Begin typing your search above and press return to search.

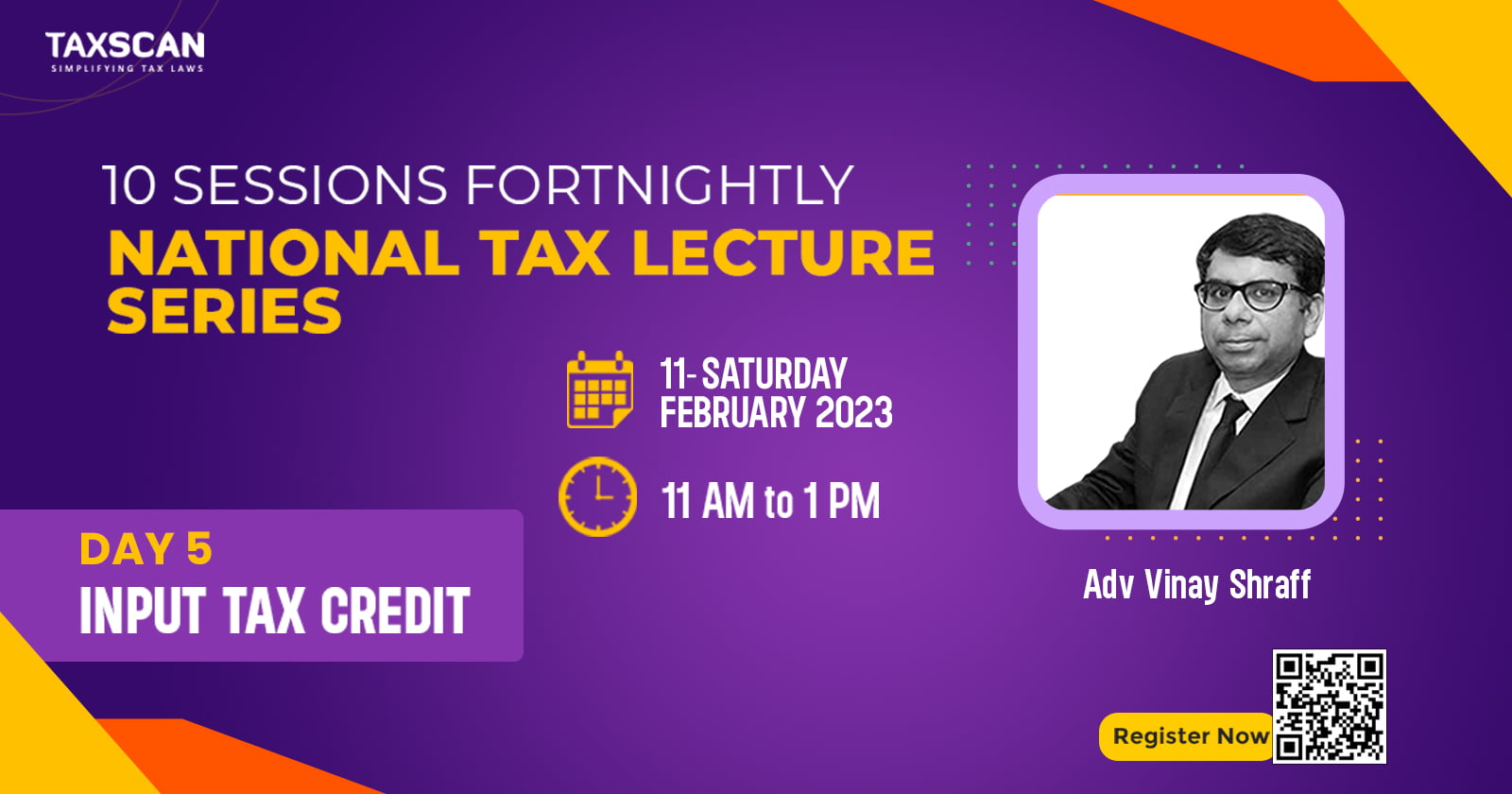

10 Sessions Fortnightly National Tax Lecture Series

Free Live Webinars on Jurisprudence in the erstwhile indirect tax regime to handle potential litigation issues under GST(Central Excise, VAT, Service...

![Fake GST and misappropriation of Government Funds: Punjab & Haryana HC grants bail to Forest Officers [Read Order] Fake GST and misappropriation of Government Funds: Punjab & Haryana HC grants bail to Forest Officers [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/12/bail-Fake-GST-GST-misappropriation-of-Government-Funds-Government-Funds-Punjab-and-Haryana-High-Court-Forest-Officers-bail-to-Forest-Officers-Taxscan.jpg)

![Issuance of REG-31 Instead of GST registration cancellation notice: Kerala HC Quashes Proceedings [Read Order] Issuance of REG-31 Instead of GST registration cancellation notice: Kerala HC Quashes Proceedings [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/12/GST-registration-REG-31-GST-cancellation-notice-notice-Kerala-High-Court-Taxscan.jpg)

![Detention of Vehicle and GST Demand on Expiry of E-way Bill: Jharkhand HC directs to seek Statutory Remedy [Read Order] Detention of Vehicle and GST Demand on Expiry of E-way Bill: Jharkhand HC directs to seek Statutory Remedy [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/12/GST-Demand-Expiry-E-way-Bill-Jharkhand-HC-TAXSCAN.jpg)

![Taxable amount rightly reflected as Basic Rate in Tender: Himachal Pradesh HC upholds GST Demand [Read Order] Taxable amount rightly reflected as Basic Rate in Tender: Himachal Pradesh HC upholds GST Demand [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/12/Taxable-Taxable-amount-Basic-Rate-Tender-Himachal-Pradesh-High-Court-GST-Demand-GST-Taxscan.jpg)

![Madras HC quashes proceedings on Errors in order issued u/s 129(3) of Tamil Nadu-GST Act [Read Order] Madras HC quashes proceedings on Errors in order issued u/s 129(3) of Tamil Nadu-GST Act [Read Order]](https://www.taxscan.in/wp-content/uploads/2022/12/Madras-High-Court-GST-Act-GST-Taxscan.jpg)

![GST Offences of Fraud or any Willful-Misstatement or Suppression of Facts to Evade Tax and Its Effect of Limitation [Read Circular] GST Offences of Fraud or any Willful-Misstatement or Suppression of Facts to Evade Tax and Its Effect of Limitation [Read Circular]](https://www.taxscan.in/wp-content/uploads/2022/12/GST-Offences-GST-Fraud-Misstatement-Evade-Tax-Taxscan.jpg)

![Recovery of GST during IBC Proceedings: CBIC Clarifies [Read Circular] Recovery of GST during IBC Proceedings: CBIC Clarifies [Read Circular]](https://www.taxscan.in/wp-content/uploads/2022/12/Recovery-of-GST-GST-IBC-taxscan.jpg)