- Home

- »

- Kalyani B. Nair

Kalyani B. Nair

Kalyani is graduated from Government Law College Thiruvananthapuram on BA, LLB and is currently pursuing LLM in Criminal Law, Criminology and Penology. She always believes that Fear kills more dreams, than failure ever will. Her area of interest are Criminal law and Constitutional Law. She is also into baking, reading and gardening.

![Expiry of E-Way Bill by one day: Calcutta HC directs Issuance of FORM GST MOV-02 [Read Order] Expiry of E-Way Bill by one day: Calcutta HC directs Issuance of FORM GST MOV-02 [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/FORM-GST-MOV-02-E-Way-Bill-Expiry-of-E-Way-Bill-Calcutta-High-Court-Taxscan.jpeg)

Expiry of E-Way Bill by one day: Calcutta HC directs Issuance of FORM GST MOV-02 [Read Order]

The Calcutta High Court directed the issuance of FORM GST MOV-02 as the expiry of e-way bill is only by one day. By the writ petition, petitioner,...

CPC not Authorized to Carry Out Adjustment for Disallowance of Deduction u/s 80P Income Tax Act: ITAT [Read Order]

The Income Tax Appellate Tribunal (ITAT), Mumbai Bench held that Centralized Processing Centre (CPC) not authorized to carry out adjustment for disallowance of deduction under Section 80P of the...

Service Tax leviable on Right to Use of Mining of Natural Resources (Sand), No Tax Exemption after 01.04.2016: CESTAT [Read Order]

The Customs, Excise and Service Tax Appellate Tribunal ( CESTAT ), Kolkata Bench observed that service tax is leviable on right to use of mining of natural resources (Sand) and noted that there is no...

Excess Utilized Credit cannot be Demanded, as Rule 6(3)(c) of CCR is silent on Period during which 20% Credit shall be Utilized: CESTAT [Read Order]

The Ahmedabad Bench of the Customs, Excise and Service Tax Appellate Tribunal ( CESTAT ), noted that excess utilized credit cannot be demanded, as Rule 6(3)(c) of Cenvat Credit Rules, 2004 ( CCR ) is...

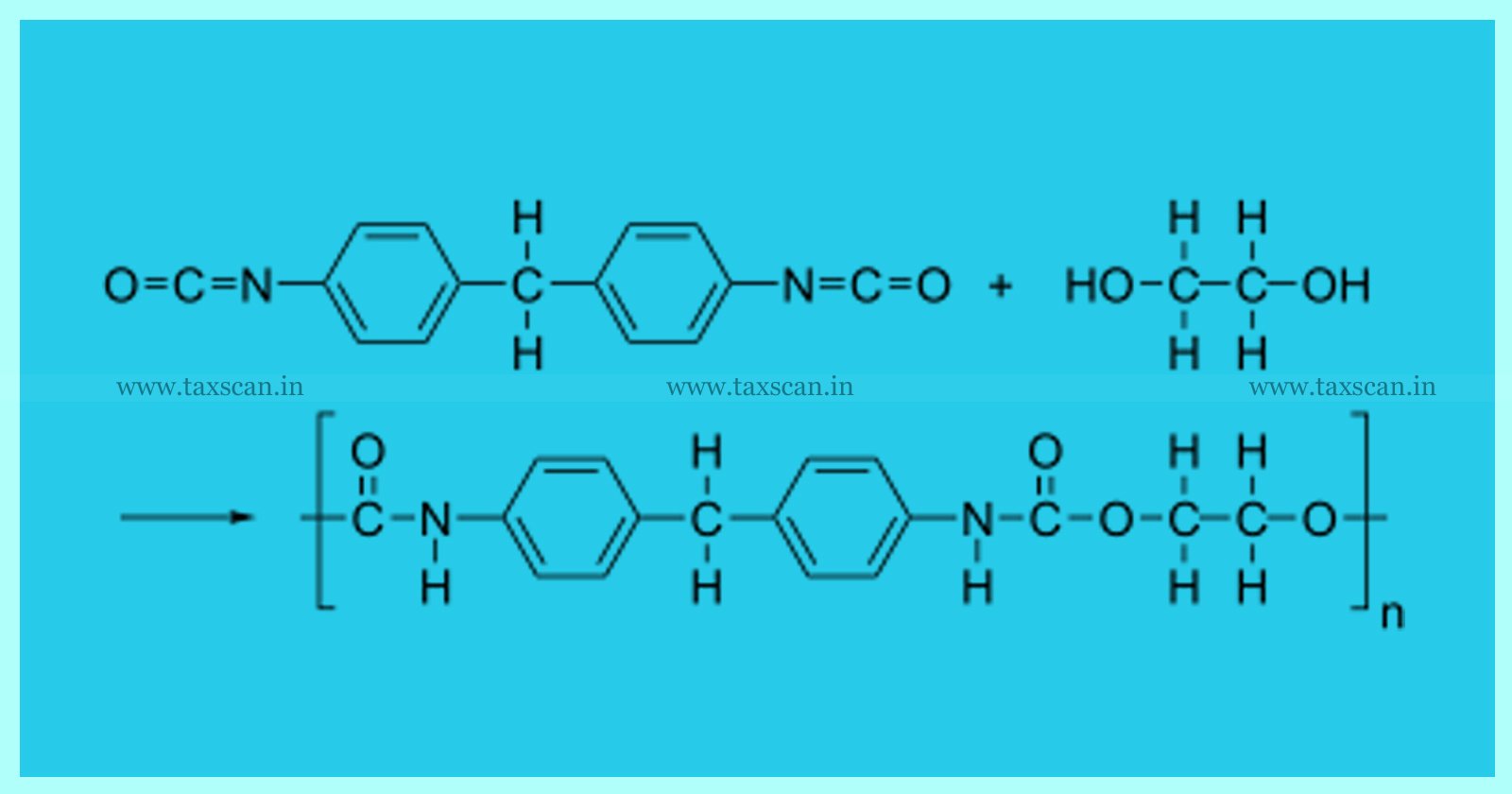

Madras HC orders retest to determine presence of Polyurethrene for Imposing Anti-dumping Duty [Read Order]

A Single Bench of the Madras High Court ordered retest to determine presence of Polyurethrene for imposing Anti-dumping duty. The Petitioner, M/s.Flower Garden, challenged the impugned order under...

Machining of Casting is Manufacture and not Business Auxiliary Service, not Taxable: CESTAT [Read Order]

The Ahmedabad Bench of the Customs, Excise and Service Tax Appellate Tribunal ( CESTAT ) comprising Ramesh Nair, Judicial Member and CL Mahar, Technical Member observed that machining of casting is...

![Setback to Deutsche India: ITAT confirms Disallowance on Delayed Payment of Employee’s Contribution to Provident Fund [Read Order] Setback to Deutsche India: ITAT confirms Disallowance on Delayed Payment of Employee’s Contribution to Provident Fund [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/Deutsche-India-ITAT-Disallowance-Delayed-Payment-Payment-Provident-Fund-Taxscan.jpg)

![Madras HC quashes Assessment Order for not conducting Search u/s 132 of Income Tax Act [Read Order] Madras HC quashes Assessment Order for not conducting Search u/s 132 of Income Tax Act [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/Madras-HC-Assessment-Order-Search-us-132-Income-Tax-Act-TAXSCAN.jpg)

![Principles of Natural Justice not to be adhered to when there is no Enhancement of Assessment or Penalty for orders passed u/s 84 of TNVAT Act: Madras HC [Read Order] Principles of Natural Justice not to be adhered to when there is no Enhancement of Assessment or Penalty for orders passed u/s 84 of TNVAT Act: Madras HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/Principles-of-Natural-Justice-Natural-Justice-Assessment-Penalty-TNVAT-Act-Madras-High-Court-Taxscan.jpg)

![CPC not Authorized to Carry Out Adjustment for Disallowance of Deduction u/s 80P Income Tax Act: ITAT [Read Order] CPC not Authorized to Carry Out Adjustment for Disallowance of Deduction u/s 80P Income Tax Act: ITAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/CPC-Disallowance-of-Deduction-Deduction-Income-Tax-Act-ITAT-Income-Tax-taxscan.jpg)

![Delhi HC confirms Cancellation of GST Registration against Koenig Solutions [Read Order] Delhi HC confirms Cancellation of GST Registration against Koenig Solutions [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/Delhi-High-Court-GST-Registration-Koenig-Solutions-Cancellation-of-GST-Registration-GST-Taxscan-.jpg)

![Service Tax leviable on Right to Use of Mining of Natural Resources (Sand), No Tax Exemption after 01.04.2016: CESTAT [Read Order] Service Tax leviable on Right to Use of Mining of Natural Resources (Sand), No Tax Exemption after 01.04.2016: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/Service-Tax-Mining-of-Natural-Resources-Tax-Exemption-CESTAT-Customs-Excise-Taxscan.jpg)

![Excess Utilized Credit cannot be Demanded, as Rule 6(3)(c) of CCR is silent on Period during which 20% Credit shall be Utilized: CESTAT [Read Order] Excess Utilized Credit cannot be Demanded, as Rule 6(3)(c) of CCR is silent on Period during which 20% Credit shall be Utilized: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/Utilized-Credit-Credit-CCR-CESTAT-Customs-Excise-Service-Tax-Taxscan.jpg)

![Machining of Casting is Manufacture and not Business Auxiliary Service, not Taxable: CESTAT [Read Order] Machining of Casting is Manufacture and not Business Auxiliary Service, not Taxable: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/Machining-of-Casting-Business-Auxiliary-Service-Taxable-CESTAT-Customs-Excise-Service-Tax-Tax-Manufacture-taxscan.jpg)

![Gujarat HC quashes 257 petitions u/s 148 and 148A(d) of Income Tax Act [Read Order] Gujarat HC quashes 257 petitions u/s 148 and 148A(d) of Income Tax Act [Read Order]](https://www.taxscan.in/wp-content/uploads/2023/03/Gujarat-High-Court-petitions-Income-Tax-Act-Income-Tax-Tax-Taxscan.jpg)