- Home

- »

- Gopika V

Gopika V

Property Sold Below Distress Value Violating Rule 8(6) SARFAESI Rules: DRAT Directed Bank to Refund Auction Amount with 8% Interest [Read Order]

The sale notice dated 07.07.2014 did not comply with Rule 8(6), missing auction details and redemption rights, and was published even before...

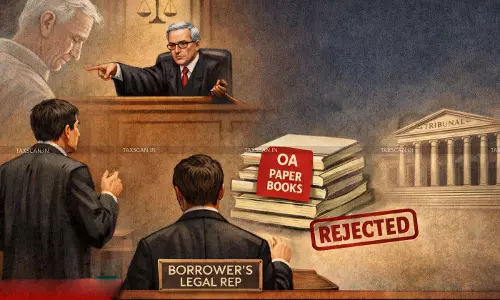

Legal Rep Cannot Raise New Defence Not Taken By Deceased Borrower: DRAT Upholds Rejection of Non-Supply of OA Paper Book Plea

The Debt Recovery Appellate Tribunal (DRAT), Kolkata, held that legal heirs cannot introduce new defences not raised by the original defendant, also rejected her defence for non-filing of a written...

DRT Dismisses Appeal due to Non‑Compliance with Pre‑Deposit: DRAT Remands Matter to Examine ₹3.71 Crore Deposit u/s 30 RDB Act [Read Order]

The Debt Recovery Appellate Tribunal ( DRAT ) referred a case back to the Debt Recovery Tribunal (DRT) after finding that the dismissal of an appeal for want of pre-deposit of ₹3.71 Crore under...

Stakeholders Show Unwillingness to Mediation: DRAT Directs DRT to Expedite Hearing of Securitisation Application [Read Order]

The Debt Recovery Appellate Tribunal (DRAT), Kolkata, has disposed of an appeal, directing the debt recovery tribunal to hear the pending securitization application expeditiously. The appeal...

Guarantors Misused Moratorium to Stall SARFAESI Recovery: NCLAT Upholds Dismissal of Repeat S. 94 Petitions [Read Order]

In a recent ruling, national company law appellate tribunal (NCLAT) Delhi has dismissed the appeals, holding that the repeated section 94 petitions under the Insolvency and Bankruptcy Code (IBC) to...

Section 7 IBC Threshold of 100 or 10% Allottees Applies at Filing Stage: NCLAT allows Homebuyers’ Plea [Read Order]

In a recent ruling, the National Company Law Appellate Tribunal (NCLAT) Delhi allowed the appeal of 115 homebuyers, ruling that the threshold requirement under section 7 of the Insolvency and...

No Clear Proof Illegal Money: Delhi HC Grants Bail in ₹696 Cr PMLA Case with Alleged Shell Firms and Fake Tax Certificates [Read Order]

In a recent ruling, the Delhi High Court granted bail in a ₹696 crore case under the Prevention ofMoney Laundering Act, 2002 (PMLA), noticing that there was no clear proof that directly connected...

![Depreciation on Goodwill cannot be Revisited in Later Years Once Allowed in First Year: ITAT [Read Order] Depreciation on Goodwill cannot be Revisited in Later Years Once Allowed in First Year: ITAT [Read Order]](https://images.taxscan.in/h-upload/2026/02/07/250x150_2124110-depreciation-on-goodwill-itat-taxscan-.webp)

![Only Final Stamp Valuation Determined by Collector Applies u/s 50C: ITAT allows Full Section 54F Exemption [Read Order] Only Final Stamp Valuation Determined by Collector Applies u/s 50C: ITAT allows Full Section 54F Exemption [Read Order]](https://images.taxscan.in/h-upload/2026/02/06/250x150_2124059-only-final-stamp-valuation-determined-collector-applies-taxscan.webp)

![Single GST SCN Covering Five Financial Years is Impermissible: Madras HC Quashes Order [Read Order] Single GST SCN Covering Five Financial Years is Impermissible: Madras HC Quashes Order [Read Order]](https://images.taxscan.in/h-upload/2026/02/06/500x300_2124010-single-gst-scn-covering-five-financial-years-impermissible-madras-hc-quashes-order-taxscan.webp)

![DRT Dismisses Appeal due to Non‑Compliance with Pre‑Deposit: DRAT Remands Matter to Examine ₹3.71 Crore Deposit u/s 30 RDB Act [Read Order] DRT Dismisses Appeal due to Non‑Compliance with Pre‑Deposit: DRAT Remands Matter to Examine ₹3.71 Crore Deposit u/s 30 RDB Act [Read Order]](https://images.taxscan.in/h-upload/2026/02/06/500x300_2123973-drt-dismisses-appeal-due-noncompliance-predeposit-drat.webp)

![Stakeholders Show Unwillingness to Mediation: DRAT Directs DRT to Expedite Hearing of Securitisation Application [Read Order] Stakeholders Show Unwillingness to Mediation: DRAT Directs DRT to Expedite Hearing of Securitisation Application [Read Order]](https://images.taxscan.in/h-upload/2026/02/06/500x300_2123977-securitisation-application-drat-drt-taxscan.webp)

![Guarantors Misused Moratorium to Stall SARFAESI Recovery: NCLAT Upholds Dismissal of Repeat S. 94 Petitions [Read Order] Guarantors Misused Moratorium to Stall SARFAESI Recovery: NCLAT Upholds Dismissal of Repeat S. 94 Petitions [Read Order]](https://images.taxscan.in/h-upload/2026/02/05/500x300_2123870-guarantors-misused-moratorium-stall-sarfaesi-recovery.webp)

![Section 7 IBC Threshold of 100 or 10% Allottees Applies at Filing Stage: NCLAT allows Homebuyers’ Plea [Read Order] Section 7 IBC Threshold of 100 or 10% Allottees Applies at Filing Stage: NCLAT allows Homebuyers’ Plea [Read Order]](https://images.taxscan.in/h-upload/2026/02/05/500x300_2123858-homebuyerjpg.webp)

![No Clear Proof Illegal Money: Delhi HC Grants Bail in ₹696 Cr PMLA Case with Alleged Shell Firms and Fake Tax Certificates [Read Order] No Clear Proof Illegal Money: Delhi HC Grants Bail in ₹696 Cr PMLA Case with Alleged Shell Firms and Fake Tax Certificates [Read Order]](https://images.taxscan.in/h-upload/2026/02/04/500x300_2123763-no-clear-proof-illegal-money-delhi-hc-grants-bail-taxscan.webp)