Shri P.C. Mody, Chairman, Central Board of Direct Taxes (CBDT), inaugurated the Web Portal for Exchange of Information on Income Tax Website here today.

The Web Portal consolidates all the relevant Automatic Exchange of Information (AEOI) related information at one place for convenient access by financial institutions, Departmental officers as well as the public at large.

India is committed to exchange financial account information automatically from 2017 under the Common Reporting Standard (CRS) on Automatic Exchange of Information (AEOI). Information is reported annually by financial institutions which are then exchanged by India under the standard.

The Web Portal would be a repository of policy and technical circulars/guidance/notifications issued by the CBDT and provide links to relevant circulars/guidance issued by the regulatory authorities in India and other international bodies. The portal would not only be useful for the domestic financial institutions but will also help the foreign tax authorities and financial institutions to get information about the Indian laws, rules and procedures related to AEOI under CRS.

To implement the AEOI standard, necessary domestic legal framework was put in place in 2015. A comprehensive Guidance Note was released on 31st August 2015 to provide guidance to the financial institutions, sectoral regulators and officers of the Income Tax Department for ensuring compliance with the reporting requirements under the Income-tax Act and Rules. The sectoral regulators have also issued necessary notifications and circulars for compliance by the financial institutions. Stakeholder consultations are also carried out by CBDT to educate financial institutions about their reporting obligations. In its persistent endeavour to reach out to the financial institutions and account holders, CBDT has created an Exchange of Information portal on the Income-tax Department website for dissemination of information to all stakeholders.

The West Bengal Authority for Advance Ruling has ruled that the Conservancy/solid waste management service for local government is exempt from the payment of GST and since the Applicant is making an exempt supply, the mechanism of TDS, do not apply to the Supply.

The ruling was made by a bench of the Authority consisting of Ms Susmita Bhattacharya, and Mr. Parthasarathi Dey, while considering the application of M/s Singh Transport Agency.

The Applicant provides conservancy/solid waste management service to the Conservancy Department of the Howrah Municipal Corporation (HMC). The HMC, was deducting TDS while paying consideration for the above supply in accordance with the TDS Notifications. The Applicant sought a ruling on whether the above supply is exempted under the Exemption Notification and whether the notifications regarding TDS are applicable in the particular case.

The applicant argued that since he supplies pure service he is exempted under SI No. 3 of the Exemption Notification.

The eligibility under Exemption Notification was examined by the Authority from three aspects: (1) whether the supply being made is pure service or a composite supply, where supply of goods does not exceed more than 25% of the value of the supply, (2) whether the recipient is government, local authority, governmental authority or a government entity, and (3) whether the supply is being made in relation to any function entrusted to a panchayat or a municipality under the constitution. The Authority noted that the services were pure services, the recipients are a local authority and the supply is in relation to a function of the local authority.

The Authority further ruled that TDS notifications are applicable only if TDS is deductible on the Applicant’s supply under section 51 of the GST Act. The Authority ordered that, “As the Applicant is making an exempt supply to HMC the provisions of section 51 and, for that matter, the TDS Notifications do not apply to his supply”.

Subscribe Taxscan Premium to view the JudgmentIn a significant ruling delivered by National Company Law Tribunal ( NCLT ) Ahmedabad has set aside ROC order to struck down the name of the company from ROC register.

M/s J R Diamonds P Limited, company wherein no financial creditors are their was under Insolvency process and eventually went into Liquidation. NCLT vide order dated 01.10.18 company was liquidated and Mr.Vinod T Agrawal was appointed as Liquidator, thereafter during the process of liquidation and sale of assets to realise amount for all stakeholders interest.

Liquidator being aggrieved by the order of ROC appealed before NCLT for the restoration of the company name.

Liquidator through Advocates Nipun Singhvi and Vishal J Dave presented their apathy if the restoration is not done will impact stakeholders to the extent the realisation of money and distribution for their benefits.

NCLT after relying on judgements of Supreme Court and High Court quashed the ROC order and directed the restoration of the company.

The Institute of Chartered Accountants of India ( ICAI ) has announced Scheme of Financial Assistance / Scholarship to Students of CA Course, Year 2019-20.

The Board of Trustees of the Chartered Accountant Students Benevolent Fund (CASBF) has decided to provide financial assistance / scholarship for the amount of Rs. 1500/- PM, to students who are registered in CA Intermediate /IPCC course and serving articled training as well as the amount of Rs. 2000/- PM for those students registered in CA Final Course and serving of articled/industrial training on the date of application. Financial Assistance will be given in lump sum for the period of one-year i.e 01st April ,2019 to 31st March, 2020.

Needy, financially week but meritorious students perusing the Chartered Accountancy course may apply in the prescribed application form.

The eligibility criteria for obtaining financial assistance from CASBF are as under:

Students as above who are fulfilling the eligibility criteria may apply in the prescribed Application form, duly filled in and recommended by any of Central Council Member/Chairman/Vice-Chairman/Secretary of the Regional Council/Ex-President/Chairman/Vice-Chairman and Member-Secretary/Board of Trustees of CASBF and send to the Member Secretary, Chartered Accountants Students Benevolent Fund so as to reach at the following address latest by 15th December, 2019.

To,

Member Secretary

Chartered Accountants’ Students Benevolent Fund- (M&C-MSS Section)

C/o The Institute of Chartered Accountants of India,

ICAI Bhawan

A-29, Sector -62, Noida- 201309

Dist. Gautam Budh Nagar (U.P.)

Website: www.icai.org; email:cabf@icai.in

The Board of Trustees will consider each case on merit basis and decide at their discretion on the selection of application and the amount to be granted from Chartered Accountants Students Benevolent Fund.

For Application Click here.

The Union Cabinet chaired by the Prime Minister Narendra Modi has approved the proposal for introducing the Taxation Laws (Amendment) Bill, 2019 in order to replace the Ordinance.

Economic developments after the enactment of the Finance (No. 2) Act, 2019 (Finance Act) along with the reduction of the rate of corporate income tax by many countries world over necessitated the provision of additional fiscal stimulus to attract investment, generate employment and boost the economy. As these could have been achieved through an amendment to the Income-tax Act, 1961 (IT Act) or to the Finance Act and the Parliament was not in session, it was done through the promulgation of The Taxation Laws (Amendment) Ordinance 2019 (the Ordinance) in September 2019. Salient features of the amendments made by the Ordinance are provided in the following paras.

In order to promote growth and investment, a new provision was inserted in the IT Act to provide that with effect from the current financial year 2019-20, an existing domestic company may opt to pay tax at 22% plus surcharge at 10% and cess at 4%, if it does not claim any incentive/deduction. The effective tax rate for these companies comes to 25.17% for these companies. They would also not be subjected to Minimum Alternate Tax (MAT).

In order to attract fresh investment in manufacturing and provide boost to ‘Make-in India’ initiative of the Government, another provision was inserted to the IT Act, to provide that a domestic manufacturing company set up on or after 1st October, 2019 and which commences manufacturing by 31st March, 2023, may opt to pay tax at 15% plus surcharge at 10% and cess at 4% if it does not claim any incentive/deduction. The effective rate of tax comes to 17.16% for these companies. They would also not be subjected to MAT.

A company which does not opt for the concessional tax regime and avails the tax exemption/incentive shall continue to pay tax at the pre-amended rate. However, these companies can opt for the concessional tax regime after the expiry of their tax holiday/exemption period. After the exercise of the option, they shall be liable to pay tax at the rate of 22%. Further, in order to provide relief to companies which continue to avail exemptions/incentive, the rate of MAT was reduced from existing 18.5% to 15%.

In order to provide relief to listed companies, the buy-back tax on shares of listed companies introduced through the Finance Act will not apply to buy-backs in respect of which public announcement was made before 5th July, 2019.

In order to stabilise the flow of funds into the capital market, it was provided that the enhanced surcharge introduced through the Finance Act on capital gains arising on account of transfer of listed equity share or certain units which are liable to securities transaction tax will not apply. Further, it was also provided that the enhanced surcharge will not apply to capital gains income of FPIs arising out of the transfer of any security including derivatives, having concessional tax regime.

Subscribe Taxscan Premium to view the JudgmentThe Union Cabinet chaired by Prime Minister Narendra Modi yesterday approved for withdrawing of the International Financial Services Centres Authority, 2019 Bill which was introduced in the Rajya Sabha on 12th February, 2019 and pending in the Rajya Sabha and introducing the International Financial Services Centres Authority Bill, 2019 in the Lok Sabha in the ensuing session of the Parliament.

Benefits

Currently, the banking, capital markets and insurance sectors in IFSC are regulated by multiple regulators i.e. RBI, SEBI and IRDAI. The dynamic nature of business in the IFSCs necessitates a high degree of inter-regulatory coordination. It also requires clarifications and frequent amendments in the existing regulations governing financial activities in IFSCs.

The development of financial services and products in IFSCs would require focused and dedicated regulatory interventions. Hence a need is felt for having a unified financial regulator for IFSCs in India to provide a world class regulatory environment to financial market participants.

Further, this would also be essential from an ease of doing business perspective. The unified authority would also provide the much-needed impetus to further development of IFSC in India in-sync with the global best practices.

Background

The Union Cabinet in its meeting held on February 6, 2019, had approved the proposal for the establishment of a unified authority for regulating all financial services through the introduction of the International Financial Services Centres Authority Bill 2019 in the Parliament. Subsequently, the International Financial Services Centres Authority Bill, 2019 was introduced in the Rajya Sabha on February 12, 2019, by the then Hon’ble Minister of State (Finance).

The Lok Sabha Secretariat has now conveyed that this is a Finance Bill under Article 117(1) of the Constitution and that it should be introduced in Lok Sabha accordingly with the recommendation of the President under Article 117(1) and 274(1) of the Constitution.

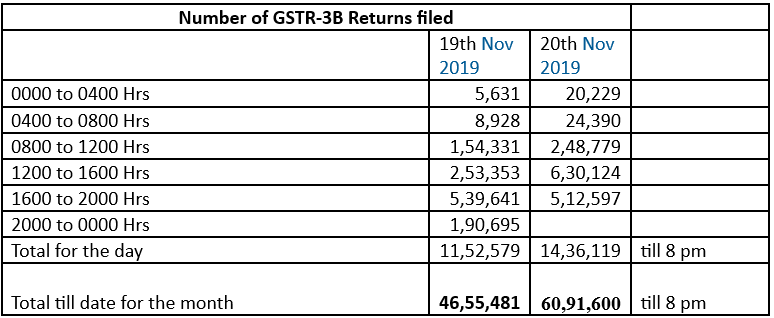

Certain complaints made yesterday on the social media regarding the GSTN system not functioning are incorrect. GSTN assures that the GST Return filing system was working within expected limits. Had it not been so, how more than 11.52 lakh GSTR-3B (October) returns could have been filed yesterday on 19th Nov with about 1.82 lakh returns filed in a peak hour.

Also, on 18th Nov more than 8.14 lakh returns were filed while today on 20th Nov more than 9.23 lakh GSTR-3B returns were filed by 4.00 pm and filing is going on smooth with 6.30 lakh returns filed between 12 to 4 pm. Any online system has to have a load threshold and for GST return filing system it is at 1.5 lakh returns filing at a particular moment. If this threshold is reached then the site shows a message asking the taxpayer to wait for his turn in a few minutes.

Referring to complaints, it is stated that it could have been possible that some filers may have momentarily experienced being logged out at the load threshold of 1.5 lakh returns load at a particular point of time or some difficulty due to any local issue at the ‘taxpayer filers’ end.

But the GST return filing system has been working as expected and coherently and a total of more than 55.79 lakh returns were filed by 4.00 pm today.

The taxpayers are requested that they should not wait till the last three days to file their returns as normally there may be a huge rush of return filing on these days. Rather they should file their return on days other than the last three days to avoid rush hour momentary difficulty in the filing.

Following the notification by the Central Government on 15th November, relating to proceedings of Personal Debtors to Corporate Debtors, the Insolvency and Bankruptcy Board of India (IBBI) today notified Regulations for Insolvency Resolution and Bankruptcy Proceedings of Personal Guarantors to Corporate Debtors.

The following Regulations for Insolvency Resolution and Bankruptcy Proceedings of Personal Guarantors to Corporate Debtors were notified:

The Insolvency & Bankruptcy Code, 2016, (IBC) classifies individuals into three classes, namely, personal guarantors to CDs, partnership firms and proprietorship firms, and other individuals, to enable implementation of individual insolvency in a phased manner. The Central Government, vide a notification dated 15th November, 2019, appointed 1st December, 2019 as the date for commencement of the provisions of the Code relating to personal guarantors to CDs. It also notified the following on the same day-

These Rules provide for the process and forms of making applications for initiating insolvency resolution and bankruptcy proceedings against personal guarantors to CDs, withdrawal of such applications, forms for public notice for inviting claims from the creditors, etc.

The IBC envisages reorganisation and insolvency resolution of corporate persons, partnership firms and individuals in a time-bound manner for maximisation of value of assets of such persons, to promote entrepreneurship, availability of credit and balance the interests of all stakeholders. The provisions of the IBC relating to corporate processes (insolvency resolution, fast track resolution, liquidation and voluntary liquidation) have since been operationalised.

There are occasions when a corporate debtor (CD) takes a loan guaranteed by another corporate person (corporate guarantor to the CD) or an individual (personal guarantor to the CD). The lender may pursue a remedy against the guarantor or the CD, being principal borrower, when there is a default in repayment of the loan. The insolvency resolution of corporate guarantors to the CD and of personal guarantors to the CD complement insolvency resolution of the CD. Accordingly, the IBC provides that where an application for insolvency resolution or liquidation proceeding of a CD is pending before a National Company Law Tribunal (NCLT), an application relating to insolvency resolution or liquidation or bankruptcy of a corporate guarantor or a personal guarantor shall be filed before the NCLT. It further provides that insolvency resolution, liquidation or bankruptcy proceeding of a corporate guarantor or a personal guarantor of the CD pending in any court or tribunal shall stand transferred to the NCLT dealing with insolvency resolution or liquidation proceeding of such CD.

Subscribe Taxscan Premium to view the JudgmentShri Injeti Srinivas, Secretary, Ministry of Corporate Affairs, inaugurated the Investor Education and Protection Fund Authority ( IEPFA ) Help Line number — 1800-114-667 — and Call Centre here today.

Speaking on the role of the new Help Line, the Secretary, MCA, said that in order to facilitate the investors with smooth information flow, the step taken by IEPFA to developed a Help Line (Call Centre Solution) with the help of CSC e-Gov SPV (Meity) will come a long way in speeding the process in addressing the queries of claimants. This is one major step taken by the government to address the concerns of various claimants.

Shri Dinesh Kumar Tyagi, CEO, CSC e-Gov, informed that CSC SPV will provide hosting and support/ maintenance/ training support for the application.

The Help Line will facilitate callers in tracking the status of their claims refund. Citizens can also report a suspicious claim on Help Line as also the newly revamped IEPF portal at www.iepfportal.in, which is user-friendly interface for various stakeholder for gaining information about the initiatives taken by the Government in addressing the investor protection related issues. The application developed by CSC will also record and maintain calls received on various forms i.e. from Company and claimants.

The Help Line launch event was attended by Shri Rajib Sekhar Sahoo, Member, IEPF Authority, senior officials of IEPF Authority and CSC e-Governance.

IEPFA Background

The Government of India has established the Investor Education and Protection Fund Authority (IEPF Authority) under the provisions of Companies Act, 2013 to inter-alia promote investors’ education, awareness and protection apart from making refunds of shares, unclaimed dividends, matured deposits / debentures to the investors. IEPFA also strives to provide investors with requisite knowledge and skills pertaining to investor education and protection.

The Lower House of the Parliament, Lok Sabha has passed a bill to amend the Chit Funds (Amendment) Bill, 2019.

The Chit Funds (Amendment) Bill, 2019 was introduced in Lok Sabha on August 5, 2019. The Bill seeks to amend the Chit Funds Act, 1982. The 1982 Act regulates chit funds and prohibits a fund from being created without the prior sanction of the state government. Under a chit fund, people agree to pay a certain amount from time to time into a fund. Periodically, one of the subscribers is chosen by drawing a chit to receive the prize amount from the fund.

The Act specifies various names which may be used to refer to a chit fund. These include chit, chit fund, and Kuri. The Bill additionally inserts ‘fraternity fund’ and ‘rotating savings and credit institution’ to this list.

Key Changes

The West Bengal Authority for Advance Ruling has ruled that supply of stores to foreign going vessels, as defined under section 2(21) of the Customs Act, 1962 Act, is not export or zero-rated supply unless it is marked specifically for a location outside India.

The bench constituted of Ms Susmita Bhattacharya, Joint Commissioner, CGST & CX Mr Parthasarathi Dey, Senior Joint Commissioner, SGST.

The ruling was made while deciding on an application by Shewralan Company Pvt Ltd. The application claimed that it supplies foreign going vessels stores like paint, rope, spare parts, electronic equipment etc. The applicant sought a ruling on whether it is liable to pay tax on such supplies to foreign going vessels. More specifically, it wants to know whether such supplies are zero-rated supplies.

The applicants relied on Section 8B(a) and Section 89of the 1962 Act to argue that supply of stores in a foreign going vessel is export and a zero-rated supply in terms of section 16 of the IGST Act.

The Authority held that the “specific Foreign going vessels obtain stores and spare parts while staying anchored at a port in India. There is no reason why the part of such stores that the crew consume or is used for repairing or servicing of the vessel while in India should be treated as export”.

The Authority also held that, “A foreign going vessel anchored within the territory of India is not a place outside India and taking the stores on board such a vessel does not amount to supply to a location outside India”.

Subscribe Taxscan Premium to view the JudgmentThe Mumbai Bench of the Income Tax Appellate Tribunal in the case of Adi D Vachha v. ITO held that period of holding the asset has to be computed not from the date when MoU was cancelled in the year 2004 but from the original date of acquisition of property.

The AO noticed that the assessee has computed Long Term Capital Gain from the sale of TDR. The assessee in response submitted that he had to right to acquire TDR in view of land acquired by Pune Municipal Authority and the same has been transferred to the third party for a consideration of Rs 50 lakh. The timelines for the transactions are: The assessee had sold his right in TDR by way of an MoU on 17/08/1996. The MoU was cancelled by the way of cancellation deed dated 14/06/2004 and the right In TDR was sold by agreement dated 14/06/2006 for a consideration of Rs 50 lakh.

It was submitted that the right in TDR in lieu of land is a capital asset and hence, the same has been rightly considered under the head capital gains after considering the necessary cost of acquisition computed Long Term Capital Gain of Rs 25 lacs.

The assessee contended that the holding period of the TDR is less than 36 months and accordingly, gain received from the transfer of TDRs is assessable under the head Short Term Capital Gain. Hence, the present appeal.

The Bench constituting of members Ram Lal Negi and G. Manjunatha held that if the date of acquisition of property originally is taken, then the period of holding the asset is more than 36 months and hence, surplus from the transfer of the asset is rightly assessable under the head long term capital gains.

Hence, the period of holding the asset has to be computed not from the date when MoU was cancelled in the year 2004 but from the original date of acquisition of property.

Subscribe Taxscan Premium to view the JudgmentThe High Court of Delhi, on tuesday reinstated that the Settlement Commission is not intended to operate as a parallel, summary adjudicatory forum, to substitute the process of regular adjudication before the competent adjudicating authority.

The court held that the Settlement Commission fell into serious error of jurisdiction, in settling the case arising from the Show Cause Notice without allowing the case to move through a formal adjudicatory body.

The division bench comprising of Chief Justice Dhirubhai Naranbhai Patel and Justice C. Hari Shankar made this observation in the judgement of Commissioner, Central Excise, Customs & Service Tax, Sonepat & Ors v. Amit Decorative Plywoods Pvt. Ltd. & Ors.

The Court pronounced this while considering the matter of an order of the settlement commission in the case of tax evasion by extrapolating data and manipulating records. The Respondents were found to be evading Central Excise duty and also found to be indulging in clandestine removal and undervaluation of goods manufactured by them. The Respondents without responding to the show cause, moved to the settlement commission. The orders of the commission were challenged by the Petitioners in the writ.

The court, while considering the matter of the nature of jurisdiction exercised by the Settlement Commission ruled that, “the Settlement Commission does not transmute itself into an adjudicating authority, in respect of the case before it”. The Court further stressed that the Commission, by the conferment of the powers of the Customs officer as under Section 127F(2), does not become a parallel adjudicating authority, adjudicating a Show Cause Notice.

The Court while deciding the case held that the “Complex issues of fact, or cases in which determination of the liability of the assessee is dependent on the detailed appreciation of evidence would, by their very nature, stand excluded from the purview of jurisdiction of the Settlement Commission”.

The court reprehended the Settlement Commission stating the Commission could not have returned the findings in the absence of the adjudicatory procedures, as it could only have emerged from a formal adjudicatory process.

The court pointed out that a “Show Cause Notice is the terminus a quo of the adjudicatory process, and not the terminus ad quem thereof”.

Subscribe Taxscan Premium to view the JudgmentThe Punjab and Haryana High Court had observed that, Arrest of Chartered Accountant or Advocates who had filed Returns or Otherwise Assisted in Business but are not beneficiary or part of fraud merely on the basis of the statement without any corroborative evidence linking the professional with an alleged offence should be avoided.

The Petitioner is a practising lawyer in the field of taxation. The Petitioners through instant petition sought quashing of summons dated 28.8.2019 issued by Senior Intelligence Officer Directorate General of GST Intelligence.

The Petitioner No. 2 was interrogated on 11.9.2019 & 12.9.2019 by DGGI and thereafter handed over to DRI, who arrested him. There is nothing on record showing admission by Petitioner No. 2 and no further statement has been recorded in jail though he is in judicial custody since 13.9.2019.

The Petitioner No. 1 has already put appearance on various occasions and there is nothing in file to show which indicates that Petitioner No. 1 was connected with alleged illegal refund sought by Exporters. Concededly, the Petitioner No. 1 is neither proprietor nor partner nor shareholder of any Exporter Concern/Firm/Company, who availed refund of IGST.

There is no evidence of transfer of funds in the accounts of Petitioners or withdrawal of cash by any one of them. Petitioner No. 1 is in the legal profession since 2017 and after the introduction of GST, he had not dealt with directly or indirectly with export consignments. The Respondent has produced a copy of an order dated 1.10.2019 (date of hearing 22.5.2019) passed by Tribunal wherein Petitioner No. 1 has represented Appellants as an Advocate which buttress the argument of Petitioner that he in practice and appeared as an Advocate on behalf of four exporters who availed alleged illegal refund of IGST.

The division bench comprising of Justice Jaswant Singh and Justice Lalit Batra observed that, “the persons who are having established manufacturing units and paying good amount of direct or indirect taxes; persons against whom there is no documentary or otherwise concrete evidence to establish direct involvement in the evasion of huge amounts of tax, should not be arrested prior to determination of liability and imposition of penalty. Similarly, the arrest of Chartered Accountant or Advocates who had filed returns or otherwise assisted in business but are not beneficiary or part of fraud merely on the basis of the statement without any corroborative evidence linking the professional with an alleged offence should be avoided. It is well known that if top brass of a running concern is arrested, there are all possibilities of the closure of unit which results in unemployment and wastage of precious natural resources”.

The Court also said that, “it is the case of some misunderstanding between Petitioners and officers of Respondent/DGGI who now want to implicate Petitioner and his family members. The investigation is going on for last couple of months and Respondents are unable to produce any evidence showing direct involvement of Petitioners”.

“Intention of Respondents seems only to arrest Petitioner No. 1, one way or the other, which is evident from the fact that Petitioner No. 2 was handed over to DRI without concluding investigation at least qua petitioner no.2 and there is nothing contained in different affidavits of Respondent, filed before this Court, indicating that involvement of Petitioner No. 2 is apparent from his statements”, the Court also added.

The Court also directed to Respondent not to take him in custody without prior approval of the court.

Subscribe Taxscan Premium to view the JudgmentIn a First, the Goa-based Chartered Accountant SB Zavare elected as the Chairman of the Asian-Oceanian Standard-Setters Group ( AOSSG ).

Recently, Chartered Accountants from several countries and within India were in Goa for the annual three-day meeting of AOSSG.

(Dr) SB Zaware, former chairman of Accounting Standards Board of ICAI elected as the AOSSG chairman for a period of two years, 2019-21.

At the same meeting, Nishan Fernando, Sri Lanka was elected as the vice-chairman of the group.

Speaking to media persons, Zaware reportedly said, “My appointment as chairman of AOSSG is a step in the direction of the ICAI’s commitment to actively engage in the International Financial Reporting Standards (IFRS) setting process, engaging with National Standard Setters in the Asia and Oceanic regions and across the world.”

According to Zaware, the AOSSG aims to establish relationships with governments, regulators and other regional and international organisations to improve accounting practices, enhance the quality of financial reporting and facilitate cross-border trade, investments and governance in the region.

AOSSG is a group of twenty-seven national accounting standards setters from Asian-Oceanian region formed in 2009. The group’s objective is to contribute to the development of a high-quality set of global accounting standards by the International Accounting Standards Board of the IFRS Foundation.

The Income Tax Appellate Tribunal (ITAT) Delhi Bench upheld the addition of disallowance on TDS stating that “the assessee was under statutory obligation to deduct the income tax at the time of credit or/and, payment to the payee”.

However, the ITAT held that Disallowance of Vehicle Depreciation was not right stressing that “the vehicles have been used for business purposes and are business assets of the assessee”.

The Tribunal consisting of N.K. Billaiyasuchitra Kamble, and Suchitra Kamble made this ruling in the case of M/S. Bhardwaj Construction V. ACIT

The Assessee firm was engaged in the business civil contractor and deals in contract line from various years. During scrutiny, the Assessing Officer made various additions including disallowed of Salary and Wages, Telephone Expenses, Interest on TDS, Donation, etc. The aggrieved assessee hence moved to the Tribunal.

While considering the case, the tribunal however considered the Disallowance u/s 40A(3) and finding that the factual part was never questioned by the AO or CIT(A), remanded back the issue to the file of the Assessing Officer. The Tribunal also remanded back the issues of disallowance of travelling and conveyance expenses to the file of the AO.

The Tribunal stressed that “the assessee be given the opportunity of hearing by following principles of natural justice” while reconsidering the matter.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Direct Taxes (CBDT) has notified the Form No 26QD for the payment of Tax Deduction at Source (TDS) under Section 194M of the Income Tax Act, 1961.

The government vide Finance Act (No 2) 2019, recently introduced section 194M in the Income Tax Act, 1961 making it mandatory for an individual or HUF to withhold taxes at 5% on such payments to a contractor or a professional or commission or brokerage more than Rs 50 lakh in a financial year.

However, this section applies only to those individuals and HUFs whose accounts are not required to be audited for tax purposes.

Earlier, only individuals and HUFs who were mandatorily required to have their accounts audited as per the tax laws were required to deduct tax at source (TDS) on contractual, professional and commission or brokerage payments under sections 194C, 194J and 194H of the Act, respectively.

The Notification said that, “any sum deducted under section 194M shall be paid to the credit of the Central Government within a period of thirty days from the end of the month in which the deduction is made and shall be accompanied by a challan-cum statement in Form No. 26QD”.

The Notification also said that, “Where tax deducted is to be deposited accompanied by a challan-cum-statement in Form No.26QD, the amount of tax so deducted shall be deposited to the credit of the Central Government by remitting it electronically within the time specified in sub-rule (2C) into the Reserve Bank of India or the State Bank of India or any authorised bank”.

“Every person responsible for deduction of tax under section 194M shall furnish the certificate of deduction of tax at source in Form No.16D to the payee within fifteen days from the due date for furnishing the challan-cum-statement in Form No.26QD under rule 31A after generating and downloading the same from the web portal specified by the Principal Director General of Income-tax (Systems) or the Director-General of Income-tax (Systems) or the person authorised by him.”

“Every person responsible for deduction of tax under section 194M shall furnish to the Principal Director General of Income-tax (Systems) or Director General of Income-tax (System) or the person authorised by the Principal Director General of Income-tax (Systems) or the Director-General of Income-tax (Systems) a challan-cum statement in Form No.26QD electronically in accordance with the procedures, formats and standards specified under sub-rule (5) within thirty days from the end of the month in which the deduction is made”, the Notification also added.

Subscribe Taxscan Premium to view the JudgmentThe National Anti-profiteering Authority (NAA) under the Central Goods & Services Tax Act, 2017, passed an order requiring the company to pay back the profiteering amount to the consumers.

The bench consists of Sh. B. N. Sharma (Chairman), Sh. J. C. Chauhan (Technical Member) and Ms. R. Bhagyadevi, (Technical Member).

The order was passed in the matter of Shri Diwakar Bansal and Director General of Anti-Profiteering v. M/s Horizon Projects Pvt. Ltd.

The Respondent Company was engaged in the business of constructions and real estate. In the present case, the petitions alleged profiteering by the Respondent, in respect of the purchase of Flats. The issue discussed whether Respondent has passed on the benefit of ITC to the owners by way of commensurate reduction in the price of the flat. The Authority also went on to discuss the quantum of price reduction also.

The Authority concluded that the Respondent had been profiteering from the sales of the flats in question and ordered the reimbursement of the amount profiteered. The Authority further held that Respondent has denied the benefit of ITC to the buyers and “hence he has committed an offence under section 171 (3A) of the CGST Act, 2017 and therefore, he is liable for imposition of penalty under the provisions of the above Section”.

Subscribe Taxscan Premium to view the JudgmentThe Company Law Committee was constituted by the Ministry of Corporate Affairs in September, 2019, inter alia, to further decriminalise the provisions of the Companies Act, 2013 based on their gravity and to take other concomitant measures to provide further Ease of Living for corporates in the country.

The report of the Committee was presented today to the Union Minister of Finance and Corporate Affairs, Smt. Nirmala Sitharaman by Shri Injeti Srinivas, Secretary, Ministry of Corporate Affairs, who chaired the Committee. The other members of the Committee included Shri T. K. Viswanathan, Ex- Secretary-General, Lok Sabha; Shri Uday Kotak, MD, Kotak Mahindra Bank; Shri Shardul S Shroff, Executive Chairman, Shardul Amarchand Mangaldas & Co; Shri Amarjit Chopra, Senior Partner, GSA Associates; Shri Rajib Sekhar Sahoo, Principal Partner, SRB & Associates; Shri Ajay Bahl, Founder and Managing Partner, AZB & Partners; Shri G. Ramaswamy, Partner, G. Ramaswamy & Co.; Shri Sidharth Birla, Chairman, Xpro India Limited; Ms. Preeti Malhotra, Group President, Corporate Affairs & Governance, Smart Group and Shri K.V.R. Murty, Joint Secretary, Ministry of Corporate Affairs (Member Secretary of the Committee).

The Committee took note of the progress made consequent to the Companies (Amendment) Act, 2019, which had resulted in de-criminalisation of 16 minor procedural/technical lapses under the Companies Act, 2013 into ‘civil wrongs’, and adopted a principle-based approach to further remove criminality, in case of defaults which can be determined objectively and which, otherwise, lack the element of fraud or do not involve larger public interest. Alternative methods of imposing sanctions have also been explored and recommended by the Committee, in some cases.

In Chapter I of the report, the Committee has proposed amendments in 46 penal provisions, so as to either remove criminality, or to restrict the punishment to only fine, or to allow rectification of defaults through alternative methods, which would lead to further de-clogging of the criminal justice system in the country. The main recommendations of the Committee in Chapter 1 are as follows:

In Chapter 2, the Committee has made recommendations targeted towards providing further ease of living for law-abiding corporates, which are as follows:

In addition, the committee while deliberating on certain other issues felt that wider consultation would be necessary and recommended that the following be taken up in due course, at a later stage;

As per the information received from National Company Law Tribunal (NCLT), total 1,821 cases filed by homebuyers against builders since June, 2018, under the Insolvency and Bankruptcy Code (IBC) 2016, were pending in NCLT on 30.09.2019. Data regarding cases filed against builders for defaults of less than a month is not available with NCLT, this was stated by Shri Anurag Singh Thakur, Minister of State for Finance & Corporate Affairs, in a written reply to a question in Lok sabha today.

Elaborating further, Shri Thakur said the matter of the status of homebuyers as financial creditors or modify the definition of default in these cases in order to reduce the number of insolvency cases filed against builders in the NCLTs for small defaults is under consideration of the Ministry of Corporate Affairs.

The Government is taking all steps to strengthen the NCLT in terms of number of benches, number of courts and number of members, to reduce the burden of the NCLT.

Five new benches have been announced during 2018-2019 at Jaipur, Cuttack, Kochi, Indore and Amaravati. The Government has also appointed 28 more members in NCLT recently and vacant posts of members in NCLT are being filed up regularly. For capacity building of members, regular colloquiums are being held. e-Court project is also being implemented by NIC for all the benches of NCLT.

The Income Tax Appellate Tribunal (ITAT), Mumbai, held that the differences in the accounting policy followed by the taxpayer and its clients, who have deducted TDS, could explain the TDS Return differential.

The Tribunal consisting of Shri. Mahavir Singh, and Shri. Ramit Kochar clarified this while disposing of the case, TUV India Pvt. Ltd v. DCIT 15(3)(1).

The appellant here is a service provider engaged in the certification work. The assessing officer noted an additional amount in the income of the assessee on account of mismatch of TDS between the books of accounts maintained by the assessee and Form No. 26AS per income tax department database.

The tribunal ruled that the differences in the accounting policy as well wrong mention/punching of the PAN number of the taxpayers by clients while filing TDS returns with the department could reason for the difference. The Tribunal further noted that, “One of the reasons for differential could be that clients have deducted TDS on the gross amount inclusive of service tax while income is reflected by tax-payers exclusive of service tax”.

The Tribunal stressed that since the assessee has no control over the database of the Income-tax department, at best the assessee could do is to offer bonafide explanations for the differential.

The Tribunal ruled that since the lower bodies did not point to any defect in the book or rejected the books of account, and also due to the absence of any cogent incriminating material, it was the duty of the CIT(A)/AO to conduct necessary enquiries to unravel the truth. The court also pointed out that the authorities failed to dislodge/rebut the contentions of the assessee

The tribunal ruled that, “The learned CIT(A)/AO ought to have conducted necessary enquiries to unravel the truth but asking the assessee to do impossible is not warranted”.

Subscribe Taxscan Premium to view the Judgment