Begin typing your search above and press return to search.

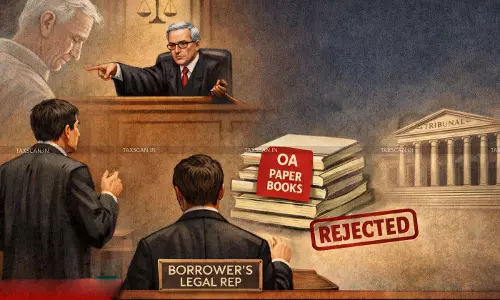

Legal Rep Cannot Raise New Defence Not Taken By Deceased Borrower: DRAT Upholds Rejection of Non-Supply of OA Paper Book Plea

The Debt Recovery Appellate Tribunal (DRAT), Kolkata, held that legal heirs cannot introduce new defences not raised by the original defendant, also...

![Stakeholders Show Unwillingness to Mediation: DRAT Directs DRT to Expedite Hearing of Securitisation Application [Read Order] Stakeholders Show Unwillingness to Mediation: DRAT Directs DRT to Expedite Hearing of Securitisation Application [Read Order]](https://images.taxscan.in/h-upload/2026/02/06/250x150_2123977-securitisation-application-drat-drt-taxscan.webp)

![CESTAT Dismisses Appeal Due to Inordinate Delay Beyond Limitation Period, Upholding FAAs Order [Read Order] CESTAT Dismisses Appeal Due to Inordinate Delay Beyond Limitation Period, Upholding FAAs Order [Read Order]](https://www.taxscan.in/wp-content/uploads/2025/03/CESTAT.jpg)

![ITAT directs CIT(A) to Consider Reasons for Delay in Filing Appeal after Dismissing it over 208-Day Delay [Read Order] ITAT directs CIT(A) to Consider Reasons for Delay in Filing Appeal after Dismissing it over 208-Day Delay [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/11/ITAT-ITAT-DIRECTS-INCOME-TAX-INCOME-TAX-APPEALS-Bangalore-Bench-Income-Tax-Appellate-Tribunal-Commissioner-of-Income-Tax-Filing-Appeal.jpg)

![NFAC dismisses Appeal in-limine for Non-appearance: ITAT Remands Case [Read Order] NFAC dismisses Appeal in-limine for Non-appearance: ITAT Remands Case [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/10/NFAC-Appeal-ITAT-taxscan.jpg)

![ITAT allows 69-Day Delay in appeal Filing due to Reasonable Cause, directs CIT (A) to Reassess Case [Read Order] ITAT allows 69-Day Delay in appeal Filing due to Reasonable Cause, directs CIT (A) to Reassess Case [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/Delay-filing-Appeal-Reasonable-Cause-ITAT-TAXSCAN.jpg)

![No Opportunity of Hearing Required for Taxpayer when Case is Transferred between AO’s within Same City u/s 127 (3): ITAT dismisses Appeal [Read Order] No Opportunity of Hearing Required for Taxpayer when Case is Transferred between AO’s within Same City u/s 127 (3): ITAT dismisses Appeal [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/08/WhatsApp-Image-2024-08-28-at-12.42.38_3dd72db0.jpg)

![AO has Power to Reassess only on Material Evidence: Gujarat HC dismisses Income Tax Dept’s Appeal [Read Order] AO has Power to Reassess only on Material Evidence: Gujarat HC dismisses Income Tax Dept’s Appeal [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/07/site-img-17-1.jpg)

![Appeal against Refund Rejection order filed within Statutory Period under Limitation Act: Delhi HC directs to consider Appeal on Merits [Read Order] Appeal against Refund Rejection order filed within Statutory Period under Limitation Act: Delhi HC directs to consider Appeal on Merits [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/05/Appeal-Refund-Rejection-Order-Statutory-Period-Limitation-Act-Delhi-HC-Appeal-on-Merits-taxscan.jpg)

![Appeal abates once CIRP is initiated, IRP appointed and Resolution Plan is approved: CESTAT [Read Order] Appeal abates once CIRP is initiated, IRP appointed and Resolution Plan is approved: CESTAT [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/CIRP-Initiation-Impact-on-Appeals-Appeal-CIRP-IRP-Resolution-Plan-CESTAT-taxscan.jpeg)

![Failure to provide details for Commissioning of Assets on different dates to compute Depreciation: ITAT dismisses Appeal [Read Order] Failure to provide details for Commissioning of Assets on different dates to compute Depreciation: ITAT dismisses Appeal [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/01/Commissioning-of-Assets-compute-Depreciation-ITAT-Appeal-taxscan.jpg)