Zoho Introduces Free Practice Management Software 'Zoho Practice' for Chartered Accountants: Know the Features

Practice Management Software – Management Software – Zoho Practice – Chartered Accountants – Accountants – Zoho Practice Features – Zoho Latest News – TAXSCAN

Practice Management Software – Management Software – Zoho Practice – Chartered Accountants – Accountants – Zoho Practice Features – Zoho Latest News – TAXSCAN

Zoho, a technology company headquartered in Chennai, has introduced Zoho Practice, a comprehensive practice management solution specifically designed for chartered accountants (CAs). This newly launched software, offered at no cost, aims to provide CAs with an end-to-end solution to enhance their operational efficiency.

Zoho Practice facilitates the streamlining of workflows for CAs, offering seamless internal collaboration and improved interactions with clients. The software is poised to become a valuable tool for chartered accountants, enabling them to manage their practices more effectively and deliver enhanced services to their clients.

CA Sanjib Sanghi, Partner at S.SANGHI & CO, has stated that “Zoho Practice is a complete solution that simplifies a CA firm's day-to-day operations, equipping them with the insights needed to provide exemplary services, and helping them manage their team efficiently.”

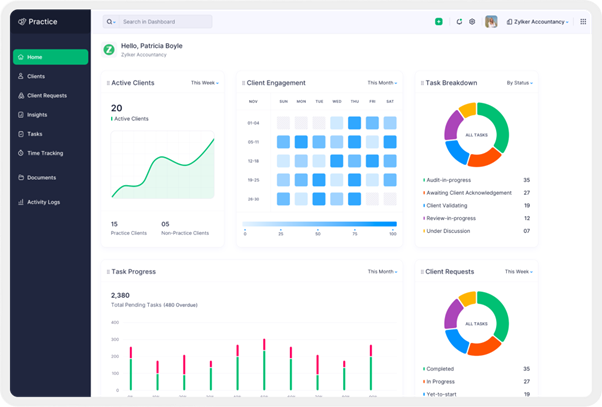

The dashboard of Zoho Practice is given below:

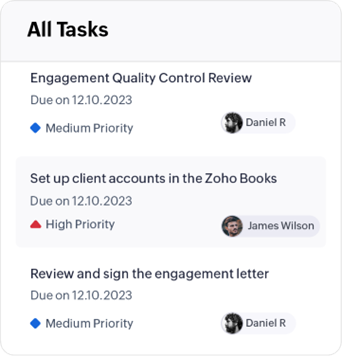

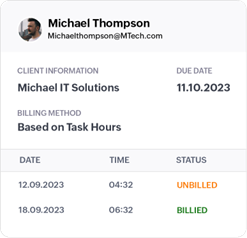

The features are:

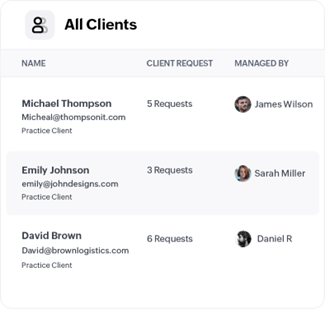

- Centralised client management: Effortlessly bring new clients on board, import your current clientele, and maintain thorough records of client information, fostering enduring client relationships within a consolidated platform.

- Real-time client collaboration: Engage in direct communication with clients via live chat, email correspondence, document collection, and swift resolution of their inquiries. Facilitate dedicated connections between specific staff members and individual clients to encourage deeper collaboration and elevate the overall quality of service.

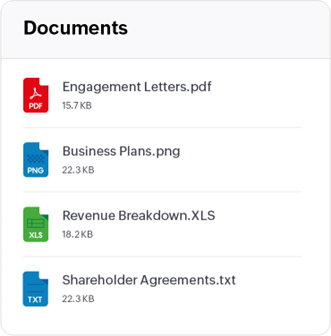

- Unified document repository: This Securely stores, retrieves, and oversees all documents pertaining to clients, including contracts, invoices, and financial papers in a protected environment.

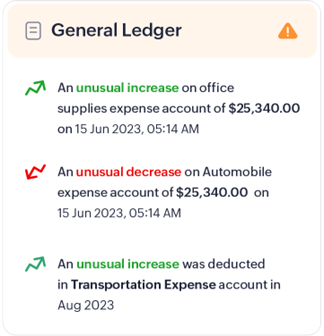

- Clients insights and books review: Delve extensively into your client's financial records to assess their financial performance. Identify and correct any discrepancies in client data to guarantee a clear perspective on their financial status. Utilise data-driven insights to make informed decisions that contribute to the growth of the business.

- Streamlined task handling: Effortlessly generate tasks tailored for specific clients. Allocate sub-accountants to manage designated accounting responsibilities, establish reminders, monitor progress, and categorise tasks according to client projects and priorities. This ensures a well-organised task structure with clarity in organisation based on client projects and priorities.

- Timesheets and billing: Never miss a billable moment. Zoho Practice’s timesheets are crafted for optimal performance, guaranteeing that every billable moment is recorded and contributes to your revenue.

Access Zoho Practice here.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates