Begin typing your search above and press return to search.

![Gujarat High Court upholds Validity of GST Summons without DIN issued by State GST Officers [Read Order] Gujarat High Court upholds Validity of GST Summons without DIN issued by State GST Officers [Read Order]](https://images.taxscan.in/h-upload/2025/06/18/500x300_2050029-gujarat-high-court-gujarat-high-court-upholds-validity-of-gst-summons-taxscan.webp)

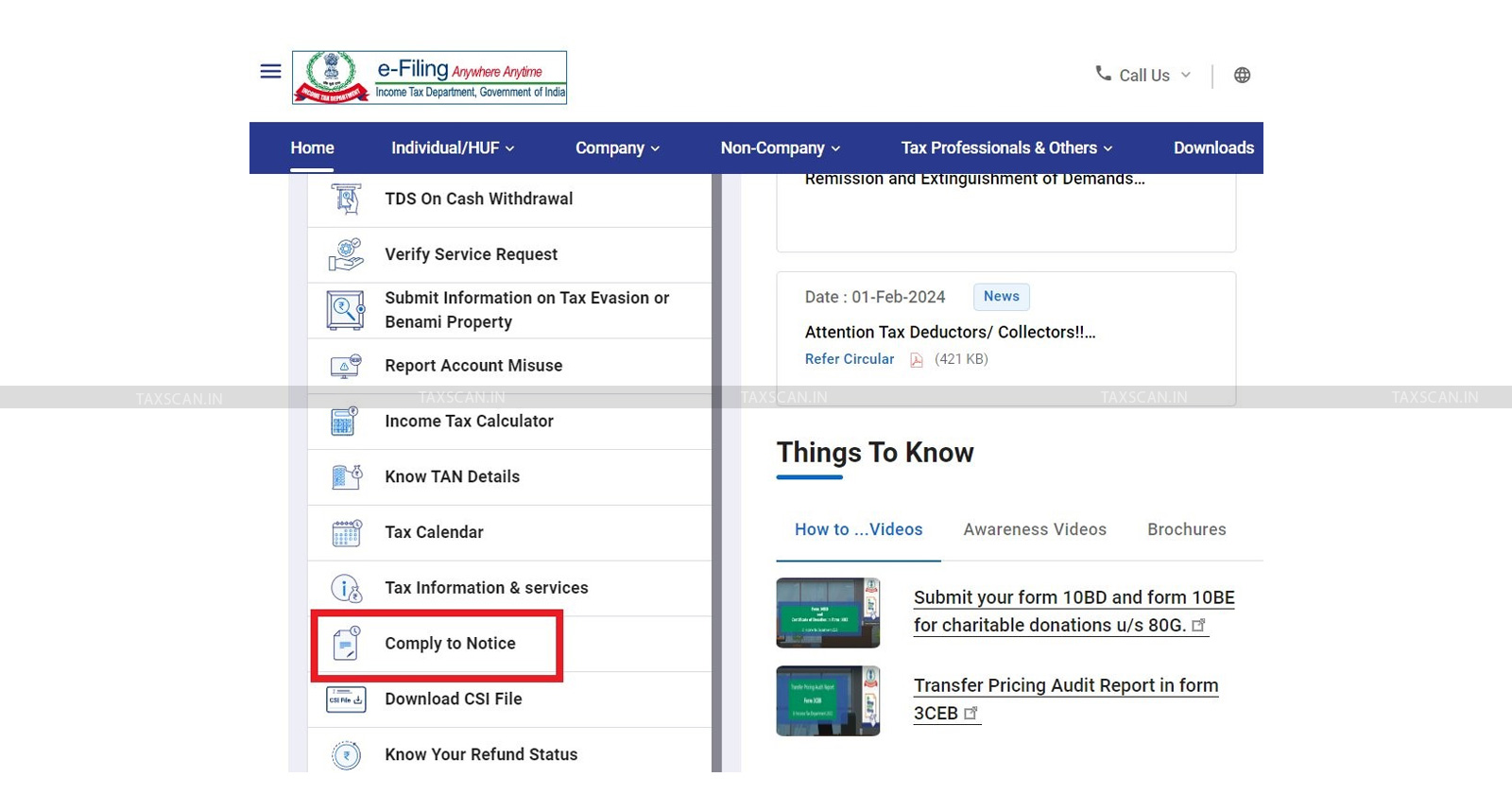

Gujarat High Court upholds Validity of GST Summons without DIN issued by State GST Officers [Read Order]

In a significant ruling for State Goods and Services Tax (GST) administrations, the Gujarat High Court has held that the absence of a Document...

![Patna HC sets aside GST Demand Order Lacking Date making Appeal Limitation Indeterminable [Read Order] Patna HC sets aside GST Demand Order Lacking Date making Appeal Limitation Indeterminable [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/09/Patna-High-Court-GST-Demand-Order-GST-Demand-GST-Taxscan.jpg)

![Audit by CAG: Punjab & Haryana HC stays GST SCN to Leading Pharma Manufacturer [Read Order] Audit by CAG: Punjab & Haryana HC stays GST SCN to Leading Pharma Manufacturer [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/08/GST-Punjab-Haryana-High-Court-DRC-01-GST-audit-by-CAG-GST-audit-pharmaceutical-manufacturer-GST-taxscan.jpg)

![GST proceedings initiated without Generating DIN is Invalid as per CBDT Circular: Andhra Pradesh HC sets aside Proceedings [Read Order] GST proceedings initiated without Generating DIN is Invalid as per CBDT Circular: Andhra Pradesh HC sets aside Proceedings [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/07/GST-GST-Proceedings-CBDT-Central-Board-of-Direct-Tax-Andhra-Pradesh-High-Court-Document-Identification-Number-taxscan.jpg)

![GST Proceedings issued without DIN not Valid: Andhra Pradesh HC [Read Order] GST Proceedings issued without DIN not Valid: Andhra Pradesh HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/06/Andhra-pradesh-hc-GST-Goods-services-tax-GST-proceedings-DIN-TAXSCAN.jpg)

![Notice for Reopening Assessment u/s 148 of IT Act without DIN is Invalid: Bombay HC [Read Order] Notice for Reopening Assessment u/s 148 of IT Act without DIN is Invalid: Bombay HC [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/05/Bombay-high-court-Income-Tax-Act-DIN-income-tax-authority-in-India-texscan.jpg)

![Absence of Generated DIN in Notice of demand u/s 156 of Income Tax Act: ITAT quashes assessment order and Notice demand [Read Order] Absence of Generated DIN in Notice of demand u/s 156 of Income Tax Act: ITAT quashes assessment order and Notice demand [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/03/DIN-Notice-of-demand-Income-Tax-Act-ITAT-taxscan.jpg)

![Absence of DIN while granting Statutory Approval u/s 153D Income Tax Act: ITAT allows Assesee appeal [Read Order] Absence of DIN while granting Statutory Approval u/s 153D Income Tax Act: ITAT allows Assesee appeal [Read Order]](https://www.taxscan.in/wp-content/uploads/2024/03/Income-Tax-ITAT-ITAT-Delhi-Document-identification-Number-Tax-news-taxscan.jpg)