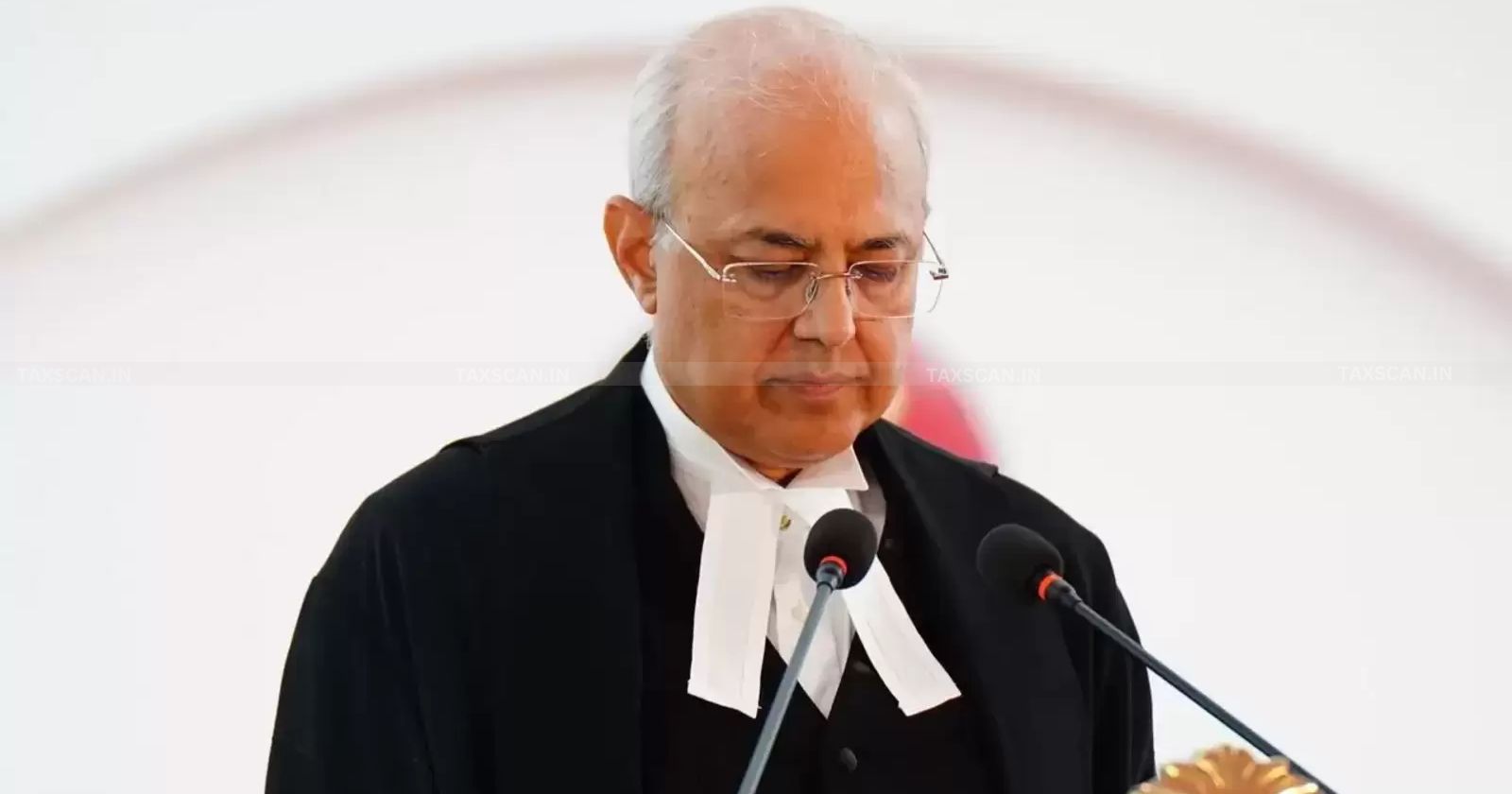

Who is SC Collegium-Recommended Delhi CJ Manmohan? A Look at His Tax Bench Judgments

The Supreme Court Collegium recommended the appointment of Delhi Chief Justice Manmohan as SC judge

Delhi Chief Justice Manmohan – Chief Justice Manmohan – Justice Manmohan tax bench judgments – Taxscan

Delhi Chief Justice Manmohan – Chief Justice Manmohan – Justice Manmohan tax bench judgments – Taxscan

The Delhi Chief Justice Manmohan, a prominent figure in India's tax judiciary, has had his name recommended by the Supreme Court Collegium to the government for appointment as a Supreme Court Judge. Known for his expertise in tax law, he is widely regarded as one of the leading judges handling tax matters in the country.

Justice Manmohan’s elevation comes just 20 days before his retirement as a High Court judge on December 16, 2024. His tenure in the Supreme Court is expected to span over three years. He is a graduate in history from Hindu College and a law graduate from the Campus Law Centre, Delhi University, he was designated as a senior advocate in January 2003.

Become a PF & ESIC expert with our comprehensive course - Enroll Now

This article delves into the notable rulings of the judge in tax matters.

Tax Judgements of CJ Manmohan

Section 115BBE of Income Tax Act cannot be held Unconstitutional on ground that there is Apprehension of Misuse: Delhi HC TRIVENI ENTERPRISES LIMITED vs INCOME TAX OFFICER

The Delhi High Court recently ruled that Section 115BBE of the Income Tax Act, 1961 cannot be deemed unconstitutional merely due to concerns of misuse. The case involved challenges to orders under Section 148A(d) of the Act for the Assessment Years 2015-16 to 2017-18, as well as notices issued under Section 148. The petitioner argued that the notices were issued after three years and without the necessary sanction from the Principal Chief Commissioner.

However, the Revenue stated that after orders under Section 148A(d), final assessments were made in May 2023. The Court, comprising Acting Chief Justice Manmohan and Justice Mini Pushkarna, ruled that the constitutional validity of Section 115BBE cannot be questioned at this stage and that the proper avenue for addressing issues of limitation is through Appellate Authorities, not the High Court under Article 226.

No Relief to Uber & Ibibo: Delhi HC validates Notification Levying GST on Auto Rickshaws and buses through ECO

The Delhi High Court, comprising Justice Manmeet Pritam Singh Arora and Justice Manmohan, dismissed the petitions filed by Uber India, IBIBO Group (Make My Trip), and Pragatisheel Auto Rickshaw Driver Union challenging the withdrawal of GST exemptions for services booked through Electronic Commerce Operators (ECOs). The court upheld the validity of Notifications No. 16/2021 and 17/2021, which removed the GST exemption for non-air-conditioned stage carriage and auto-rickshaw services booked through ECOs, effective from January 1, 2022.

The petitioners argued that the levy of GST should be based on the nature of the service rather than the mode of booking (online or offline), contending that the exemption was intended for auto-rickshaw drivers who are unable to bear the compliance burden. However, the court ruled that the withdrawal of exemption was not discriminatory. It clarified that there is a principal-to-principal relationship between ECOs, the consumers, and the service providers (auto-rickshaw and bus operators).

The court noted that ECOs operate as independent service providers and are responsible for collecting and paying GST on services provided through their platforms.

Tax Dues in SVLDRS cannot Exceed the Amount Confirmed by Central Excise Department: Delhi HC MUKESH JAIN vs UNION OF INDIA & ORS

In this case, the Delhi High Court ruled that under the SVLDRS, tax dues cannot exceed the amount confirmed by the commissioner of the Central Excise department. This decision came after Mukesh Jain, the petitioner, challenged the tax amount determined by the Designated Committee under the SVLDRS.

The High Court bench emphasized that the tax dues in the case should be based on the amount confirmed by the original authority in the first round of litigation, as accepted by the Department. The Court set aside the tax determination in Form No. SVLDRS-3 and directed that the disputed tax dues be the Rs. 1,11,35,419 confirmed earlier.

No Income Tax on Receipt of Compensation on Lease hold Rights Over A Plot: Delhi HC PR. COMMISSIONER OF INCOME TAX-7 vs PAWA INFRASTRUCTURE (P) LTD.

A division bench of the Delhi High Court held that leasehold rights over a plot of land shall be considered a "capital asset" and that the compensation received for the cancellation of such leasehold rights will not be subject to income tax under the Income Tax Act, 1961.

Justice Manmohan and Justice Manmeet Pritam Singh Arora concluded that the leasehold rights were indeed a capital asset and that the compensation received for the cancellation of the plot should be treated as a capital receipt, not subject to income tax under the provisions of the Income Tax Act. The Court upheld the Assessing Officer’s (AO) order dated 15th February 2016, stating that the PCIT had erred in invoking powers under Section 263, as the payment was compensatory and did not constitute a revenue receipt.

High Court can’t decide on Taxability of Payments received from Indian Customers on Centralized Services When Appeal pending before Supreme Court: Delhi HC THE COMMISSIONER OF INCOME TAX vs WESTIN HOTEL MANAGEMENT LP

The Delhi High Court has ruled that it cannot decide on the taxability of payments received from Indian customers for centralized services, as the matter was already pending appeal before the Supreme Court.

The ITAT had ruled in favor of the Assessees based on the judgment in Director of Income Tax v. Sheraton International Inc., which the Revenue had appealed against, and which was pending before the Supreme Court.

The Delhi High Court, comprising Justice Manmohan and Justice Manmeet Pritam Singh Arora, noted that the Revenue had not presented any facts distinguishing this case from the Sheraton International Inc. case. The Court ruled that since the matter was pending before the Supreme Court, it could not be decided by the Delhi High Court. While dismissing the petition, the Court clarified that despite the appeal before the Supreme Court, there was no stay on the previous judgment.

Delhi HC sets aside Order passed u/s 148A(d) when AO voluntarily accepts the Mistakes in SCN issued VIDISHA SINGHAL vs INCOME TAX OFFICER WARD 29(1) DELHI & ORS

The Court, comprising Justice Manmohan and Justice Manmeet Pritam Singh Arora, set aside the order passed under Section 148A(d) of the Income Tax Act, 1961, after the Assessing Officer (AO) admitted to mistakes in the Show Cause Notice (SCN) issued to the petitioner, Vidisha Singhal. The case involved a notice issued under Section 148A(b) on 29th May 2022, an order under Section 148A(d) on 22nd July 2022, and an impugned notice under Section 148 dated 23rd July 2022.

The bench directed the AO to issue an amended notice under Section 148A(b) along with the relevant material within two weeks. The petitioner was given four weeks to respond, and the AO was directed to decide the matter afresh within four weeks. The petition was disposed of with these directions, and the rights and contentions of all parties were left open.

No materials Which Show Reassessment Proceedings as Arbitrary, can’t invoke Writ Jurisdiction: Delhi HC AJAY GUPTA (HUF) vs INCOME TAX OFFICER WARD 54(1)

The Delhi High Court bench of Justice Manmohan and Justice Manmeet Pritam Singh Arora dismissed a writ petition filed by Mr. Ajay Gupta, the Karta of a Hindu Undivided Family (HUF), seeking the quashing of an order dated 18th July 2022, passed under Section 148A(d) of the Income Tax Act, 1961, and the corresponding notice under Section 148. The case arises from a Show Cause Notice (SCN) issued on 23rd May 2022 by the Income Tax Officer (AO), alleging that the Assessee had received 32,000 shares of TVS Motor Company Ltd. (worth Rs. 94,81,600) from a dummy Demat account operated by Mridul Securities Pvt. Ltd. This was linked to a larger investigation into Tradenext Securities Ltd., accused of providing accommodation entries.

The Assessee contended that the sale of the shares was duly disclosed in the Return of Income (ROI) as Short-Term Capital Gain (STCG), and thus there was no escapement of income. However, the Court observed that the Petitioner failed to present any evidence to show that the reassessment proceedings were arbitrary or unjustified. The Court held that writ jurisdiction under Article 226 of the Constitution cannot be invoked to resolve disputed questions of fact. As such, the writ petition was dismissed along with the pending applications.

Power to Grant Stay with Pre-Deposit of 20% of Disputed Demand is a directory in Nature, not Mandatory: Delhi HC DR B L KAPUR MEMORIAL HOSPITAL vs COMMISSIONER OF INCOME TAX

In this matter, the bench of Justice Manmohan and Justice Manmeet Pritam Singh Arora of the Delhi High Court held that the requirement to pay 20% of the disputed demand as a pre-deposit to obtain a stay on tax recovery is directory in nature, not mandatory. The case involved Dr. B.L. Kapur Memorial Hospital, which challenged orders from September and November 2022, where its stay applications were rejected and it was directed to pay 20% of the disputed tax demands under Section 201(1) of the Income Tax Act for Assessment Years 2013-14 and 2014-15.

The hospital had been declared an "assessee-in-default" for short deduction of tax, with a tax liability of over Rs. 36 crores. The petitioner argued that the directive to pay 20% as per the office memorandums was merely a guideline and not a strict requirement. The Court agreed, stating that the 20% payment condition could be relaxed in appropriate cases and that it should not be a blanket precondition for granting a stay.

Furthermore, the Court found that the orders were non-reasoned and failed to address the petitioner’s arguments or consider essential principles like prima facie case, balance of convenience, and irreparable injury in deciding the stay application. As a result, the Court set aside the orders and remanded the matter back to the Commissioner of Income Tax for fresh adjudication.

Unclear basis of Suo-Motu Disallowance of Exempt Income by H T Media Limited: Delhi HC rejects Estimated Disallowance H.T. MEDIA LIMITED vs PRINCIPAL COMMISSIONER OF INCOME TAX-4

In the case of HT Media Limited, the Delhi High Court, comprising Justices Manmohan and Manmeet Pritam Singh Arora, upheld the disallowance of expenses related to tax-free income for the Assessment Year (AY) 2013-14, rejecting the company’s challenge to the decisions of the Income Tax Appellate Tribunal (ITAT) and Assessing Officer (AO). HT Media, the publisher of Hindustan Times and Mint, earned a dividend income of Rs. 7.04 crores and had self-disallowed Rs. 9.75 lakhs under Section 14A of the Income Tax Act for administrative expenses related to the tax-free income. However, the AO found this self-disallowance inadequate and determined a higher disallowance of Rs. 1.15 crores under Rule 8D(2)(iii) of the Income Tax Rules.

The Court affirmed the AO’s decision, noting that the AO’s dissatisfaction with the initial disallowance was properly recorded and upheld by the appellate authorities. The Court also observed that the ITAT had remanded the issue of satisfaction for earlier years to the AO for further examination and concluded that the disallowance was in line with the law. As a result, the Court declined to intervene with the findings of the lower authorities.

No Permanent Establishment under Article 5(2)(g) of India Cyprus Treaty when threshold period of twelve months not exceeded, Income Taxable: Delhi HC COMMISSIONER OF INCOME TAX vs BELLSEA LTD

In this matter, the High Court upheld the ITAT decision, ruling that no Permanent Establishment (PE) was established under Article 5(2)(g) of the India-Cyprus Tax Treaty, as the threshold of twelve months was not exceeded. The Commissioner of Income Tax – International Taxation-1 challenged the ITAT's decision in the present appeal against Bellsea Ltd. The petitioner argued that the ITAT erred by disregarding the fact that the assessee’s activities began in September 2007, before the contract date, and failed to provide details about employee stays in India prior to the contract, which could have triggered Article 5(2)(g). Article 5(2)(g) defines PE for construction or assembly projects lasting over twelve months. However, the ITAT found that the activities did not exceed the twelve-month threshold, and thus, no PE was established.

The High Court concurred, observing that no material was presented to challenge the finding that work commenced only after January 4, 2008. The Court emphasized that preparatory activities, such as travel for tendering or contracting, do not mark the start of the project under Article 5(2)(g). Consequently, the High Court found no error in the Tribunal's findings.

Notice served under Section 143 (2) in the name of Dead-Assessee is Null and Void: Delhi HC VIKRAM BHATNAGAR vs ASSISTANT COMMISSIONER OF INCOME TAX

The High Court ruled that a notice issued under Section 143(2) of the Income Tax Act in the name of a deceased person is null and void. The case involved a writ petition filed by Mr. Vikram Bhatnagar, the legal representative of the late S.H. Virendra Kumar Bhatnagar. The Assessing Officer had issued the notice on September 22, 2019, in the name of the deceased, without mentioning the legal heirs or their PAN number.

Despite the legal representative having registered and used the deceased's account with the Income Tax Department from October 6, 2018, the Assessing Officer proceeded with scrutiny assessment and passed an order on September 30, 2021, assessing the total income at Rs. 13,49,43,945 for FY 2017-2018 in the name of the deceased, along with a demand and penalty.

The petitioner’s counsel argued that the notice was invalid because it was issued in the name of a deceased person, and no reference was made to the legal heirs or their PAN number. The legal representative had already filed the return for the deceased for AY 2018-19.

The High Court, agreeing with the petitioner's contention, observed that the notice and assessment order against the deceased were jurisdictionally flawed. Citing the case of Savita Kapila vs. Assistant Commissioner of Income Tax, the Court set aside the assessment order and all related notices, declaring them null and void.

Petition to Quash Re-Assessment against Struck-Off Company cannot be Entertained after Restoration by MCA: Delhi HC imposes Cost of Rs. 50,000 RAVINDER KUMAR AGGARWAL vs INCOME TAX OFFICER, CITATION: 2022 TAXSCAN (HC) 932

A division bench of the Delhi High Court imposed a cost of Rs. 50,000 on Mr. Ravinder Kumar Aggarwal for filing a petition to quash the re-assessment notice under Section 148 of the Income Tax Act, 1961, issued against a struck-off company. The petition challenged the notice on the grounds that it was issued in the name of a company that had been struck off by the MCA due to its failure to file statutory returns. However, the NCLT later restored the company to enable the Income Tax Department to recover the outstanding tax dues.

The bench, consisting of Justice Manmohan and Justice Manmeet Pritam Singh Arora, observed that the company's initial strike-off was due to its own defaults, and the restoration was done to safeguard the department’s interest in recovering tax dues. The court found that the petitioner, by opposing the restoration and continuing with the petition even after the company's restoration, was obstructing the legal process in bad faith.

The bench dismissed the petition, vacated the interim order, and directed the petitioner to deposit a cost of Rs. 50,000 with the Delhi High Court Legal Services Committee. The petitioner was also instructed to file proof of the deposit with the court’s registry within two weeks.

Section 195 has no application once TDS has been made on Salary: Delhi HC upholds order of ITAT PRINCIPAL COMMISSIONER OF INCOME TAX vs M/S BOEING INDIA PVT. LTD.

The Delhi High Court upheld the order of the Income Tax Appellate Tribunal (ITAT) in deleting the addition under Section 192 read with Section 195 of the Income Tax Act, 1961. The revenue had challenged the ITAT’s decision, arguing that the draft order issued under Section 144C(1) in the name of a non-existing company was void, but the Court found that the correct jurisdictional notice was issued in 2016, and the final assessment order had been passed as per the directions of the Dispute Resolution Panel (DRP). The core issue involved the disallowance under Section 40(a)(ia) for payments that were claimed to be fees for technical services, but the Court upheld the ITAT’s opinion that Section 195 does not apply once the nature of the payment is determined as salary and TDS is deducted under Section 192.

The Court clarified that salaries paid to personnel, such as Mr. Laser in this case, are taxable in India and cannot be treated as fees for technical services under Section 9 of the Act. The explanation to Section 9(1)(vii) specifies that payments qualifying as income under the head "salaries" do not constitute fees for technical services. Since the payment was made as salary and TDS had already been deducted under Section 192, the provisions of Section 195 were deemed inapplicable. The Court concluded that the issues of receivables and disallowance under Section 40(a)(ia) were factual in nature and did not present substantial questions of law. The appeal was therefore dismissed.

Dividend from OMIFCO (Oman) Taxable as ‘Other Income’ in India: Delhi HC deletes Disallowance u/s 14A THE PR. COMMISSIONER OF INCOME TAX vs IFFCO LTD

A division bench of Justice Manmohan and Justice Manmeet Pritam Singh Arora ruled that dividend income received by IFFCO Ltd. from OMIFCO, Oman, is taxable in India under the head "Income from Other Sources" and forms part of the total income. Consequently, disallowance under Section 14A of the Income Tax Act, 1961, cannot be applied.

The bench upheld the ITAT's ruling, stating that under Section 14A(1), disallowance applies only to income not forming part of the total income. The Court clarified that "total income" under Section 2(45) includes income taxable under Section 5, and the dividend from OMIFCO is taxable under "Income from Other Sources."

Though IFFCO received a rebate on taxes under Section 90(2) of the Income Tax Act and Article 25 of the Indo-Oman DTAA, the dividend is included in taxable income. Therefore, the provisions of Section 14A are not applicable, as the income is not excluded from total income for taxation purposes.

Every Assessment Year is a Separate Unit, Assessment based on Its Peculiar Facts: Delhi HC dismisses Appeal by Akzonobel India AKZONOBEL INDIA PRIVATE LIMITED vs THE ADDITIONAL COMMISSIONER OF INCOME TAX

The High Court dismissed the appeal filed by M/s Akzonobel India Private Limited, upholding the transfer pricing adjustment of ₹1.94 crore made by the authorities. The adjustment pertained to an international transaction involving business support services, where the arm's length price was determined as "Nil”.

The Court emphasized that each assessment year is independent and must be judged based on its unique facts. The bench, comprising Justice Manmohan and Justice Manmeet Pritam Singh Arora, noted that all lower authorities had consistently found that the appellant failed to provide evidence to prove that services were actually rendered by the associated enterprise (AE). The ITAT had also observed that despite a specific query from the Bench, the appellant could not furnish any evidence, such as communication with the AE, to substantiate the claim.

DSC not mandatory for Service of Notice u/s 148: Delhi High Court SUMAN JEET AGARWAL vs INCOME TAX OFFICER

The High Court held that Section 148 notices sent via email without a Digital Signature Certificate (DSC) but meeting the requirements of Section 282A of the Income Tax Act and Rule 127A of the Income Tax Rules are valid.

Justice Manmohan and Justice Manmeet Pritam Singh Arora, addressed the validity of such notices when issued as email attachments from the designated email addresses of Jurisdictional Assessing Officers (JAOs).

The Court observed that the JAOs have the option to either generate notices with or without DSCs, as per the ITBA system. A lack of DSC, the Court noted, constitutes a defect but does not invalidate the notice if it includes the name and office of the designated authority, satisfying authentication requirements under Section 282A(2).

No GST on Renting of Residential Building by Proprietor of a registered proprietorship firm: Delhi HC SEEMA GUPTA vs UNION OF INDIA & ORS

Justice Manmohan and Justice Manmeet Pritam Singh Arora have ruled that GST is not applicable to the portion of rent received by a proprietor of a registered proprietorship firm when the rental property is used in their personal capacity as a residence and not for business purposes.

The Court accepted the clarification issued by the CBIC, which stated that renting a residential dwelling by a proprietor in their personal capacity for residential use and not for the business of the proprietorship firm remains exempt from GST under the amended notification. The bech affirmed that such renting, when not for furthering business purposes, qualifies for GST exemption. The Court held that all respondents are bound by this clarification, ensuring that the exemption is upheld for similar cases.

Order u/s 143(1) of Income Tax Act is not ‘Assessment’: Delhi HC dismisses EY’s Plea ERNST AND YOUNG U.S. LLP vs ASSISTANT COMMISSIONER OF INCOME TAX

Justices Manmohan and Mini Pushkarnam have ruled that an order passed under Section 143(1) of the Income Tax Act, 1961, does not qualify as an "assessment" for the purposes of reopening under Section 147 of the Act. This decision was made while dismissing a petition filed by Ernst and Young U.S. LLP challenging the reassessment proceedings initiated for the assessment year 2018-19.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates