Begin typing your search above and press return to search.

![Single GST SCN Covering Five Financial Years is Impermissible: Madras HC Quashes Order [Read Order] Single GST SCN Covering Five Financial Years is Impermissible: Madras HC Quashes Order [Read Order]](https://images.taxscan.in/h-upload/2026/02/06/500x300_2124010-single-gst-scn-covering-five-financial-years-impermissible-madras-hc-quashes-order-taxscan.webp)

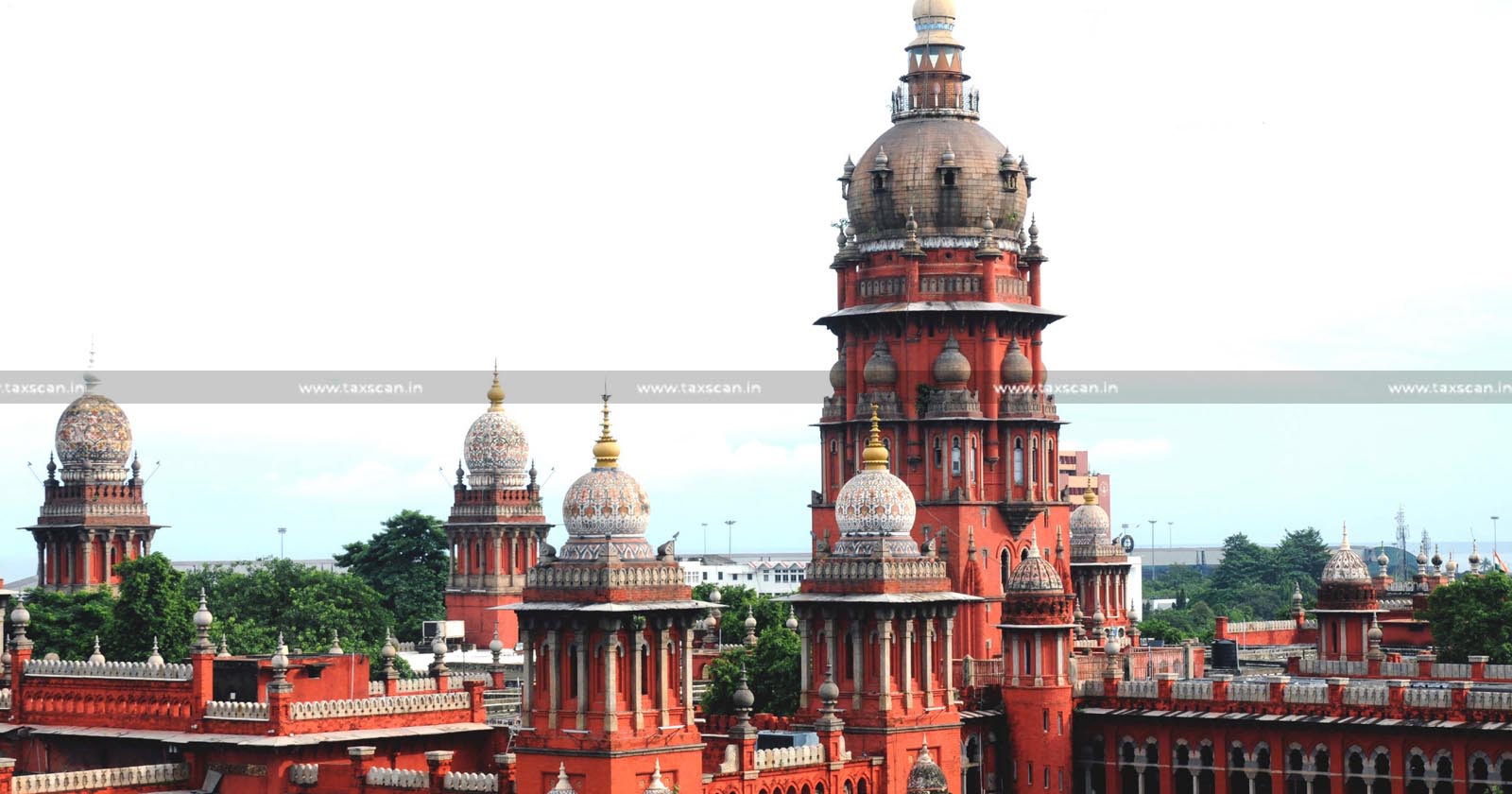

Single GST SCN Covering Five Financial Years is Impermissible: Madras HC Quashes Order [Read Order]

In a recent ruling, the Madras High Court quashed a consolidated GST assessment order covering five financial years 2019-20 to 2023-24, holding that...

![S. 9(2) of CST Act Creates no Statutory Charge: NCLAT Dismisses State Tax Officer Appeals, Rules CST Dues as Unsecured Debt [Read Order] S. 9(2) of CST Act Creates no Statutory Charge: NCLAT Dismisses State Tax Officer Appeals, Rules CST Dues as Unsecured Debt [Read Order]](https://images.taxscan.in/h-upload/2026/01/20/250x150_2120899-nclat-new-delhi-state-tax-officer-unsecured-debt-state-tax-officer-appeals-nclat-cst-dues-cst-dues-unsecured-debt-nclat-tax-officer-appeal-nclat-rules-cst-dues-as-unsecured-debt-taxscan.webp)

![Expedite Inquiry Decision: Allahabad HC Tells State in Challenge to Suspension of Tax Officer [Read Order] Expedite Inquiry Decision: Allahabad HC Tells State in Challenge to Suspension of Tax Officer [Read Order]](https://images.taxscan.in/h-upload/2025/11/24/250x150_2107642-expedite-inquiry-decision-allahabad-hc-challenge-suspension-tax-officer-taxscan.webp)

![GST Liability Cannot Be Deferred Due to Non-Reimbursement by Government Department: Madras High Court Allows Installment Relief to Contractor [Read Order] GST Liability Cannot Be Deferred Due to Non-Reimbursement by Government Department: Madras High Court Allows Installment Relief to Contractor [Read Order]](https://images.taxscan.in/h-upload/2025/10/19/250x150_2098047-gst-liability-due-non-reimbursement-by-government-department-madras-high-court-installment-contractor-taxscan.webp)

![Failure to Reply to GST SCN: Madras HC Gives Assessee Second Chance, Orders Additional 15% Deposit and Fresh Adjudication [Read Order] Failure to Reply to GST SCN: Madras HC Gives Assessee Second Chance, Orders Additional 15% Deposit and Fresh Adjudication [Read Order]](https://images.taxscan.in/h-upload/2025/10/08/250x150_2094803-gst-scn-hc-taxscan.webp)

![Vehicle Intercepted for Non-Possession of E-Invoice: Madras HC Holds Timely Manual Appeal Valid, Directs Appellate Authority to Decide with Additional Evidence [Read Order] Vehicle Intercepted for Non-Possession of E-Invoice: Madras HC Holds Timely Manual Appeal Valid, Directs Appellate Authority to Decide with Additional Evidence [Read Order]](https://images.taxscan.in/h-upload/2025/09/15/500x300_2087490-madras-high-court-vehicle-intercepted-for-non-possession-taxscan.webp)

![Penalty u/s 125 of GST Cannot Be Levied When Late Fee u/s 47 Already Imposed: Madras HC [Read Order] Penalty u/s 125 of GST Cannot Be Levied When Late Fee u/s 47 Already Imposed: Madras HC [Read Order]](https://images.taxscan.in/h-upload/2025/08/30/500x300_2082117-penalty-gst-madras-hc-taxscan.webp)

![Late GST Appeal and Non-Reply to SCN: Madras HC Orders Fresh Adjudication on Additional 15% Tax Deposit from ECL [Read Order] Late GST Appeal and Non-Reply to SCN: Madras HC Orders Fresh Adjudication on Additional 15% Tax Deposit from ECL [Read Order]](https://images.taxscan.in/h-upload/2025/08/14/500x300_2076697-evidences-in-gst-appellate-tribunal-appeal-a-guide-under-rule-112-central-gst-rules-taxscan.webp)

![Over 200 Pages of Supporting Documents Ignored: Madras HC sends back GST Demand for Proper Adjudication [Read Order] Over 200 Pages of Supporting Documents Ignored: Madras HC sends back GST Demand for Proper Adjudication [Read Order]](https://images.taxscan.in/h-upload/2025/08/14/500x300_2076696-gst-demand-taxscan.webp)

![Petition Filed before GST Appeal Deadline Ends: Madras HC Grants 15 Days to File Appeal before Appellate Authority [Read Order] Petition Filed before GST Appeal Deadline Ends: Madras HC Grants 15 Days to File Appeal before Appellate Authority [Read Order]](https://images.taxscan.in/h-upload/2025/07/18/500x300_2064943-gst-appeal-taxscan.webp)

![Business Closed, Unaware of GST Notices: Madras HC allows to Contest Order on Payment of Dues without Interest and Penalty [Read Order] Business Closed, Unaware of GST Notices: Madras HC allows to Contest Order on Payment of Dues without Interest and Penalty [Read Order]](https://images.taxscan.in/h-upload/2025/07/09/500x300_2062047-business-closed-unaware-gst-notices-madras-hc-contest-order-payment-of-dues-interest-and-penalty-taxscan.webp)