GSTN enables Form DRC-01C for Dealing Discrepancies Between GSTR 2B and GSTR 3B

The Goods and Services Tax Network (GSTN) has enabled the Form DRC-01C for dealing mismatches between GSTR 2B and GSTR 3B. The Form DRC-01C is the form to intimate the difference in input tax credit available in auto-generated statements containing the details of input tax credit and that availed in return.

A new rule 88D is inserted to the CGST rule via this amendment which details the Manner of dealing with difference in Input Tax Credit (ITC) available in Auto-Generated Statement containing details of ITC and that availed in Return, that is GSTR-2B and GSTR-3B.

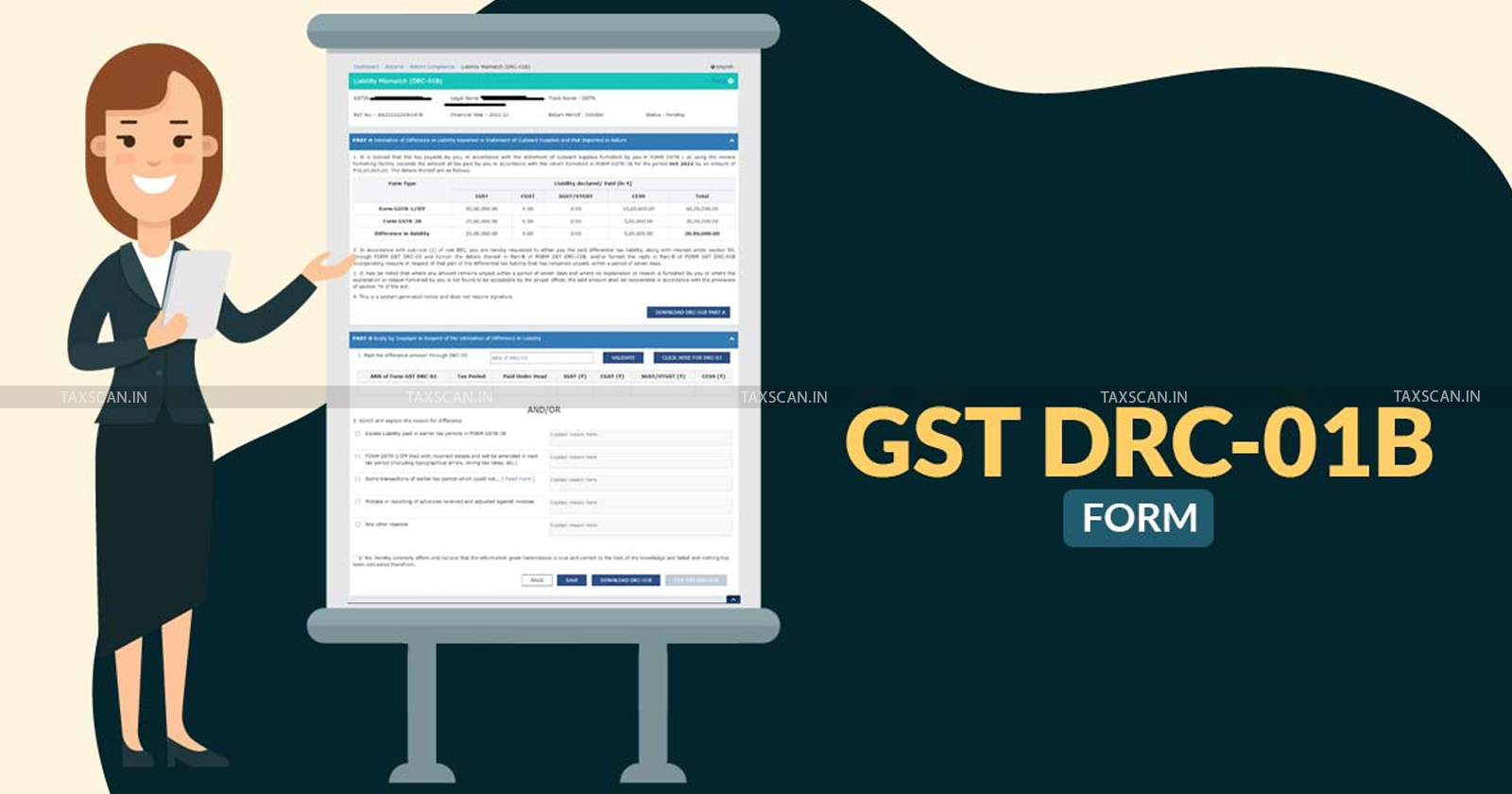

The government has introduced a new Form GST DRC-01C, a system generated form for the Intimation of difference in input tax credit available in auto-generated statement containing the details of input tax credit and that availed in return with respect to newly inserted Rule 88D.

Read about Rule 88D: CBIC notifies new Rule for Manner of dealing with difference in ITC available in Auto-Generated Statement containing details of ITC and that availed in Return

Steps to access Form DRC -01C

- Go to GST Portal - https://www.gst.gov.in/

- Navigate to ‘Services’ and further to ‘Returns’

- Click on ‘Return Compliance’ under Returns

- Click on ‘View’ option of ITC Mismatch (DRC-01)

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates