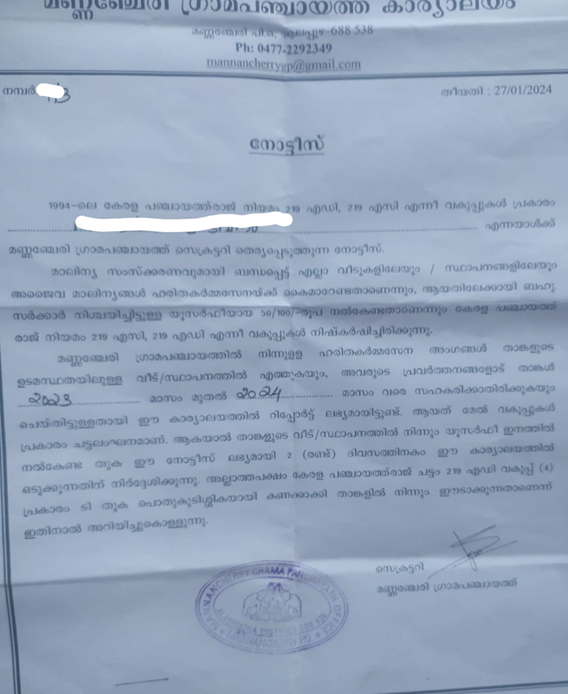

The notice, in summary, roughly translates to – “Report has been received in this office that you have not paid the user fee of Rs. 50/100 and have been non-cooperative towards Haritha Karma Sena members from 2023 to 2024. You are hereby directed to remit the fee dues within 2 days. Failure to do so will result in recovering the same from you as tax dues as per Kerala Panchayati Raj Rule 219a(d)(4) provisions.”

The notice has been issued by the Secretary, Mannancherry Grama Panchayat, Alappuzha, Kerala.

Although the local body had the power to exempt individuals from the user fee, the order did not provide any assurance regarding any form of relaxations for the BPL category. The local bodies were advised to arrange for the collection of non-biodegradable waste and transfer it to shredding units for recycling. Minister M B Rajesh defended the government’s decision to charge the user fee, stating that HKS’s waste disposal services justified the fee.

Haritha Karma Sena, a waste management organization with the support of Kudumbasree, was set up to collect items like plastics, footwear, clothes, and e-waste from households and establishments. If anyone failed to pay the user fee, it would be collected as arrears along with the property tax.

Read More: Unpaid Waste Collection Fees to be considered as Property Tax Dues: Kerala Govt issues Order

Following a negative campaign against the imposition of user fees in Thiruvananthapuram city corporation, where only two wards had more than 50% households paying HKS’s user fees, the government implemented strict measures to collect user fees alongside property tax. Waste disposal has always been a major problem for Kochi, Kerala.

In 1998, the Kochi Corporation had purchased 37 acres of land at Brahmapuram, 17 kms from the city. An agreement was signed in 2005 to build a waste treatment plant there.

However, the plant had turned into a junkyard and had caught fire earlier, suffocating the majority of the population in Ernakulam. It was hoped that the waste collected by the Haritha Karma Sena would provide sustainable relief, unlike the unfortunate incident at Brahmapuram.

Here, there is an innate inconsistency with the collection of waste collection fees as property tax dues.

It is a very basic principle or canon of taxation that tax collection should be equitable and certain. Legally, a fee is something collected in the nature of a compensation/remuneration/charge for a service provided, with a clear “quid pro quo” or something in return. However, tax collection cannot be based on the guise of a fee unpaid as tax and fees are levied for entirely different intents.

It is a citizen’s responsibility to pay taxes, whereas it is the government’s responsibility to provide services for the ease of living of citizens. Here, the collection of fees for waste collection over and above property tax collections is arbitrary in every sense.

This overlap of tax and fees by the State and Local Self Government Authorities of Kerala raise serious concerns, both legally and causing major inconvenience to the citizens, regarding the certainty of tax to be paid to the Government, as responsible law-abiding individuals.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates