- Home

- »

- Manu Sharma

Manu Sharma

Manu Sharma is a tax-law enthusiast who is also a Physics Graduate deeply passionate about gaming, puzzles, technology and movies. With an eye for detail and knack for legal research, Manu plays a crucial role in curating and editing content to ensure accuracy, clarity, and relevance.

Technical Challenges: GSTN defers Invoice-wise Reporting in GSTR-7, releases Advisory

In a recent development, the Goods and Services Tax Network (GSTN) has issued an official advisory announcing the deferment of invoice-wise reporting...

Rebate to be Granted when no Cenvat Credit Availed on Inputs Used in Exported Goods: Bombay High Court

The Bombay High Court has recently upheld a rebate claim, ruling that no Cenvat credit was availed on the inputs used in the exported goods, thus making the exporter eligible for the rebate under...

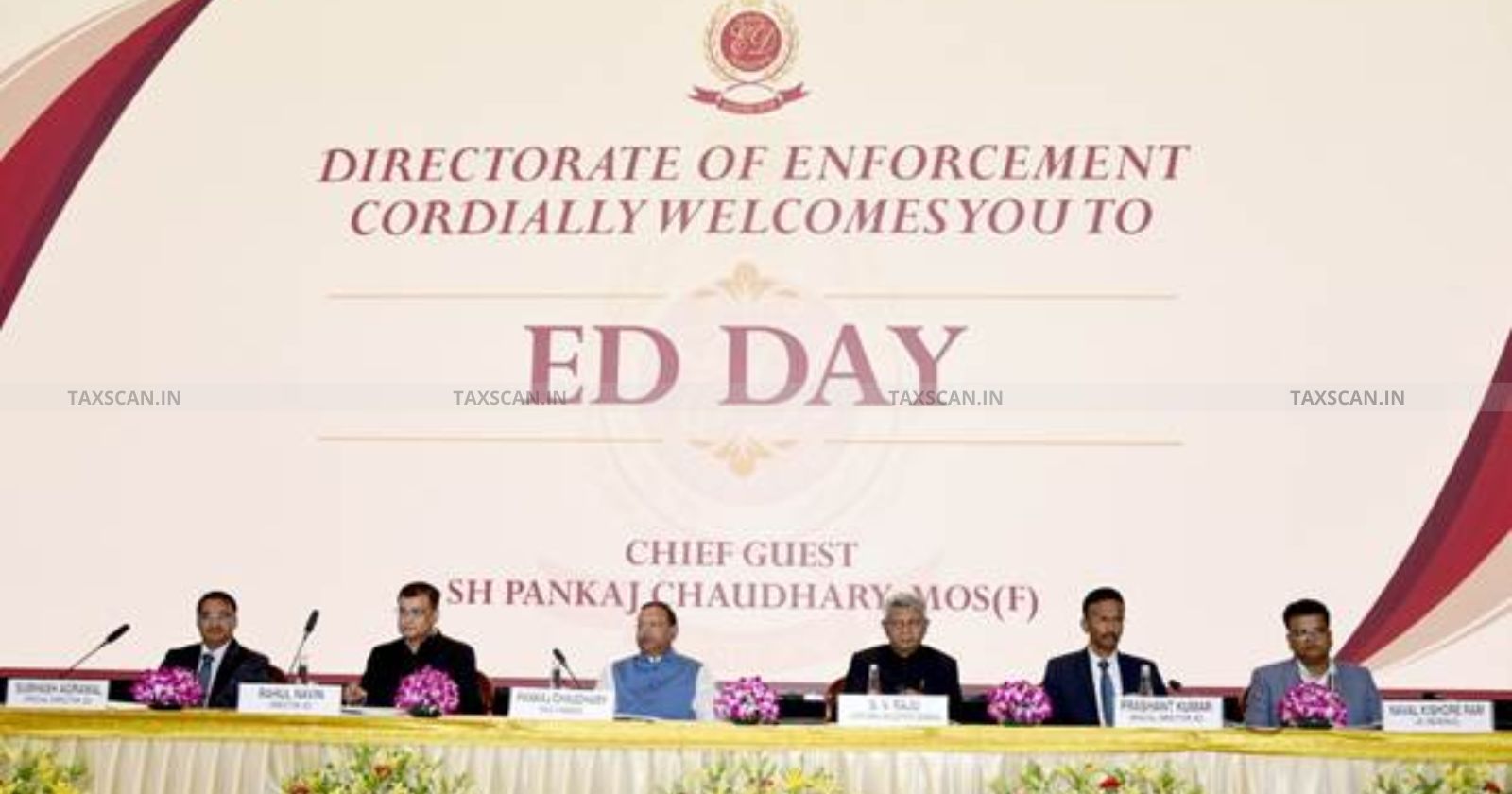

MoS Finance Pankaj Chaudhary presides over 69th ED Foundation Day, releases Annual Report [Read Report]

The 69th Foundation Day of the Directorate of Enforcement (ED) was marked by a sense of pride and purpose as Union Minister of State for Finance, Shri Pankaj Chaudhary, led the celebrations in New...

Bail is the Rule in GST S. 132 Offence Cases Except in Extraordinary Situations: Supreme Court [Read Order]

The Supreme Court has reiterated the principle that bail should be the norm, not the exception, in cases involving offences under Section 132 of the Central Goods and Services Tax (CGST) Act, 2017....

![CBDT notifies Revised Income Tax Return Form ITR-2 [Read Notification] CBDT notifies Revised Income Tax Return Form ITR-2 [Read Notification]](https://www.taxscan.in/wp-content/uploads/2025/05/CBDT-Revised-Income-Tax-Return-ITR-2-taxscan.jpg)

![Cylinders Essential Component for Printing Machine: CESTAT allows Full CENVAT Credit Claim [Read Order] Cylinders Essential Component for Printing Machine: CESTAT allows Full CENVAT Credit Claim [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/CENVAT-Credit-Printing-Machine-Cylinders-taxscan.jpg)

![CBDT Notifies Revised ITR-3 Form for AY 2025-26 [Read Order] CBDT Notifies Revised ITR-3 Form for AY 2025-26 [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/CBDT-ITR-3-Form-Revised-ITR-3-Form-updates-TAXSCAN.jpeg)

![Bail is the Rule in GST S. 132 Offence Cases Except in Extraordinary Situations: Supreme Court [Read Order] Bail is the Rule in GST S. 132 Offence Cases Except in Extraordinary Situations: Supreme Court [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/05/Bail-Bail-is-the-Rule-in-GST-Section-132-Offence-Cases-taxscan.jpg)