The Central Board of Direct Taxes (CBDT) has extended the due date for filing of Income tax returns (ITRs) and Tax Audit Reports for audit cases has been extended to October 31 from September 30.

The Income Tax Department said in a tweet:

Earlier, the Institute of Chartered Accountants of India (ICAI) had written to CBDT, urging it to extend the ITR deadline for audited entities to November 30. The CBDT is the authority responsible for framing policies for the I-T Department.

On consideration of representations recd from across the country,CBDT has decided to extend the due date for filing of ITRs & Tax Audit Reports from 30th Sep,2019 to 31st of Oct,2019 in respect of persons whose accounts are required to be audited.Formal Notification will follow.

— Income Tax India (@IncomeTaxIndia) September 26, 2019

In a note addressing all its members, ICAI wrote: “We would like to inform members that based on the feedback about the various technical and practical difficulties being faced by taxpayers in filing of the new forms of returns of income for AY 2019-20, the difficulties being faced by the taxpayers in filing the ITR Forms as well as tax audit report under section 44AB by 30th September 2019 have been conveyed to the CBDT vide a representation dated 16th September 2019.”

The Central Board of Indirect Taxes and Customs ( CBIC ) has issued clarifications on Sabka Vishwas (Legacy Dispute Resolution) Scheme, 2019.

Only the persons who are eligible in terms of Section 125 can file a declaration under the Scheme. The eligibility conditions are captured in Form SVLDRS-1 (Sr. No. 8). The system automatically disallows persons who are not eligible for filing a declaration. However, there is a possibility that such ineligible persons may still make a declaration by selecting an incorrect response. For instance, under Sr. No. 8.1, the person making a declaration has to indicate whether he/she has been convicted for an offense for the matter for which the declaration is being made. If, the answer is ‘Yes’, then the person is ineligible and is not allowed to proceed further by the system. However, such a person is able to file a declaration if he/she incorrectly indicates ‘No’ as the answer even though he/she has been convicted. Such declarations are void and do not merit consideration under the Scheme. Such persons may be informed of their ineligibility through a letter.

The CBIC also said that, “Section 124(1)(a) outlines the relief available in the case of one or more appeals arising out of a Show Cause Notice. Such an appeal may have been filed either by the party or by the department. Further, Section 127(6) provides for deemed withdrawal of such appeals filed by a declarant pending at a forum other than the Supreme Court or High Court. It is clarified that such deemed withdrawal will also be applicable for departmental appeals. Further, where a departmental appeal, reference or writ petition is pending before the Supreme Court or High Court, the department will file an application for withdrawal of such appeal, reference or writ petition after issuance of the discharge certificate. Similarly, if prosecution has already been launched, the procedure as laid down in Circular No. 1009/16/2015-CX dated 23-10-2015 should be followed for withdrawal of prosecution after issuance of discharge certificate”.

“One of the category of cases for which a declaration can be made under the Scheme is where the declarant has filed a return but not paid duty. It is possible that a taxpayer may not have paid duty in case of multiple returns. It may be noted that Rule 3 of the Sabka Vishwas (Legacy Dispute Resolution) Scheme Rules, 2019 provides that a separate declaration shall be filed for each case. Further, in terms of the Explanation to Rule 3, in case of arrears, a case means ‘an amount in arrears’. Section 121(c)(iii) defines an “amount in arrears” as the duty recoverable on account of the declarant having filed a return but not paying duty. Since the amount in arrears pertains to a return, a separate declaration will need to be filed for each such return”, the CBIC also said.

Subscribe Taxscan Premium to view the JudgmentActing on specific intelligence that a few units located in Kandla SEZ at Gandhidham, (Gujarat) in connivance with about 20 exporter firms/companies based in the National Capital Region (NCR) have hatched a major conspiracy to defraud the Government exchequer, the Directorate General of GST Intelligence (DGGI), Ahmedabad Zone (an Investigative arm of the Central Government), has initiated investigations by conducting searches in three units located in SEZ and thereafter at the premises of NCR based exporters and their godowns.

The modus operandi detected indicates huge overvaluation to the extent of 3000% of the market value of goods exported to the SEZ (zero-rated supply) and claiming of refund of Input Tax Credit (ITC) obtained by fraudulent means. Evidence confirming that the source of ITC claimed as a refund against exports itself is fraudulent.

In what seems to be a meticulously planned conspiracy, the commodity selected by the entities for the fraudulent act has been found to be sin goods viz “manufactured tobacco and other related products” falling under CTH 2403 which is subject to tax at the rate of 93% and 188%, including Cess. Due to high incidence of taxes on such goods the scope to claim refunds of ITC against refunds is manifold more than the goods which are subject to tax at lower rate of 28% or 18%. Thus, the conspirators have aimed at deriving maximum illegal gain out of fraudulent transactions. It is noteworthy to mention that tobacco products are mostly Business to Consumer (B2C) supply items and it is relatively easier to obtain from the market GST paid invoices without corresponding goods, as the goods often get sold in the market without corresponding bills.

It has been revealed that low grade material like scented jarda, kimam (tobacco extract), filter khaini etc. which have been manufactured clandestinely without payment of tax by a few Noida based units or procured from the local market at the rate of Rs. 150 to 350 per kg have been exported to the SEZ based units at the rate of Rs. 5000 to 9000 per kg and subsequently, refund of accumulated ITC, sourced fraudulently, in excess of Rs. 400 crores has been claimed by the exporters from the jurisdictional GST authorities.

The agency has been able to identify more than 25 such suppliers located in States like Assam, Bihar, Delhi, Haryana, MP and UP who have issued fake invoices of more than Rs.1000 crores to the NCR based exporters without supply of goods to facilitate refunds. These suppliers are either non-existent or are being indirectly controlled by the exporters themselves.

To give a semblance of legitimacy to the otherwise sham transactions, low value goods manufactured in Noida or procured locally in Delhi have been dispatched to SEZ units under the cover of invoices. Thus, while the Input Tax Credit has been obtained fraudulently from one source, the low value goods have been procured from another source and both the streams have converged at the end of exporters who have made highly overvalued supplies to the SEZ units for illegal gains through ITC refund route.

Due to the proactive steps taken by the DGGI, refund claims of ITC in excess of Rs. 300 crores in the process of getting disbursed by the jurisdictional authorities, have been withheld from going into the hands of scamesters.

In addition, the surplus ITC of more than Rs 100 crores still lying in the credit ledger of such exporters has also been prevented from getting siphoned off by way of likely refunds claims. Thus, an act of indiscretion has been nipped in the bud.

The illegitimate export incentives availed by the SEZ units shall also be further investigated by the Customs Authorities.

The agency has been able to identify the key conspirators and the actual beneficiaries of the scam who are on the run. Efforts are being made to bring them to the book.

This is a major detection of export fraud coupled with fraudulent ITC refunds though SEZ based units. This investigation is an outcome of specific intelligence input which was further refined by rigorous analysis of data available on the GST Network and the E-way Bill system.

The case is indicative of the resolve of DGGI to implement the directives of the Government to ensure tax compliance and to strive to provide a level playing field to the honest entrepreneurs who are the wealth creators of the Nation.

The Government of India has reconstituted the Economic Advisory Council to the Prime Minister (EAC-PM) for a period of two years with effect from 26th September 2019.

Dr. Bibek Debroy and Shri Ratan P. Watal will continue to be the Chairman and Member Secretary respectively of the reconstituted EAC-PM. Apart from these two Full-Time Members, the EAC-PM will have two Part-Time Members.While Dr. Ashima Goel continues to be one of the Part-Time Members, Dr. Sajjid Chinoy has been made as another Part-time Member.

The Supreme Court in the case of ITC Ltd. v Commissioner of Central Excise, Kolkata held that a person aggrieved by any order of assessment has to get it modified under Section 128 or other relevant provisions and not Section 27 for claiming of refund.

The appellants are engaged in the manufacture of paper from conventional and unconventional raw materials. In the course of manufacturing activity, waste paper/ broke arises which are recycled in the manufacturing process by making pulp. The appellant has been paying duty on paper cleared from its factory. They availed the exemption under NN 67/95-CE dated March 16, 1995. NN 6/2000-CE dated March 1, 2000, granted a complete exemption in respect of paper up to the specified quantitative limit manufactured from unconventional raw materials. On receiving a letter from Superintendent and admission of its mistake, the appellant stopped availing the exemption and started payment of duty on waste paper/ broke.

A refund claim was filed by the appellant for the period from July 2001 to March 2002 for an amount in respect of duty paid on said waste paper. The assessment committee, Commissioner of Appeals and Tribunal dismissed the appeal and hence the appeal has been preferred under Section 35(b) of the 1944 Act.

It has been contended by the department that it is not open to the proper officer after accepting the self-assessment to entertain a claim for refund in the absence of the self-assessment being questioned on appeal. Further, citing the case of Flock (India) Pvt. Ltd. and Priya Blue Industries it was contended that once the self-assessment/assessment attains finality and has not been questioned, it cannot be reopened at any point of time.

The bench constituting of Justices Arun Mishra, Navin Sinha and Indira Banerjee held that “the provisions under Section 27 cannot be invoked in the absence of amendment or modification having been made in the bill of entry on the basis of which self-assessment has been made. In other words, the order of self-assessment is required to be followed unless modified before the claim for refund is entertained under Section 27. The refund proceedings are in the nature of execution for refunding amount. It is not assessment or reassessment proceedings at all.”

The Court hence upheld the necessary amendment to the original order of assessment for a refund claim as has been held by the Priya Blue Industries case and overruled the view taken by the Delhi High Court in the case of Union of India & Ors. v. Micromax Informatics Ltd. (2016) 335 ELT 446 (Del).

Subscribe Taxscan Premium to view the JudgmentThe Institute of Chartered Accountants of India (ICAI) has made an announcement with respect to Evaluation of answer books of CA exams on September 21, 2019. Thereafter, a webinar was conducted on September 22, 2019, wherein the procedure and processes followed in the examination system were explained and all the misgivings about the examination process were cleared.

1. Digital evaluation: As communicated in January 2019 Chartered Accountant Student newsletter, continuing further from the pilot e evaluation for the first group of Intermediate Nov 2018 exams; all papers of Intermediate and Foundation level exams in November 2019/May 2020 will be put through the digital evaluation mode bringing in following benefits

Currently, the Regulation 39(4) dealing with the subject matter provides as under:-

(4) (i) Information as to whether a candidate’s answers in any particular paper or papers of any examination have been examined and marked shall be supplied to the candidate on his submitting within a month of the declaration of the result of the said examination, an application, accompanied by a fee as may be fixed by the Council which shall not exceed rupees five hundred in any case.]

(ii) The fee shall be only for verifying whether the candidate’s answers in any particular paper or papers have been examined and marked, and not for the re-examination of the answers.

(iii) The marks obtained by a candidate in individual questions or in sections of a paper shall not be supplied.

(iv) If as a result of such verification, it is discovered that there has been either an omission to examine or mark any answer or answers or there has been a mistake in the totalling of the marks, the fee for verification shall be refunded in full to the candidate.

The above Chartered Accountants Regulations allow correction of marks awarded in case of :

Beyond this, the Regulation does permit any subjectivity in checking of answer books.

The representatives were explained about the afore-stated provisions of Chartered Accountants Regulations 39(4) of the Chartered Accountants Regulations, 1988.

However, they were insistent on the demand for allowing re-evaluation of the answer books. They were informed that due process will be followed for consideration of their demand. They were also requested to call off the agitation and students be advised to concentrate on their studies and preparation for the forthcoming examination. In spite of the same; the representatives mentioned that they would continue with this agitation till the time the matter is sorted out.

All the students are advised not to be carried away by such issues. The Institute is seized of their problems and will be considered and taken up at the appropriate forum by following due process.

The Central Board of Direct Taxes ( CBDT ) has issued directions for handling grievances of Start-ups and addressing its tax-related issues.

In a letter addressed to officers said that, In case of any grievance, the preliminary Action Taken Report is to be submitted to this office by the next day., i.e., within one working day of calling of report by this office.

The letter also said that, Final Action Taken Report in this regard is to be submitted within 3 working days if calling of the report by this office.

All Pr. CCIT & Pr. DGIT has been directed that in case of any grievance, the preliminary Action Taken Report is to be submitted within one working day and final Action Taken Report in this regard is to be submitted within 3 working days.

Subscribe Taxscan Premium to view the JudgmentThe Kerala High Court in the case of Raju Sebastian and Ors v. Union of India held that the demand of details pertaining to the bank account of a person shall amount to infringement of Right to Privacy.

The appellants conduct petroleum retail outlets on the basis of the dealership agreements executed by them with the oil marketing companies. The appellants alleged that the oil marketing companies demanded them to furnish the sales tax returns, bank account statements and income tax returns pertaining to their dealership and on failure, the supply of petroleum products of them would be discontinued.

The issue before the present Court was the determination of whether furnishing of details of bank accounts and the income tax returns of a person infringes the right to privacy, which is a fundamental right.

The division Bench comprising of Justice C.K. Abdul Rehim and Justice C.K. Narayana Pisharadi held that “There can be no doubt with regard to the fact that details of the bank account of a person constitute personal and private information. The statement of account of a person in a bank would reveal the amount in deposit in the bank and the amounts deposited and withdrawn in the past. It would give a clear picture of a person’s financial capacity. It would disclose the cash transactions which a person had with third parties. It would reveal the amount transferred to and received by a person from another. It may show the loans availed of by a person from the bank. Habits of a person, his lifestyle, his association with other persons and many other personal matters can be deduced from close scrutiny of his bank account for some period. Therefore, we have no hesitation to hold that details of the bank account of a person constitute personal information and that any demand made to disclose such information amounts to infringement of his right to privacy.”

The Court hence held that a demand of bank details of a person shall amount to infringement of his Right to Privacy. Further, it held that the respondents had got no right to require the appellants to furnish their income tax returns and the bank account statements, as a condition for continuing the petroleum retail dealership granted to them.

Subscribe Taxscan Premium to view the JudgmentThe Bangalore Bench of the Income Tax Appellate Tribunal ( ITAT ) in the case of M/s Google India Pvt. Ltd. v. The Assistant Commissioner of Income Tax held that no penalty can be levied under Section 271(1)(c) if Hon’ble High Court has admitted the matter.

The assessee company engaged in the business of providing information technology and information technology-enabled services to its group companies is a subsidiary of Google International LLC, USA. It entered into a distribution agreement with an Ireland PE whereby assessee was granted marketing and distribution rights of AdWord Program to advertisers in India.

The Assessing Officer (hereinafter referred to as the ‘AO’) observed that assessee under agreement acquired marketing and distribution rights over AdWord Programmes for the territory of India from its U.S. AE. AO noticed that there was no deduction of TDS and no ‘nil’ deduction certificate was obtained.

The Respondent before the present tribunal in agreement of the view taken by the Commissioner of Income Tax (Appeals) (hereinafter referred to as ‘CIT(A)’) contended that that the payments made by assessee under the agreement were business profits in the hands of U.S. AE paid for purchase of Adword space even though AdWord advertisement spaces was further sold to different advertisers. Hence, penalty order was passed levying a penalty for alleged ‘tax evasion’ passed by the CIT (A) shall be upheld.

The Bench constituting of Hon’ble members: Shri. B.R. Baskaran (accountant member) and Smt. Beena Pillai (judicial member) held that the AO initiated penalty proceedings without referring to any charge as to for “concealment of income” or “filing of inaccurate particulars of income. Further, the AO subsequent to order passed by Ld. CIT (A) passes penalty order, wherein penalty has been levied for the deliberateness of “tax evasion”, which in our considered opinion is not at all the requirement of Sec.271(1)(c ) of the IT Act. Furthermore, the admission of the matter before the High Court itself signifies that the issue is certainly debatable and in such circumstances penalty cannot be levied by AO.

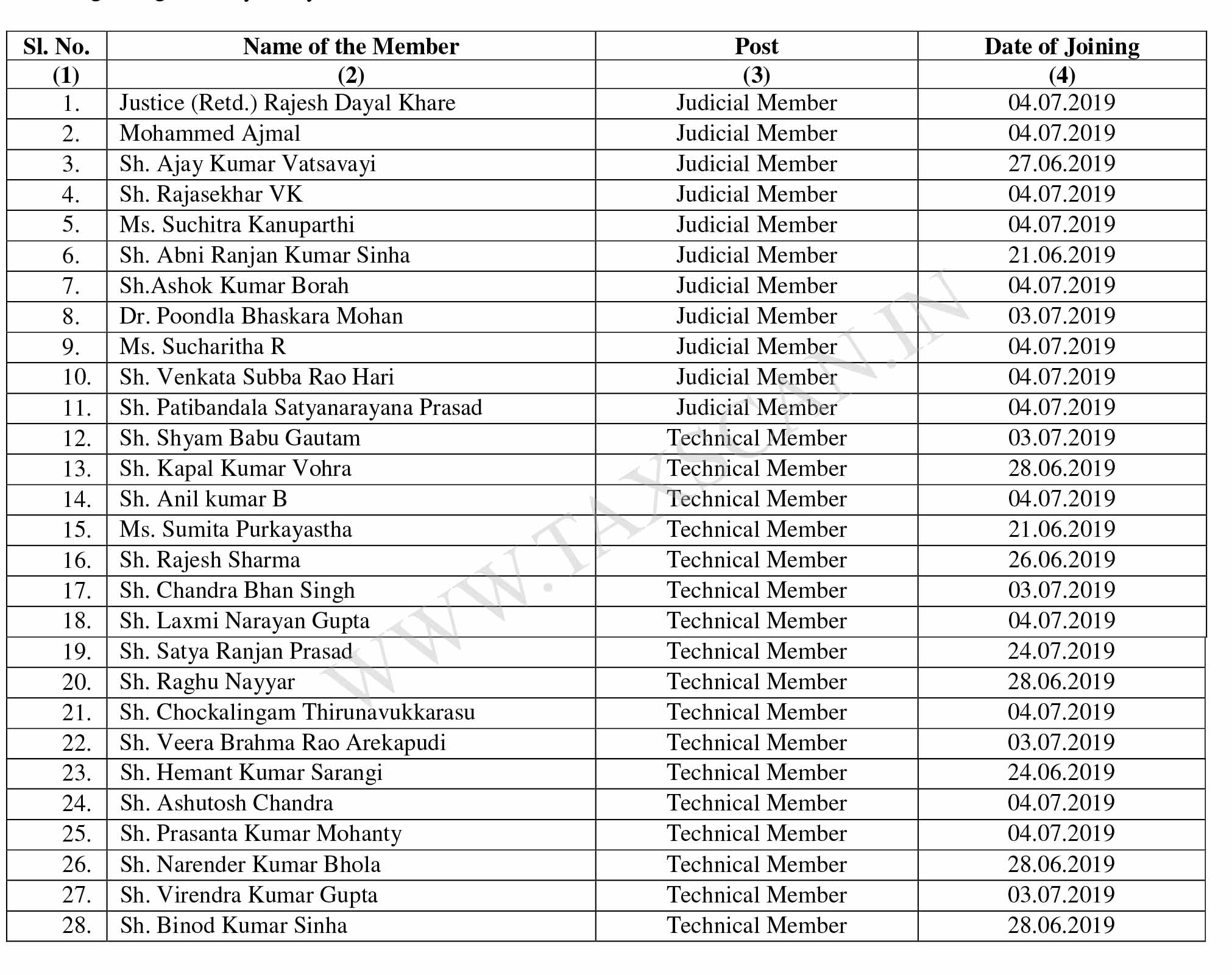

Subscribe Taxscan Premium to view the JudgmentThe Ministry of Corporate Affairs ( MCA ) has appointed twenty-eight new Judicial and Technical Members in National Company Law Tribunal ( NCLT ).

The National Company Law Tribunal is a quasi-judicial body in India that adjudicates issues relating to Indian companies. The tribunal was established under the Companies Act 2013 and was constituted on 1 June 2016 by the government of India and is based on the recommendation of the Justice Eradi committee on law relating to insolvency and winding up of companies.

NCLT bench is chaired by a Judicial member who is supposed to be retired/Serving High Court Judge and a Technical member who is from Indian Corporate Law Service, ICLS Cadre.

The National Company Law Tribunal is the adjudicating authority for insolvency resolution process of companies and limited liability partnerships under the Insolvency and Bankruptcy Code, 2016.

No civil court shall have jurisdiction to entertain any suit or proceeding in respect of any matter which the Tribunal or the Appellate Tribunal is empowered to determine by or under this Act or any other law for the time being in force and no injunction shall be granted by any court or other authority in respect of any action taken or to be taken in pursuance of any power conferred by or under this Act or any other law for the time being in force, by the Tribunal or the Appellate Tribunal.

The tribunal has sixteen benches, six at New Delhi (one being the principal bench) and two at Ahmedabad, one at Allahabad, one at Bengaluru, one at Chandigarh, two at Chennai, one at Guwahati, three at Hyderabad of which one is at Amaravathi, one at Jaipur, one at Kochi, one at Cuttack, two at Kolkata and five at Mumbai.

Subscribe Taxscan Premium to view the JudgmentThe Competition Commission of India (CCI) approves the following Combinations under Section 31(1) of the Competition Act, 2002, :

The proposed transaction entails acquisition of equity shares in DTPL by Varenna. Varenna already holds 60% of the shares in DTPL.

Varenna is an indirect subsidiary of funds managed by Advent International Corporation.

DTPL is primarily engaged in manufacturing of hosiery products including men’s inner wear (including boy’s inner wear), women’s inner wear (including girl’s inner wear) and casual wear (including T-shirts, Tracks, sweatshirts, shorts, leggings, athleisure, thermal wear, capris and skirts).

The proposed transaction contemplates an acquisition of approximately up to 25.02% shareholding of FMGI by the Acquirers from the public shareholders of FMGI. Under the SEBI (Substantial Acquisitions of Shares and Takeover) Regulations, 2011, IEP LP and AEP, together with its subsidiary, IEH are the persons acting in concert with Tenneco Inc.

FMGI (the target) manufactures and sells pistons, piston rings, valve seats, valve guides and structured parts for a wide range of applications including two/three wheelers, cars, sport utility vehicles, tractors, light commercial vehicles, heavy commercial vehicles, stationary engines and high output locomotive diesel engines.

In terms of the proposed combination, the front end standalone pharmacy business of AHEL shall be transferred by AHEL to Apollo Pharmacies Limited (APL) by way of slump sale pursuant to approval of the National Company Law Tribunal, Chennai Bench.

AHEL is a part of the Apollo Group and provides integrated healthcare services in India and internationally. AHEL healthcare facilities comprise primary, secondary, and tertiary care facilities.

APL is engaged in the business of buying, selling, importing, exporting, distribution or dealing in or manufacturing, Medical and Pharmaceuticals products like intravenous sets, intravenous solutions, all kinds of drugs, disinfectants, tinctures, colloidal products, injectable and all pharmaceuticals and medical preparations and other related products.

The Sales Tax Bar Association (STBA) has moved the writ petition in Delhi High Court raising several issues in relation to the difficulties being faced in entertainment, processing and allowance of the refund claims made under Section 54 of the Central Goods and Services Tax Act, read with Section 16 of the Integrated Goods and Services Tax Act.

The Petitioners urge that refunds are not being acknowledged, processed and granted in terms of the aforesaid Acts and the Rules framed there-under.

The grievance of the petitioners is also that the statutory mechanism created for entertaining refund claims is not being implemented, and that there are some inherent lacunas in the scheme formulated by the Respondents to process the refund claims.

While hearing the petition, the division bench comprising of Justice Vipin Sanghi and Justice Sanjeev Narula has observed that “During the course of hearing the Counsel for the Petitioner highlighted several issues which are being faced by the Taxpayers on a daily basis. Some of the issues related to technical & procedural aspect. On some of the technical issues the stand of the Respondent is that they are legal issues and therefore, needs the Court’s interpretation/intervention. On other technical issues the Respondents have stated that they are ready to address the same.

Therefore, the Petitioner shall prepare a representation in bullet points and shall address all the issues as mentioned in the W.P and otherwise, and it shall be circulated among all the respondents and their counsel.

The Court also said that, “Further, IT grievance redressal mechanism will have a nodal officer who will receive the complaints from the taxpayers, and will update the status on of the complaints received/complaints resolved/pending and rejected within 2 weeks. Also, the Nodal Officer shall give the reason for the applications which have been rejected. Also for the pending application, it will indicate the time within which it will be solved”.

Further, if any grievance is not addressed or solved then it will escalate to the redressal committee. Also individual grievances shall be accepted by the Nodal Officer, the Court also added.

The Court was also has given directions such as: 1. The email id and phone number of the nodal officer will be published on the GST website and CBIC website. The status of the complaints will also be published on the status website. 2. GSTN shall upload a list of the operationalized forms on the GST Network. This exercise should be completed within the next 10 days.

Subscribe Taxscan Premium to view the JudgmentThe Central Board of Direct Taxes ( CBDT ) has notified new depreciation rates of 30% and 45 on vehicles purchased between 23.08.2019 to 31.03.2020.

The rates of 15% is applicable on Motor cars, other than those used in a business of running them on hire, acquired or put to use on or after the 1st day of April, 1990 except those covered under entry (ii);

The rate of 30% on motor cars (other than those used in a business of running them on hire) & 45% on Motor buses, motor lorries and motor taxis used in a business of running them on hire. Such vehicles should have been acquired on or after 23-08-2019 but before 01-04-2020 and are put to use before the 01-04-2020.

It is also applicable on Motor buses, motor lorries and motor taxis used in a business of running them on hire other than those covered under entry (b).

Subscribe Taxscan Premium to view the JudgmentThe RITES Limited has invited applications from CA/CMA, B.com graduates for the post of Junior Manager (Finance) and Junior Assistant (Finance).

RITES Ltd., a Mini Ratna Central Public Sector Enterprise under the Ministry of Railways, Govt. of India is a premier multi-disciplinary consultancy organization in the fields of transport, infrastructure and related technologies.

Name of the Post: Junior Manager (Finance)

Qualification: Qualified CA/CMA (earlier known as ICWAI)

Name of the Post: Junior Assistant (Finance)

Qualification: B.Com/ BBA (Finance) / BMS (Finance)

Selection Process

The applications received shall be screened for eligibility. The candidates may be shortlisted for selection. The company reserves the right to shortlist the number of candidates for selection out of eligible candidates.

For the post of Junior Manager, based upon the performance in the Written Test, and fulfilling the conditions of eligibility; candidates shall be shortlisted for Interview. Candidates have the option to appear for interview either in Hindi or English.

For the post of Junior Assistant, based upon the performance in the Written Test, and fulfilling the conditions of eligibility; candidates shall be shortlisted for Document Scrutiny.

Appointment of selected candidates will be subject to their being found medically fit in the Medical Examination to be conducted as per RITES Rules and Standards of Medical Fitness for the relevant post.

Last date of online registration: 10.10.2019

For Further Information Click here

The Central Board of Direct Taxes ( CBDT ) has notified that provisions of section 194N of the Income Tax Act ( TDS ) shall not be applicable to the commission agent or trader operating under Agriculture Produce Market Committee (APMC).

The Notification issued by Finance Ministry said that, “the commission agent or trader, operating under Agriculture Produce Market Committee (APMC), and registered under any Law relating to Agriculture Produce Market of the concerned State, who has intimated to the banking company or co-operative society or post office his account number through which he wishes to withdraw cash in excess of rupees one crore in the previous year along with his Permanent Account Number (PAN) and the details of the previous year and has certified to the banking company or co-operative society or post office that the withdrawal of cash from the account in excess of rupees one crore during the previous year is for the purpose of making payments to the farmers on account of purchase of agriculture produce and the banking company or co-operative society or post office has ensured that the PAN quoted is correct and the commission agent or trader is registered with the APMC, and for this purpose necessary evidences have been collected and placed on record”.

The notification came into force with effect from the 1st day of September, 2019.

Subscribe Taxscan Premium to view the JudgmentThe 37th GST Council met in Goa today under the Chairmanship of Union Finance & Corporate Affairs Minister Smt Nirmala Sitharaman. The meeting was also attended by Union Minister of State for Finance & Corporate Affairs Shri Anurag Thakur besides Chief Minister of Goa Shri Pramod Sawant, Finance Ministers of States & UTs and seniors officers of the Ministry of Finance.

The council took the following decisions in respect to rates relating to goods.

The rate changes shall be made effective with effect from 1st October, 2019.

The 37th GST Council met in Goa today under the Chairmanship of Union Finance & Corporate Affairs Minister Smt Nirmala Sitharaman. The meeting was also attended by Union Minister of State for Finance & Corporate Affairs Shri Anurag Thakur besides Chief Minister of Goa Shri Pramod Sawant, Finance Ministers of States & UTs and seniors officers of the Ministry of Finance.

The GST Council, in its meeting, recommended the following Law & Procedure related changes :

In order to tackle the menace of fake invoices and fraudulent refunds, in-principle decision to prescribe reasonable restrictions on the passing of credit by risky taxpayers including risky new taxpayers.

The GST Council in the 37th meeting held on 20th September, 2019 at Goa took following decisions relating to changes in GST rates, ITC eligibility criteria, exemptions and clarifications on connected issues.

Rate reduction sector wise:

Hospitality and tourism:

| Transaction Value per Unit (Rs) per day | GST |

| Rs 1000 and less | Nil |

| Rs 1001 to Rs 7500 | 12% |

| Rs 7501 and more | 18% |

Job work service:

Exemption sector wise:

Warehousing:

Transportation:

Insurance:

Export promotion:

Miscellaneous

(C) CLARIFICATIONS:

To clarify the scope of the entry ‘services of exploration, mining or drilling of petroleum crude or natural gas or both”.

To clarify taxability of Passenger Service Fee (PSF) and User Development Fee (UDF) levied by airport operators.

Taking forward its mission of inclusive growth & empowering students, the Council of The Institute of Chartered Accountants of India ( ICAI ) has taken a major decision providing concession on registration course fee for the students of newly formed Union Territories of Jammu & Kashmir and Ladakh and for 8 North-Eastern States.

It has been decided to waive off 75% fee for the students registering from the newly formed Union Territories of Jammu & Kashmir, Ladakh and also from 8 North-Eastern States, for all level of CA Course i.e. Foundation, Intermediate and Final.

This decision would be a step forward towards encouraging the young aspirants who wish to pursue their dream of becoming a Chartered Accountant and serve the nation with their capabilities and knowledge.

The Council of the ICAI also decided to open a Representative Office of the Institute in Union Territory of Ladakh.

ICAI, being a true Partner in Nation Building has always collaborated with various initiatives of the Government and is proud to become part of the development of the newly formed Union Territory.

The ICAI office will act as a facilitation centre to spread awareness about Chartered Accountancy Course as a tool for social empowerment and provide much needed professional employment opportunities to the local youth.

The opening up of office in Ladakh, the Chartered Accountancy Course, one among the most economical courses, will be accessible to the interested candidates at their doorstep and thus empower the youth through skill development and will also to equip them to be a part of the mainstream / economy.

This step would enable the Institute to spread knowledge in the field of accountancy, Corporate Governance and facilitate services to the Members, Students and Stakeholders in the aforesaid Union Territory.

The Madras High Court has ruled that the constitution of GST Appellate Tribunal ( GSTAT ) is unconstitutional.

The division bench comprising of Justice S. Manikumar and Justice Subramonium Prasad has held that the number of judicial members must exceed the number of technical members.

However, dismissing an argument made during the course of hearing, it also concluded that advocates do not have a fundamental right to become judges / judicial members of the GSTAT.

While hearing a petition challenging the constitution of the Appellate Tribunal ( GSTAT ) under the Goods and Services Tax (GST) regime, noted that the provisions of Sections 109 and 110 of the Central Goods and Services Tax (CGST) Act 2017 are prima facie contrary to the Apex Court’s decision in Union of India vs. R.Gandhi.

A petition filed by Advocate V Vasanthakumar has contended that Sections 109 and 110 of the Central Goods and Services Tax (CGST) Act 2017 are unconstitutional as the same is void, defective and unconstitutional, being violative of doctrines of separation of powers and independence of the judiciary.

The provisions are relating to the constitution of the AT and qualification, appointment and condition of services of its member. As per the petitioner, “…during the pre-GST regime, taxes were levied under separate laws namely Central Excise, Custom and Service tax had also the scheme of the second appeal before the Appellate Tribunal known as Custom, Excise & Service Tax Appellate Tribunal (‘CESTAT’). Each bench of CESTAT consisted of two members, one Judicial Member and one Technical Member. “GST law provides for the constitution of Appellate Tribunal.

The Appellate Tribunal is constituted under Section 109 of the CGST Act and Tamil Nadu GST Act and Section 110 of the CGST / TNGST Act, provides for qualification appointment, condition of services, etc., for President and members of the Appellate Tribunal.

According to the petitioner, the provision is contrary to the decision of the Supreme Court in Union of India v R. Gandhi wherein it was categorically enunciated that Bench of National Company Law Tribunal / National Company Law Appellate Tribunal should consist of one Judicial Member and one Technical Member or the Judicial Member should be equal or in majority in compare to the Technical Member and in no circumstances the number of Technical Member should be in majority compared to Judicial Members.

Subscribe Taxscan Premium to view the JudgmentThe Government has brought in the Taxation Laws (Amendment) Ordinance 2019 to make certain amendments in the Income Tax Act 1961 and the Finance (No. 2) Act 2019. This was announced by the Union Minister for Finance & Corporate Affairs Smt Nirmala Sitaraman during the Press Conference in Goa today. The Finance Minister elaborated further, the salient features of these amendments, which are as under:-

The total revenue foregone for the reduction in corporate tax rate and other relief estimated at Rs. 1,45,000 crore.