Income Tax Dept issues Notices on Saturday asking Production of Documents on Monday, sparks outrage among CA, Tax Professionals

Issuance of Notices for Hearing and Production of Documents for FY 2017-18 in Short Spans of Time in Violation of Natural Justice is being commonplace. Know one more such incident here

Ideally, tax should be levied like how a honey bee collects honey from flowers. What Chanakya said, explaining Raj Dharma, was that a government should collect taxes in the manner a honey bee collects honey from the flowers. In fact, Chanakya had opined that a kingdom whose kings are greedy is not worth living in.

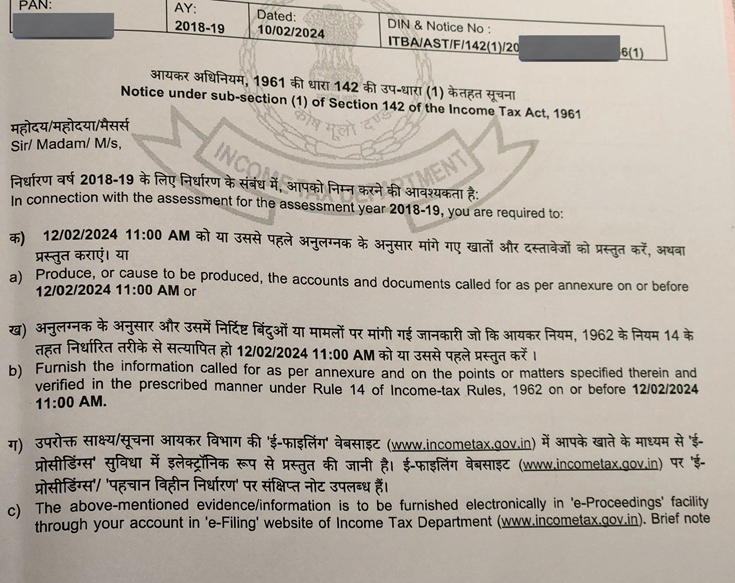

Notice u/s 142(1) pertaining to AY 2018-2019

Given above is a notice issued to an assessee, pertaining to the assessment year 2018-19 or Financial Year 2017-18, on 10 February 2024.

As evident from the notice itself, the notice demands the assessee to produce documents as per attached annexure, on 12 February 2024 at 11 AM.

Notably, the notice is received by the assessee, in the evening of 10th February.

Section 142(1) of the Income Tax Act 1961 empowers Income-tax authorities to issue a notice for more clarification or for further details about where a return has been filed or if the return has not been filed, then to furnish the required information in a prescribed manner.

Notice under Section 142(1) can be issued in both cases, where you file your income tax return u/s 139 (1) and also in the case you do not file your income tax return u/s 139 (1) and time specified to file such a return has expired. However, an Assessing Officer shall only require the production of accounts or information relating to a period of three years before the previous year.

Given below is the original tweet that shared this seemingly foul practice of the department, violating all natural justice principles available to assessees and the responses in this regard: –

The Income Tax Faceless Assessments and appeals system is facing much criticism from the side of professionals and taxpayers alike, for being mindless about rejection of grounds of appeal and contentions raised in notices post-assessment.

Earlier, Taxscan had reported a story on the mindless rejection of appeals by NFAC–

Faceless CIT(Appeals) or Mindless CIT(Rejections)? Know what the professionals have to say

The whole faceless system is now under the radar for being not what it was intended to be, and rejecting ground without application of mind. Allegedly, there are also matters where the first ground of appeal is rejected, after due discussion and the rest of the grounds are left in ignorance.

Notably, in a bid to meet the revenue targets set for the current financial year, the Central GST & Excise Commissionerate at Surat has issued a crucial direction to all Grade A & B officers. The office circular, dated 07.02.2024, follows the D.O. dated 18.01.2024 from Chief Commissioner, Vadodara Zone.

All officers in the mentioned grades – Grade A & Grade B are directed to abstain from routine leaves until 31st March 2024, unless faced with exceptional circumstances or for medical reasons.

Further tweets by CAs and tax professionals show how the system of NFAC and Faceless Assessments is flawed in implementation —

The National Faceless Assessment Centre ( NFAC ), along with Faceless CIT(A) other centers and units, have been established by the Central Board of Direct Taxes ( CBDT ). The NFAC is in charge of conducting an assessment of your income-tax returns if they are picked up in scrutiny.

However, the issuance of notices has become a headache to both taxpayers and professionals, when guidelines and natural justice principles are hung out to dry for meeting revenue targets.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates