Will Income Tax Dept Extend ITR Filing Due Date? CAs Face this Question Very Early

Tax experts point out that in previous years, delays in notifying forms or utilities have sometimes led to deadline extensions, and with almost a month already lost in 2025, there is a possibility that the CBDT could consider an extension if taxpayers are unable to meet the compliance requirements in time

Every year, as the July 31 deadline for filing income tax returns (ITR) approaches, chartered accountants ( CAs ) across India are inundated with a familiar question from clients: Will the Income Tax Department extend the ITR filing due date? However, for this Assessment Year, the clients are asking this question very early as there is no excel utility released so far.

GST on Real Estate & Works Contracts – Your Ultimate Guide to GST in the Real Estate Sector! Click here

For Assessment Year 2025-26 (FY 2024-25), the official deadline for individuals and non-audit cases remains July 31, 2025. However, the present situation is that the department has not yet released the excel utilities for filing the tax returns. It is believed that when the ITR forms are notified, within 7-10 days, the utility will also be released.

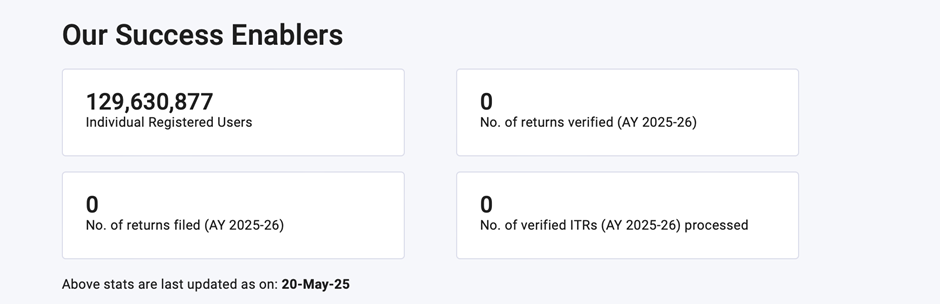

According to the most recent information on the Income Tax Department's web as of May 20, 2025, there are about 12 crore people registered on the portal, but as of yet, no returns have been submitted due to delay in ITR Form notification and utilities. This disparity from the previous year indicates an enormous hold-up in the filing of returns.both professionals and taxpayers.

Also read: KSCAA urges CBDT to ensure April 1st as Standard Timeline for Release of ITR Forms and Utilities

The Department has to anticipate demand to make sure that the required utilities and ITR forms are made available by April 1st itself, as the number of taxpayers continues to rise yearly. An extension of the filing date is not only reasonable but also required in the event that utility releases are delayed.

The last minute pressure, which is made worse by portal slowdowns, is likely to make timely submission exceedingly difficult for both professionals and taxpayers, who already have a lot of compliance responsibilities.

Historically, the government has only extended this deadline under exceptional circumstances, such as technical glitches on the e-filing portal, delays in issuing Form 16, or during extraordinary events like the Covid-19 pandemic. In normal years, the department rarely grants extensions, and any such decision is usually made close to the due date, based on prevailing conditions.

Tax experts point out that in previous years, delays in notifying forms or utilities have sometimes led to deadline extensions, and with almost a month already lost in 2025, there is a possibility that the Central Board of Direct Taxes (CBDT) could consider an extension if taxpayers are unable to meet the compliance requirements in time. However, unless there are widespread disruptions or other compelling reasons, the department is likely to adhere to the original deadline.

For those who miss the July 31 deadline, a belated return filing by December 31, 2025 is available, albeit with penalties and interest. Additionally, recent amendments have extended the window for filing updated returns (ITR-U) to four years from the end of the relevant assessment year, offering taxpayers more flexibility to correct past omissions, though at a higher penalty cost the later they file.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates