Where Should I Apply for GST Registration: Here's Everything You Need to Know

Casual Taxpayers or Non-resident taxable persons, registration should be initiated 5 days before commencing business activities

GST registration is the pivotal process of acquiring a distinct identification number for businesses obligated to pay Goods and Services Tax ( GST ). Introduced in 2017, the GST has simplified indirect taxes.

Prior to the implementation of the GST, India's indirect tax structure was convoluted and fragmented. Each state operated as a separate market with its own set of rules and tax rates, resulting in a complex web of regulations. Moreover, businesses were unable to claim input tax credits for central excise duty and other levies, thereby imposing a heavier tax burden on the general populace.

GST REGISTRATION

As per GST regulations, entities with an annual turnover exceeding Rs. 40 lakh (or Rs. 20 lakh for specific special category states) are mandated to register as regular taxable entities. However, this threshold may vary based on the nature and location of the business.

For businesses surpassing the turnover limit, GST registration becomes obligatory to avoid legal consequences and penalties. Beyond fulfilling a legal requirement, GST registration plays a fundamental role in promoting compliance and transparency within the tax system.

Registering your business for GST involves acquiring a distinctive 15-digit Goods and Services Tax Identification Number ( GSTIN ) from the appropriate authorities. This unique identifier serves as the cornerstone for gathering and aligning all business activities and data within the GST framework. It stands as the fundamental necessity in any tax system, facilitating precise identification for tax obligations and compliance verification programs.

WHY GST REGISTRATION NECESSARY

Registration in the GST system offers several benefits to businesses, including

- Official recognition as a supplier of goods or services.

- Accurate recording of taxes paid on input goods or services, which can be offset against GST liabilities on supplied goods and/or services.

- Ability to transfer the tax credits accrued from supplied goods and/or services to purchasers or recipients

- Authorization for taxpayers to collect taxes on behalf of the Government.

WHEN TO APPLY FOR GST REGISTRATION

GST regulations stipulate that for regular taxpayers, registration must be completed within 30 days of the liability arising. However, for Casual Taxpayers or Non-resident taxable persons, registration should be initiated 5 days before commencing business activities.

WHO SHOULD APPLY FOR GST REGISTRATION

Any person dealing with the supply of goods and services whose aggregate turnover exceeds Rs.40 lakhs (Rs.20 lakh in case of special category states) are liable to take GST registration. The suppliers who are required to get compulsory registration irrespective of their turnover :

- Inter-state suppliers.

- Casual traders

- Persons subject to RCM basis.

- Electronic commerce operators.

- Non-Resident taxable persons who are not having fixed place of business in India.

- TDS Deductor

- A person who supplies on behalf of some other taxable person (i.e. agents)

- Input service distributors

- Online suppliers

- Those e-commerce operators who are notified as liable for GST payment under section 9(5).

The following suppliers are exempted from taking registration under GST:

- Suppliers of goods and services that are completely exempted from tax under Composite GST Rule or GST Act.

- Farmers who supply only agricultural products.

- Those who are exempted by Government Orders according to the recommendations of the GST Council.

- Governmental and foreign diplomatic services.

- Transportation of goods where the total cost is less than Rs. 1500.

DOCUMENTS NEEDED FOR GST REGISTRATION

To apply for a new registration, you must have:

- PAN card/details of your business

- Valid and accessible e-mail ID and Mobile Number

- Documentary proof of constitution of your business

- Documentary proof of promoters/partners

- Documentary proof of principal place of business

- Details of additional places of business, if applicable

- Details of Authorised Signatories including photographs and proof of appointment

- Details of Primary Authorised Signatory

- Business bank account details along with bank statement or first page of bank passbook

- Valid Class II or Class III DSC of authorised signatory in case of companies and LLPs; valid Class II or Class III DSC or Aadhaar (for E-Sign option) in case of other entities

Note: Your mobile number should be updated with the Aadhaar authorities otherwise you cannot use the E-Sign option because OTP will be sent to the number in the Aadhaar database.

PAN FOR GST

Prior to applying for GST Registration as a regular taxpayer, it's essential to have a PAN card, except for TDS registration, which can be processed using TAN.

STEPS TO APPLY FOR GST REGISTRATION IN GST PORTAL

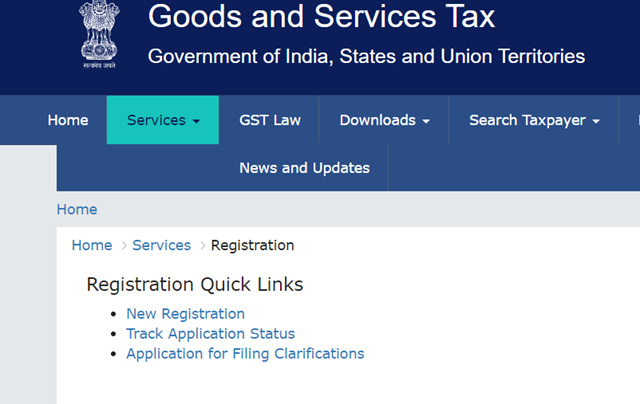

To initiate your GST Registration, you can conveniently apply through the GST web portal. No need for traditional paper applications. Alternatively, utilise the offline utility offered on the GST Website. It's worth noting that even when using the Offline Utility, the process remains digital as you upload your application online.

Register Online:

- Go to GST Portal

- Select ‘New Registration’ button

- In the drop-down under ‘I am a’ – select Taxpayer

- Select State and District from the drop down

- Enter the Name of Business and PAN of the business

- Proved Email Address and Mobile Number.

- You will receive OTPs on the registered email id and mobile number or PAN-linked contact details, as the case may be.

- Click on Proceed

- Enter the OTPs received on the email and mobile or the PAN-linked contact details.

- Click on Continue.

- You will get the 15-digit Temporary Reference Number ( TRN ) and have to complete filling the part-B details within the next 15 days.

- Again visit the GST portal.

- Select the ‘New Registration’ tab.

- Select TRN.

- Enter the TRN and the captcha code and click on Proceed.

- You will receive an OTP on the registered mobile and email or PAN-linked contact details.

- Enter the OTP and click on Proceed

- You will see that the status of the application is shown as drafts.

- Click on Edit Icon.

- Complete your PART B - related to business.

GST registration is mandatory for the people who exceed the threshold set by the government. Following the necessary steps mentioned above, make yourself a responsible citizen and stay away from penalties and interests.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates